Ethereum: Short-term pain or long-term gains for ETH holders

- Ethereum’s worth fell whereas community progress and velocity plummeted

- On a macro degree, Ethereum’s community continues to see progress

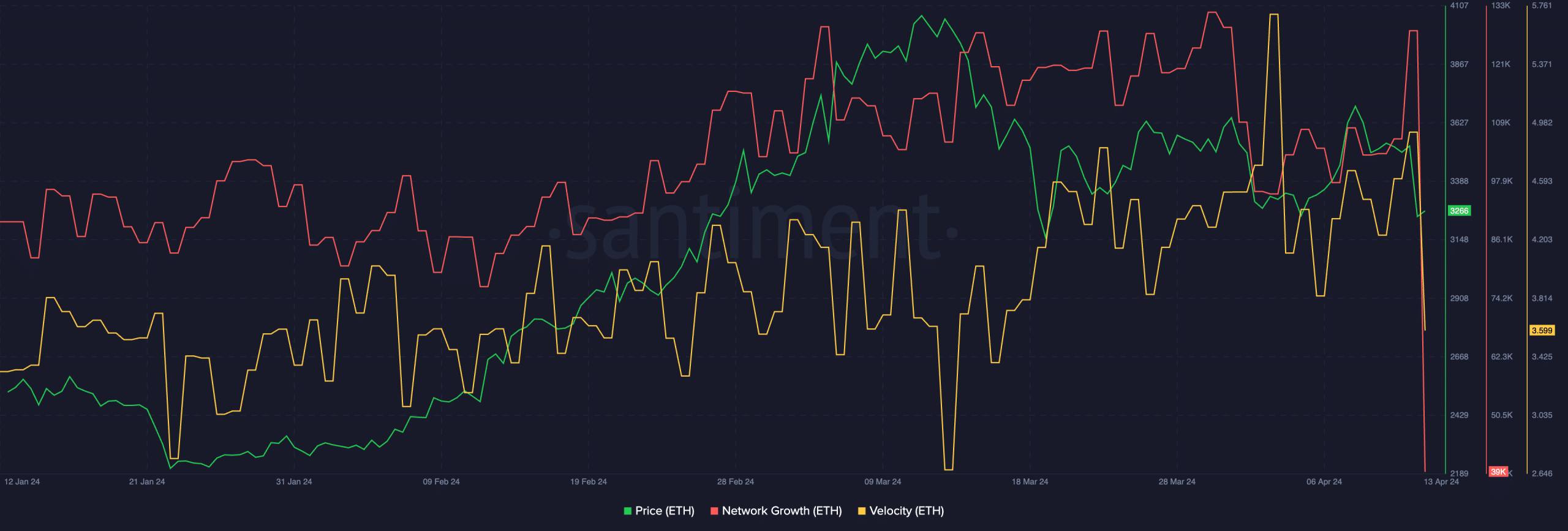

Ethereum [ETH] recorded an enormous decline in worth during the last 24 hours, together with the remainder of the cryptocurrency market. At press time, ETH was buying and selling at $3,267.60, with its worth down by 7.22% on the charts.

Ethereum takes successful

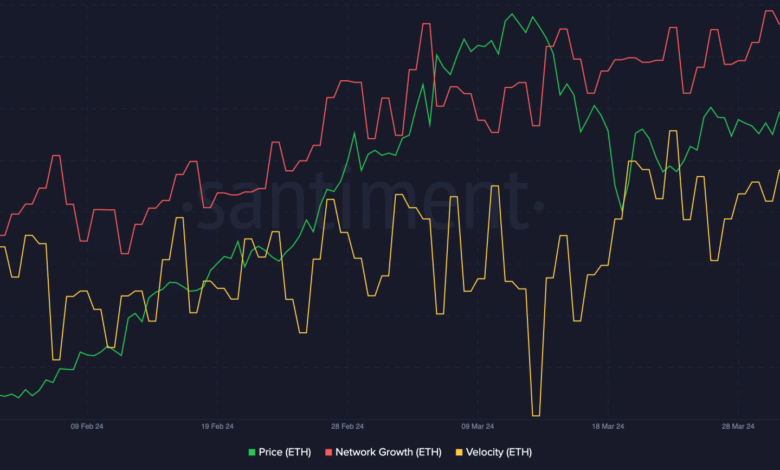

Over this era, the community progress for Ethereum declined considerably. This indicated that new customers have been dropping curiosity in ETH and the variety of new addresses prepared to purchase ETH at this fee was very low. Furthermore, the speed for ETH additionally fell, suggesting that the frequency with which ETH was being traded had declined.

