Ethereum price’s $3360 rejection – Blame profit-taking or…

- Ethereum noticed two sizeable waves of profit-taking up to now month that projected doubts about an upcoming rally.

- The ETH whales have added to their stash, with retail being eager to promote.

Ethereum [ETH] noticed a rejection from the $3360 resistance degree over the weekend. This outlined short-term bearish sentiment.

In different information, the most recent Dencun improve was a hit, serving to L2 options attain low fuel charges.

The subsequent goal for the builders known as Prague. Although hopeful information was breaking, on-chain metrics confirmed an absence of religion from market contributors.

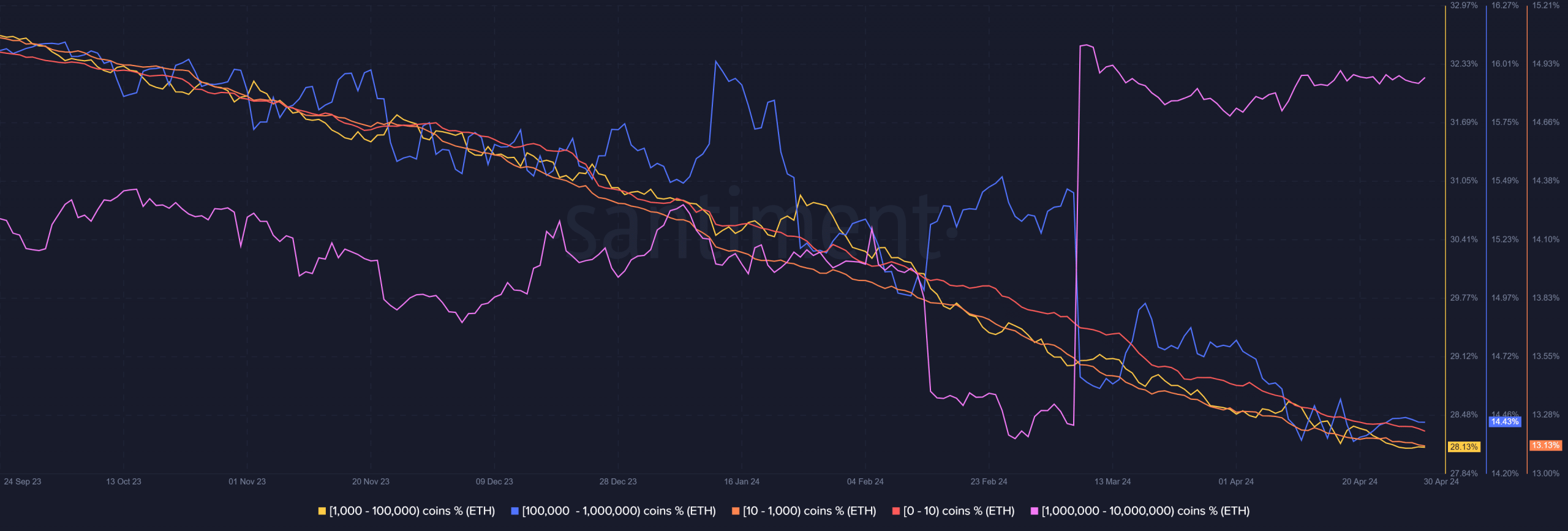

The clues from the Ethereum provide distribution

Supply: Santiment

AMBCrypto’s evaluation of the provision distribution confirmed that nearly each pockets holding wherever from 1 to 100k ETH has been promoting in latest months.

The micro wallets with beneath 0.1 Ethereum had been those shopping for, hopeful of a rally after Bitcoin’s [BTC] halving.

Previously, when the 100k-1 million token holder cohort was added to their stash, it got here throughout a market rally. Generally it preceded a significant retracement, prefer it did in mid-January.

The second half of April noticed this cohort settle down, neither including to nor promoting their provide.

The 1 million- 10 million cohort noticed a pointy uptick in early March. Since then, they too have been quiet. Collectively, it confirmed that the big contributors anticipated bullish sentiment within the coming months.

A pointy spike within the 100k- 1 million holders’ provide may very well be helpful for merchants to mark native tops and imminent retracements.

Does worry nonetheless rule the market?

