Ethereum price retreats amidst strategic whale moves

- Two Ethereum whales offered off over 28,000 tokens.

- ETH trades round $1,900 because the bull development weakens additional.

The value of Ethereum [ETH] has been present process a reversal over the previous few days. Nonetheless, latest observations of whale actions recommend that these massive wallets could also be exploiting the present value vary.

Ethereum on the transfer

As reported by LookonChain, an Ethereum whale offered off a considerable quantity of ETH on seventeenth November, promoting over 10,000 ETH.

The overall worth of this transaction amounted to $19.33 million, at $1,933 per token. Additional evaluation of the whale’s exercise revealed this was not an remoted incidence.

Earlier reviews indicated the sale of over 6,000 tokens, leading to a $12 million transaction, passed off some days in the past. These actions have created an impression that the whale is promoting off its holdings.

Moreover, another whale, initially holding a protracted place on ETH, has just lately offered off its ETH holdings.

This explicit whale acquired 12,048 ETH in October for $21.3 million, coming into into lengthy positions on Aave and Compound.

On the time of writing, the whale had offered its ETH for $23.4 million, utilizing the proceeds to settle its debt. Is that this a strategic profit-taking transfer, a market dump, or a mixture?

Influence on the Ethereum netflow?

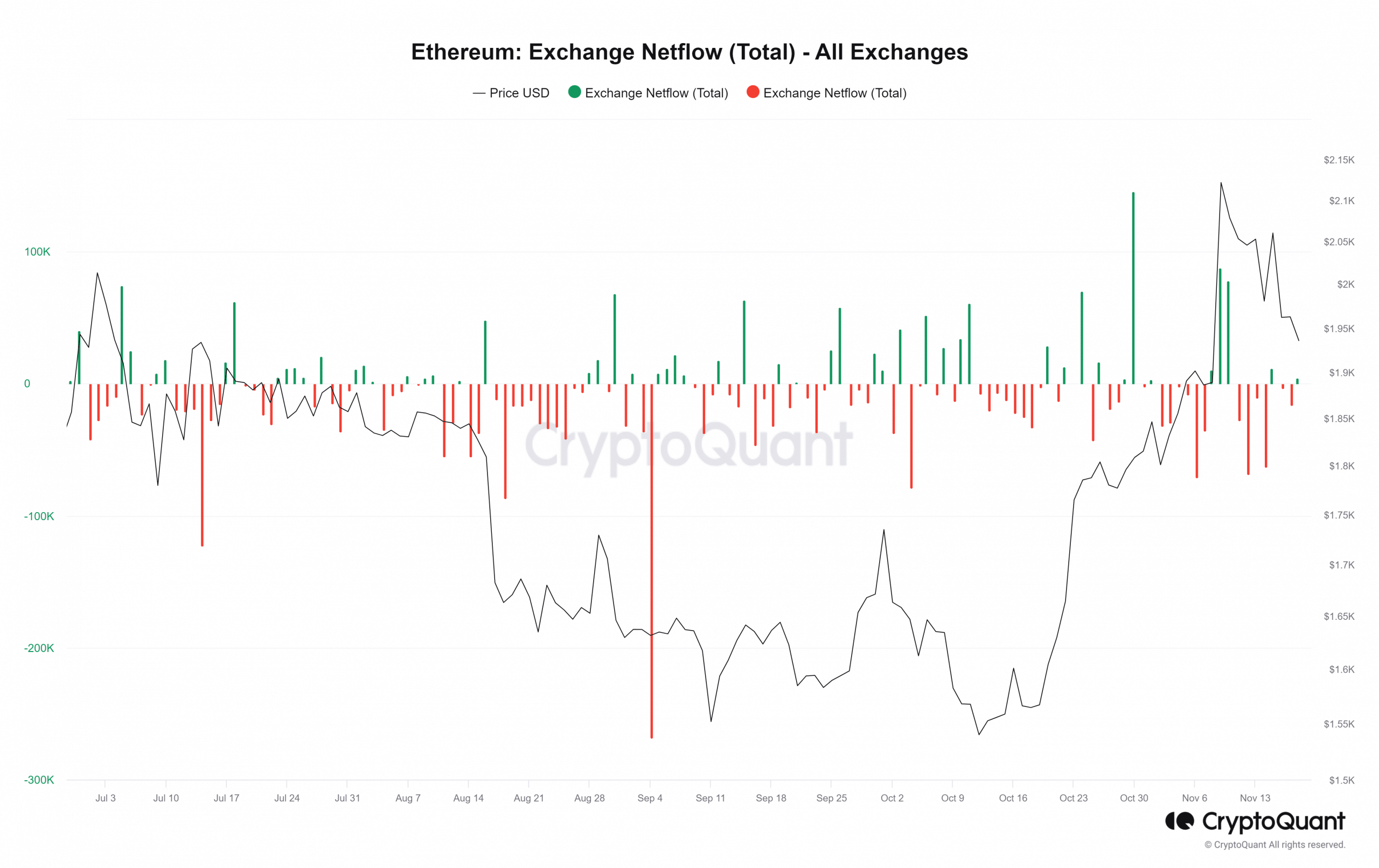

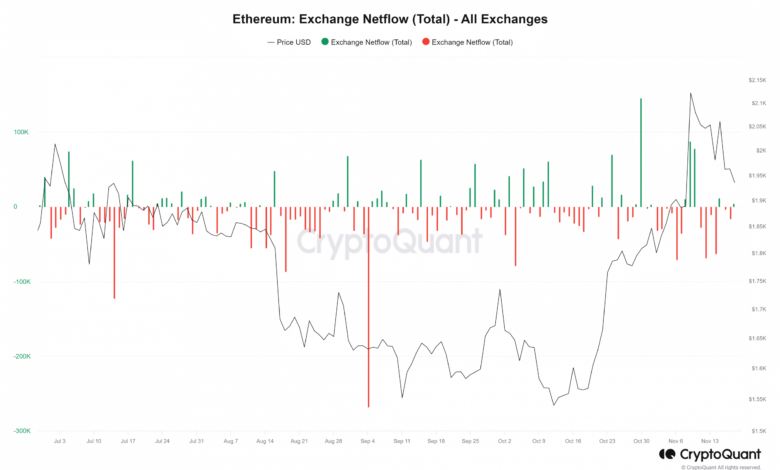

AMBCrypto’s examination of Ethereum actions throughout varied exchanges revealed an attention-grabbing development.

Regardless of the strikes from these whales, as talked about earlier, there was a internet outflow of ETH on seventeenth November. The netflow chart, as analyzed on CryptoQuant, confirmed that over 16,000 ETH left the exchanges, indicating a unfavorable netflow throughout that interval.

Nonetheless, as of this writing, there was a reversal within the netflow, with over 10,000 ETH flowing into exchanges.

This shift suggests that there’s now a rise within the quantity of ETH being deposited into exchanges, probably for promoting.

Whales tapping into revenue

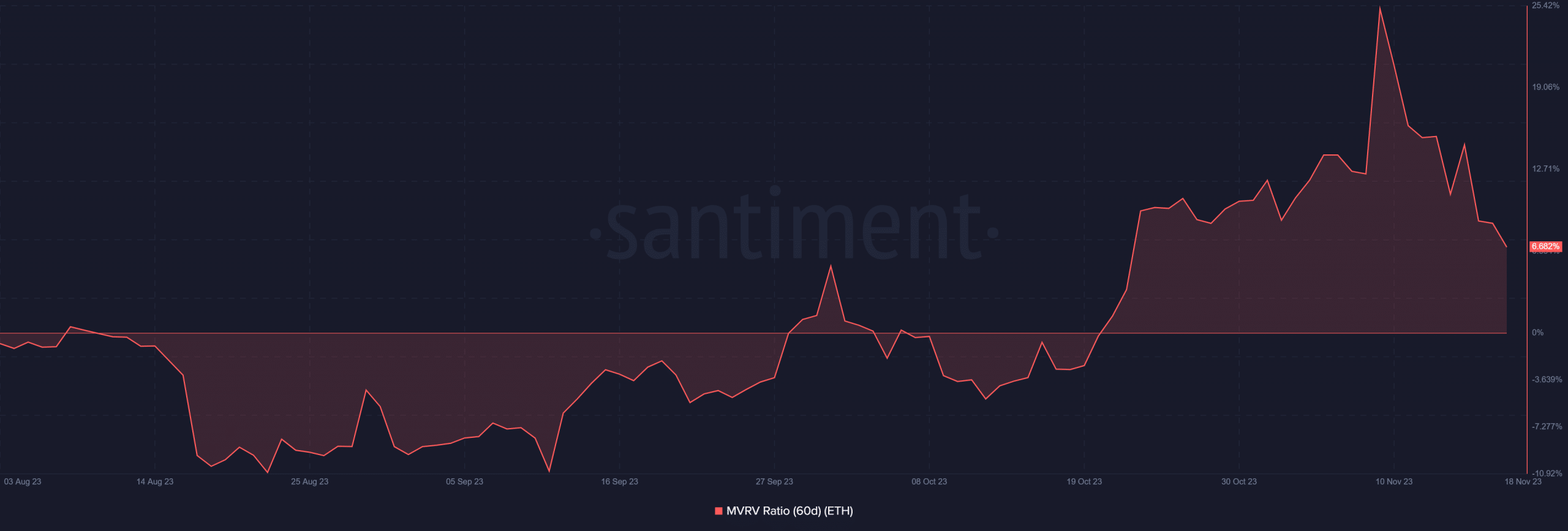

AMBCrypto analyzed the 60-day Market Worth to Realized Worth Ratio (MVRV) of Ethereum.

