Ethereum to $4000 – The main hurdle before ETH’s price target is…

- Ethereum famous a decline in bullish conviction within the Futures market

- Coinbase Premium Index confirmed merchants from the U.S are adamant in regards to the altcoin

Ethereum [ETH] rallied swiftly from $3.2k to $3.7k, making a 16.2% transfer in three days. Nevertheless, the bulls have been rebuffed on the identical near-term resistance from a month in the past – $3.7k.

The native high coincided with a large inflow of ETH to exchanges on 8 April, in line with AMBCrypto’s newest evaluation. Whereas the sentiment had been bullish, it has begun to shift during the last 24 hours.

U.S traders refuse to consider in ETH’s rally

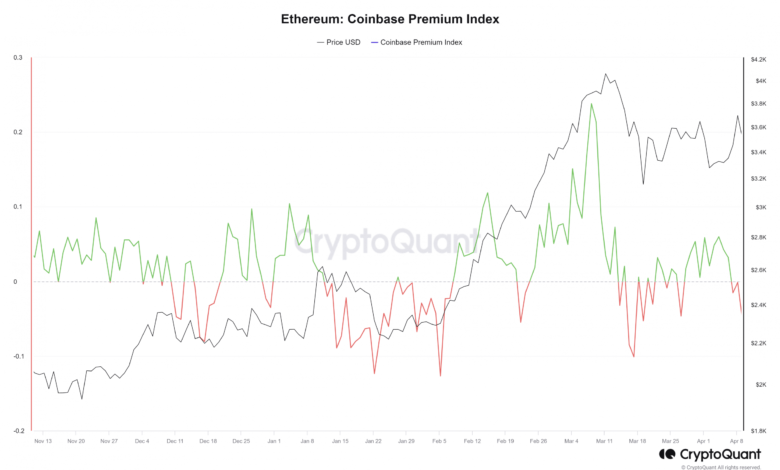

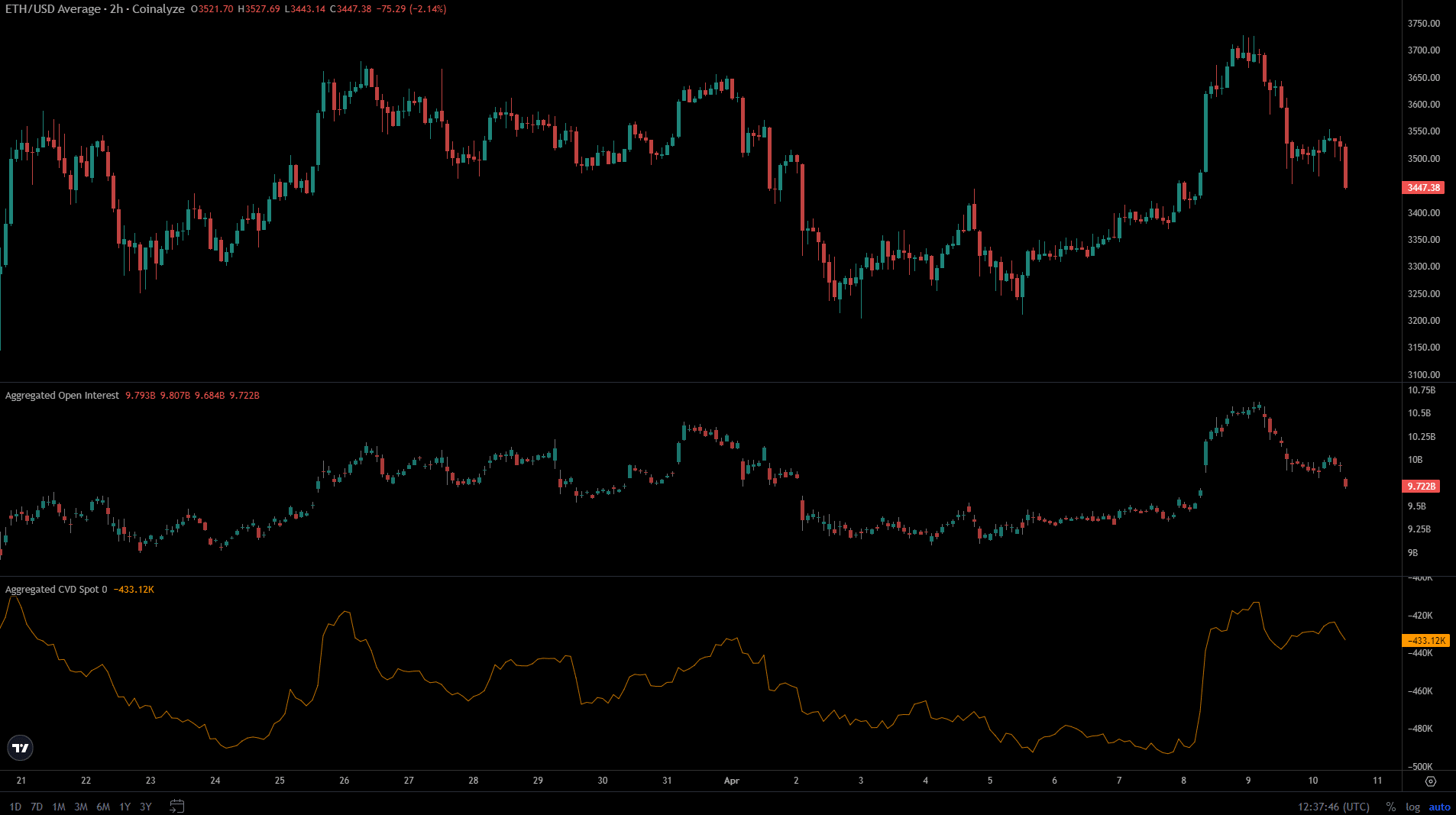

Supply: CryptoQuant

The Coinbase Premium Index represents the p.c distinction in costs (USDT pair) between Binance and Coinbase. This index has fallen since 5 April to point out that Binance ETH costs have been higher.