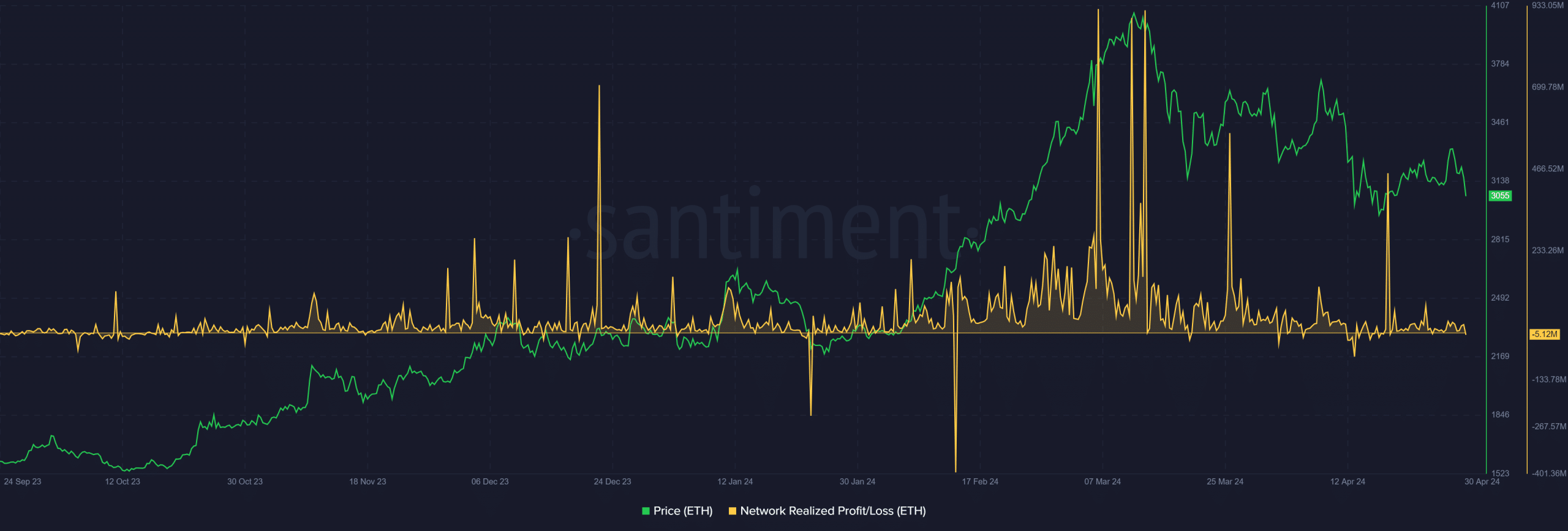

Supply: Santiment

The community realized revenue/loss (NRPL) grows during times of swift value appreciation as earnings pile up. The primary two weeks of March noticed sturdy value rallies alongside NRPL spikes.

This indicated profit-taking exercise.

Nevertheless, the NRPL has trended downward since then. It noticed occasional spikes, resembling in late March and mid-April, every smaller than the final.

This confirmed contributors had been eager on reserving earnings though the value was simply above the $3k help zone.

It indicated an absence of religion, which is a part of the prolonged retracement Ethereum has witnessed up to now two months.

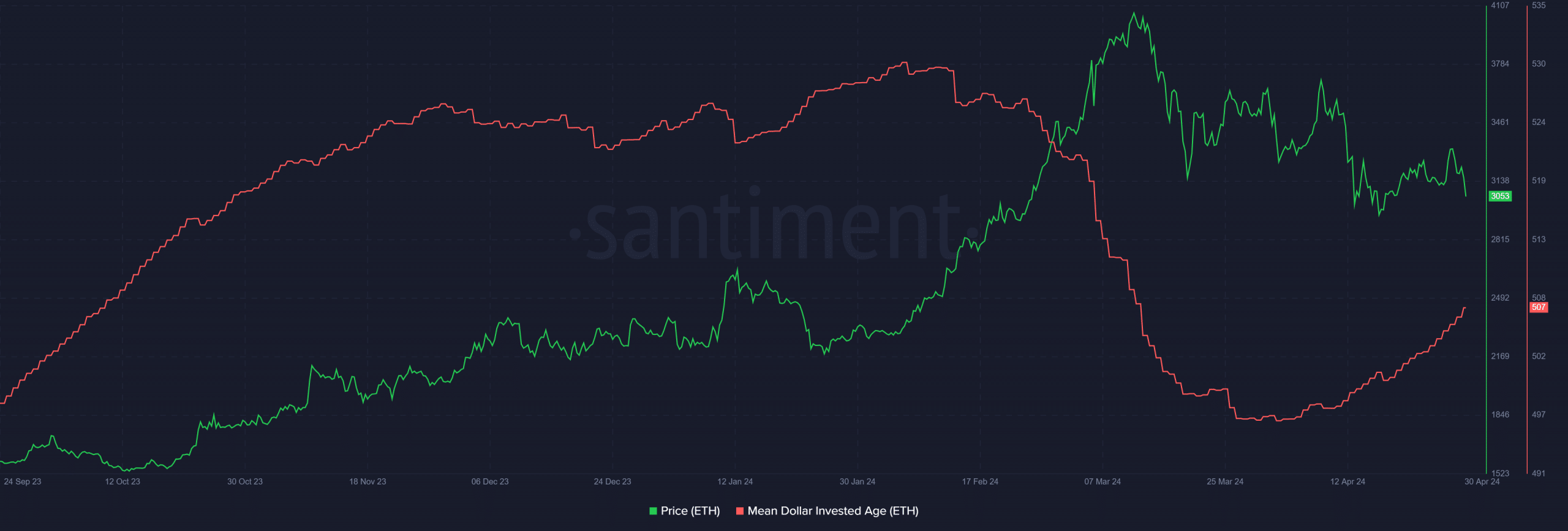

Supply: Santiment

Alternatively, the imply greenback invested age (MDIA) has trended strongly increased up to now month. This metric exhibits that the asset is in an accumulation part as soon as once more.

It fell sharply throughout the rally to point holders had been realizing earnings en masse.

Learn Ethereum’s [ETH] Value Prediction 2024-25

Previously month, the HOLDer sentiment has been stronger than the collective urge to guide earnings.

In conclusion, the metrics confirmed each worry and hope had been current out there, however long-term traders have extra purpose to carry on than to promote.