Ethereum supply up by 100,000: What about ETH’s ‘deflationary status’?

- Ethereum loses ultrasound cash standing.

- Whole provide has elevated by over 100,000.

Ethereum [ETH] has transitioned from being labeled “ultrasound cash” as a result of EIP-1559 improve, which has altered its deflationary traits.

This improve decreased Ethereum’s burn charge, resulting in a slowdown within the charge at which Ether is faraway from circulation.

The entire provide of ETH has elevated, and there was a current rise within the provide of ETH on exchanges. How does the provision on exchanges examine to the full provide?

Ethereum whole provide and charges burnt show contrasting tendencies

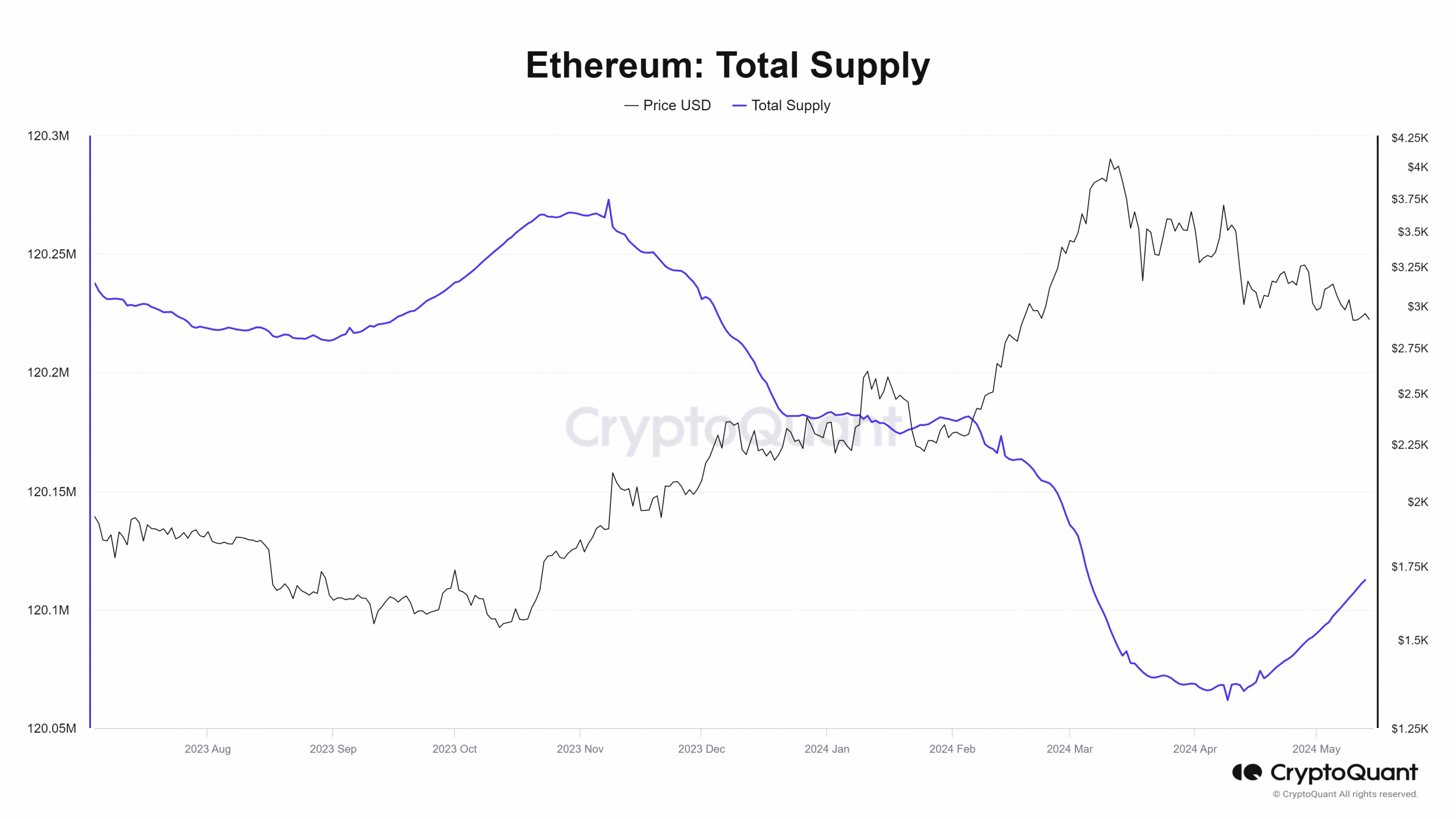

The evaluation of Ethereum’s provide metric on CryptoQuant reveals notable fluctuations in whole provide dynamics over current months.

