Ethereum: Profit-taking stalls potential rally – Will ETH see $4K?

- Ethereum Futures surged 40% in quantity as merchants positioned themselves for potential value actions.

- Revenue-taking by buyers limits a serious ETH rally, regardless of elevated outflows from exchanges.

Ethereum’s [ETH] value is experiencing a interval of volatility, with fluctuating peaks and troughs in latest weeks.

After briefly dropping beneath $2,600, the worth of Ethereum has proven indicators of restoration, buying and selling at $2,645.52 at press time.

Over the past 24 hours, the worth has elevated by 0.29%, whereas the previous week has seen a minor decline of 0.12%. Ethereum’s market capitalization was $318.46 billion, with a 24-hour buying and selling quantity of over $17.88 billion.

Key technical ranges to observe

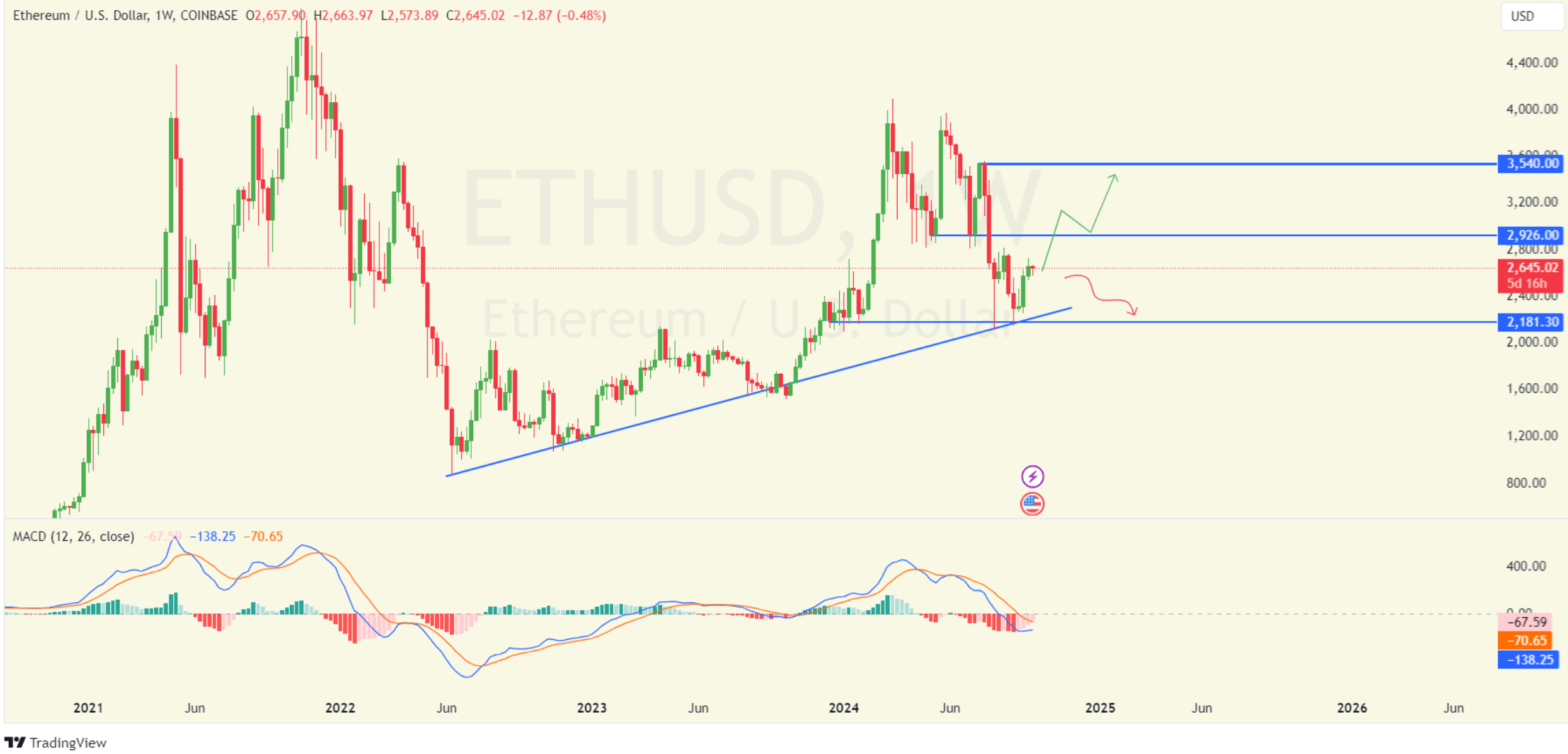

Ethereum’s value is sitting close to a vital help stage at $2,181.30. This stage has been bolstered by an ascending trendline that has supported the crypto since mid-2022.

