Ethereum selling pressure is dominating on Binance.

- Ethereum’s promoting stress was dominating on Binance

- ETH has declined over the previous month by 18.61%.

Since hitting a current excessive of $3746 per week in the past, Ethereum [ETH] has skilled robust downward stress.

Over this era, ETH declined to a neighborhood low of $3,157. Though the altcoin has made average positive factors, it’s nonetheless declining.

On the time of writing, Ethereum was buying and selling at $3,196, marking a 2.17% decline on each day charts. ETH has additionally dropped by 12.67% on weekly charts and 18.61% on month-to-month charts.

This decline throughout ETH charts is basically attributed to elevated promoting stress, in line with CryptoQuant.

Ethereum’s promoting stress dominates

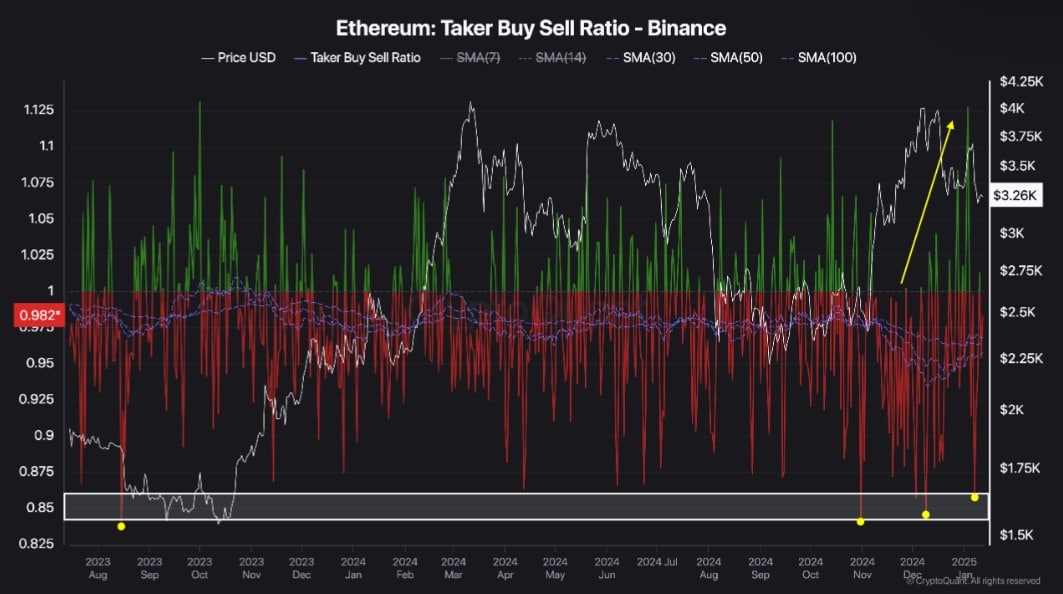

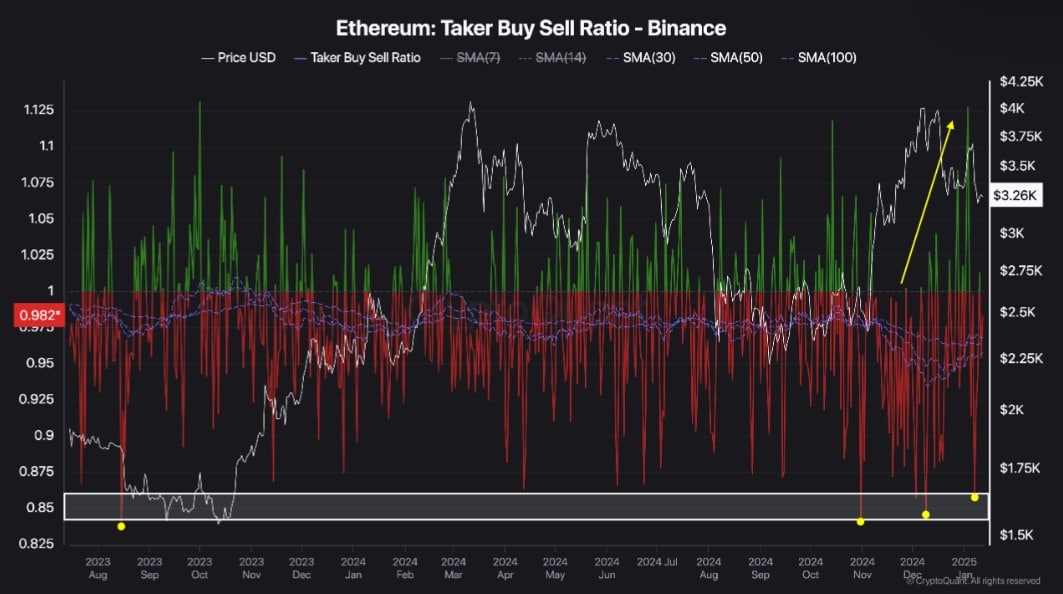

As per CryptoQuant evaluation, ETH is experiencing robust promoting stress on Binance. As such, since November 2024, Ethereum has seen appreciable promoting stress on the change.

