Ethereum stablecoin supply hits record $132B—What’s fueling ETH’s demand?

- The stablecoin provide on Ethereum has reached a brand new all-time excessive, signaling sturdy progress on the community.

- Throughout Ethereum protocols, a further $5 billion has been added as transaction exercise surges to new ranges.

After a pointy 26% decline prior to now month, Ethereum [ETH] has taken a distinct path, rallying 8.44% prior to now 24 hours. This upward motion is prone to proceed, as growing exercise fuels additional market curiosity.

At current, key metrics present important progress, suggesting that market members are accumulating ETH, which might drive costs increased within the coming weeks. AMBCrypto has analyzed a number of elements contributing to ETH’s potential rally.

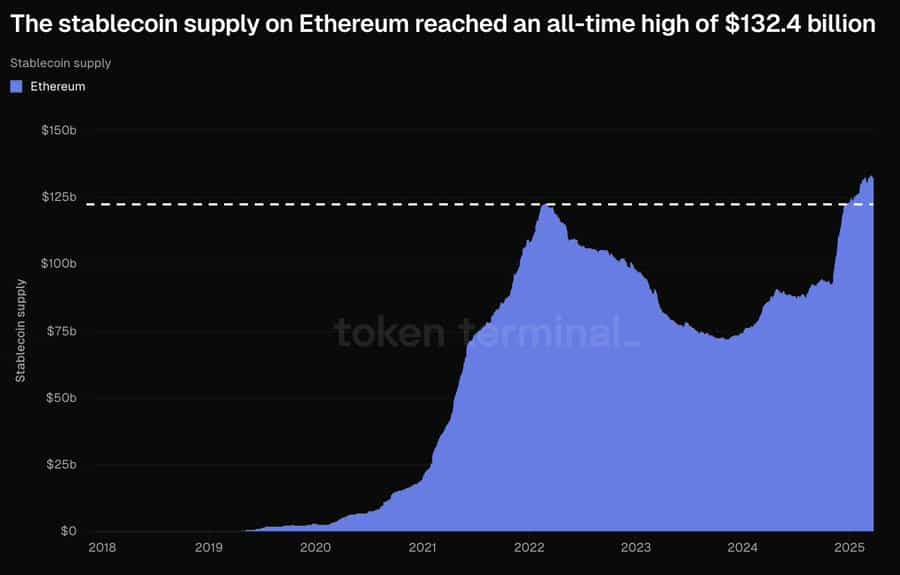

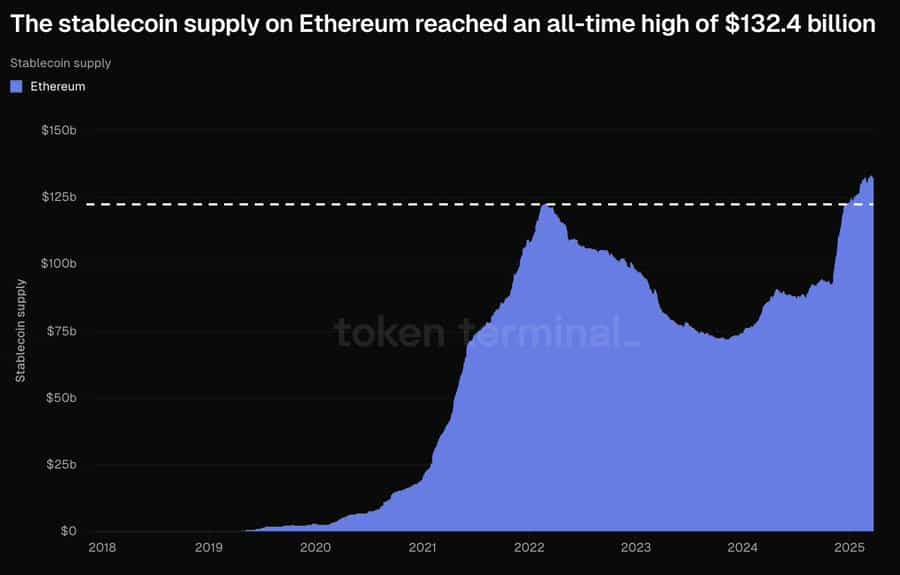

Stablecoin provide on Ethereum reaches a brand new excessive

Ethereum, recognized for its innovation-friendly ecosystem, continues to draw stablecoin deployment. Its complete stablecoin provide lately hit an all-time excessive of $132.4 billion; the best stage since its inception.

