Ethereum set for a volatile weekend as active deposits spike

- Ethereum’s energetic deposits spiked to a document excessive since March, recording over 17,000 deposits.

- Its alternate netflow nonetheless, nonetheless, confirmed dominant damaging outflow.

Ethereum’s value has been experiencing notable fluctuations of late, and in keeping with Santiment’s latest deposit metric, there could possibly be much more volatility on the horizon because the weekend approaches. Nevertheless, by inspecting Ethereum’s Netflow, we might higher perceive the prevailing sentiment, overriding the influence of those value swings.

Practical or not, right here’s ETH’s market cap in BTC phrases

Ethereum energetic deposits spike

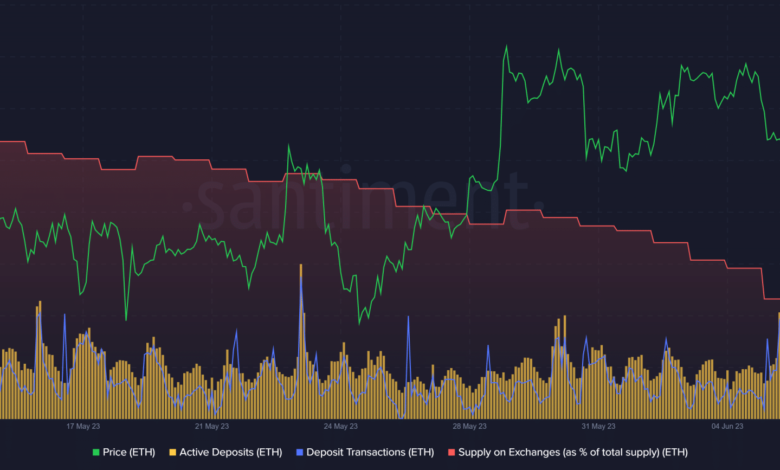

Ethereum marked a big surge on 9 June in some key metrics, as noticed on Santiment.

Based on Santiment, the energetic and deposit transaction metrics skilled a notable spike main as much as the weekend. The energetic deposits metric reached a powerful determine of over 17,500, whereas the deposit transactions metric surged previous 17,700.

Notably, energetic deposit addresses have reached their highest stage since March, suggesting the potential for elevated volatility.

Supply: Santiment

Moreover, you will need to word that energetic deposits embody each incoming and outgoing transactions, together with transfers from private wallets to deposit addresses and from deposit addresses to principal alternate wallets. Subsequently, inspecting the spike in these metrics won’t present a conclusive evaluation, because it merely signifies a surge in participant exercise.

To acquire a extra complete understanding, delving into one other essential Ethereum metric would possibly supply a clearer depiction of the state of affairs.

Ethereum alternate netflow

Based on the Santiment chart, there was a notable pattern of Ethereum exiting exchanges, leading to a lower within the quantity held on exchanges. As of this writing, the availability of Ethereum on exchanges decreased to 9.45% of the overall provide.

Supply: CryptoQuant

Moreover, analyzing the alternate netflow knowledge from CryptoQuant revealed that the stream prior to now few days had been predominantly outward transfers from exchanges. As of this writing, a big damaging netflow of roughly 30,000 Ethereum was recorded.

This indicated the next inclination towards accumulation and a lowered danger of sell-offs. Whereas this could possibly be interpreted as a bullish signal, it additionally implied the potential for impending volatility.

ETH value pattern and volatility

On the time of writing, Ethereum was present process a notable downward pattern in value when noticed on a every day timeframe chart. It was buying and selling at roughly $1,740, reflecting a decline of over 5%.

The Bollinger Band evaluation indicated that ETH was presently experiencing a sure stage of volatility, though the band’s elasticity urged that the present volatility was comparatively minimal.

Supply: TradingView

How a lot are 1,10,100 ETHs price at present

Moreover, the latest decline prompted ETH’s Relative Power Index (RSI) to drop beneath 40, indicating a stronger bearish pattern out there. Furthermore, in keeping with the volatility metric offered by Santiment, the present volatility stage of Ethereum stood at 0.01% as of this writing.