Ethereum price prediction – Holding on to $3K may be key because…

- Ethereum’s funding fee has sharply declined since rejection at $4k

- On the value entrance, ETH has declined by 10.08% over the past 7 days

During the last 3 weeks, Ethereum [ETH] has struggled to take care of any upward momentum on the charts. Actually, over this era, the altcoin has seen excessive value fluctuations whereas buying and selling sideways.

At press time, Ethereum was buying and selling at $3,232. This marked a ten.08% decline on the weekly charts, with an extension to this bearish development by one other 1.85% dip on the each day timeframe.

With ETH struggling to document any sustained beneficial properties, the crypto neighborhood has expressed some considerations with analysts seeing uncertainty. As an example – Cryptoquant analyst Shayan is suggesting that ETH should maintain its $3k help stage to maintain an uptrend.

Ethereum’s funding fee declines

In accordance with Cryptoquant‘s Shayan, Ethereum’s funding fee has seen a pointy decline for the reason that altcoin confronted rejection at its $4k resistance.

This notable drop in funding fee is an indication of lowered demand, weakening Ethereum’s bullish momentum. Due to this fact, with out renewed market confidence amongst traders, sustaining an uptrend turns into tough.

Because the funding fee declines, ETH dangers dropping under $3k. As such, the $3k help stage is important for ETH’s stability and for reigniting any northbound rally. If it breaches this stage whereas the funding fee continues to drop, ETH will see intensified promoting and a deeper correction.

Due to this fact, the general Ethereum outlook will depend on the altcoin reclaiming a better funding fee to defend the $3k help stage. These two will decide the subsequent path Ethereum takes.

What it means for ETH’s charts

Notably, when the funding fee sharply declines, it implies that traders are closing lengthy positions. Merely put, the findings for ETH alluded to a possible shift in market sentiment to bearishness.

Supply: Tradingview

We will see this weakening uptrend via the decline within the Relative Vigor Index. This has declined over the previous 4 days, pointing to robust downward momentum and a weakening uptrend.

This phenomenon might be additional confirmed by a dropping +DI and rising -DI.

Supply: Coinglass

Trying additional, this shift in market sentiment might be evidenced by the rising demand for brief positions. In accordance with Coinglass, most merchants have been going quick on ETH with 52% of the whole accounts.

When quick place holders rise, it’s a signal of bearish sentiment as they count on the value to dip.

