Ethereum stablecoin volume drops: Will it impact ETH prices?

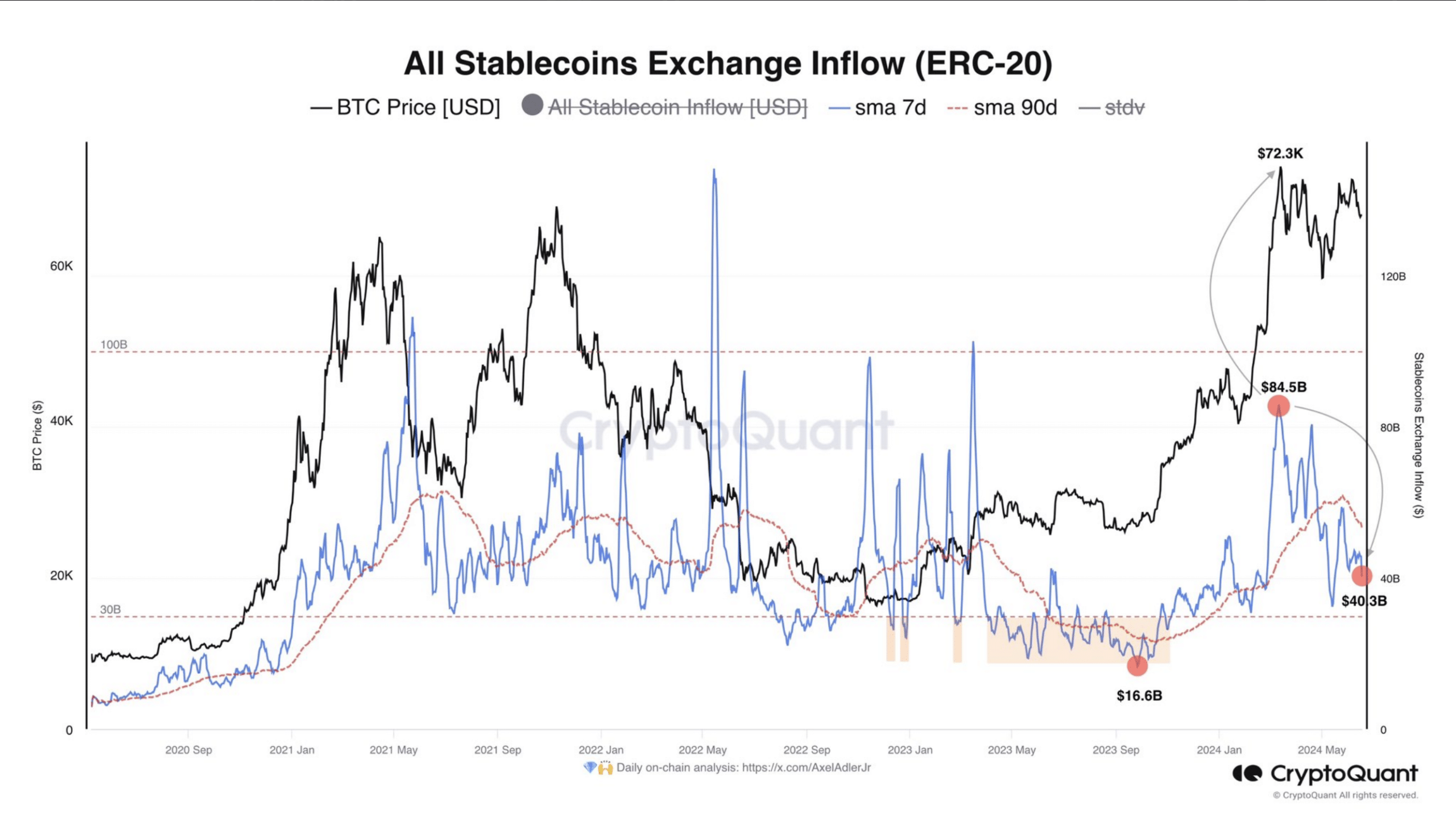

- Stablecoin quantity on Ethereum fell to $40 billion, indicating the potential of main the cryptocurrency to a bear section.

- The MVRV Lengthy/Quick Distinction, alongside holders’ sentiment confirmed that ETH’s worth may improve.

Stablecoin quantity on the Ethereum [ETH] blockchain has dropped from $84 billion to $40 billion, in keeping with information from CryptoQuant. When the amount of stablecoins will increase, it signifies that demand for tokens on a blockchain may improve.