The evaluation revealed potential motivations behind the noticed market actions from the whales.

An preliminary examination of the Santiment chart indicated a speedy decline in MVRV attributed to the altering value developments. Round ninth November, the 60-day MVRV stood at over 25%.

Nonetheless, as of this writing, the MVRV had decreased considerably to round 7%.

This shift in MVRV means that the revenue derived from the gross sales of ETH has skilled a considerable discount, dropping from over 25% to the present 7%.

Learn Ethereum (ETH) Price Prediction 2023-24

ETH weakening bull run

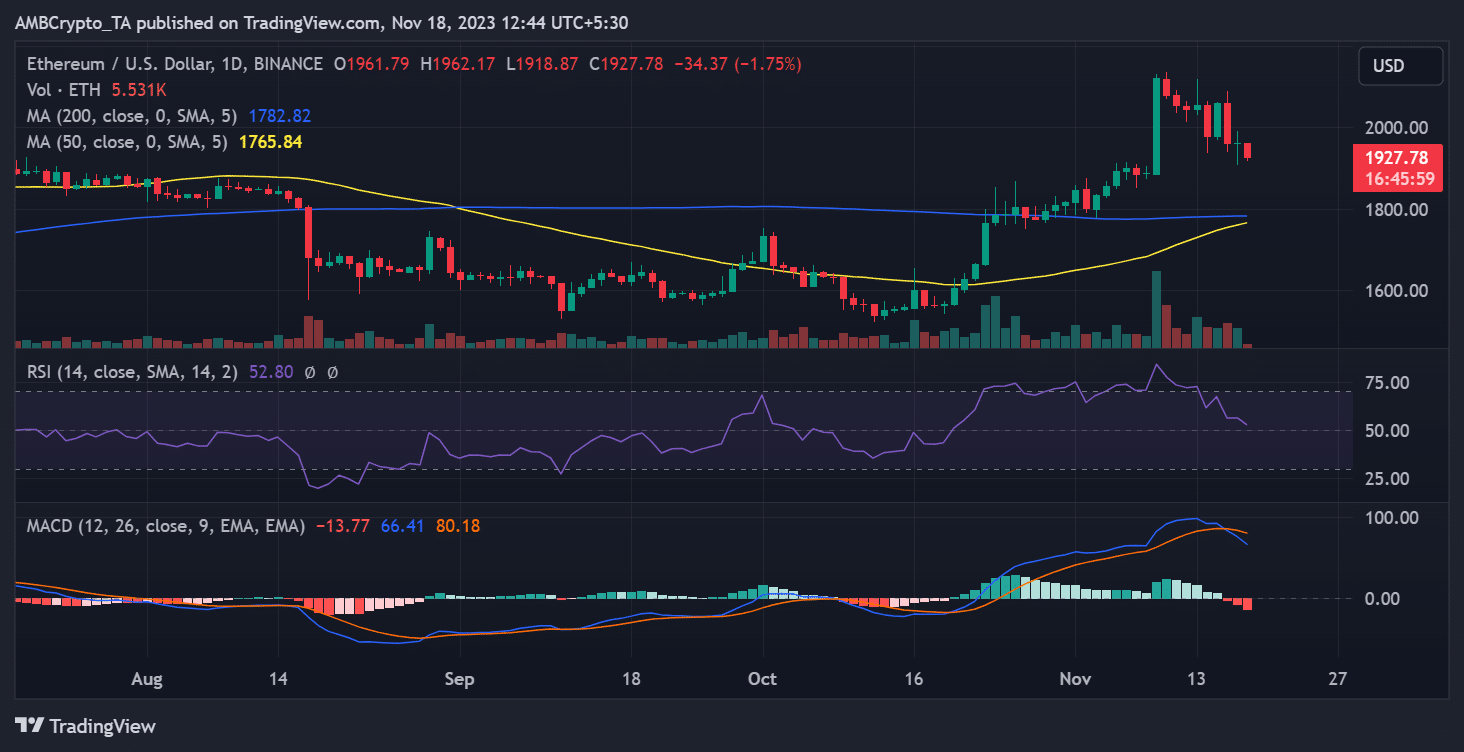

A overview of the each day timeframe chart indicated that Ethereum continued to development downward. On the time of this evaluation, it mirrored a 1.7% lower in worth, buying and selling at round $1,920. This decline is underscored by the motion of its Relative Energy Index (RSI) line.

The RSI was located within the overbought zone within the earlier interval, signifying a robust bull run. Nonetheless, the present development exhibits the RSI approaching the purpose of crossing under the impartial line, suggesting a weakening of the preliminary bull run.