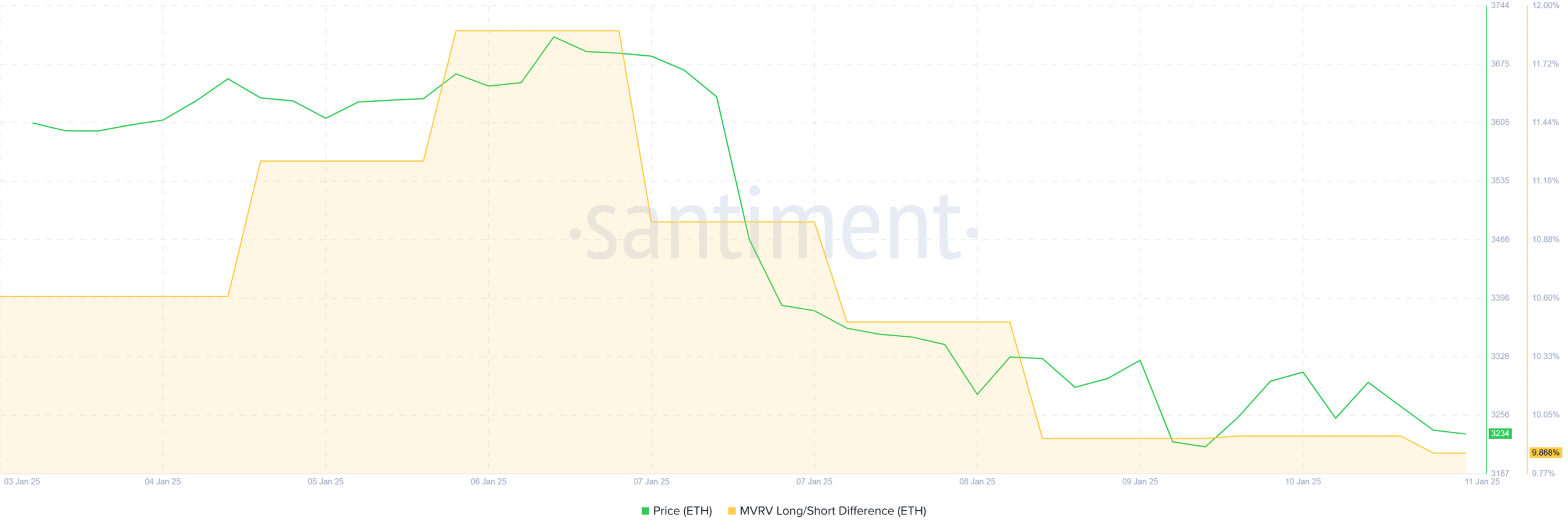

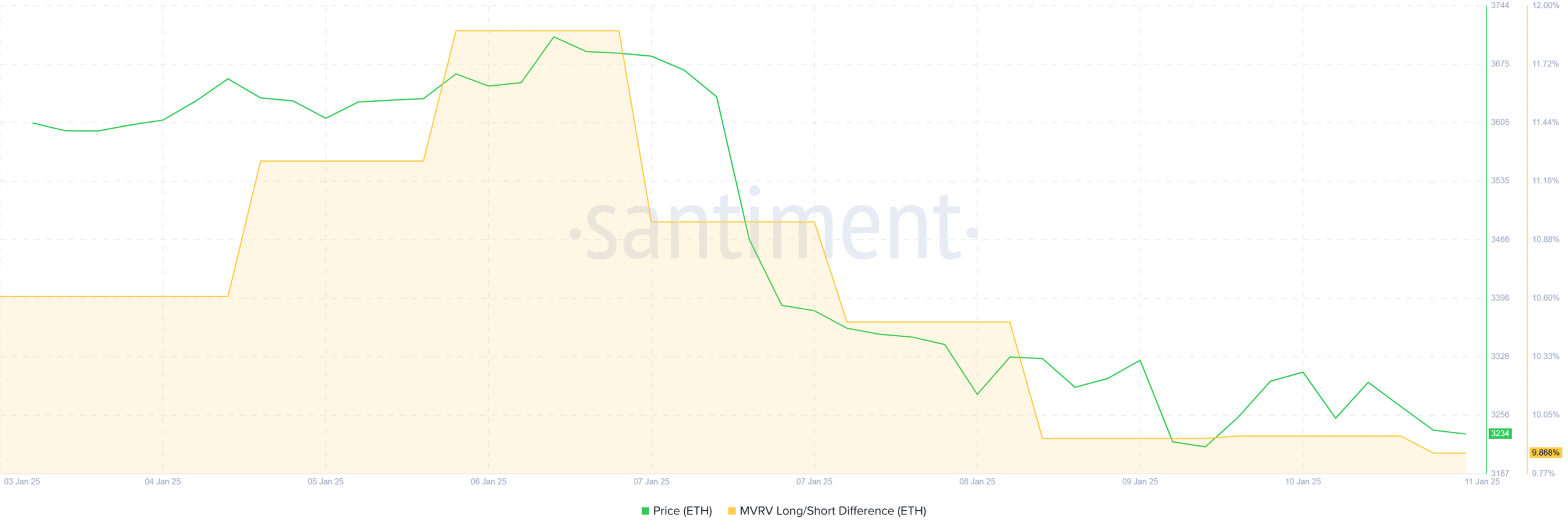

Supply: Santiment

Lastly, Ethereum’s MVRV long-short distinction declined over the previous week to 9.86%. Such a drop not solely indicators lowered profitability for long-term holders, but in addition a rising insecurity amongst long-term holders. When long-term holders lose confidence, they have an inclination to promote.

In conclusion, the declining funding fee positions Ethereum in a weak place that might see the altcoin decline. If this development continues whereas traders maintain bearish sentiments, ETH may see a drop to $3,160.

To maintain the bullish momentum, the $3k help stage should maintain. A transfer under $3,026 may see ETH dip to $2,800.