Ethereum sees rising demand from U.S. investors – Price impact?

- The rise within the Coinbase Premium Hole suggests a value improve for ETH.

- Nonetheless, ETH may not attain $4,000.

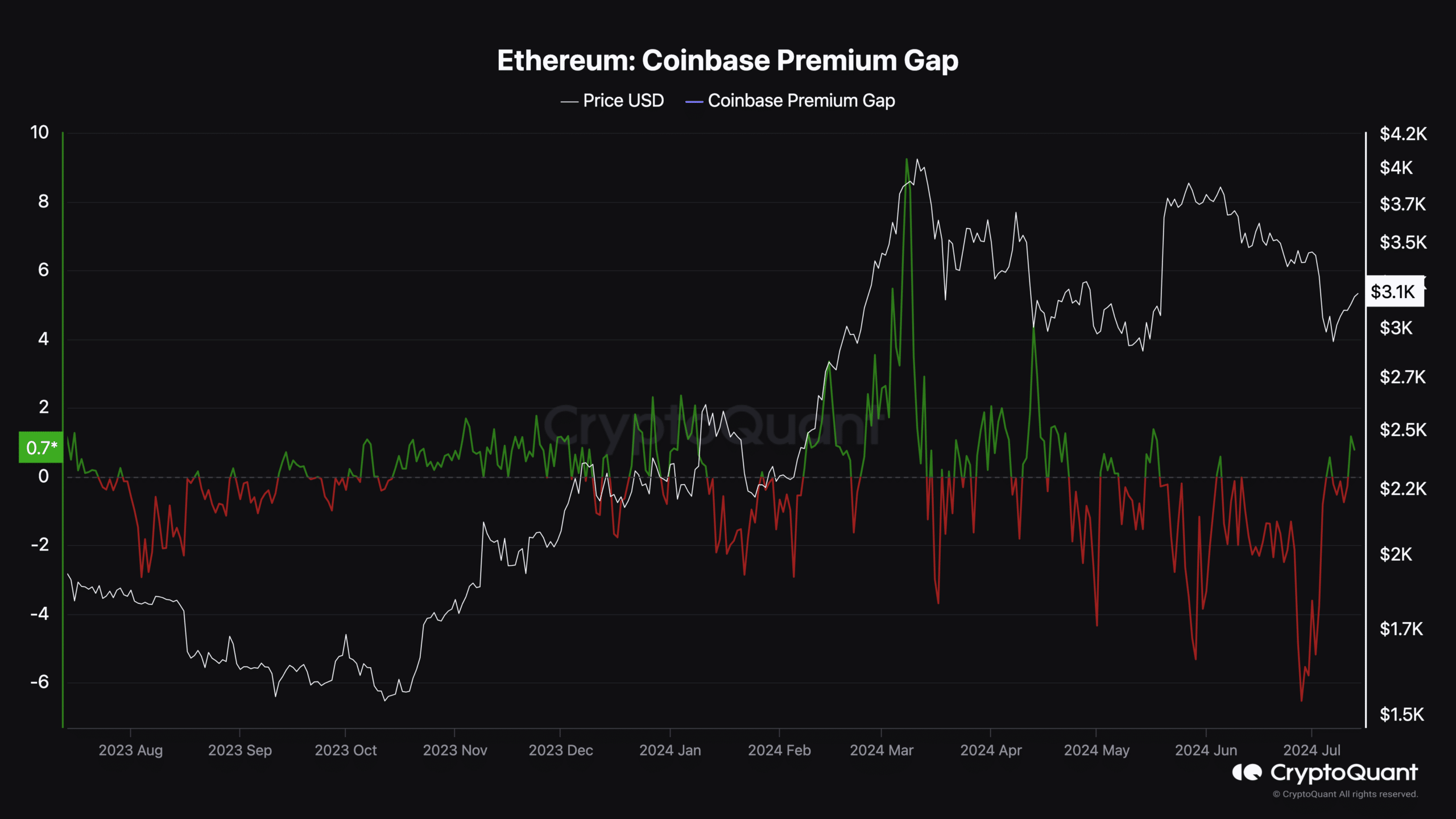

In accordance with knowledge from CryptoQuant, crypto traders have been shopping for Ethereum [ETH] in giant numbers. This was evident from the pattern of the Coinbase Premium Hole.

This metric measures the distinction between the ETH value on Coinbase and that of Binance. When it decreases, it implies that traders from America are promoting ETH or refraining from shopping for.

