Ethereum price prediction: How soon can ETH cross $2.9K again?

- Ethereum made current positive factors that have been probably not on the again of natural demand.

- The liquidity hunt within the coming days may see costs attain $2.9k.

Ethereum [ETH] introduced a superb case for consumers a few days in the past when institutional curiosity ramped up and whales started to build up extra of the token.

Some gains have been revamped the previous two days, bringing costs as much as $2672 at press time.

In different information, Vitalik Buterin backed a proposal to have multiple-block proposers within the community. This proposal was made to fight the dangers of centralization and manipulation.

Resistance overhead appeared ominous for Ethereum consumers

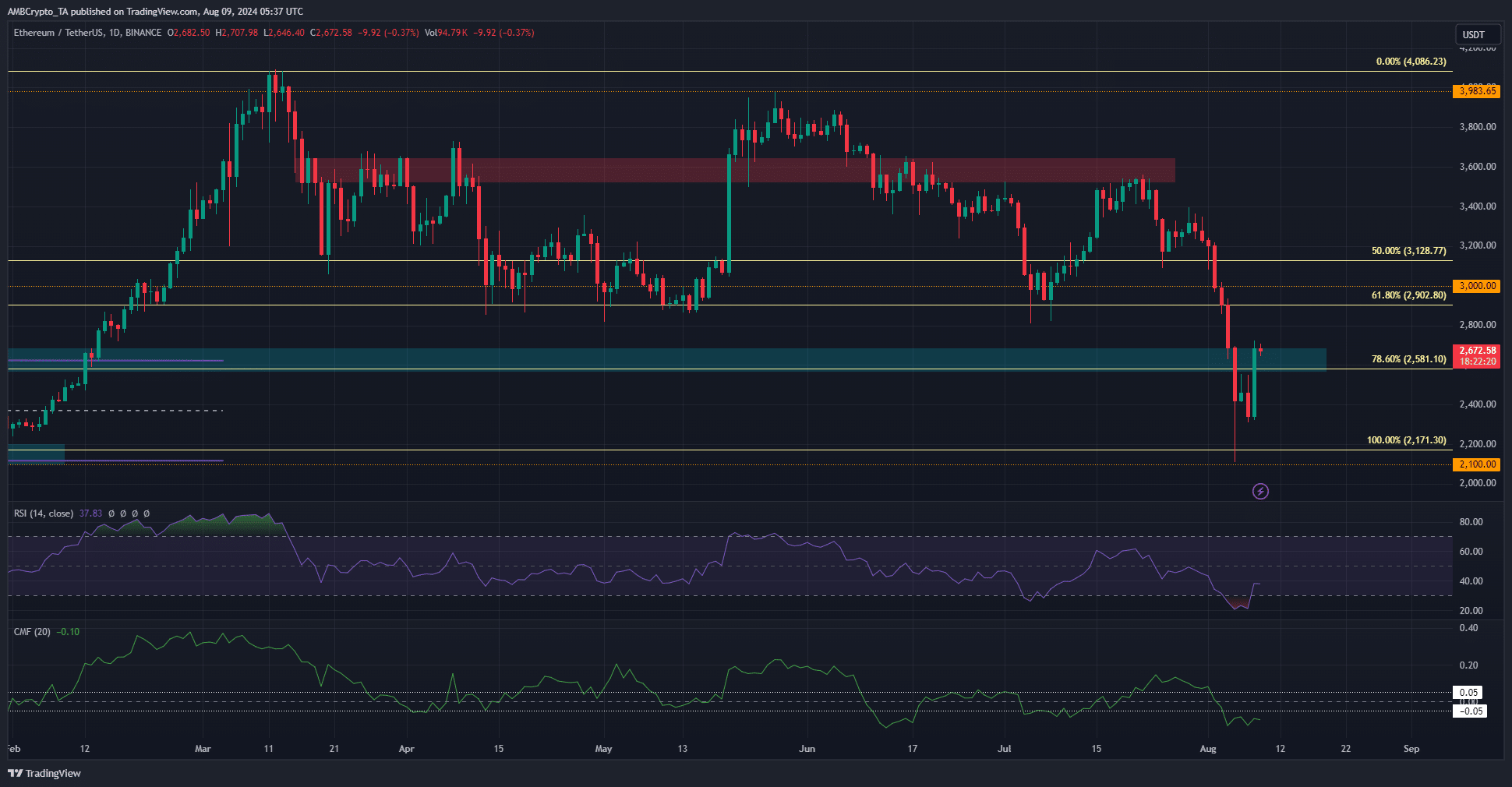

Supply: ETH/USDT on TradingView

The $2580-$2680 was a resistance zone that opposed the bulls in January and February earlier this 12 months. Therefore, it’s crucial that the bulls flip this zone to help within the coming days.

The technical indicators weren’t encouraging. The day by day RSI was at 37, displaying agency downward momentum. The CMF was at -0.1 to point out heavy capital stream out of the market. This subtracted from the current worth positive factors.

The inference was that the worth rally from the $2.1k lows was pushed by the liquidity from late short-sellers, and never by robust demand. Therefore, one other transfer southward after this liquidity hunt may ensue.

Lack of conviction from speculators

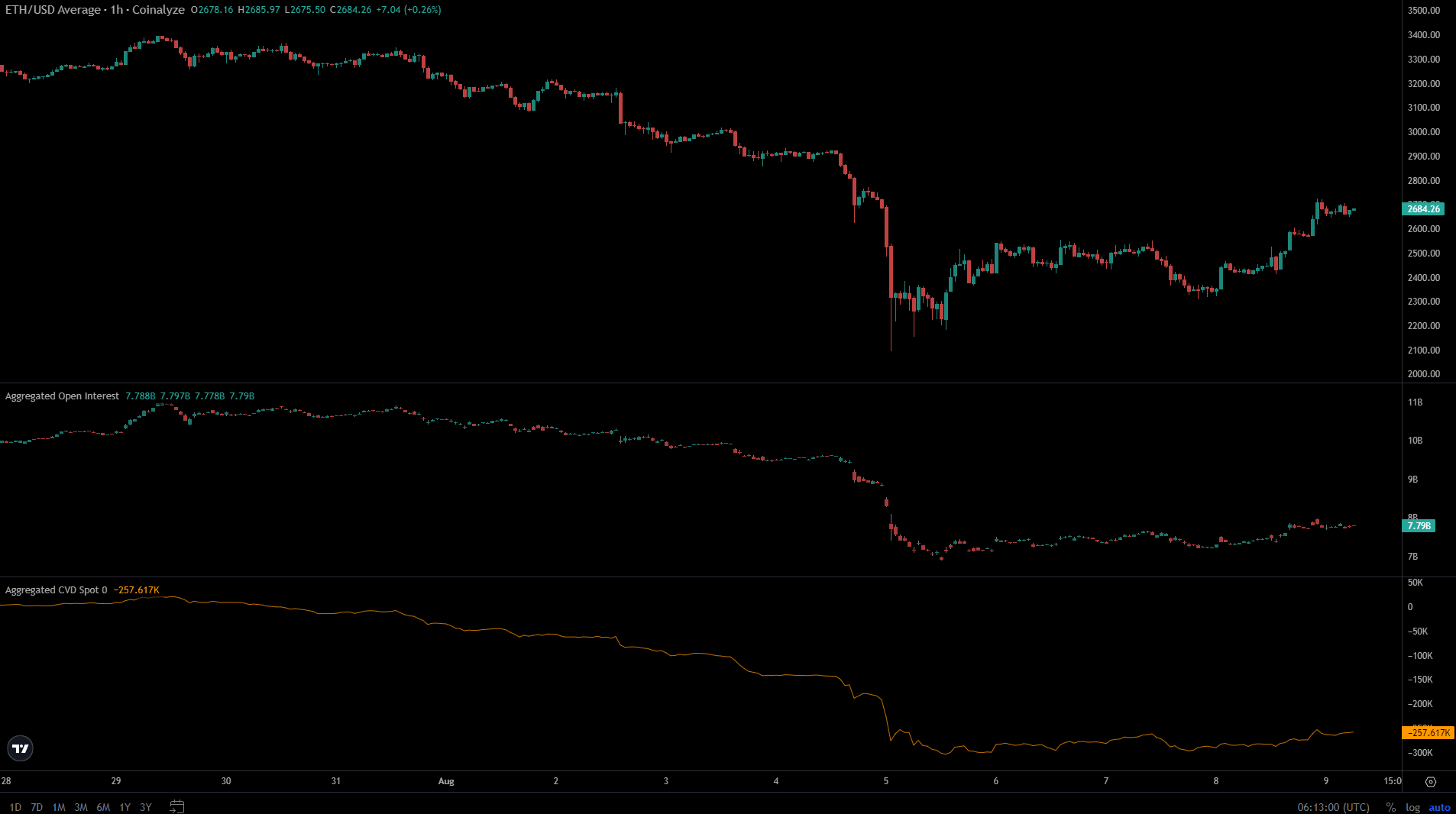

Supply: Coinalyze

Since reaching Monday’s lows, ETH has bounced by 27%. But, the Open Curiosity crept upward from $7.07 billion to $7.79 billion, a meager improve in comparison with the worth positive factors.

This confirmed that speculators lacked bullish conviction.

Nonetheless, the spot CVD noticed a gradual uptrend initiated, which was a bit of fine information for the bulls.

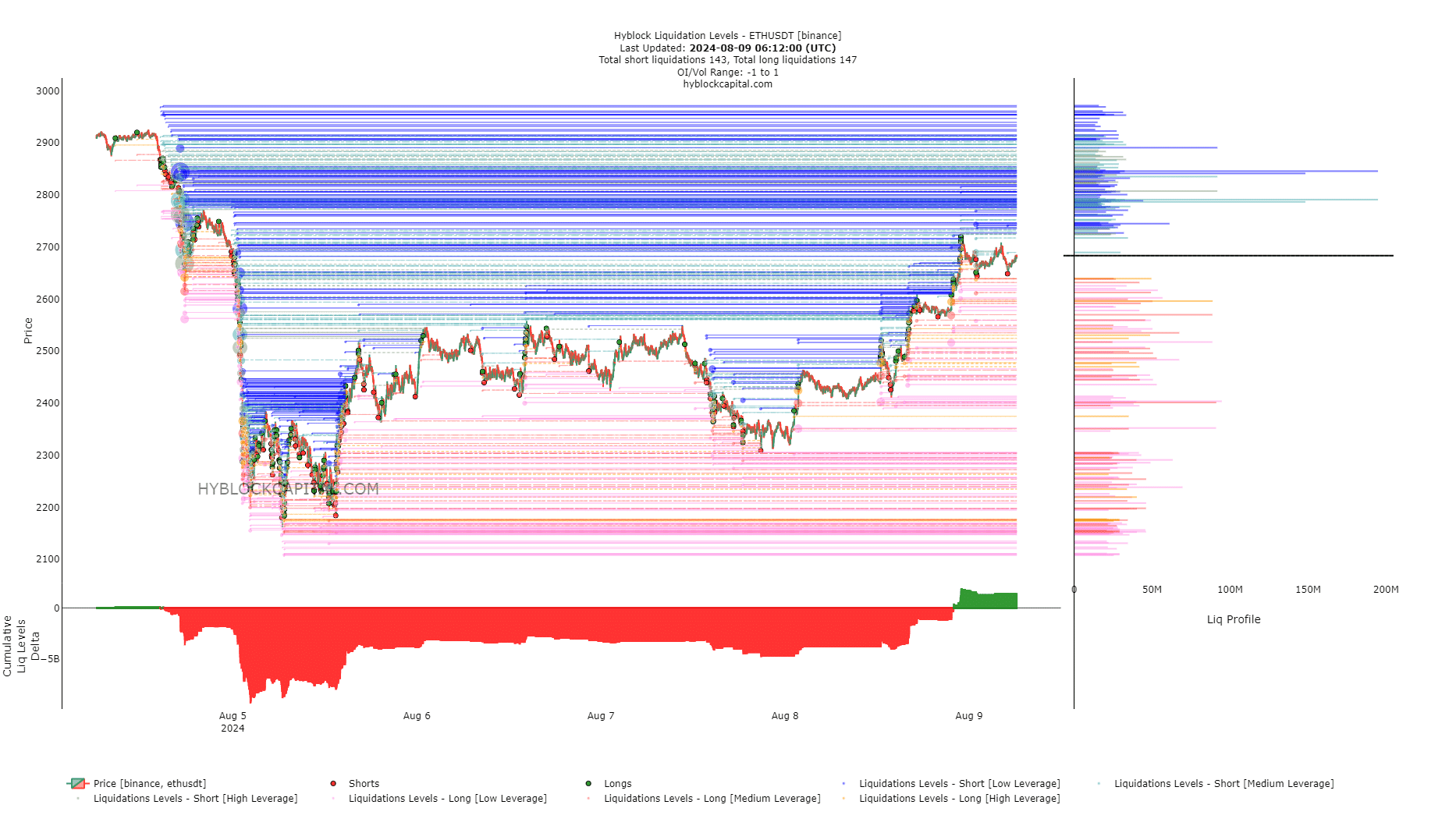

Supply: Hyblock

AMBCrypto’s evaluation of the liquidation ranges chart revealed that lengthy positions have been beginning to acquire dominance. The Cumulative liq ranges delta was turning more and more constructive.

Learn Ethereum’s [ETH] Value Prediction 2024-25

To the north, the $2791 and $2845 are the most important liquidation ranges.

Nonetheless, because the delta wasn’t overwhelmingly constructive, additional worth positive factors within the close to time period might be anticipated. Past $2845-$2900, the bulls are prone to battle, and costs may take a downward flip from there.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion.