Ethereum struggles around $3K as short positions surge: What now?

- ETH traded at $3k at press time.

- The cumulative brief liquidation of Ethereum rose to over $800 million.

After experiencing a value decline on the seventh of Could, Ethereum [ETH] noticed extra liquidations in lengthy positions. Consequently, extra merchants opted for brief positions.

On account of this elevated shorting exercise, the worth of Ethereum declined additional, falling under the $3,000 value vary in the course of the buying and selling session on the eighth of Could.

Ethereum merchants wager on value decline

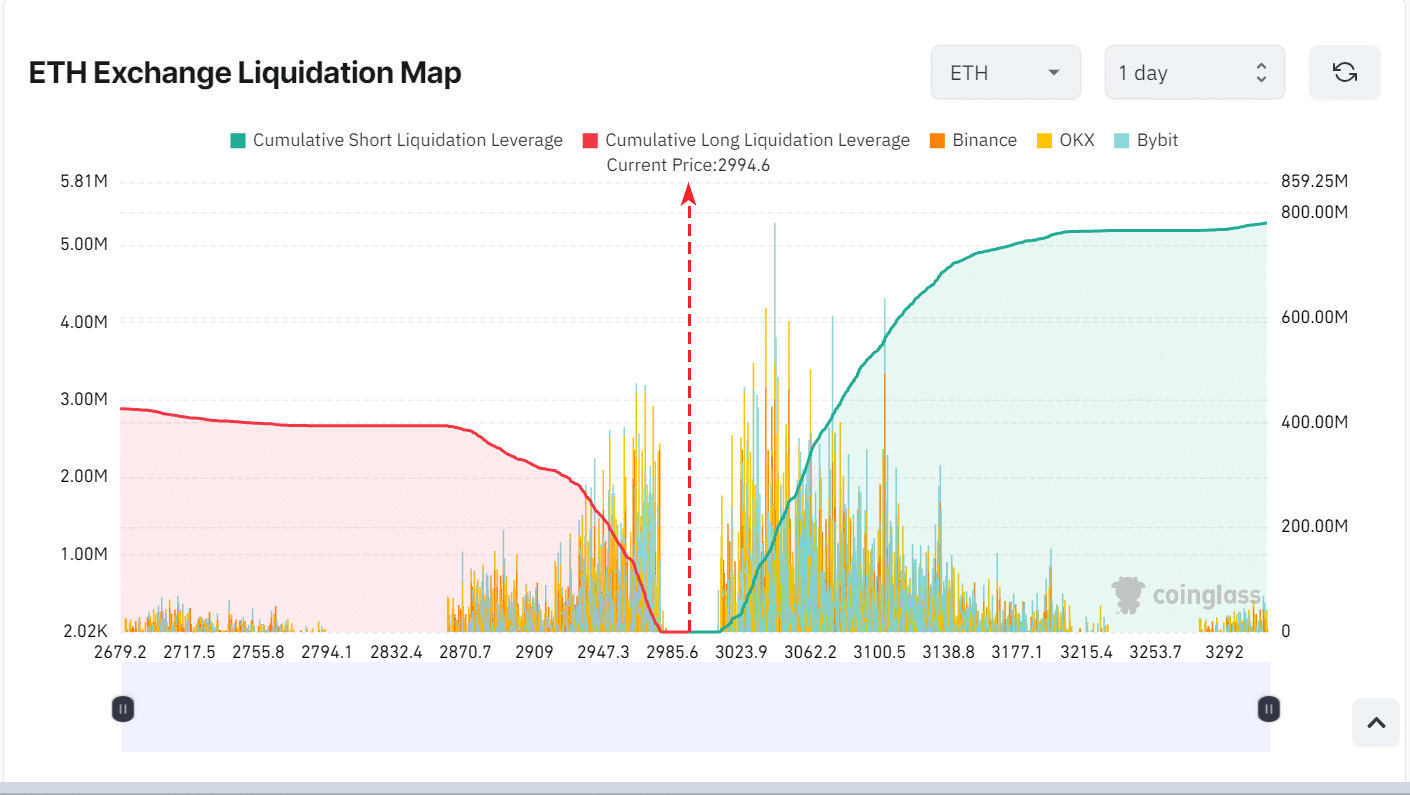

AMBCrypto’s evaluation of Ethereum’s trade liquidation map on Coinglass indicated a dominance of brief positions on the time of writing.

The cumulative brief liquidation leverage for the 24-hour interval has risen to over $800 million.

This means that merchants are more and more taking brief positions, indicating their expectation for the worth of ETH to proceed declining within the brief time period.

Supply: Coinglass

Additional examination of the map revealed that the cumulative leveraged place for the final seven days has exceeded $1.7 billion.

Given the prevailing pattern within the earlier buying and selling session, this present positioning by merchants just isn’t sudden.