Supply: TokenTerminal

Stablecoins are cryptocurrencies designed to keep up a 1:1 peg with property just like the U.S. greenback, providing merchants and traders a hedge in opposition to market volatility. They’ve develop into a most well-liked possibility for storing property and facilitating cryptocurrency transactions.

A rise in stablecoin provide on a blockchain typically alerts rising demand, as merchants place themselves for increased shopping for exercise. AMBCrypto explored extra elements to evaluate their potential impression on these property.

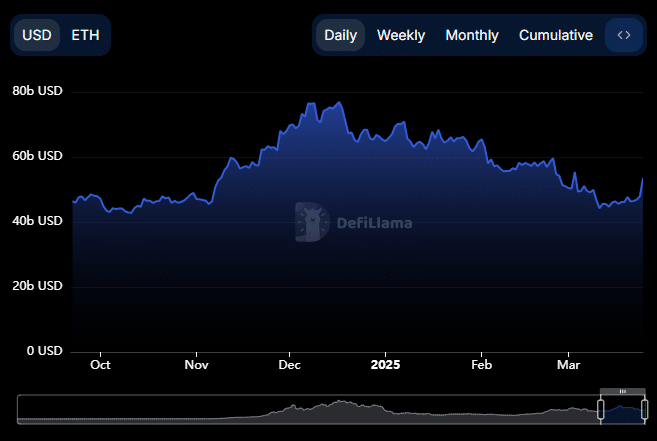

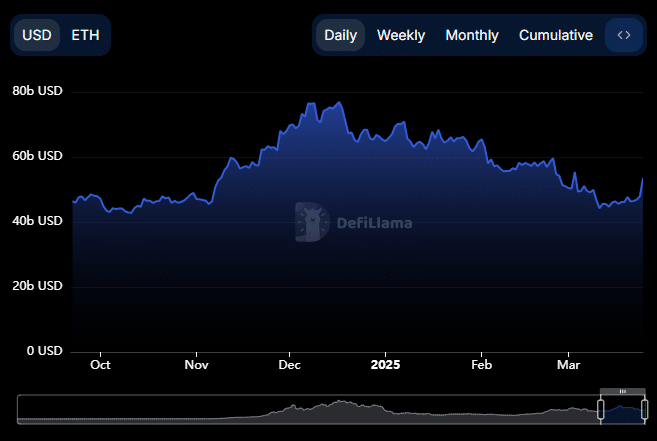

Liquidity inflows to Ethereum surge

Ethereum has seen a significant surge in liquidity inflows following its stablecoin provide reaching a document excessive.

DeFiLlama’s Whole Worth Locked (TVL), which assesses ecosystem progress, reveals that Ethereum’s TVL has risen to $53.448 billion prior to now 24 hours, up from $47.92 billion, a $5.5 billion improve.

Supply: DeFiLlama

This progress suggests elevated accumulation of Ethereum, with the asset being locked throughout a number of protocols, reflecting heightened investor curiosity.

AMBCrypto additionally famous an increase in Ethereum’s netflow, rating it because the second-highest chain in liquidity inflows prior to now 24 hours, simply behind Berachain.

Information from Artemis reveals that $22.2 million was added to the Ethereum community, reinforcing ongoing constructive developments.

