Ethereum supply shift: 52% ETH now held by large investors

- Massive ETH holders have added over 10% to their holdings prior to now yr.

- 52% of ETH is now concentrated with giant holders.

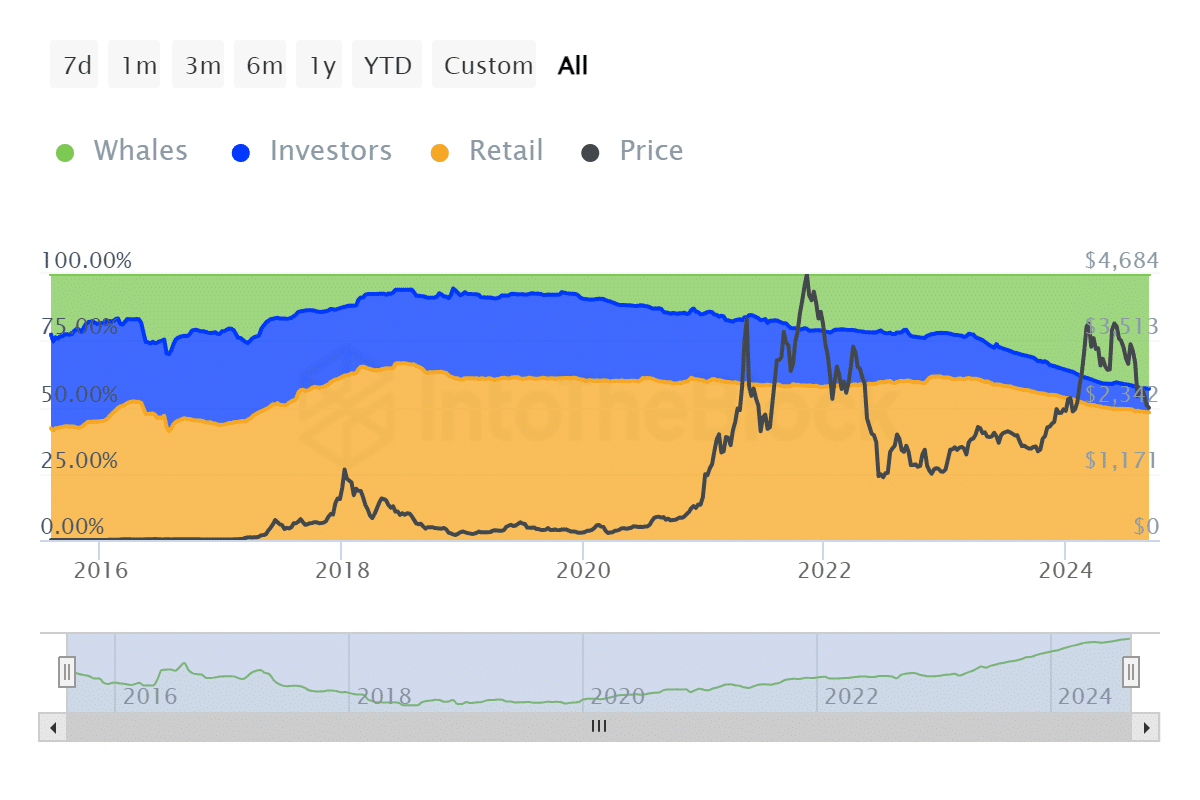

Ethereum [ETH] has skilled a major development within the variety of its giant holders, also known as whales. New information signifies that the proportion of ETH provide held by these whales was progressively catching as much as the quantity held by retail traders.

Massive holders, together with whales, management greater than half of the overall ETH provide.

Massive holders get extra Ethereum

Based on information from IntoTheBlock, Ethereum whales now maintain roughly 58.37 million ETH, representing over 43% of the overall Ethereum provide.

This marks a major enhance from the 30% they held final yr, suggesting that giant holders have added greater than 10% to their holdings over the previous yr.

Supply: IntoTheBlock

The information additionally highlights that this accumulation accelerated notably after the Shanghai improve, which allowed Ethereum withdrawals for stakers.

The full provide held by whales was now approaching the 48% held by retail traders, exhibiting that whales are catching up rapidly.

Moreover, greater than 52% of Ethereum’s whole provide is now concentrated amongst giant holders, together with each whales and institutional addresses.

Ethereum stakes enhance with giant accumulation

In early 2023, the buildup of enormous Ethereum holders elevated considerably, coinciding with the Shanghai improve. Retail traders held round 56% of the overall ETH provide at the moment.

Nonetheless, because the holdings of enormous addresses grew, the provision held by retail traders progressively declined.

Curiously, the evaluation of exchange reserves confirmed that these reserves continued to say no throughout this era. This means that the ETH bought by retail traders and different teams was absorbed by giant holders quite than ending up on exchanges.

This means that whales had been actively shopping for up the ETH bought by smaller holders, decreasing the out there provide on exchanges and tightening liquidity.

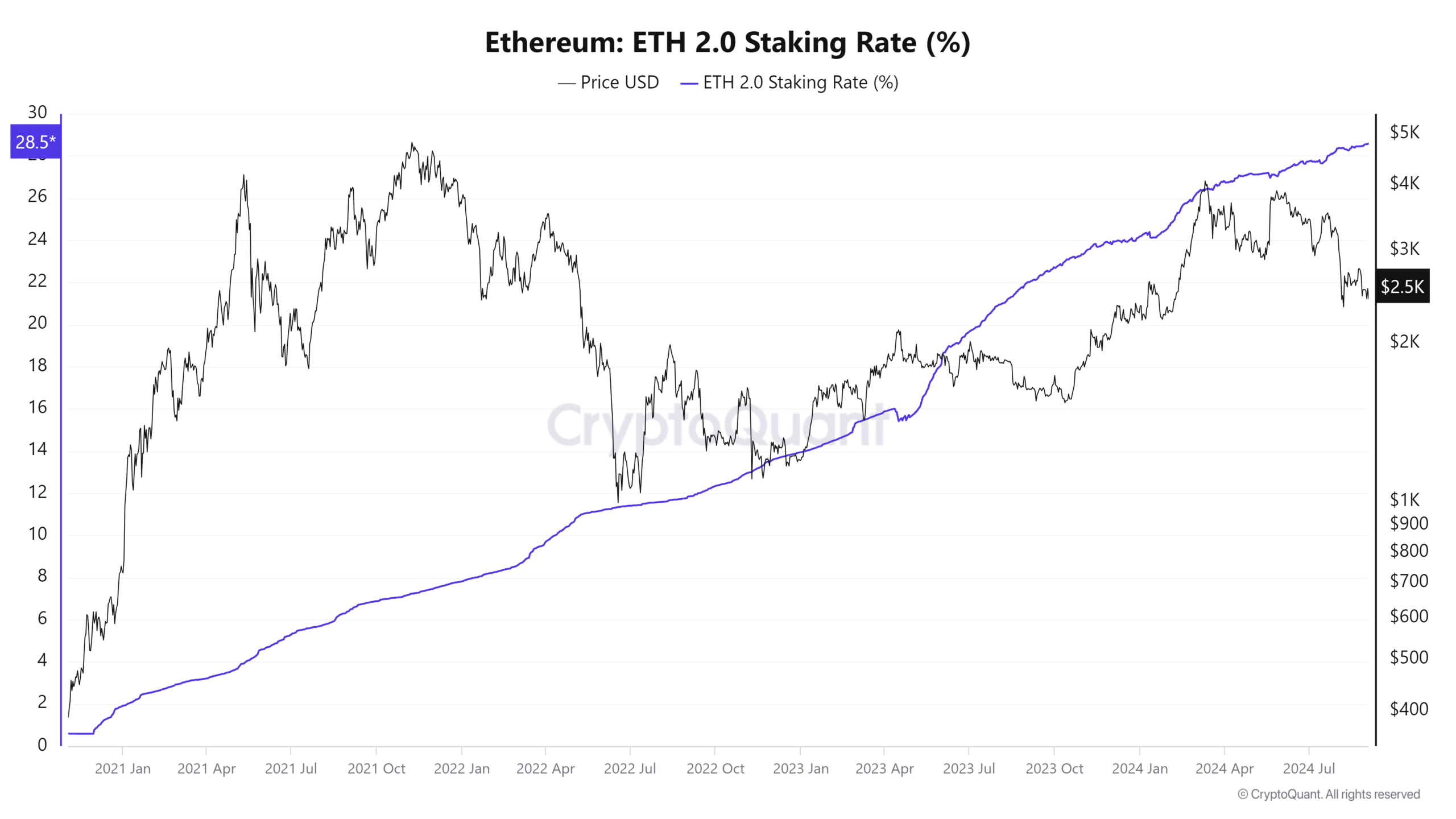

Moreover, the proportion of staked ETH has continued to rise. As of this writing, greater than 28% of the overall Ethereum provide is at the moment staked. This means that a big portion of ETH bought off by retail and different holders has probably been staked quite than traded on exchanges.

The mixture of staked ETH and whale accumulation helps a bullish outlook for Ethereum. A lowering trade provide and rising staked provide typically result in provide constraints, doubtlessly driving up costs in the long run.

Supply: CryptoQuant

ETH stays bearish

As of this writing, Ethereum (ETH) is buying and selling at round $2,340, following a 2.7% enhance within the final buying and selling session. This marks the third consecutive day of value will increase for ETH.

Nonetheless, regardless of this latest upward motion, extra is required to change Ethereum’s total pattern, which stays bearish.

Learn Ethereum (ETH) Value Prediction 2024-25

The continuing bearish pattern signifies that whereas short-term optimistic momentum exists, the broader market sentiment nonetheless leans towards warning.

Ethereum would want to interrupt by key resistance ranges and maintain a stronger uptrend for a extra important shift to happen.