Ethereum surges: Can ETH shake Bitcoin’s dominance in September?

- Ethereum confirmed indicators of restoration after testing the $2,400 zone and surged by 4%, outpacing Bitcoin.

- Does this imply the altcoin may problem BTC’s dominance?

Ethereum [ETH] confirmed indicators of energy, outpacing Bitcoin with a acquire of over 4% within the final 24 hours.

Traditionally, a bullish divergence between Ethereum and Bitcoin has been a robust indicator of a value development reversal for ETH.

Put merely, such divergences have regularly led to important surges in Ethereum’s value, with ETH typically outperforming Bitcoin throughout market volatility.

So, is historical past repeating itself? AMBCrypto investigates.

Historical past reveals ETH outperforms in September

Supply : Buying and selling View

AMBCrypto’s evaluation of the ETH/BTC weekly chart revealed that Ethereum skilled important rallies in September 2016 and 2019, peaking round mid-September.

Coincidentally, this 12 months, the Federal Reserve is ready to chop rates of interest on the 18th of September.

Given these previous patterns, the timing of the Fed’s fee minimize is perhaps extra than simply coincidence.

Historic knowledge means that ETH typically performs properly round this time of 12 months, and a fee minimize may present further market momentum, doubtlessly inflicting the worth to achieve the $2,800 resistance degree.

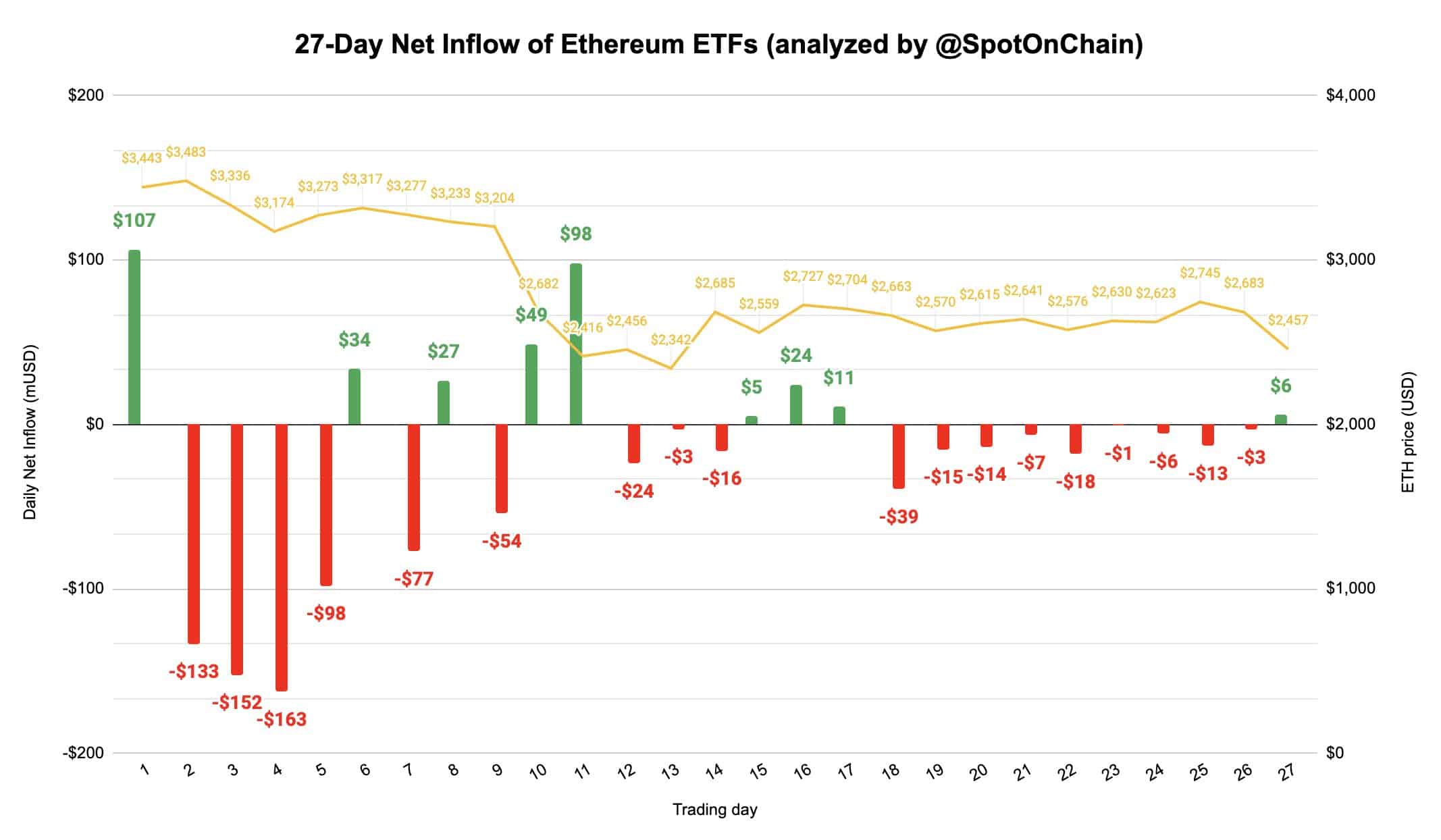

Supply : SpotOnChain/X

Including to the optimism, ETH’s internet influx yesterday ended a 9-day outflow streak. Moreover, BlackRock’s ETHA noticed an influx of $8.4M after 5 buying and selling days with zero internet flows.

