Bitcoin falls below $80k: Consolidation or drop, what’s next?

- Bitcoin discovered some assist on the $74.5k degree.

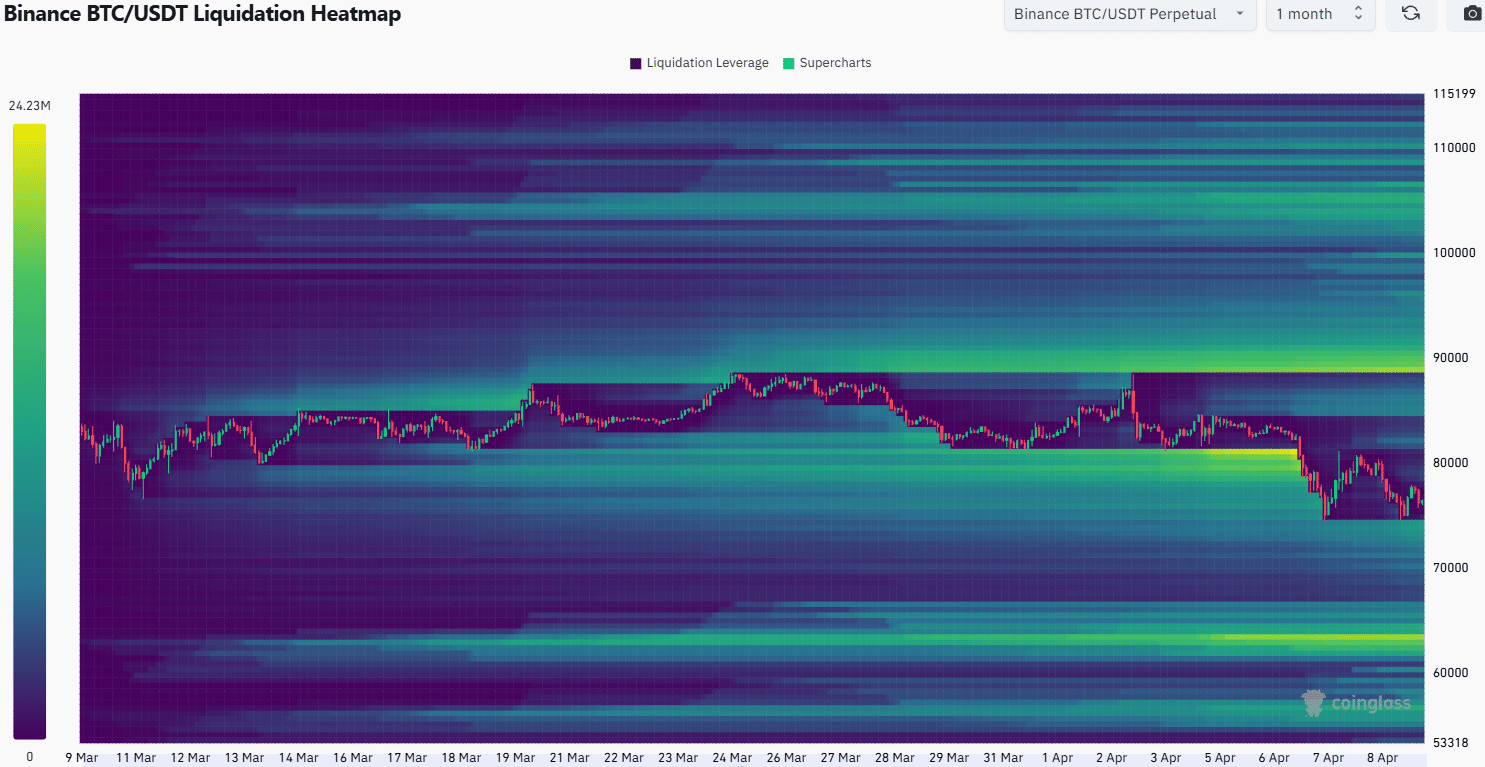

- The worth motion in late March might repeat itself, primarily based on clues from the liquidation heatmap.

Bitcoin [BTC] fell beneath the $80k mark on the sixth of April and reached $74.5k on the seventh of April, a date that despatched shockwaves throughout the worldwide markets.

The main crypto can’t be known as resilient at a time like this — it would already be in a bear market.

Michael Saylor’s Technique remained on the sidelines throughout the latest main dip, making headlines as soon as once more however this time for a scarcity of exercise available in the market.

Bitcoin might consolidate for a while

Supply: BTC/USDT on TradingView

The bearish market construction was strengthened when the latest decrease low at $78.6k was breached on the seventh of April. The worth has not fashioned a backside and bounced, so a brand new swing low was not but set.

The RSI on the each day chart was falling decrease to point out rising bearish momentum. But, though buying and selling quantity has ticked larger over the previous ten days, the OBV remained with out a pattern throughout this era.

This confirmed that the OBV didn’t point out overwhelming promoting strain, the likes of which we noticed towards the top of February.

This was solely a faint glimmer of hope. The 61.8% Fibonacci retracement degree on the $74.4k area was about to be examined as assist as soon as extra. It was unclear if BTC bulls might defend this degree.

Supply: BTC/USDT on TradingView

Zooming into the 4-hour chart, we discovered that there was some house for hope. The $75.1k and the $80k ranges appeared to type a short-term vary for Bitcoin.

Each the OBV and the RSI have made larger lows throughout the latest retest of the vary’s low.

This exaggerated bullish divergence revealed the potential for some bullish momentum within the quick time period. Nevertheless, it was not sturdy sufficient to reverse the downtrend or the latest losses.

The thought of consolidation got here from the 1-month liquidation heatmap. Within the second half of March, BTC traded above the $82k short-term assist. It allowed time for a build-up of lengthy liquidations round $81.1k.

Equally, the value of Bitcoin would possibly stabilize above $74.5k. This was to construct up lengthy liquidations to the south earlier than looking them down.

Merchants must be ready for BTC to dive beneath $74.5k, since uncertainty was rising every day.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion