Ethereum: Staking over trading? Read this, ETH holders!

- Enhance in staked provide indicated a shift in direction of assured, steady returns over risk-laden market buying and selling.

- ETH retraced 6.5% within the final 24 hours, vulnerable to plunging additional.

Curiosity in Ethereum [ETH] staking continued unscathed, as customers noticed extra worth in parking their belongings with the good contracts blockchain to earn passive income.

ETH staking continues to be scorching

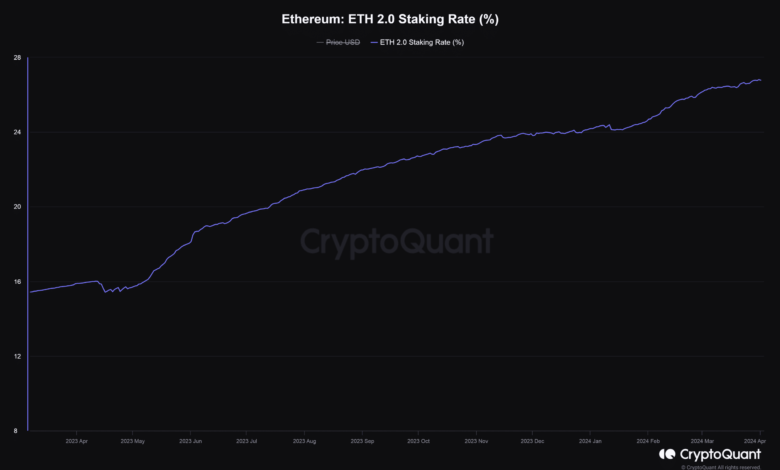

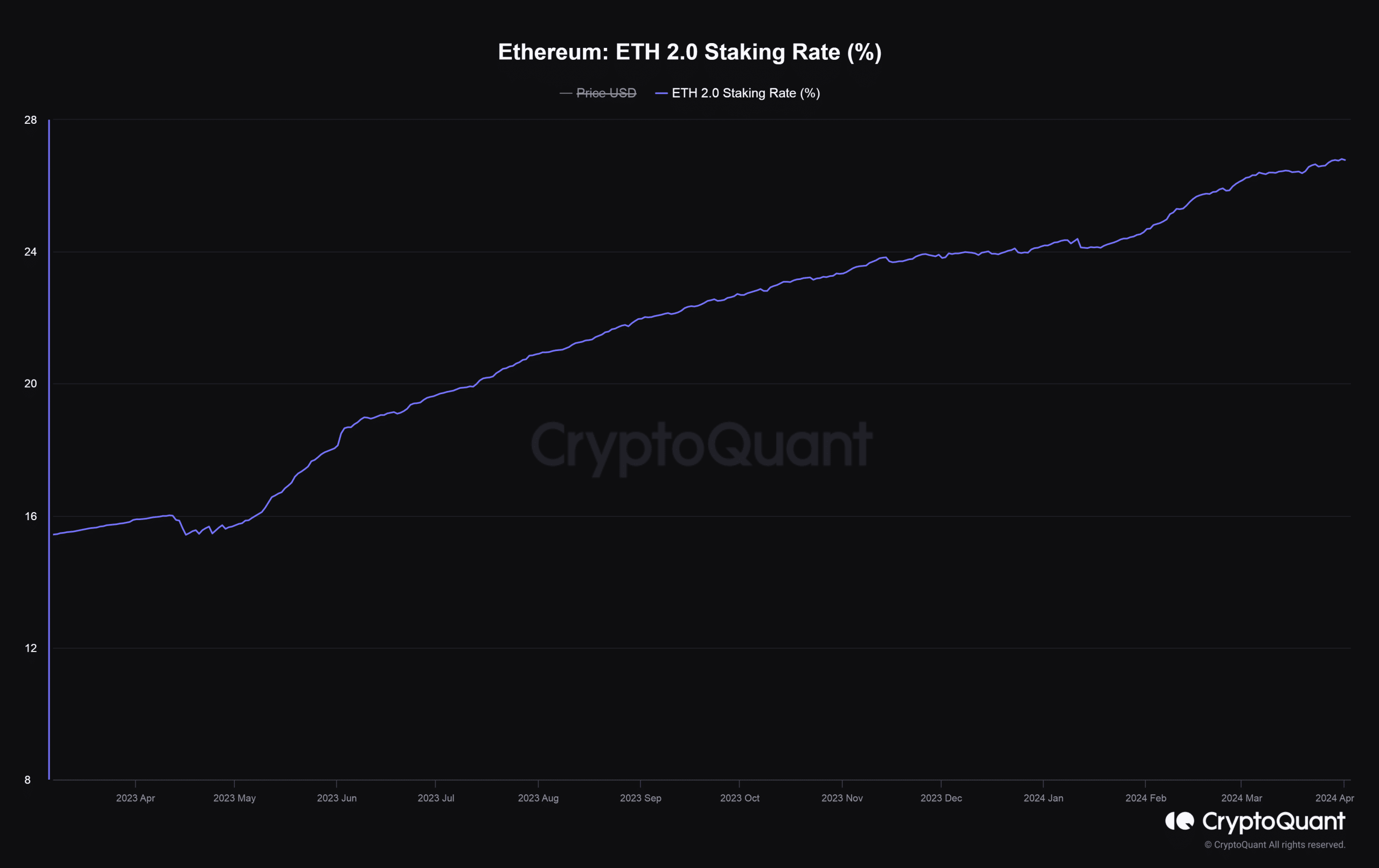

In keeping with AMBCrypto’s evaluation of CryptoQuant information, the staking participation price was inching nearer to 27% as of the first of April, which means that 27% of ETH’s complete circulation provide was deposited to safe the community. A 12 months in the past, the participation price was simply 15.89%.

Sometimes, the bigger the ETH deposit, the extra secured and decentralized the community tends to be.

Supply: CryptoQuant

Staked provide has elevated considerably because the Shapella Improve final 12 months, which permitted stakers to withdraw their belongings. Because the uncertainty across the course of was eliminated, extra customers determined to lock their ETH into the community.

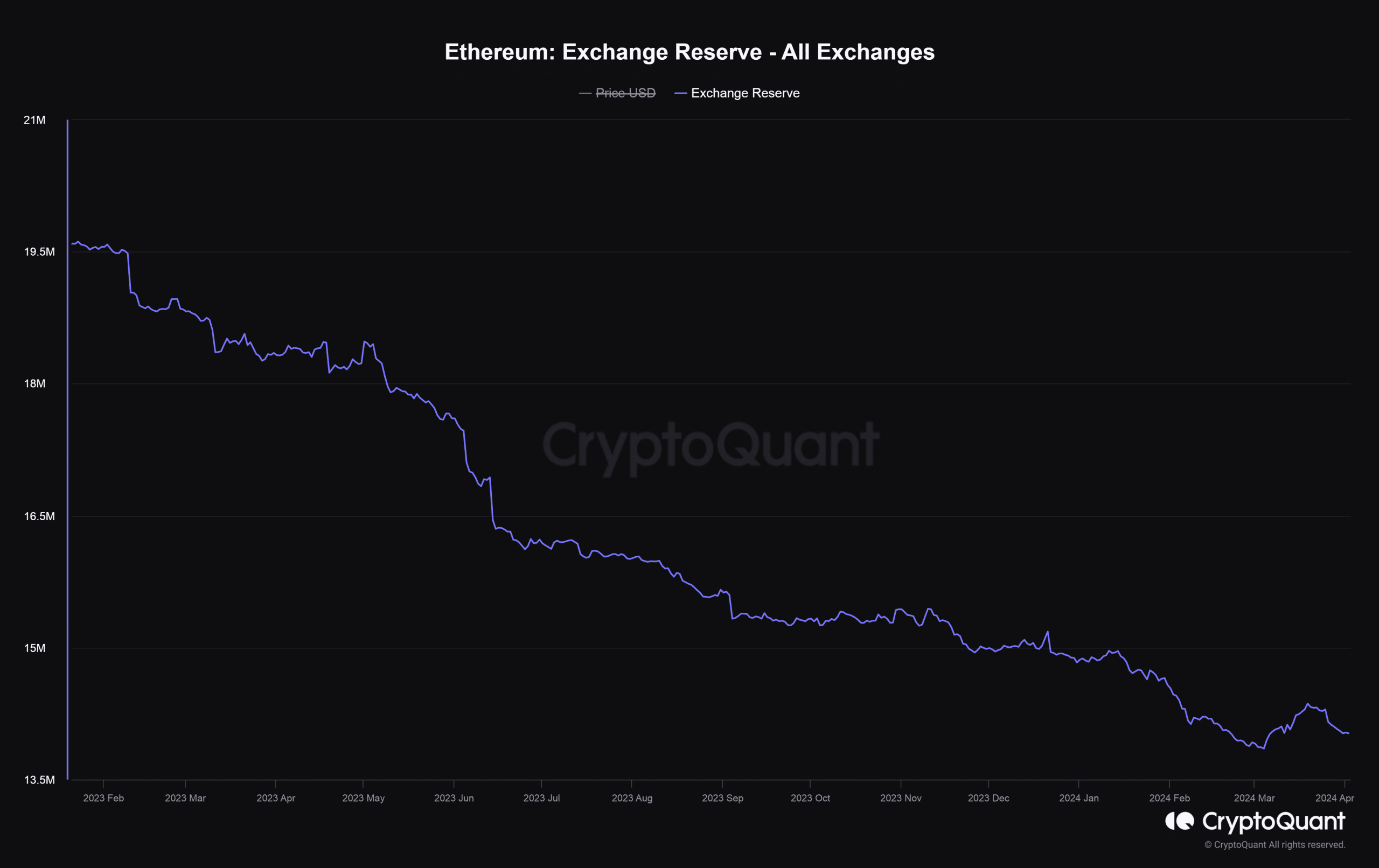

On the similar time, ETH provide on alternate has plummeted to multi-year lows, accounting for simply 11.6% of the overall provide as of this writing.

Supply: CryptoQuant

What does this imply?

These developments revealed a transparent shift within the Ethereum funding panorama – one in direction of assured, steady returns over risk-laden market buying and selling. Additionally they signaled confidence within the long-term prospects of the Ethereum blockchain.

ETH was struggling on the value charts

Whereas the long run regarded inexperienced, the current was within the purple. ETH retraced 6.5% within the final 24 hours, because the broader market sank decrease on Bitcoin spot ETF outflows and U.S. macroeconomic information.

As of this writing, the second-largest cryptocurrency was exchanging arms at $3,307, per CoinMarketCap.

Being attentive to the developments, famous on-chain analyst Ali Martinez sounded an alarm, anticipating an additional dip to $2,850.

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

ETH’s woes might be compounded by damaging sentiment over its spot ETF prospects. Developments in latest weeks have led analysts decrease the percentages of approval considerably.

In keeping with main prediction markets platform Polymarket, there was only a 19% probability of approval as of this writing.