Ethereum price stalls despite positive ETF shift – What’s happening?

- Spot Ethereum ETFs recorded $11.4M in inflows for the primary time in almost three weeks.

- This comes as outflows from exchanges elevated considerably, relieving the near-term promoting strain.

Spot Ethereum [ETH] exchange-traded funds (ETFs) recorded $11.4 million inflows on tenth September per SoSoValue information. This was the primary time in almost three weeks that the flows turned constructive.

Wall Avenue giants BlackRock and Constancy dominated the information with $4.31 million and $7.13 million inflows, respectively.

Regardless of the current shift in sentiment, ETH ETFs have underperformed in opposition to their Bitcoin [BTC] counterparts with $562 million in cumulative internet outflows since launch.

Based on Glassnode, the efficiency of Ethereum ETFs has been “comparatively tepid” due to redemptions from the Grayscale product. Nonetheless, these merchandise have a smaller affect on buying and selling volumes within the ETH spot market.

Ethereum alternate outflows attain multi-week peak

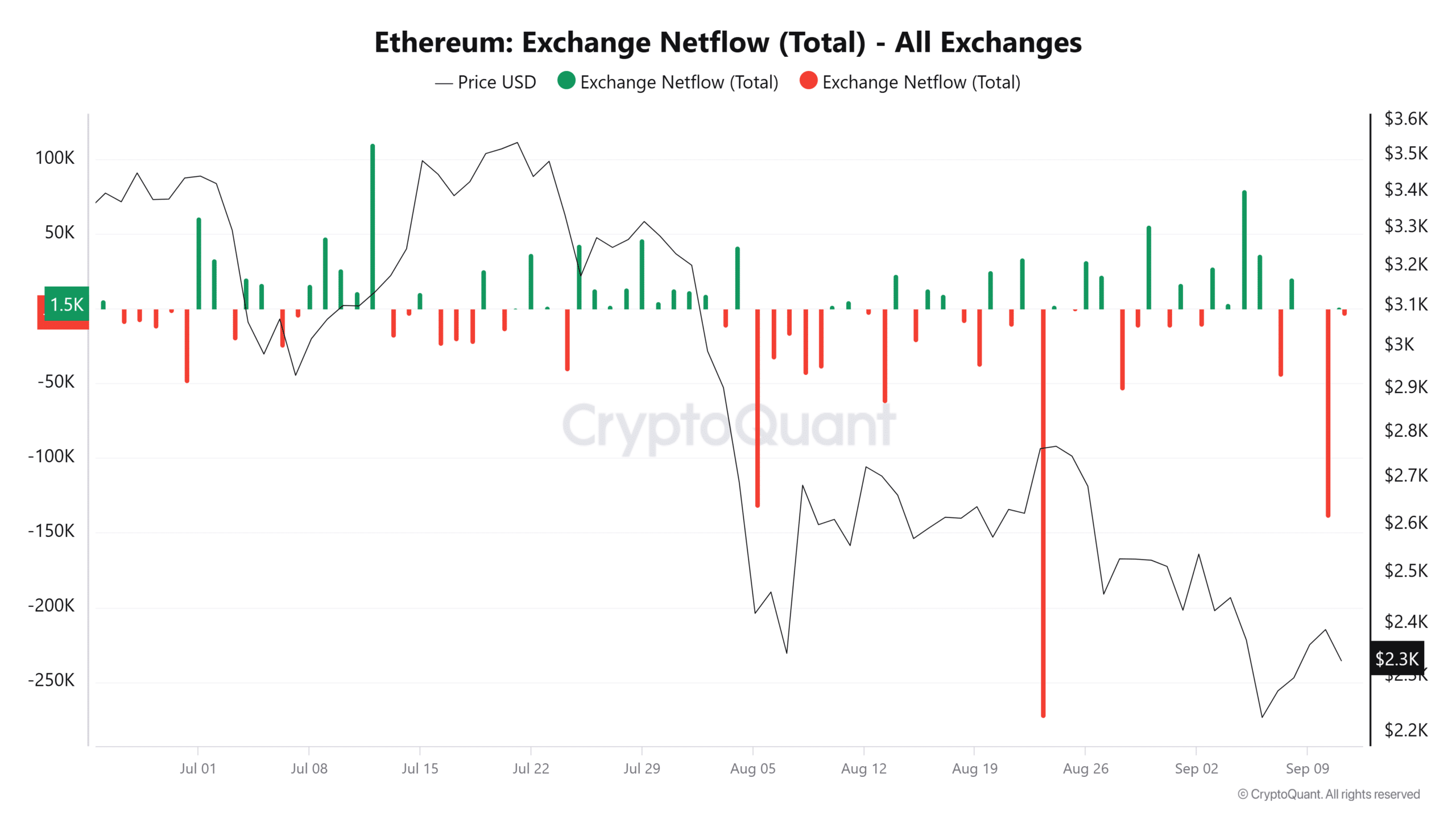

Information from CryptoQuant reveals a surge in Ethereum outflows from exchanges. ETH alternate netflows reached 139,548 on tenth September, the best stage in weeks.

Supply: CryptoQuant

A rise in alternate outflows signifies fewer merchants are all for promoting ETH within the close to time period. This relieves the promoting strain on the altcoin, and if demand will increase, it may set off a value improve.

