Ethereum sell-offs start to rise: Is weak ETH demand the reason why?

- ETH bulls have been making an attempt to push for a restoration rally however have been going through resistance close to the $2700 worth degree.

- In consequence, buyers are beginning to falter, including to the chance of capitulation.

It has been per week since Ethereum [ETH] launched into a journey to restoration after crashing earlier this month. This allowed the market ample time to check the waters, and consider momentum and demand.

Up to now, the cryptocurrency has struggled to push properly past $2,700, signaling weak demand above this worth degree.

Will ETH capitulate to decrease costs?

ETH had a press time worth of $2,649, down by 2.61% within the final 24 hours. This final result additional supported the noticed lack of demand, underpinned by market uncertainty.

Supply: TradingView

The RSI stayed beneath its 50% degree, additional confirming weak bullish momentum. This was additional supported by reviews earlier within the day, indicating that some establishments have been now offloading a few of their ETH.

For instance, personal enterprise capital agency BlockTower reportedly bought 9,232 ETH value roughly $24.8 million in the previous few hours.

Whereas these findings might recommend that the market continues to be on the sting and indecisive, some presents some confidence.

For instance, the proportion of ETH in good contracts has been rising and, at press time, was approaching 40%.

Supply: Glassnode

The chart indicated that DeFi utility had been gaining traction, which ought to bode properly for ETH’s demand.

In different phrases, natural demand has been rising, however ETH’s suppressed worth motion seemed to be as a mirrored image of market sentiment fairly than on-chain efficiency.

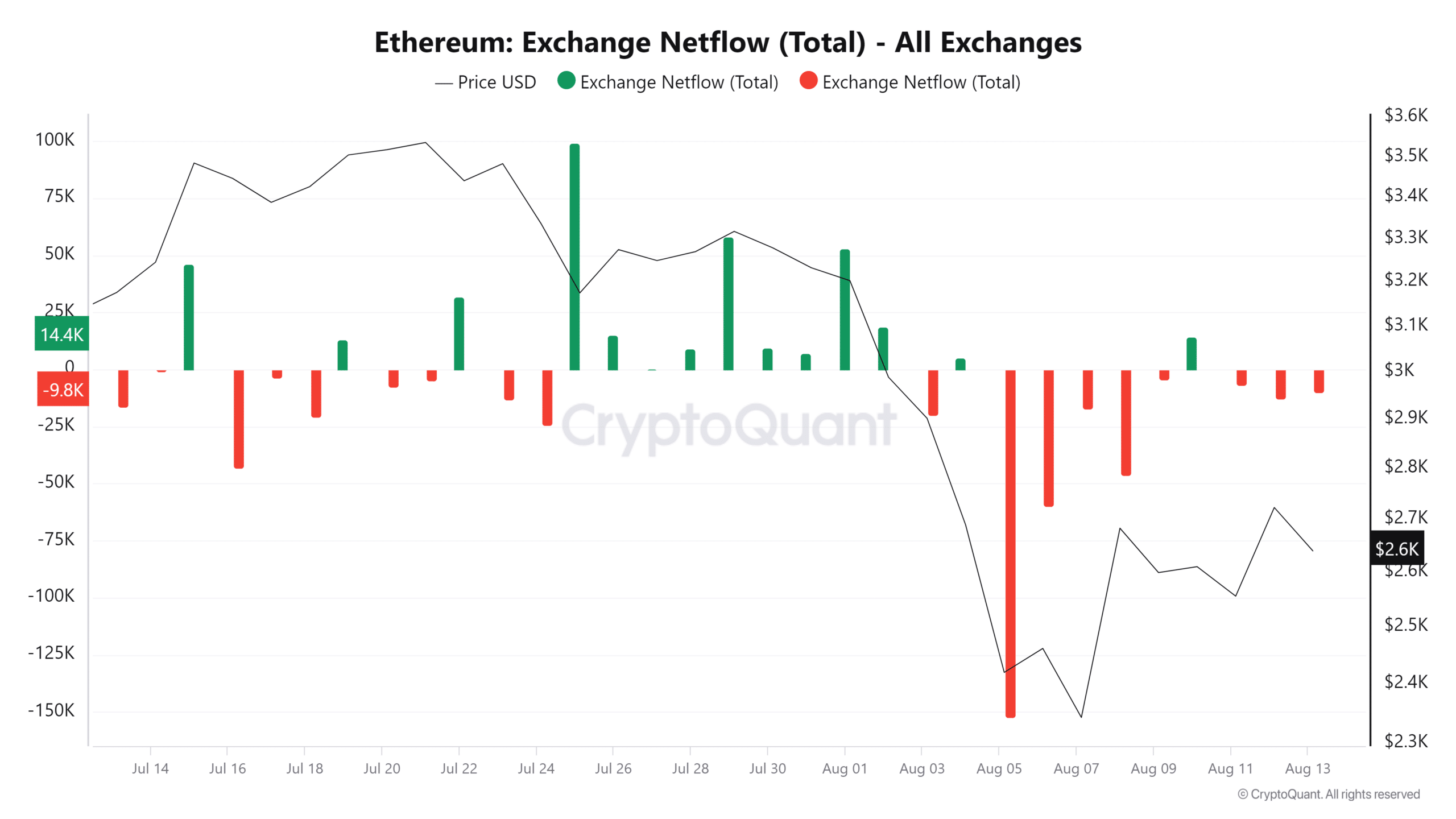

The influence of market sentiment was evident in ETH change circulate information. The cryptocurrency’s change netflows have for essentially the most half been adverse for the reason that peak of the dip.

This meant it had maintained barely greater outflows than inflows.

Supply: CryptoQuant

Regardless of the statement, the change flows stay low, therefore coinciding with the state of uncertainty out there. This implies there may be nonetheless an opportunity that the market might simply be swayed in both course.

Much less FUD out there might set off greater demand for ETH. Nonetheless, the appositive will probably be true if the market stays fearful, presumably paving the way in which for extra capitulation within the coming days.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

The Fear and Greed Index indicated a slight restoration from excessive worry within the final 48 hours.

If this restoration continues, then ETH bulls would possibly lastly get an opportunity to push past present resistance and presumably in direction of 3,000 inside the week.