Lengthy-term ETH holding on the rise

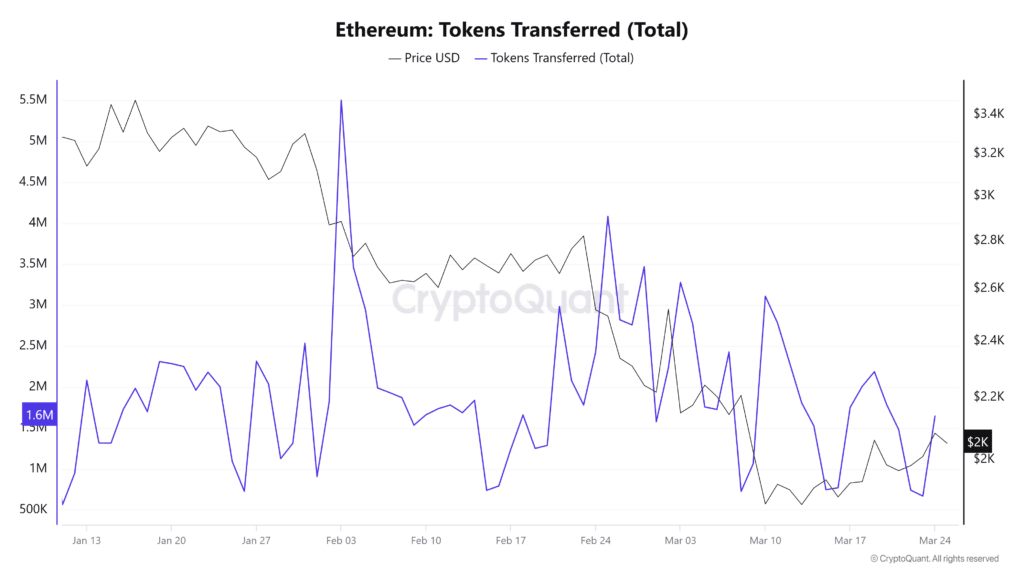

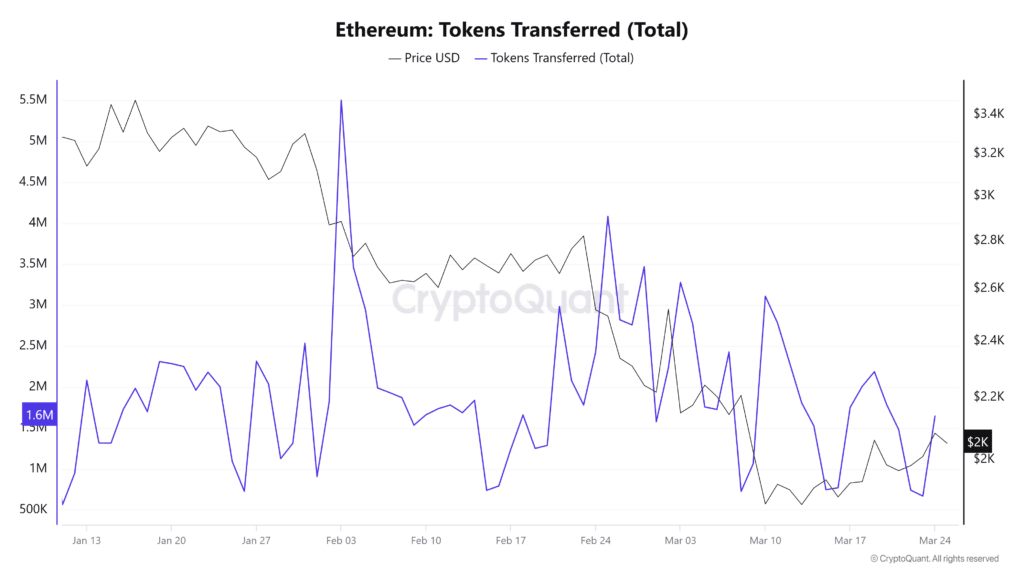

Ethereum’s complete token transfers have surged by roughly 9.33% prior to now 24 hours, pointing to elevated market exercise. This motion might point out both shopping for or promoting stress.

Supply: Cryptoquant

To make clear, AMBCrypto analyzed Ethereum’s alternate reserves and concluded that latest transfers are supporting a constructive value outlook for ETH.

Alternate reserves characterize the quantity of ETH accessible for buying and selling. Larger reserves sometimes point out elevated promoting stress, whereas decrease reserves counsel long-term holding.

The latest decline in ETH reserves implies that merchants are transferring their property to personal wallets for long-term storage, which might have a positive impression on ETH’s value over time.