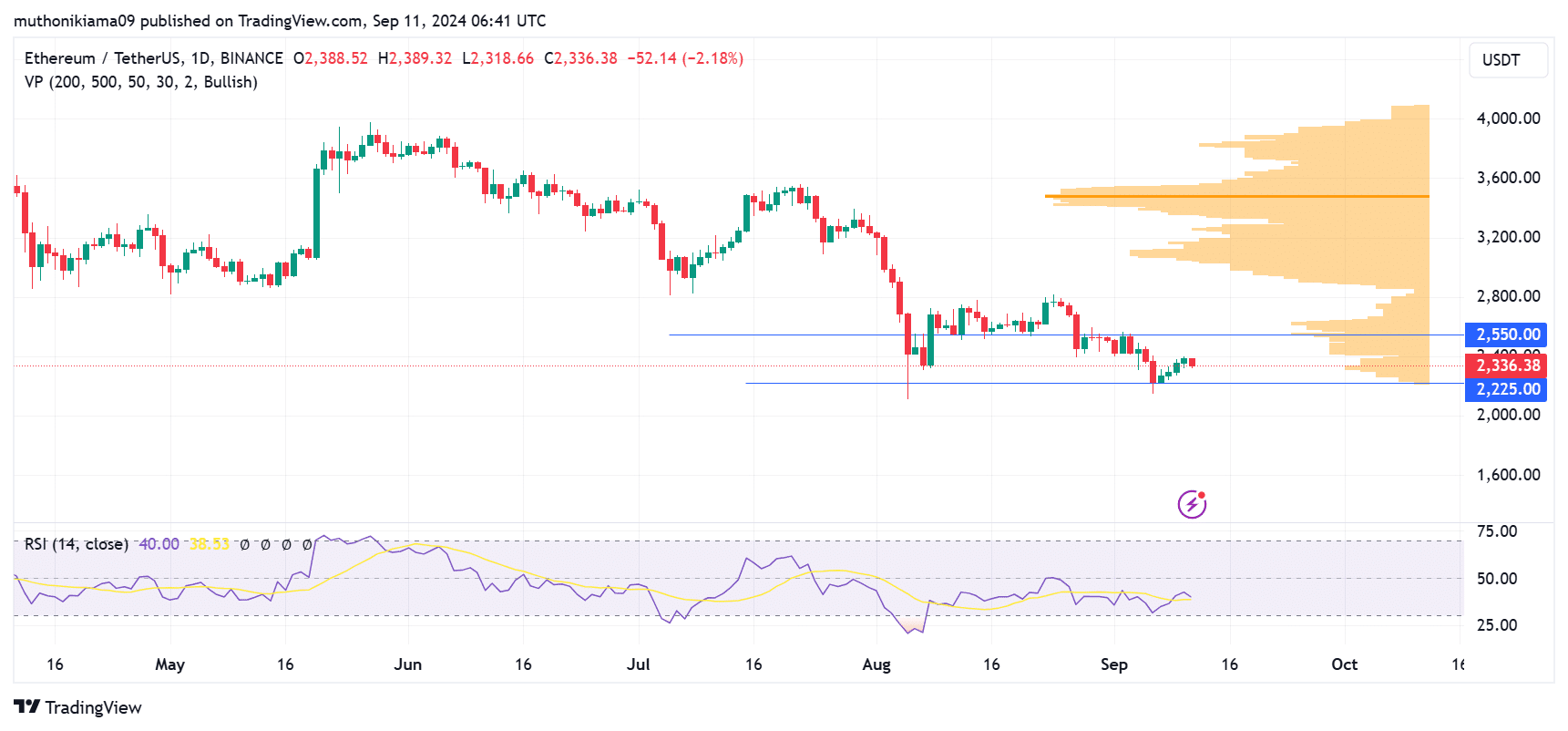

Nonetheless, this surge in demand is missing. The Relative Power Index at 40 reveals that promoting momentum is considerably excessive. Furthermore, the RSI is tipping south and dangers crossing beneath the sign line, which may create a promote sign and set off additional dips.

Supply: Tradingview

Furthermore, the amount profile information reveals that bears would possibly proceed to dominate ETH value. There are considerably low shopping for volumes on the present value, which may see ETH consolidate at present costs.

If promoting exercise continues, the altcoin will probably drop to check help at $2,225 earlier than making a decisive transfer.

