Ethereum reclaims $2.4K support – But why momentum is fading

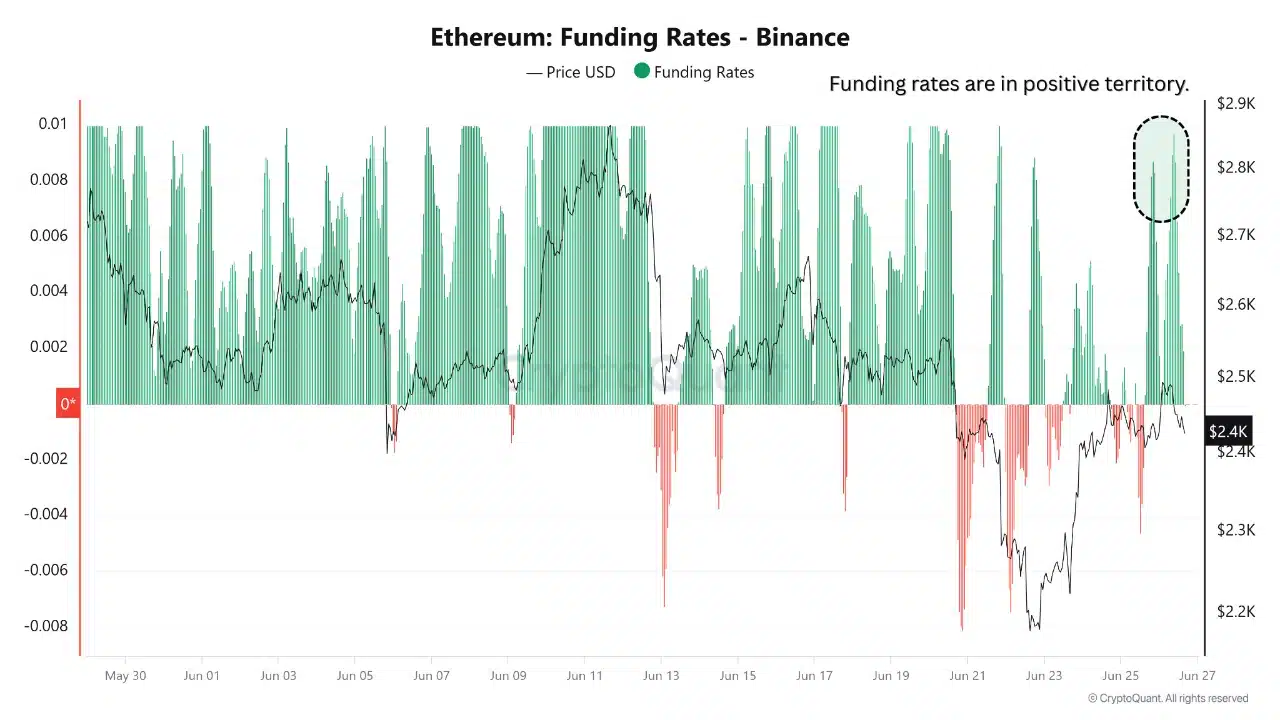

- Optimistic Funding Charges and Taker Purchase Dominance assist ETH’s climb above $2.4K.

- On-chain weak point and alternate inflows increase considerations of a possible short-term slowdown.

Ethereum [ETH] has posted a powerful rebound in latest classes, reclaiming the $2,400 degree as derivatives Funding Charges on Binance turned optimistic.

This shift revealed an inflow of leveraged lengthy positions as merchants guess on additional upside.

Nevertheless, over 177,000 ETH flowed into Binance over the previous three days, hinting at doable profit-taking by giant holders. This raised short-term threat regardless of a structurally bullish bias.

Due to this fact, whereas sentiment has flipped in favor of consumers, rising alternate inflows recommend warning as market contributors reassess near-term upside potential.

One other leg increased

ETH continued to commerce inside a rising channel sample, having bounced from its decrease trendline close to $2,195 and consolidating above $2,400 at press time.

The RSI remained impartial at 47, indicating that the asset had room to maneuver in both route with out being overbought or oversold.

This channel construction has traditionally supported bullish continuation patterns. Nevertheless, consumers should defend this zone to keep away from slipping again beneath $2,200.

Due to this fact, the continuing worth stability inside this vary might function a springboard if broader sentiment stays intact.

Supply: TradingView

Is Ethereum dropping on-chain power?

Ethereum’s on-chain exercise confirmed a weakening divergence between worth and day by day lively addresses. At press time, the DAA divergence, which beforehand spiked positively, had begun to retreat.

This implied that tackle development was not retaining tempo with the worth motion, weakening the underlying assist for the continuing restoration.

Whereas ETH has maintained ranges above $2,400, the fading divergence could restrict sustained bullish momentum.

Due to this fact, Ethereum wants renewed community participation to keep away from stagnation and reinforce the latest worth rebound.

ETH’s transaction exercise collapses

Regardless of bullish technical construction, Ethereum’s day by day transaction depend has sharply declined to 337K — a steep drop in comparison with latest averages.

This fall in exercise suggests a possible disconnection between worth motion and precise community utilization.

Due to this fact, at the same time as merchants interact in leveraged shopping for, on-chain person exercise seems to be weakening. If this continues, the shortage of transactional demand might undermine the worth rally.

Consequently, Ethereum’s subsequent transfer could rely closely on whether or not person engagement rebounds swiftly.

Are aggressive consumers retaining Ethereum afloat?

Spot taker CVD alerts confirmed that Ethereum was experiencing dominant buy-side stress at press time. This mirrored continued confidence amongst market contributors, who executed extra market buys than sells.

Such conduct sometimes aligns with short-term bullish developments and reinforces present worth ranges.

Nevertheless, given the conflicting drop in derivatives quantity and on-chain metrics, this taker purchase dominance should maintain to forestall a reversal.

Bulls stay in management for now, however momentum requires broad-based assist to final.

Can ETH maintain its floor amid combined alerts?

Ethereum’s restoration above $2,400 reveals technical and by-product market power, however fading on-chain metrics and rising alternate inflows create warning.

If taker demand persists and community exercise recovers, ETH could proceed its upward trajectory. Nevertheless, except tackle development and transaction quantity bounce again, worth momentum might stall beneath $2,500.