Ought to Ethereum break beneath this help, the market might see a downward pattern, doubtlessly resulting in additional value drops.

Alternatively, Ethereum is going through resistance round $2,926. A break above this resistance might drive the worth larger, with a possible goal of $3,540.

If shopping for momentum strengthens, the worth would possibly even take a look at earlier highs round $4,000.

For bullish buyers, the upward trendline will play an important position in sustaining market confidence.

Supply: TradingView

Ethereum Futures surge amid volatility

The MACD indicator for Ethereum confirmed a bearish sentiment, with each the MACD line and the sign line beneath zero.

Nevertheless, if the MACD histogram started to indicate optimistic motion, it might sign a reversal, supporting a extra bullish situation for Ethereum within the coming weeks.

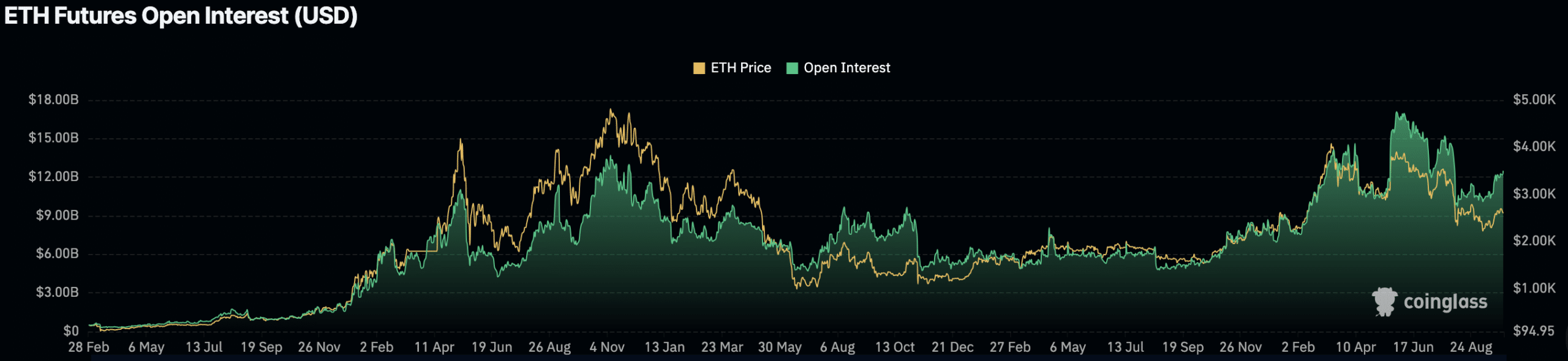

Current futures knowledge from Coinglass revealed elevated exercise within the Ethereum market. Open Curiosity in ETH futures has risen by 2.94%, now standing at $12.66 billion, indicating rising dealer curiosity.

Supply: Coinglass

Moreover, ETH’s Futures quantity has jumped by 40.39% to $25.63 billion, whereas Choices quantity has surged by 258.39%, reaching $564.17 million.

These will increase mirrored rising participation in Ethereum Futures buying and selling, suggesting market contributors are positioning themselves for potential value actions.

Revenue-taking, not accumulation

An evaluation by AMBCrypto famous that since late July, Ethereum outflows from centralized exchanges have elevated, suggesting accumulation by some buyers.

Nevertheless, this accumulation was not as intense as in the course of the February or November 2023. Over the past two weeks, netflows have proven a number of optimistic days, indicating that some holders have been taking income.

Whereas the quantity of those outflows shouldn’t be giant sufficient to counsel an exodus, it does spotlight a portion of the market opting to money in on latest value good points.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

The netflows knowledge counsel that, whereas there may be some accumulation, it will not be ample to drive a serious bullish rally for Ethereum within the close to time period.

As an alternative, profit-taking appears to be the dominant conduct as some holders capitalize on Ethereum’s efficiency since March 2024.