Ethereum rebounds, whales scoop ETH: Will the ETF approval boost gains?

- Ethereum whales are actively accumulating, with latest massive transactions signaling renewed confidence.

- Anticipation of Ethereum ETF approval drives important institutional inflows, suggesting bullish sentiment.

Ethereum’s [ETH] worth improve has triggered heightened exercise amongst massive holders, generally generally known as whales.

Following every week of downward momentum, ETH’s worth has seen a resurgence, resulting in substantial transactions by whales.

As of the time of writing, Ethereum was buying and selling at $3,113.58 with a 24-hour buying and selling quantity of $14,340,649,075, in line with CoinGecko.

This was mirrored in a 1.07% worth improve over the previous 24 hours, though the cryptocurrency has skilled a -7.46% decline over the previous seven days.

This uptick in worth has catalyzed elevated accumulation by whales, signaling a possible shift in market sentiment.

Vital whale actions

Current on-chain information indicated substantial exercise amongst Ethereum whales.

Notably, Spot On Chain, an on-chain information supplier, reported that an Ethereum whale withdrew 16,449 ETH, equal to $50.3 million, from the crypto trade Binance [BNB].

This transfer got here as ETH surged past $3,000, marking the primary notable accumulation by a brand new whale tackle. The withdrawn ETH has since been transferred to a brand new pockets and stays there.

Moreover, Whale Alert noted one other substantial transaction involving 9,966 ETH, equal to roughly $30.6 million, transferred from the Kraken trade to an unknown pockets.

This exercise aligned with a broader development of whales resuming their accumulation of ETH following a interval of distribution.

Ali, a recognized analyst on X, commented,

“After a quick distribution interval, #Ethereum whales are again to accumulating $ETH!”

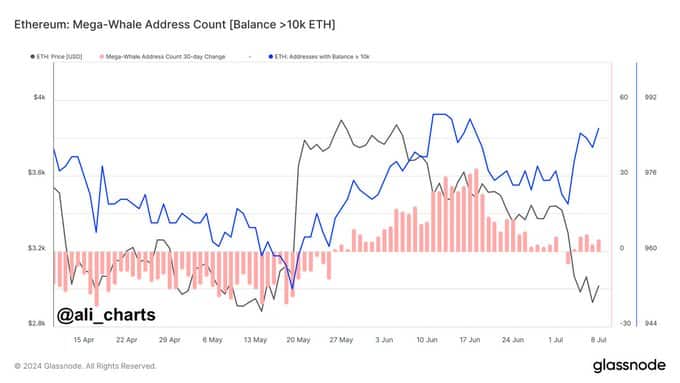

The variety of addresses holding over 10,000 ETH has declined since mid-April and commenced to rise once more in early July.

This development prompt that some mega-whales decreased their holdings throughout the worth decline however at the moment are growing their positions.

Supply: X

The timing of those large-scale withdrawals and accumulations coincided with the market’s anticipation of the Ethereum ETF, which is predicted to go dwell subsequent week.

This growth is a doubtlessly bullish sign for Ethereum, because it might appeal to additional funding and drive up costs.

Potential affect of Ethereum ETF approval

Katherine Dowling, Bitwise’s Chief Compliance Officer, has affirmed that the approval of the spot Ethereum ETF within the U.S. is approaching.

With issuers submitting their S-1 amendments, analysts anticipate the approval across the 18th of July.

Learn Ethereum’s [ETH] Worth Prediction 2024-2025

This has led to a surge in inflows into Ethereum funding merchandise, with institutional gamers accumulating ETH forward of the ETF approval.

Final week, Ethereum funding merchandise noticed inflows of $10.2 million, indicating rising curiosity from institutional traders.