From November 2023 to early April 2024, there was a discernible lower in ETH’s whole provide, dropping from over 120.2 million to roughly 120.06 million, marking a discount of over 100,000 Ether.

Supply: CryptoQuant

Nonetheless, starting from the nineteenth of April, Ethereum’s whole provide began to ascend, reaching round 120.1 million on the time of this evaluation.

This current enhance in whole provide is attributed to a decline within the charges burnt, which commenced following the Dencum improve.

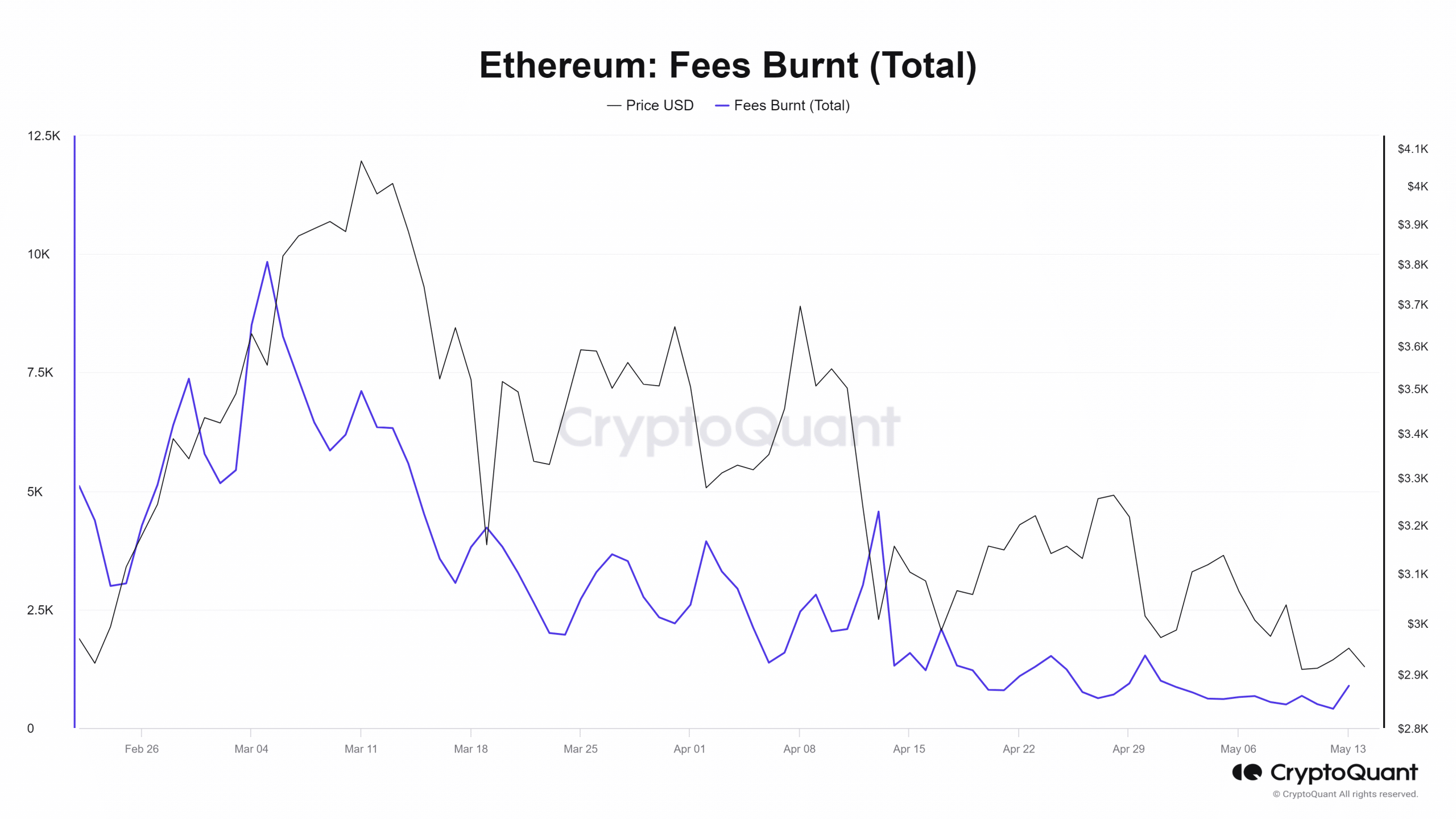

An examination of the charges burnt metric illustrates a big lower, beginning round March.