Supply: CryptoQuant

The rising dominant promoting stress on Binance is evidenced by ETH’s Taker Purchase/Promote Ratio. This metric has remained unfavourable since November 2024, indicating the next quantity of promote orders in contrast to purchase orders.

Throughout this era, the Taker Purchase/Promote Ratio has dropped to ranges not seen since August 2023, reflecting the prevailing bearish sentiment.

Whereas consumers tried to take management in December, sellers rapidly regained the higher hand, reinforcing the downward momentum.

The sustained promoting stress over the previous months underscores a market that’s each bearish and cautious.

On the flip facet, a rising promoting ratio presents a possible shopping for alternative for long-term holders.

Affect on ETH value charts?

As noticed above, Ethereum is experiencing robust promoting stress, which has negatively affected the altcoin’s value actions.

Supply: Tradingview

For starters, we are able to see larger promoting stress as ETH Chaikin Cash Move (CMF) has turned unfavourable. With CMF sitting at -0.08, it implies that sellers are dominating the market.

This market conduct is confirmed by a declining Relative Energy Index (RSI) which has dropped to virtually oversold territory to settle at 38. Such a dip implies sellers are in command of the market.

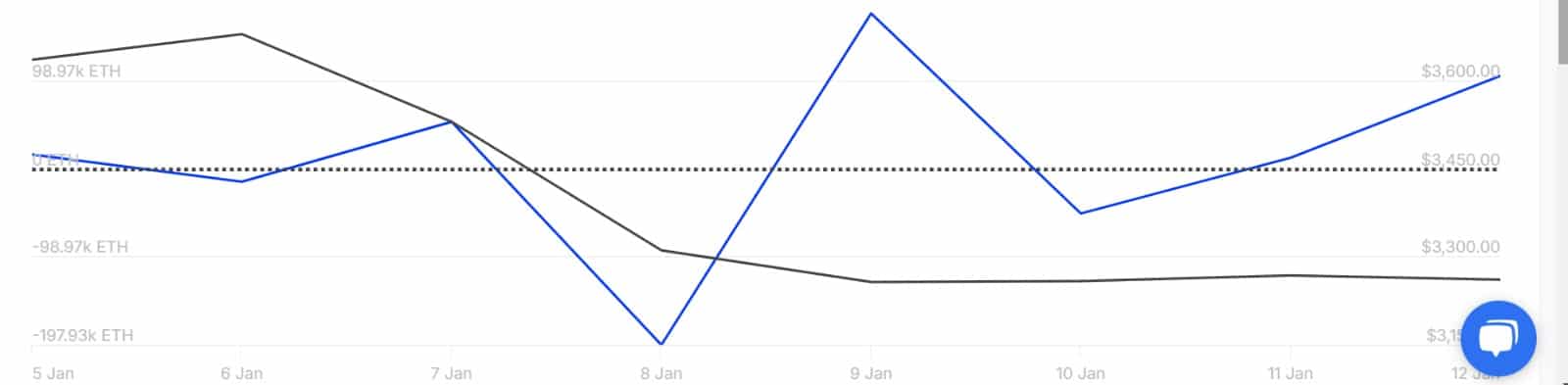

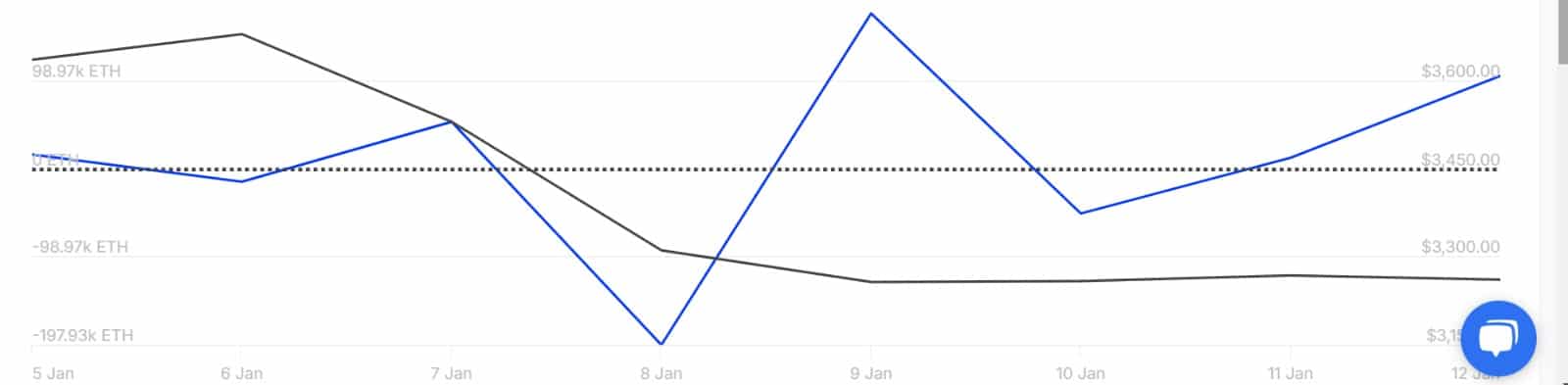

Supply: IntoTheBlock

Wanting additional, Ethereum’s influx into exchanges has spiked over the previous week. This has surged from -50.77k to 103.77k, which signifies that there’s extra ETH influx onto exchanges than outflow.

Often, larger influx into exchanges precedes elevated promoting ppressure,as traders are likely to promote after they make these transfers.

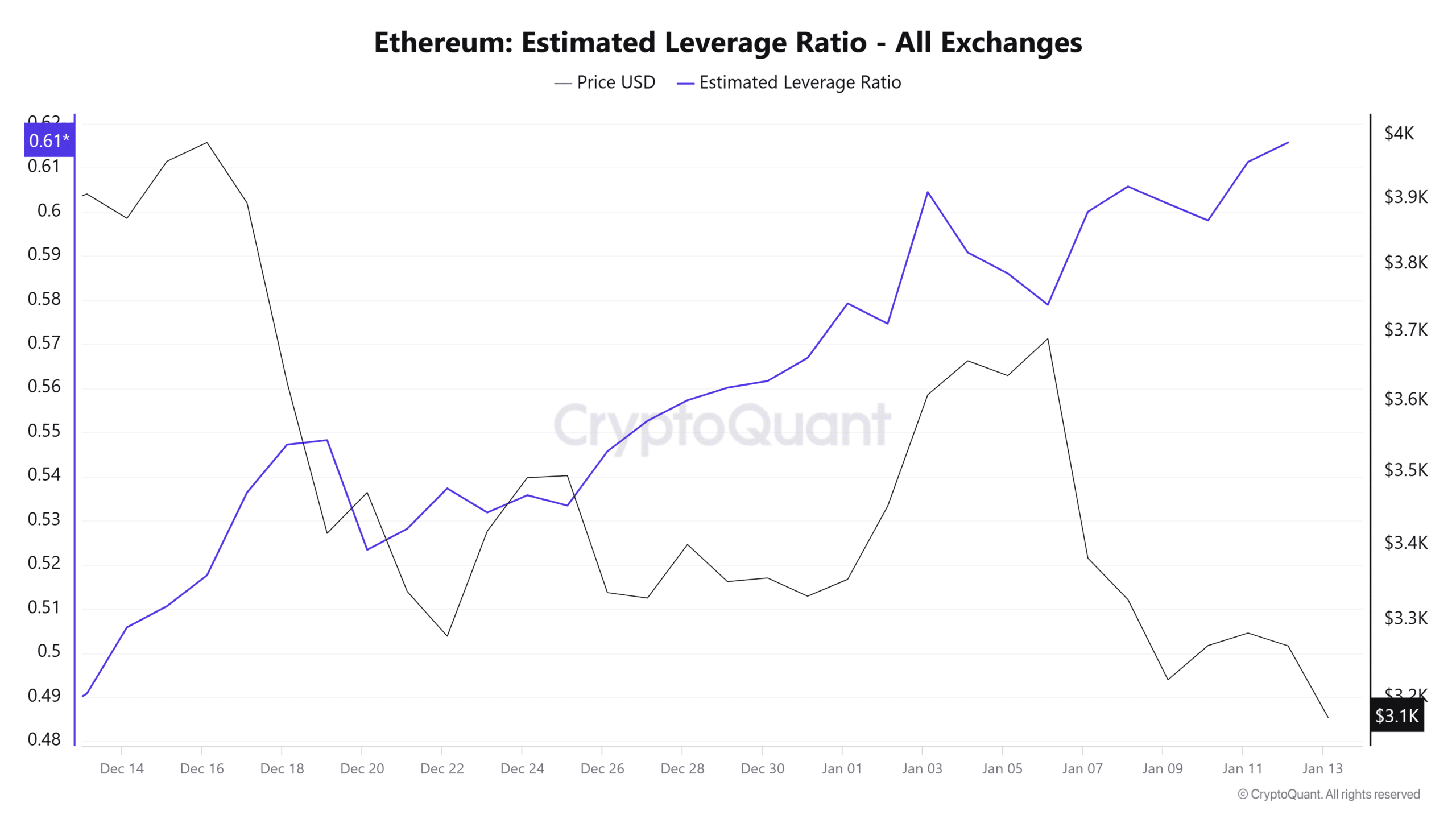

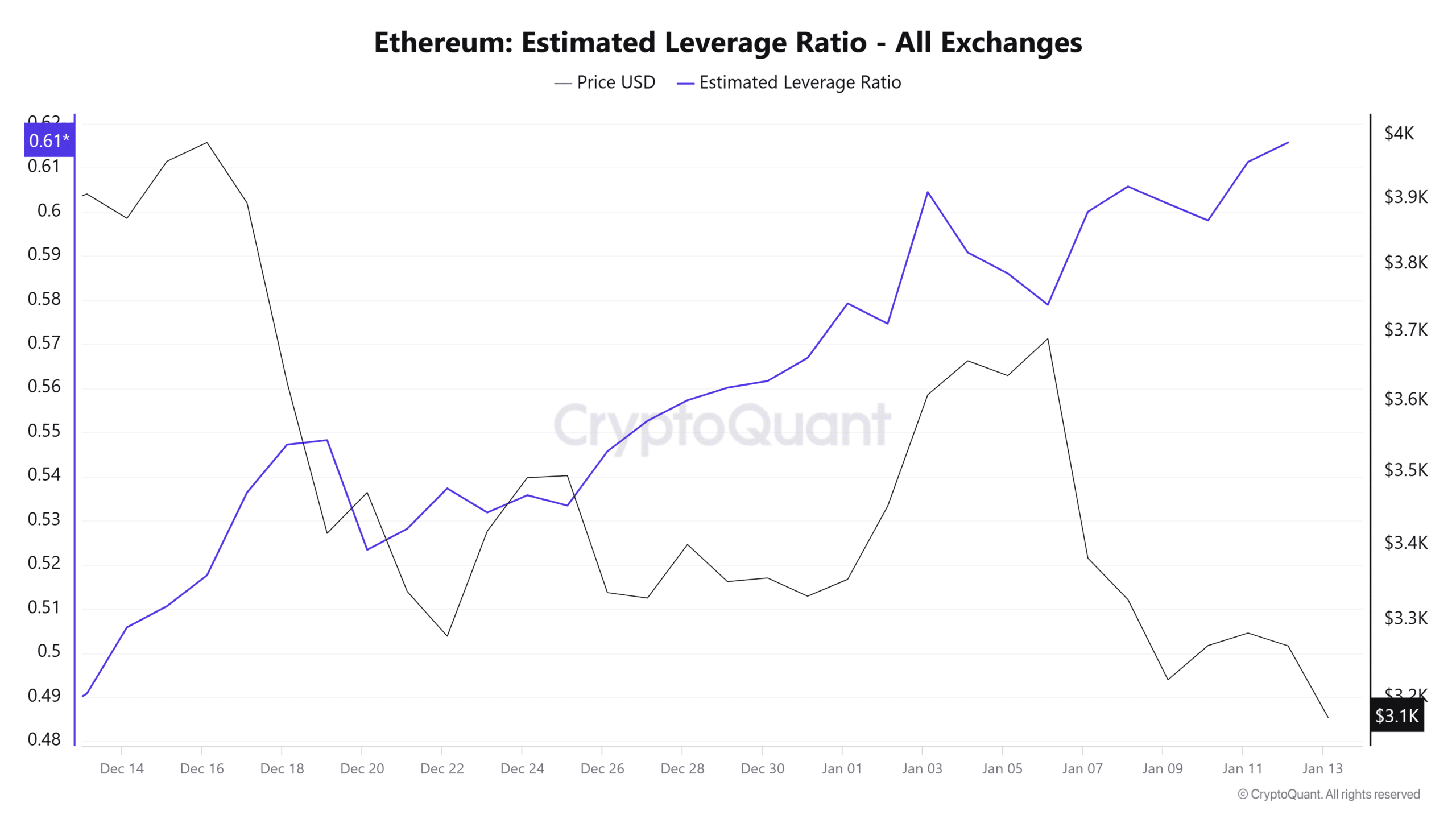

Supply: CryptoQuant

Ethereum’s Estimated Leverage Ratio (ELR) has skilled a sustained enhance over the previous month. When ELR rises throughout a downtrend, it signifies a bearish sentiment, rising the danger of a protracted squeeze.

If costs drop additional, lengthy positions might be liquidated, leading to a protracted squeeze and additional value declines.

Learn Ethereum’s [ETH] Worth Prediction 2025–2026

In conclusion, Ethereum is underneath robust promoting stress as bearish sentiments persist. If present market situations proceed, ETH may decline to $3,030 and probably drop under $3,000 to seek out assist round $2,810.

Nonetheless, if the downtrend exhausts and a reversal emerges, the altcoin may reclaim $3,300.