Ethereum staking touches new heights thanks to…

- ETH staked by way of liquid staking platforms elevated progressively because the starting of 2023.

- Liquid staking commanded 36% of the overall ETH staking market share.

Ethereum [ETH] staking started in December 2o2o, offering a chance for buyers to lock up their holdings and earn passive revenue on the identical. The curiosity was fueled by the rising graph of the crypto market the place ETH like different cryptos, was hitting new all-time highs each day.

Life like or not, right here’s LDO’s market cap in BTC’s phrases

Staking retains sheen in 2023

Reduce to 2023 and ETH has tumbled greater than 60% from its peaks. The market was in a rebuilding section on the time of writing after the massacre of 2022 crypto winter. Regardless of these headwinds, the demand for staking, if something, has solely gone northwards.

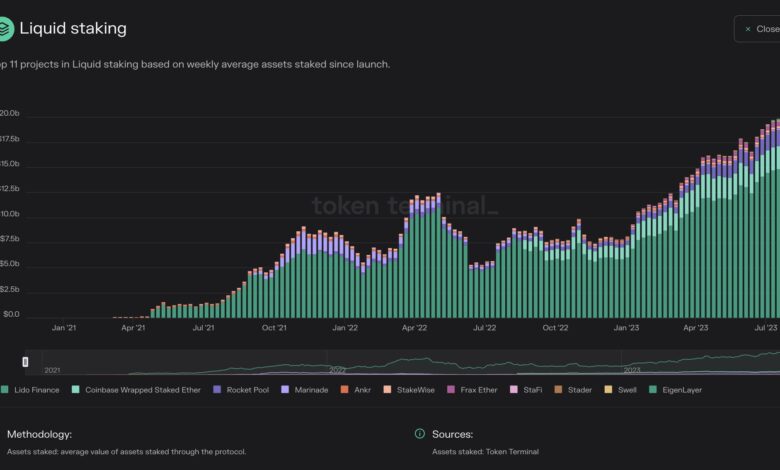

Based on a Twitter user citing Token Terminal information, complete ETH staked by way of liquid staking platforms elevated progressively because the starting of 2023.

Supply: Token Terminal

The thrill across the much-awaited Shapella improve and its eventual rollout in 2023 performed a giant half in retaining consumer’s curiosity in staking. With the addition of the withdrawal characteristic, staking turned extra dependable.

Liquid staking captures market

Liquid staking protocols prolonged their dominance after Shapella and outperformed different staking choices like centralized exchanges (CEX) and staking swimming pools. From being a non-existent class in December 2020, liquid staking commanded 36% of the overall staking marketshare at press time, as per Dune information.

Supply: Dune

Liquid staking outpaced decentralized exchanges (DEXs) and lending protocols to turn out to be the biggest sub-sector within the DeFi panorama in 2023, based on DeFiLlama. On a YTD foundation, the overall worth locked (TVL) in liquid staking protocols shot up by 144% to $21,6 billion at press time.

Unsurprisingly, the heavy-lifting was achieved by liquid staking behemoth Lido Finance [LDO] which was the largest DeFi protocol on the time of writing, with a TVL of $14.76 billion. The truth that Lido’s TVL was greater than twice as excessive because the next-ranked Aave [AAVE] on the record offered proof of its superiority.

Supply: DeFiLlama

Is your portfolio inexperienced? Try the Lido Revenue Calculator

LDO sees adoption

The rise in prominence of liquid staking additionally began to replicate on their native tokens. LDO traded at $2.03 on the time of publication, having soaked good points of seven.45% within the final 30 days.

With its rising worth, the token caught the eye of merchants. The entire variety of LDO holders grew 6% during the last month, information from Santiment revealed.

Supply: Santiment