Supply: Santiment

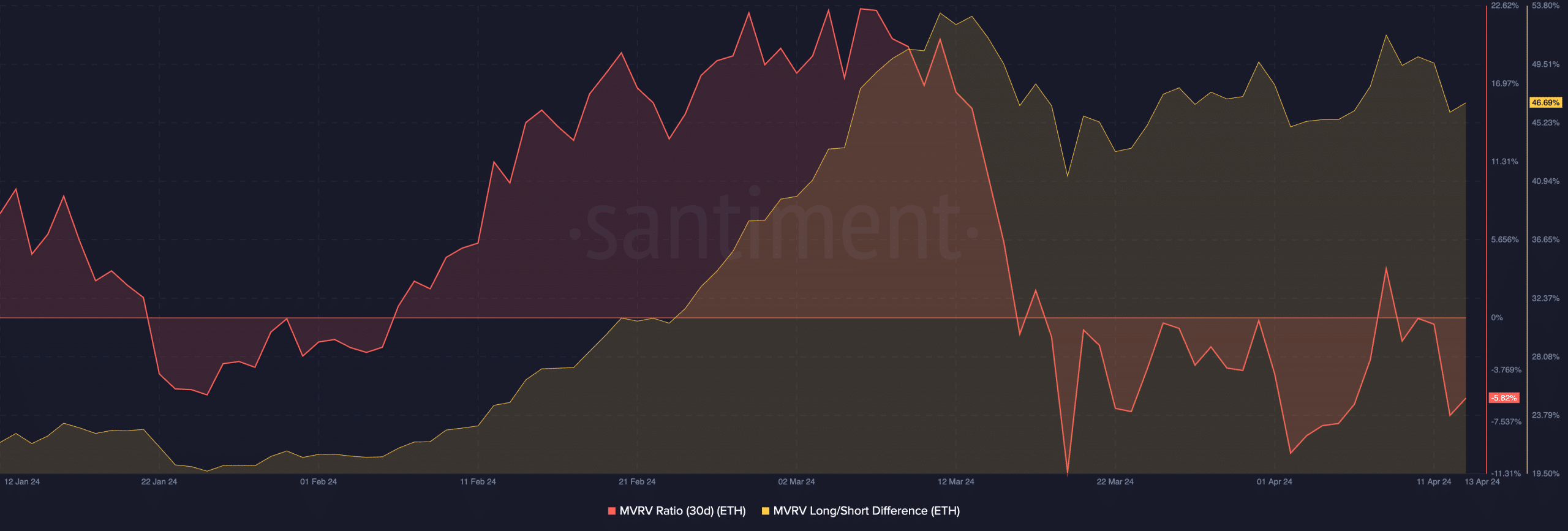

Furthermore, Ethereum’s MVRV ratio fell, indicating that the variety of addresses that have been worthwhile had fallen. Lengthy/Brief distinction for ETH hiked as nicely, indicating that the variety of long run holders of ETH had elevated.

Supply: Santiment

Wanting on the bigger image

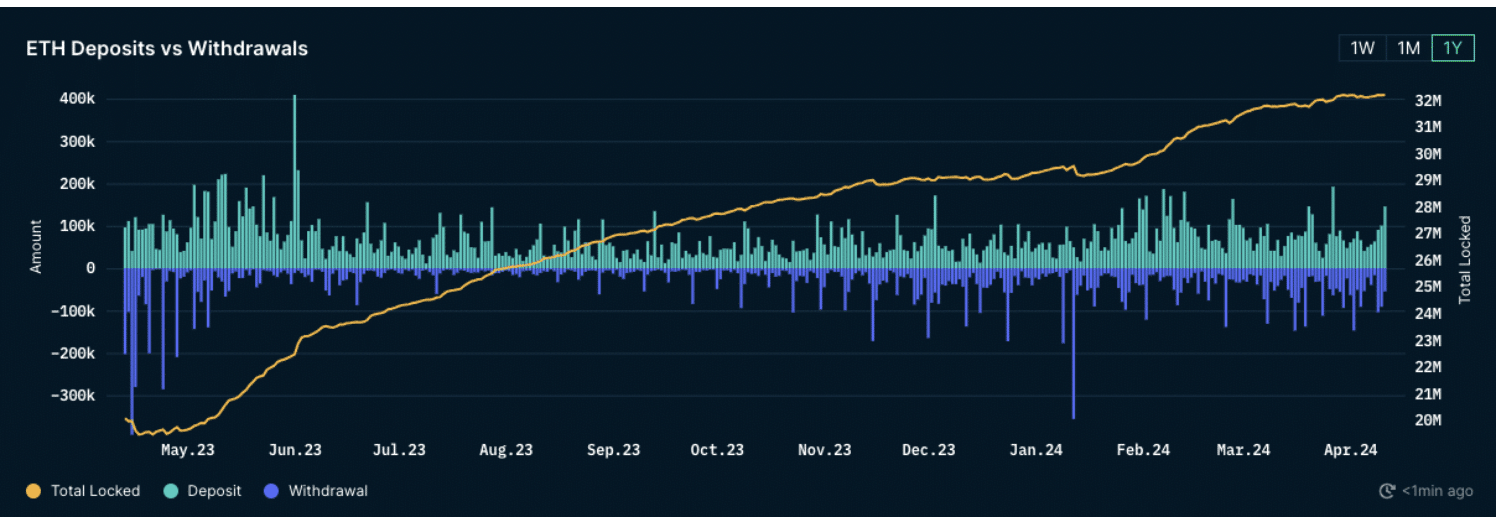

Regardless that within the quick time period it appears to be like like ETH is struggling, the massive image is far more promising. In reality, it may be seen that Ethereum’s community has come a great distance since final 12 months.

For instance – Staked Ether has seen vital progress over the previous 12 months, in response to Nansen knowledge, surging from 20 million to 32.2 million ETH. Regardless of a minor dip in staked ETH as a result of withdrawals from centralized exchanges following the roll-out of Shapella, there was a outstanding 61% surge in staked ETH.

This represents a staggering $42 billion inflow into Ethereum’s staking infrastructure, primarily based on latest pricing.

Supply: Nansen

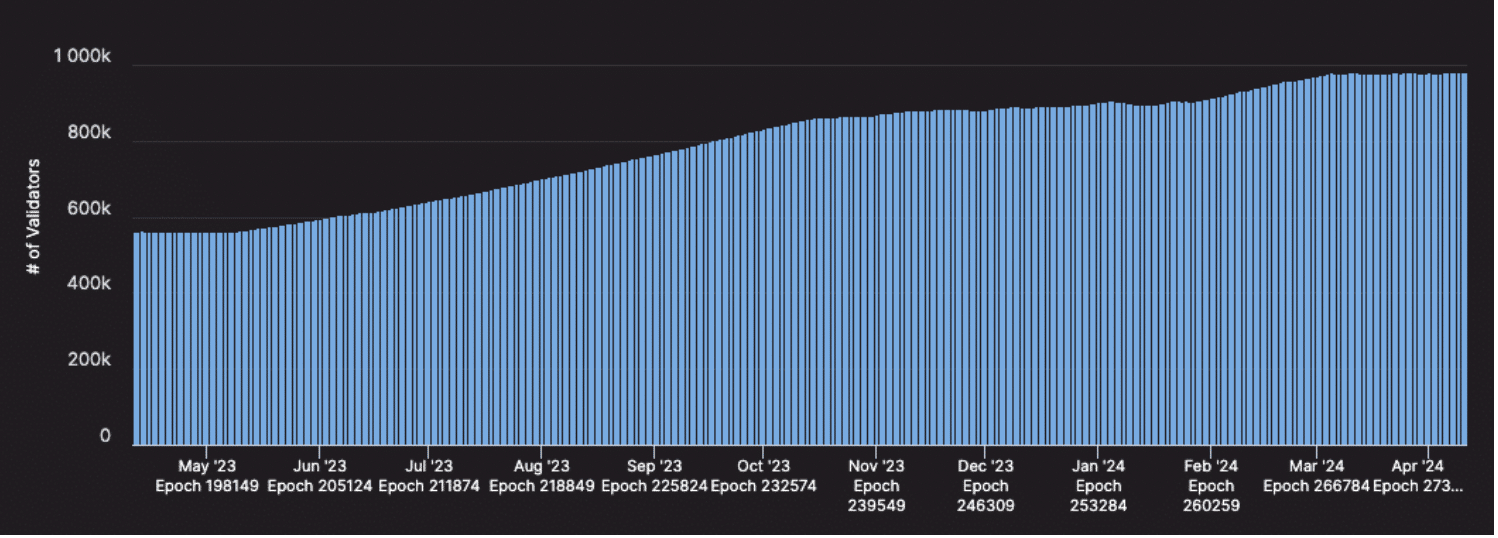

Validator numbers have additionally seen vital progress since Shapella, assuaging issues throughout the Ethereum neighborhood a few potential mass exodus of validators. In line with Austin Blackerby, EVM Analytics Supervisor at Flipside Crypto, this progress has eased many fears.

This time final 12 months, there have been practically 563,000 validators securing Ethereum. Since then, this determine has surged by over 74% to roughly 981,000 validators.

Sustained progress in validators has raised further issues amongst protocol builders and researchers, as outlined in a September 2023 report. A big validator set dimension strains peer-to-peer networking and messaging, probably inflicting node failures as a result of excessive computational load and bandwidth necessities.

Learn Ethereum’s [ETH] Value Prediction 2024-25

Supply: Nansen

Moreover, a sizeable validator set makes future upgrades more durable and riskier to realize. The upcoming improve, “Electra,” is anticipated to handle the challenges posed by the increasing validator set.

Merely put, the world’s largest altcoin’s long-term future appears safer and promising than its short-term.