Ethereum price prediction – Here’s what’s next after sustained waves of selling

- The $2.6k help zone was decisively damaged over the previous two weeks

- Ethereum sellers’ constant dominance has buyers apprehensive

Ethereum [ETH] shaped an ascending triangle sample on the upper timeframes. The 16.6% drop from Tuesday to Friday was nonetheless inside this bullish sample and steered that long-term buyers will be hopeful of restoration.

Ethereum has not been towards Bitcoin [BTC] which historically leads the crypto market. This incapability to match BTC’s efficiency is a frustration for buyers. The current 1000 ETH sale by the Ethereum Basis didn’t bolster sentiment both.

Each day wick from early August has been stuffed

Supply: ETH/USDT on TradingView

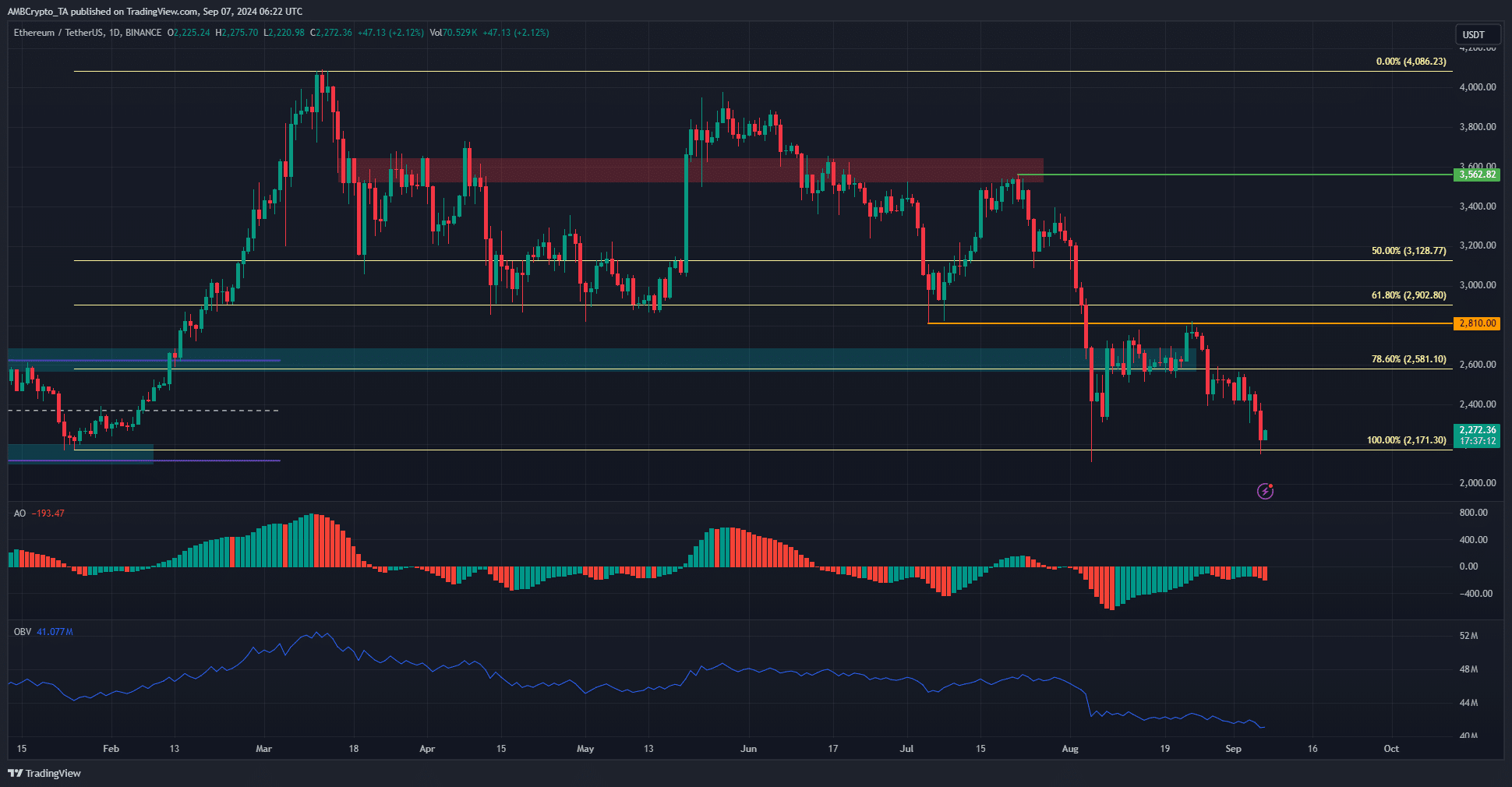

The rally in February has been wholly retraced. The losses within the second half of July noticed the $2171 zone examined, and it was retested on Friday, 6 September, once more.

The Superior Oscillator confirmed pink bars on the histogram beneath zero to sign sturdy bearish momentum. The bearish aspect has been dominant since early August and has not relinquished its grip.

The OBV was additionally on a downtrend to replicate regular promoting stress. Two weeks in the past, the worth of ETH was above $2.6k and there was some hope that restoration was at hand.

Alas, since then, the help zone which was the vary excessive in early 2024 has been decisively damaged. Therefore, additional losses appeared probably given the sellers’ dominance.

Ethereum vs Bitcoin additionally mirrored weak point

Supply: ETH/BTC on TradingView

The weekly chart of Ethereum towards Bitcoin revealed that the downtrend has been in play since early 2023. The 2022 low at 0.056 was breached in 2024, and ETHBTC continued to pattern downwards on the charts.

Learn Ethereum’s [ETH] Value Prediction 2024-25

Ethereum’s weak efficiency additionally introduced worries that the altcoin market may battle throughout this run. The older cash can have an particularly arduous time grabbing the eye of the brand new capital inflow into the market. Particularly if and when a bull run will get underway.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion