Ethereum price prediction – Will rising leverage drive or weaken ETH’s rally?

- Ethereum has surged to a three-month excessive above $2,900 as bullish sentiment strengthens.

- The rising estimated leverage ratio and funding charges level in direction of rising speculative exercise from by-product merchants.

Ethereum [ETH] has gained by 20% in simply two days, with the value oscillating between $2,400 and $2,950. At press time, ETH traded at $2,922, its highest degree in over three months.

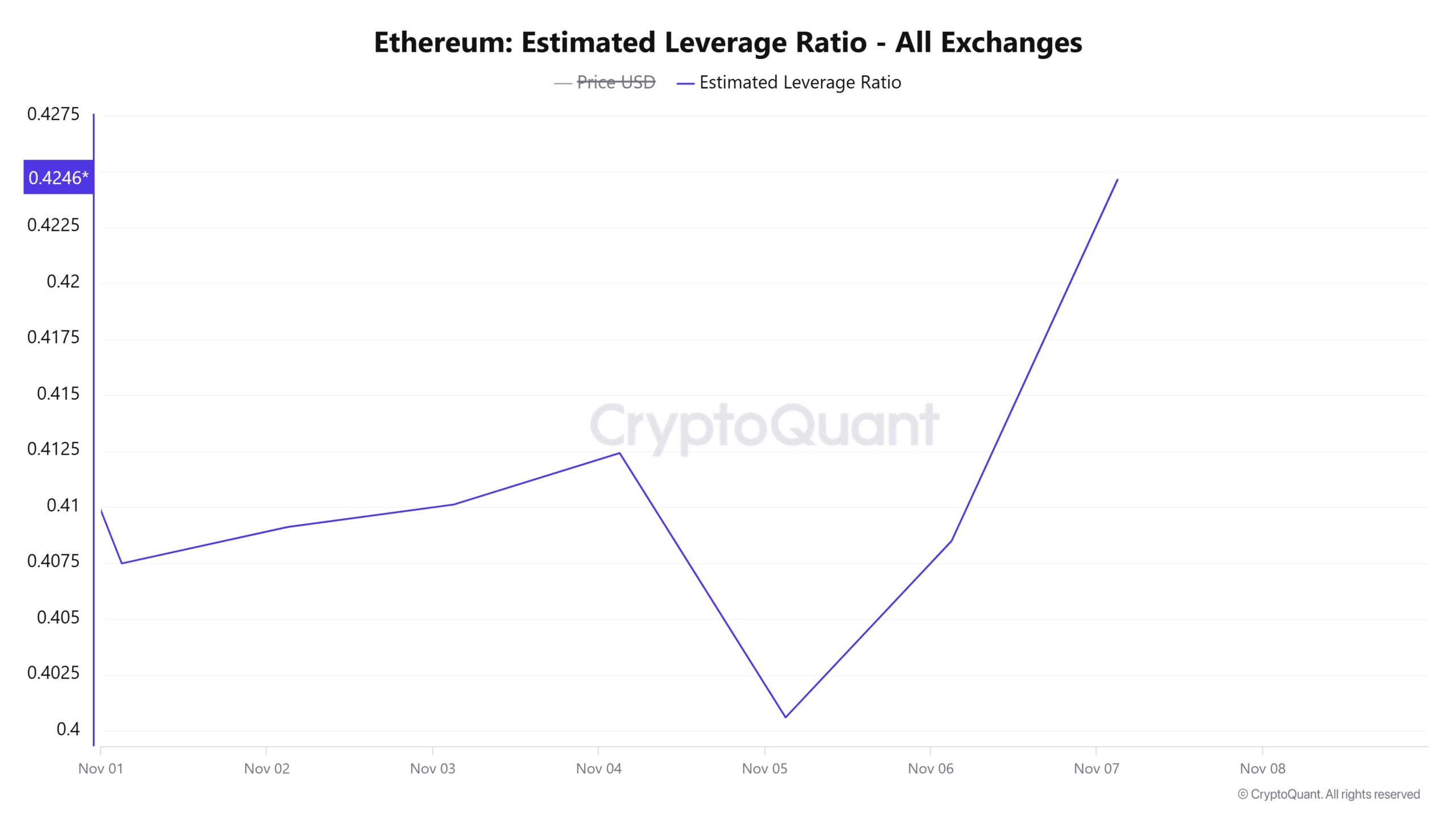

The latest features have been accompanied by rising volatility. In truth, the estimated leverage ratio has spiked considerably this week to a seven-day excessive.

At press time, this metric stood at 0.42. This reveals that 42% of the open positions on the derivatives market are backed by leverage. A build-up of leverage exercise tends to intensify value volatility.

Supply: CryptoQuant

Nonetheless, the estimated leverage ratio has but to hit excessive ranges, giving Ethereum room to proceed with the uptrend.

Funding charges & open curiosity hit multi-month highs

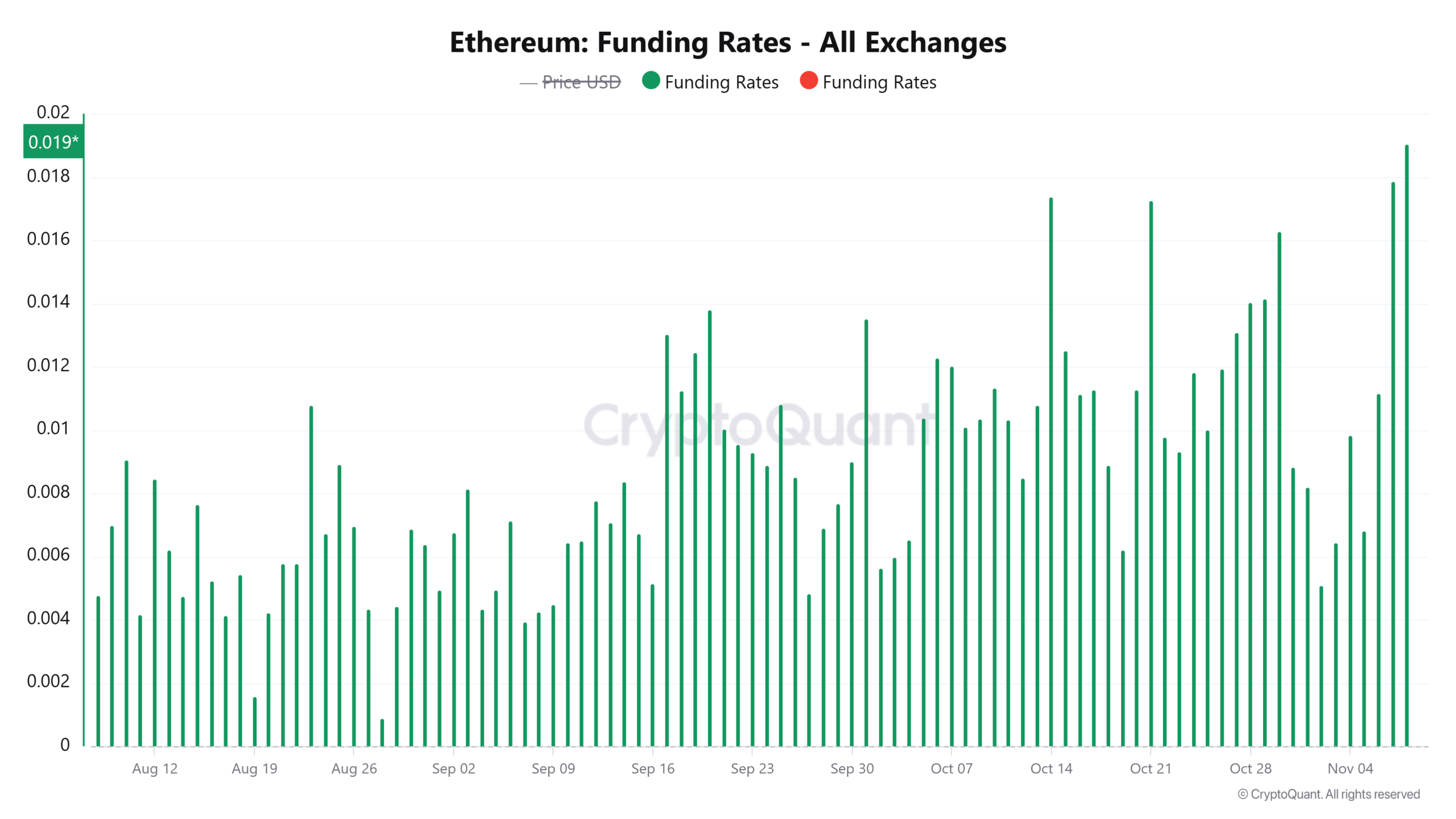

The newly opened positions on the derivatives market look like longs. That is seen within the rising funding charges to a three-month excessive.

When funding charges are rising, it reveals an inflow of lengthy positions. It additionally signifies that lengthy merchants are keen to pay the next payment to take care of their positions, additional suggesting that there’s a bullish bias out there.

Supply: CryptoQuant

On the identical time, Ethereum’s open curiosity continues to rise, and at press time, it was at a five-month excessive of $16.61 billion per Coinglass information.

Within the final two days, Ethereum’s open curiosity has elevated by greater than $3 billion, additional exhibiting that speculative curiosity in ETH is excessive.

The spike in buying and selling exercise and open positions within the derivatives market will increase the probability of excessive volatility. It may additionally point out that ETH might be on the verge of an overheated market.

Nonetheless, technical indicators counsel that an ETH bull run is also underway.

Ethereum exams 200-day transferring common

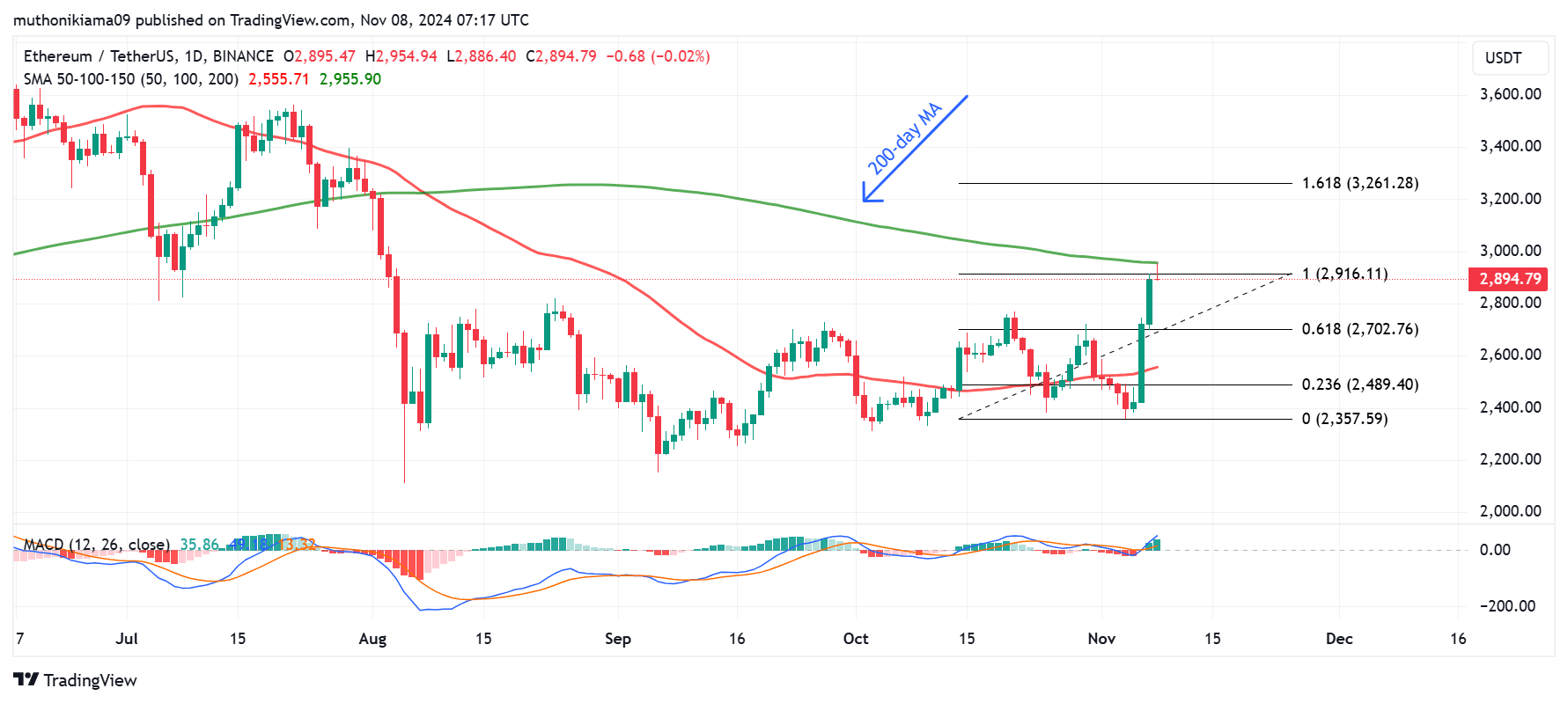

Ethereum is at the moment testing essential resistance on the 200-day Easy Transferring Common (SMA) on its one-day chart. If ETH manages to flip this value degree at $2,955, it may result in a sustained uptrend.

Flipping this resistance may additionally pave the best way for a 12% rally to the 1.618 Fibonacci degree ($3,260).

Supply: Tradingview

The Transferring Common Convergence Divergence (MACD) means that extra features lie forward. This metric has flipped optimistic and has additionally made a pointy transfer north, which reveals that the uptrend is gaining energy.

Nonetheless, merchants ought to be careful for indicators of profit-taking as promoting strain may see the value drop to check assist at $2,700. A drop beneath this assist may usher in a downtrend.

Are inflows to ETH ETFs driving the rally?

On seventh November, the whole inflows to identify Ethereum exchange-traded funds (ETFs) reached $79.74 million, their highest degree since August in response to SoSoValue.

The Constancy Ethereum Fund (FETH) ETF had the best inflows of $28 million, adopted by the BlackRock iShares Ethereum Belief with $23 million inflows.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

The VanEck Ethereum Belief additionally recorded $12 million inflows marking its first inflows in two weeks.

If the demand for ETH ETFs continues, it may bode nicely for Ethereum’s value.