Throughout this era, charges burnt have been roughly 6,000 Ether, contrasting sharply with the present worth of round 890 ETH on the time of this evaluation.

This vital discount in charges burnt accounts for the noticed uptick in Ethereum’s whole provide, indicating a shift in its deflationary dynamics.

Additionally, the decline in charges burn is as a result of decline in charges on the community.

Supply: CryptoQuant

Ethereum sees a decline in general charges

The current Ethereum improve has led to a discount in transaction charges, each on the primary community and its Layer 2 options.

Information from Coin98 Analytics indicated that Ethereum transaction charges has reached a yearly low, averaging 0.00017E, which interprets to roughly $0.5 per transaction.

This charges marks a big lower in comparison with ranges noticed round February.

Moreover, evaluation of the overall fees generated on the Ethereum community revealed a noticeable decline in current instances.

As of this writing, the full charges have been round $3.6 million, contrasting sharply with the height recorded in March, which stood at roughly $7.8 million.

This downward development in charges commenced a few month in the past.

Ethereum provide on exchanges climbs

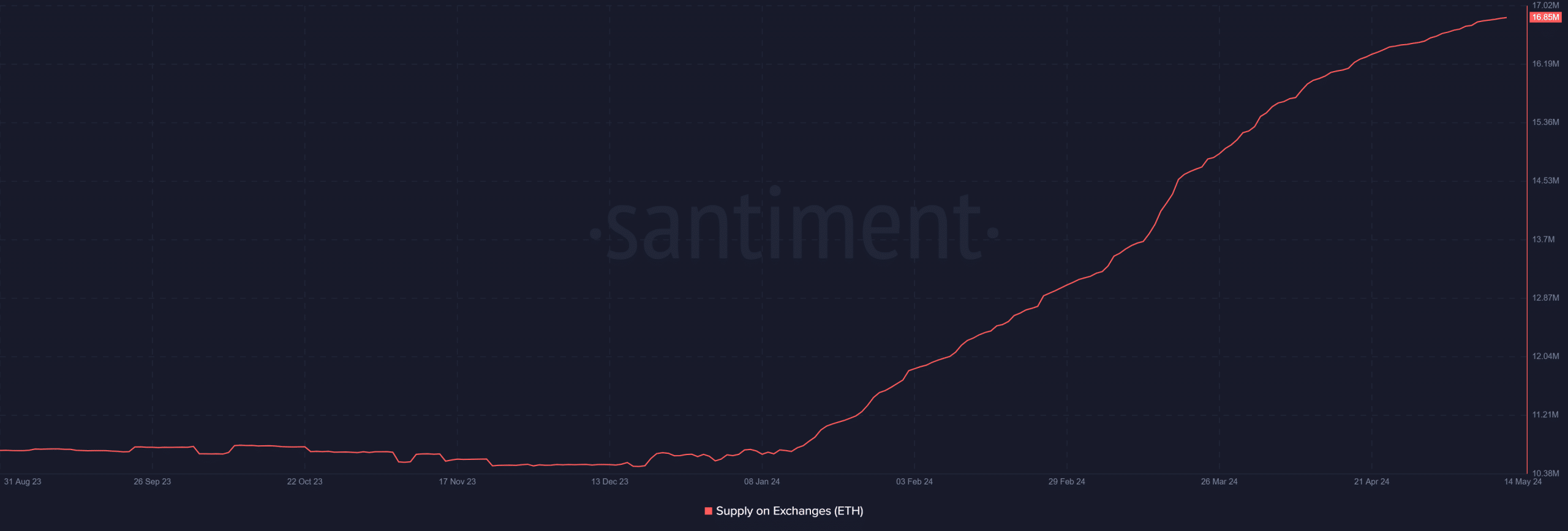

Evaluation of the Ethereum change provide signifies a notable upward development, albeit with some attention-grabbing nuances.

The rise in change provide started earlier than the full provide began to rise, with the expansion, noticed between March and press time, amounting to over 3 million Ether.

As of this writing, the full change provide was over 16.8 million.

Supply: Santiment

Regardless of this vital development, the change provide remained comparatively low in comparison with the full provide of Ethereum. This implies that Ethereum is dealing with a manageable danger of oversupply.

Moreover, the proportionately low change provide signifies that the present value of Ethereum shouldn’t be below quick menace from inflationary pressures.

ETH continues to development beneath $3,000

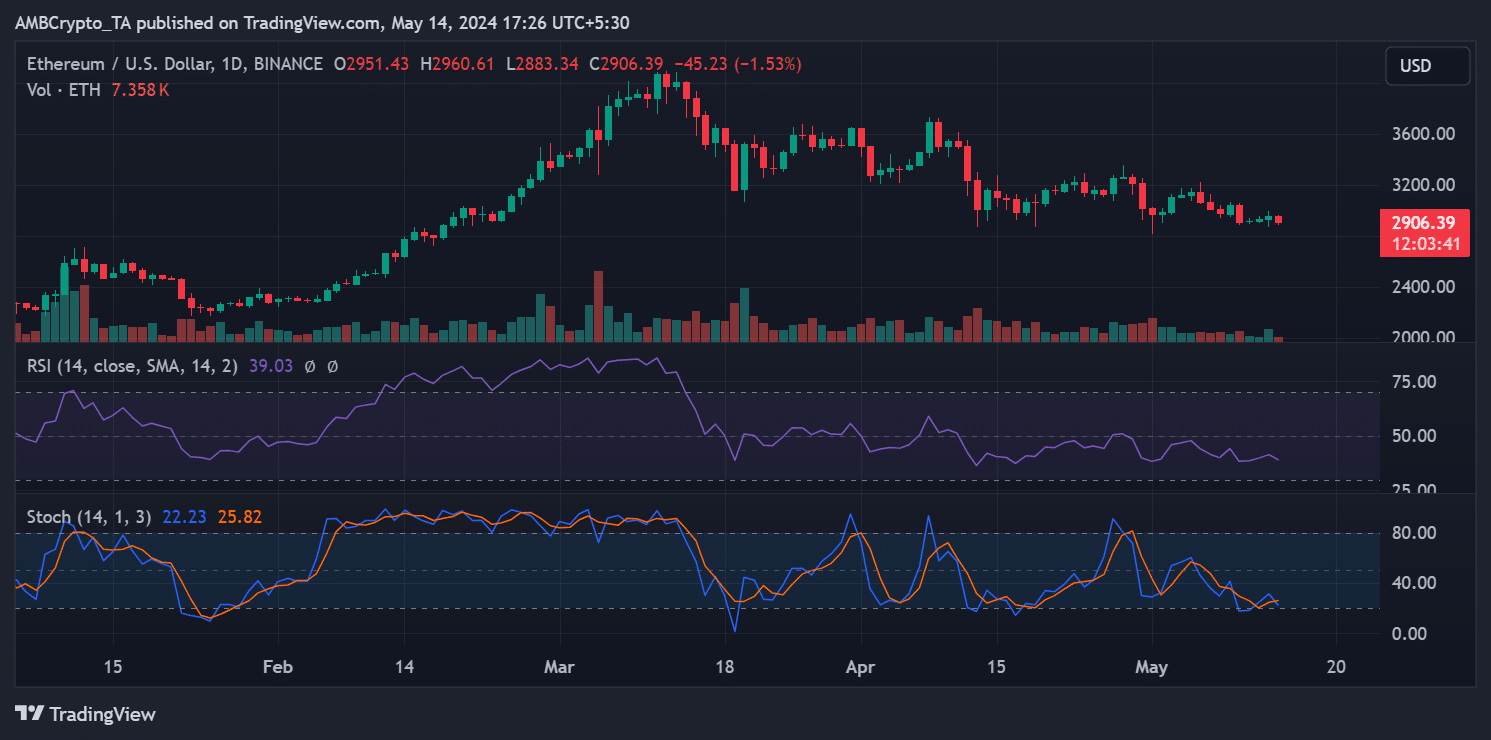

Evaluation of the Ethereum value development on the day by day timeframe is reflecting a difficult interval. Following its drop beneath the $3,000 value stage within the earlier week, ETH has struggled to regain its footing.

As of this writing, it was buying and selling at round $2,900, experiencing a decline of roughly 1.5%.

Supply: TradingView

Learn Ethereum (ETH) Value Prediction 2024-25

Each the Stochastic indicator and the Relative Energy Index (RSI) have been signaling a unfavourable value development. The RSI, specifically, indicated a bearish development because it remained beneath the impartial line.

Nonetheless, the present place of those indicators recommended a possible value reversal within the close to future, with ETH poised for a attainable uptick.