Ethereum lengthy positions feeling the warmth

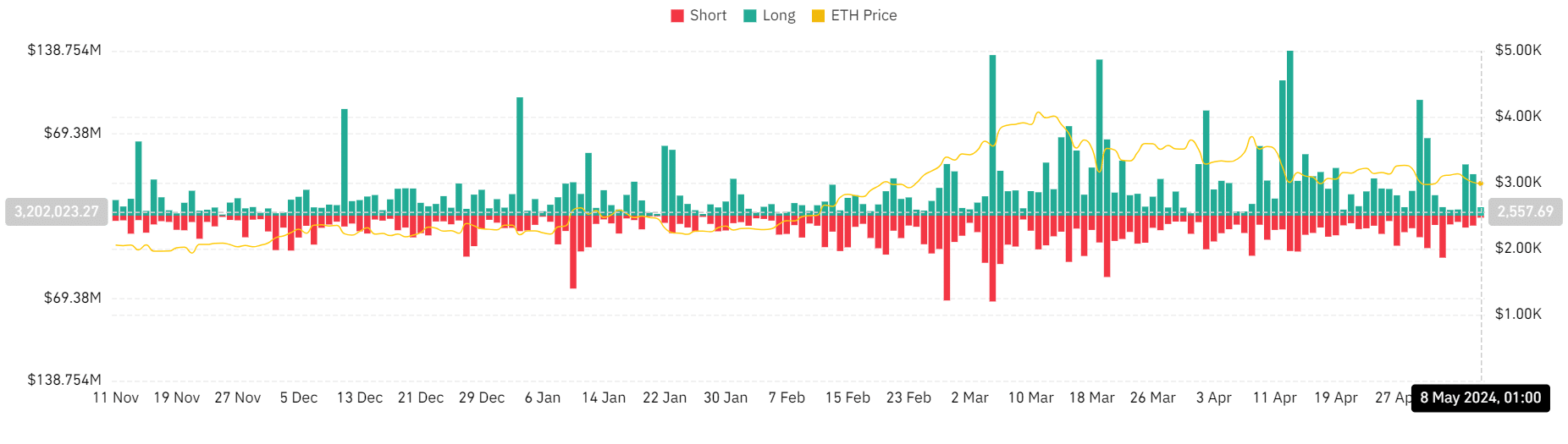

Ethereum’s lengthy positions have skilled extra liquidations than brief positions over the past three days.

AMBCrypto’s take a look at Coinglass’ liquidation chart revealed that between the sixth and the seventh of Could, longs exceeded $78 million.

Conversely, brief liquidations, throughout the identical interval, amounted to roughly $18.3 million.

Supply: Coinglass

This pattern persevered at press time, with lengthy liquidations surpassing $7 million, whereas brief liquidation quantity stood at round $1.6 million.

ETH to fall deeper?

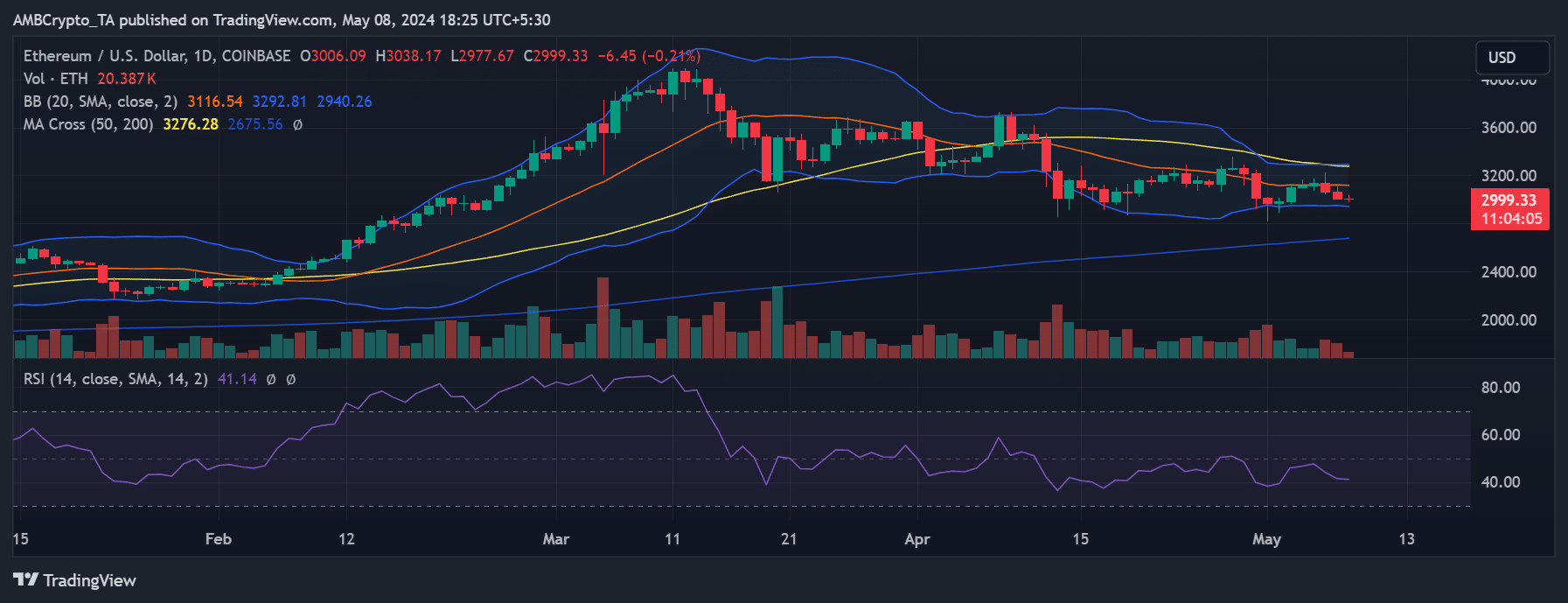

AMBCrypto’s take a look at Ethereum’s each day timeframe value pattern revealed a notable three-day decline.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

Buying and selling at round $3k on the time of writing, with a lower of lower than 1%, the worth motion indicated some degree of volatility as depicted by the Bollinger Band.

This decline has additional entrenched ETH right into a bearish pattern, with the Relative Energy Index (RSI) standing at 40, signaling a powerful bearish sentiment.

Supply: TradingView