In comparison with this, data confirmed that BTC’s internet movement remained strongly destructive for the second day.

Moreover, no U.S. Bitcoin ETFs noticed an influx yesterday, and Grayscale Mini (BTC) recorded its first-ever outflow.

Briefly, this comparability reveals a stark distinction in market sentiment between ETH and BTC.

Whereas Bitcoin struggles to interrupt above the $60K resistance, Ethereum has surged roughly 4% since yesterday.

Nevertheless, AMBCrypto notes that to solidify this thesis, on-chain knowledge should align with Ethereum’s dominance. So, does it?

Ethereum stays inferior in dominance

In the intervening time, Ethereum has proven indicators of restoration after testing the $2,400 zone. Analysts consider that ETH wants to interrupt via the $2,600 resistance ranges for a possible rebound.

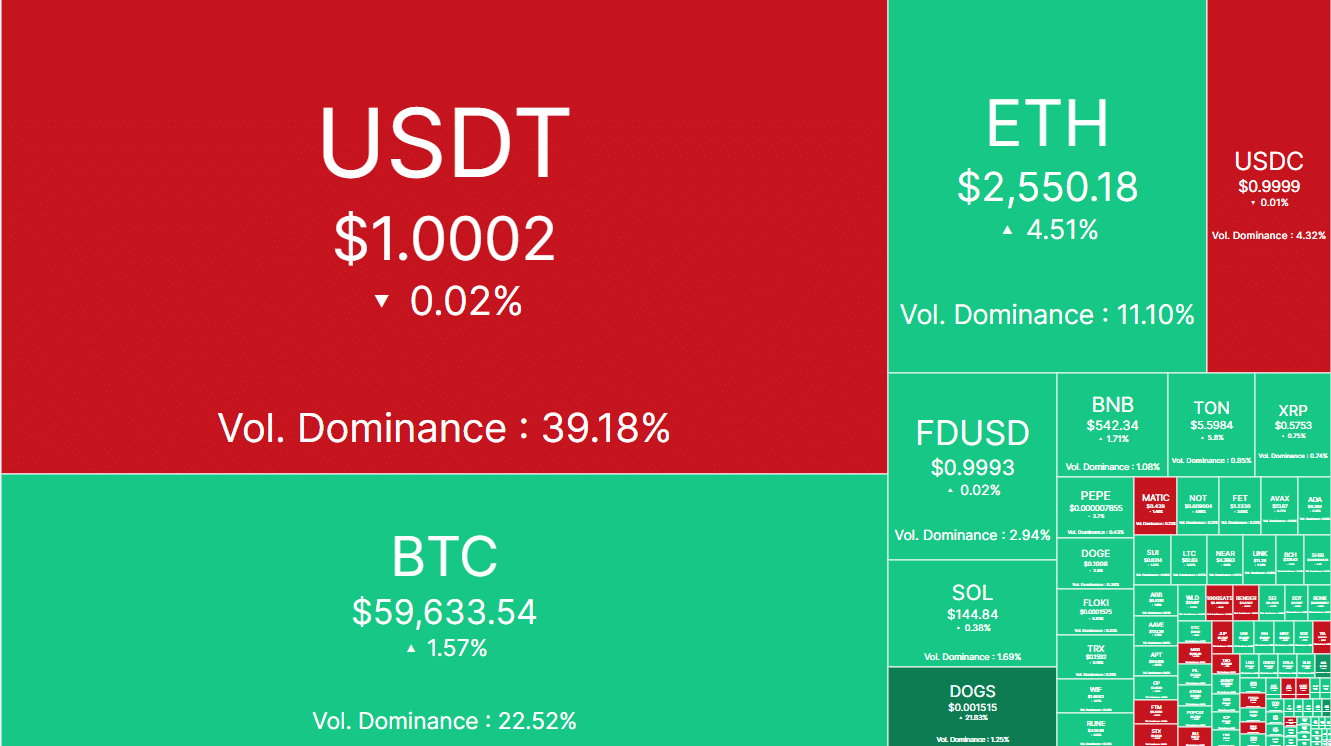

At press time, the altcoin was buying and selling at $2,550. Regardless of this, ETH trails behind BTC in quantity dominance.

Supply : CoinMarketCap

The next quantity dominance for Bitcoin suggests it’s extra actively traded and has higher liquidity out there. Consequently, regardless of intervals of bearish downturn, Bitcoin tends to rebound extra reliably.

Learn Ethereum (ETH) Value Prediction 2024-25

In distinction, Ethereum’s possibilities of restoration are extra depending on Bitcoin’s efficiency.

In different phrases, ETH market sentiment is influenced by BTC’s general efficiency. If Bitcoin declines, Ethereum is prone to comply with go well with, reinforcing BTC’s dominance over its counterpart.