Consumers seem like saturated at $2,550. This value acts as a key resistance stage, with merchants ready for a breakout to verify an uptrend.

ETH’s rally can also be contingent on the efficiency of the Ethereum community if help from the broader market fails.

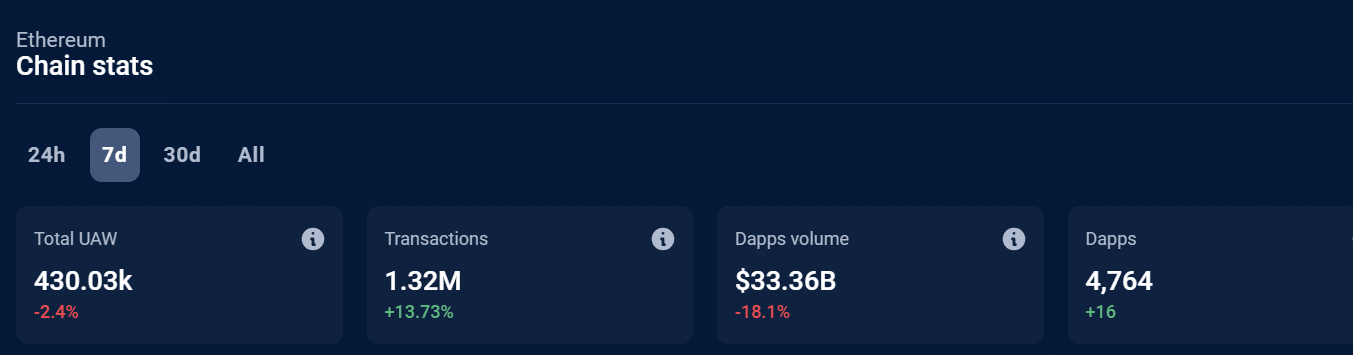

Information from DappRadar reveals that the Ethereum community has been lagging when it comes to volumes. Within the final seven days, volumes for decentralized functions (DApps) created on Ethereum have dropped by 18% to $33 billion.

Nonetheless, the blockchain noticed a 13% improve in transactions throughout the identical interval This means that buying and selling exercise is rising however there are fewer interactions on the community.

Supply: DappRadar