Additionally, when this occurs, it strengthens the native cryptocurrency of the ecosystem. For Ethereum, the drop in quantity signifies that the majority ERC-20 tokens have been underperforming.

ETH holders don’t consider in bears

ERC-20 tokens discuss with the fungible tokens created utilizing the Ethereum blockchain. Traditionally, if the stablecoin quantity plummets to $30 billion, ETH falls right into a bear market. Due to this fact, the danger was current.

Supply: CryptoQuant

At press time, ETH’s worth was $3,517, representing a 4.18% lower within the final seven days. Whereas there have been predictions that the worth would revisit $4,000, that has not occurred in weeks.

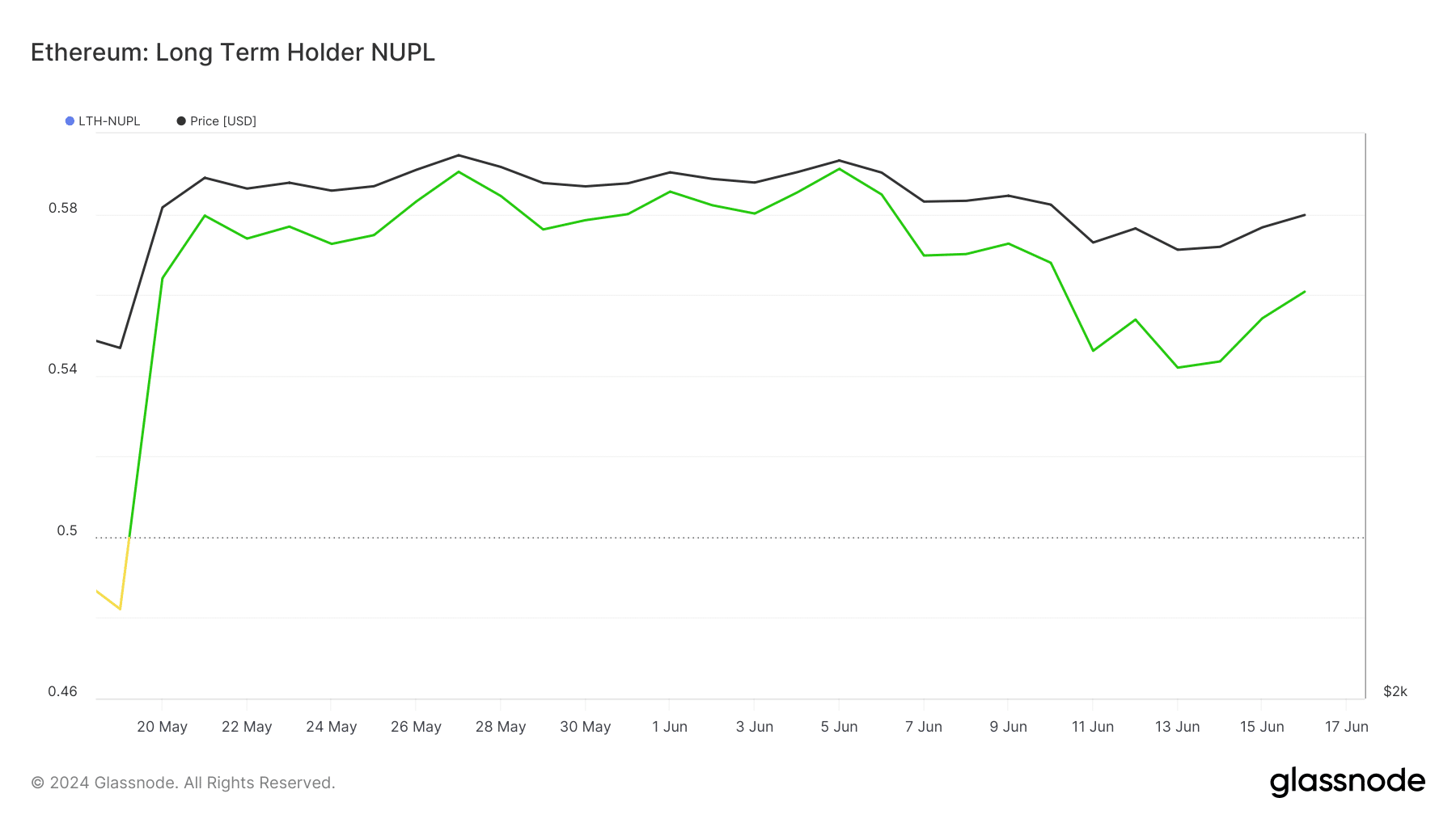

In addition to this, AMBCrypto regarded on the LTH-NUPL. LTH-NUPL stands for Lengthy-Time period Holder- Internet Unrealized Revenue/Loss. This metric assess the conduct of long-term holders.

Sometimes, the metric considers UTXOs with at the least a lifespan of 155 days. In response to Glassnode, Ethereum’s LTH-NUPL was within the perception (inexperienced) zone.

This means that holders of the token are convinced that the worth may improve.

If this conviction stays the identical within the coming weeks, then ETH may not fall right into a cycle. As a substitute the worth of the token, backed by demand, could possibly be taking a look at hitting a brand new all-time excessive.

Supply: Glassnode

Will rising volatility lead the worth increased?

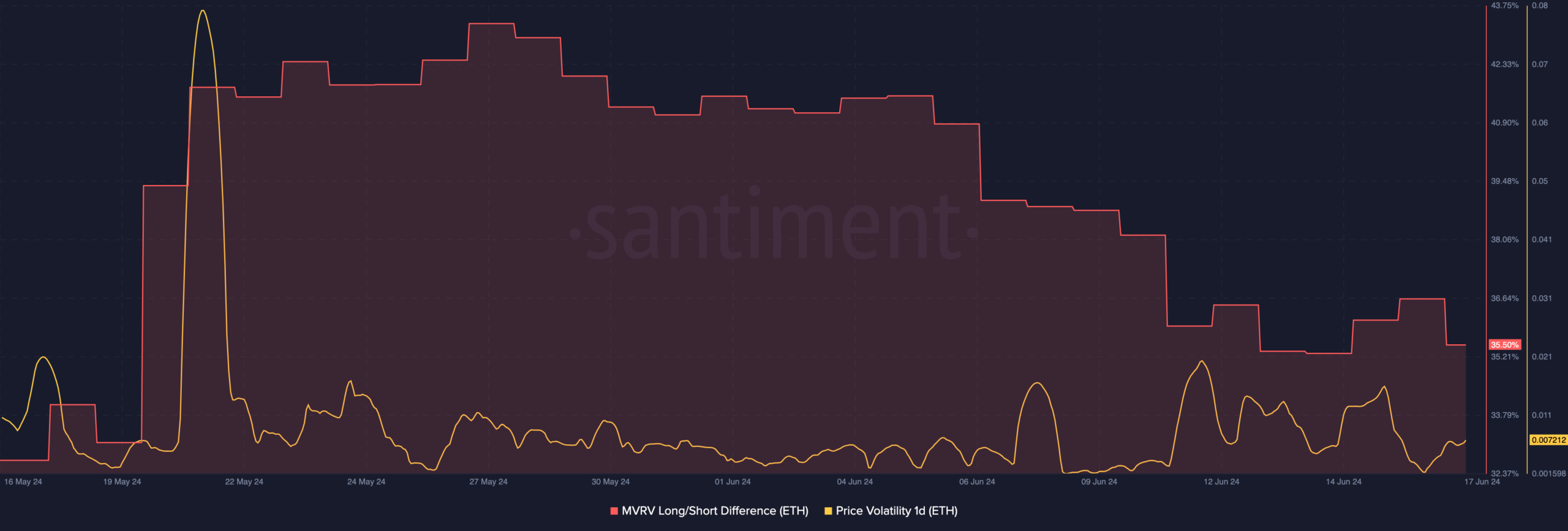

The Market Worth to Realized Worth (MVRV) Lengthy/Quick Distinction is one other metric that may inform if ETH is in a bear zone or not.

When the studying of the metric falls into the adverse area, it signifies that a cryptocurrency might need dropped to the bear market.

However so long as the metric stays optimistic, the cryptocurrency is in a bull section. At press time, AMBCrypto noticed that the MVRV Lengthy/Quick Distinction was 35.50%.

Whereas this was a lower from the studying final month, it was an indication that ETH has not succumbed to the bear zone. Nonetheless, one can not deny that it implies that ETH’s worth may fall.

But when it does, the worth of the cryptocurrency is unlikely to slip under $3,000. If this stays the case, ETH might need an opportunity at retesting $4,000 and past.

In the meantime, the one-day volatility has begun to extend. Volatility measures how speedy worth can transfer in numerous instructions. When volatility improve with shopping for strain, worth can leap to unbelievable figures.

Supply: Santiment

Learn Ethereum’s [ETH] Worth Prediction 2024-2025

However, excessive volatility will promoting strain results in correction. For ETH, it stays unsure the place the worth would head subsequent.

Nonetheless, one thing appeared virtually sure, holders may not give in to bearish demand that drive the worth decrease than anticipated.