People now belief within the altcoins

However excessive values, like its current rise to 0.78 counsel robust shopping for stress from the U.S. As per AMBCrypto’s findings, elevated publicity to Ethereum could be linked to the upcoming Ethereum ETF launch.

However aside from that, it provides the altcoin value with a better likelihood of accelerating. For instance, in March 2023, the Coinbase Premium Hole dropped to one among its lowest level ever.

Supply: CryptoQuant

This led ETH value to drop beneath $1,400. Quick ahead to March 2024, the identical metric hit a excessive level. At the moment, ETH jumped to $4,065.

At press time, the market worth of ETH was $3,194. This was a 34.70% lower from its all-time excessive. Nonetheless, if shopping for stress continues to enhance within the U.S. and different areas globally, we might see the worth erase some components of this drawdown.

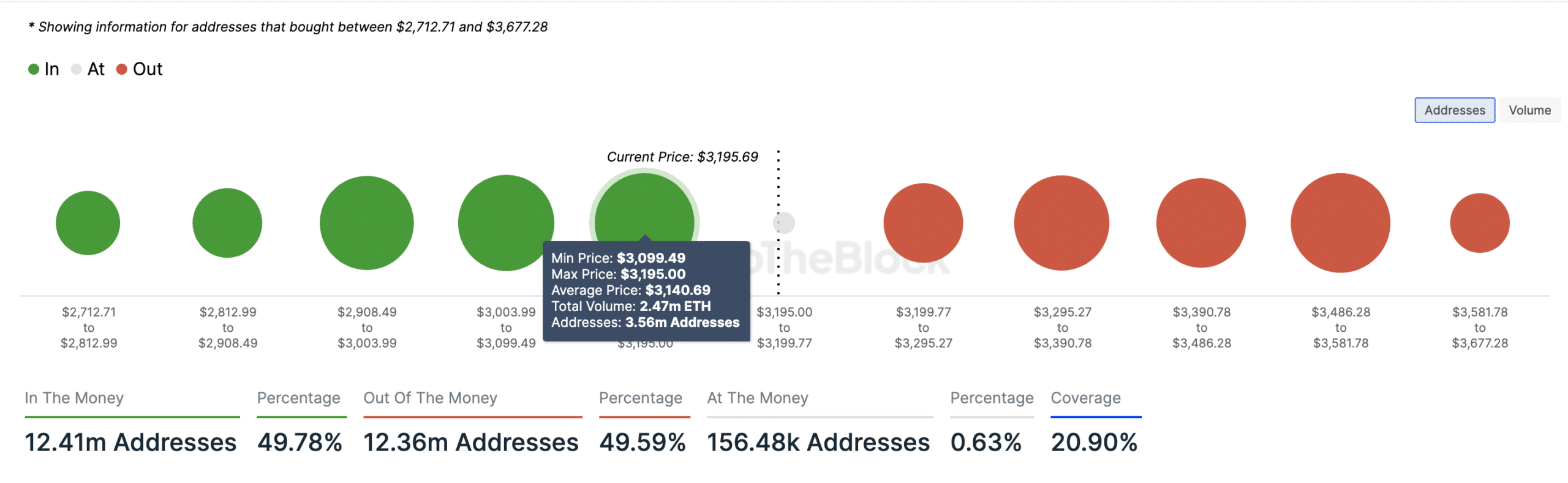

Moreover, knowledge tracked by IntoTheBlock offers context of value Ethereum can attain ought to accumulation intensify. The particular metric AMBCrypto checked out was the IOMAP.

ETH set to retest $3,437 regardless of impartial sentiment

IOMAP stands for In/Out of Cash round Value. As well as, this indicator spots shopping for and promoting zones which are purported to act as assist or resistance.

It classifies addresses primarily based on these earning profits, at breakeven level, and people out of cash.

The bigger the cluster of addresses at a value vary, the stronger the assist or resistance it gives. As of this writing, 3.56 million Ethereum addresses had been within the cash and bought 2.47 million ETH at a median value of $3,140.

To the appropriate, 2.02 million addresses purchased 4.01 million ETH round $3,242, and are out of the cash. Contemplating the larger addresses in the money, there’s a likelihood ETH may break the resistance at $3,242.

Supply: IntoTheBlock

If so, the subsequent space for the cryptocurrency to achieve might be $3,347. AMBCrypto checked the Ethereum Concern and Greed Index to see if it might be a very good time to purchase ETH.

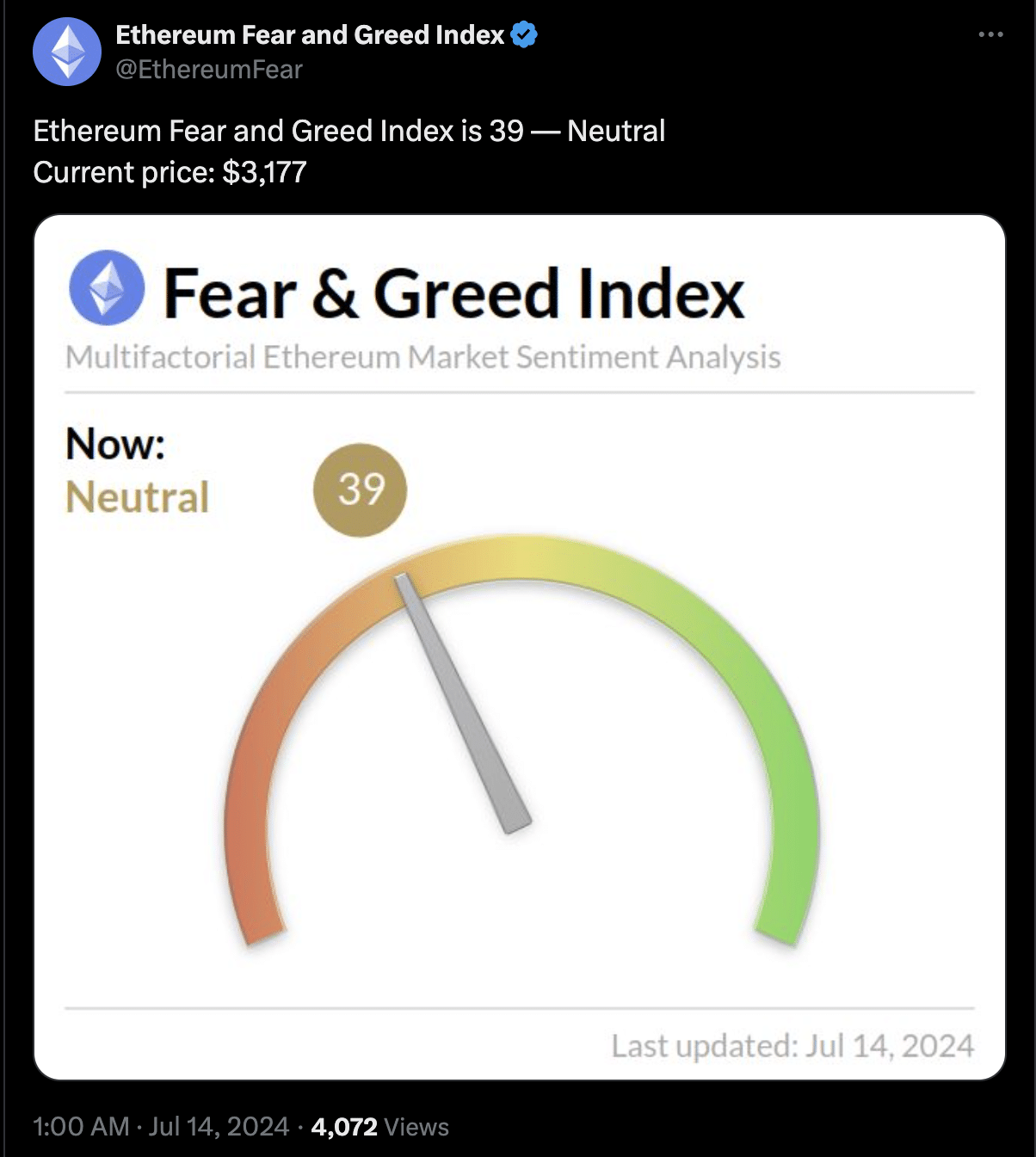

Additional, this index ranges from o to 100. Values near 0 signifies worry and people near 100 signifies greed. As of this writing, the index was 39, which means that there was neither excessive worry nor greed.

Supply: X

Learn Ethereum’s [ETH] Value Prediction 2024-2025

Nonetheless, the studying supplies a chance to buy the altcoin particularly because the ETF launch is seemingly a bullish occasion.

Whereas the worth of ETH appears in line to extend, a lower in general curiosity might invalidate the prediction.