In different phrases, it mirrored an absence of bullish enthusiasm from U.S traders, since they will’t commerce on Binance and need to depend on Coinbase. Therefore, regardless of the sharp bounce to $3.7k, sentiment west of the Atlantic has been muted.

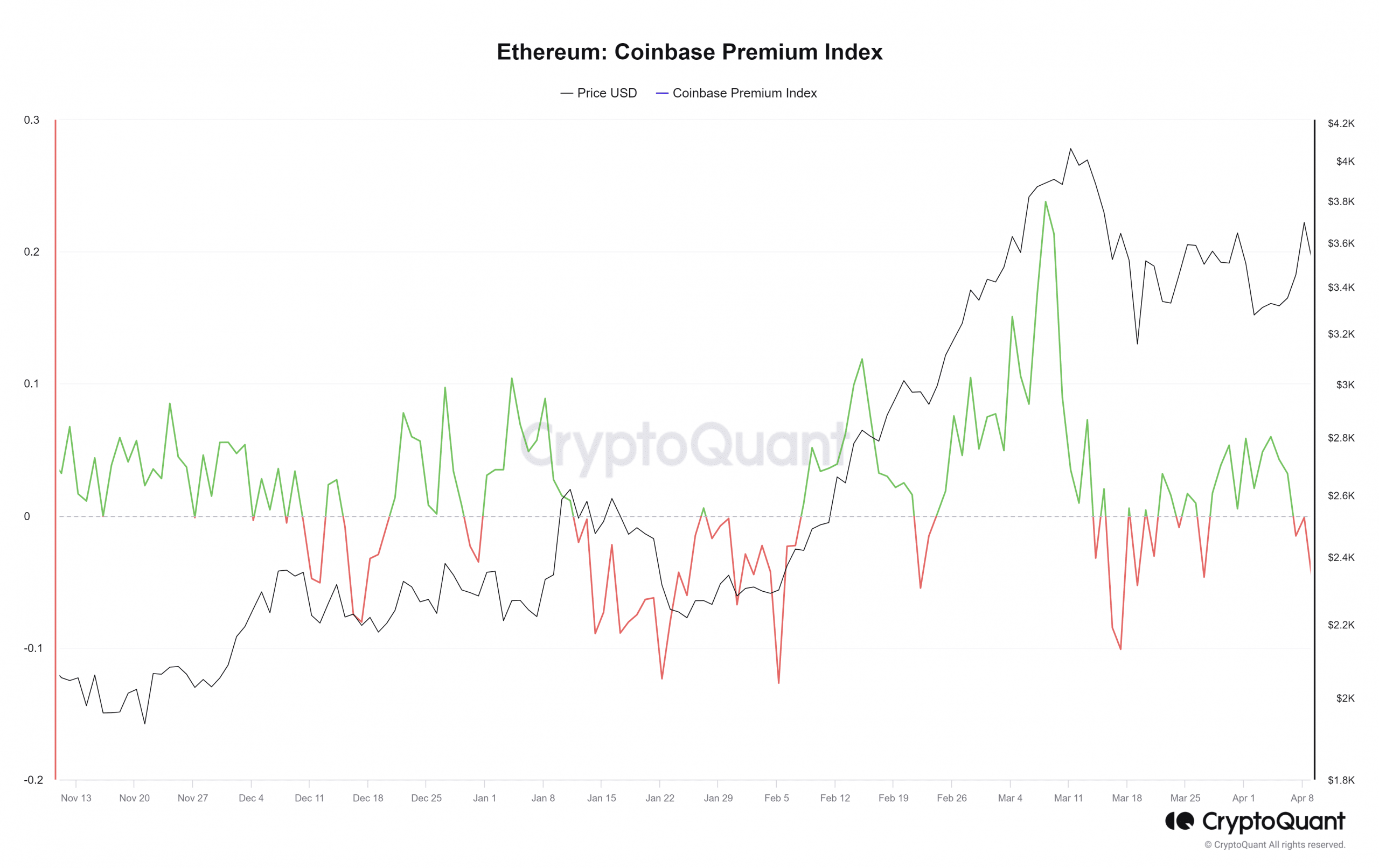

Supply: Santiment

The ratio of each day on-chain transaction quantity in revenue to loss metric from Santiment leapt to three.01 on 8 April. Since February, this metric has confronted a glass ceiling at 3. Due to this fact, merchants may keep watch over this metric’s each day readings to grasp if a short-term value despair is perhaps inbound.

Day by day energetic addresses and community progress metrics noticed a stoop on 30 March. They continued to development decrease over the previous ten days. This was an indication of an absence of person adoption and natural demand for Ethereum. It raised the query – What’s the short-term sentiment like within the spot and Futures ETH markets?

Open Curiosity knowledge supported concept of bearish market sentiment

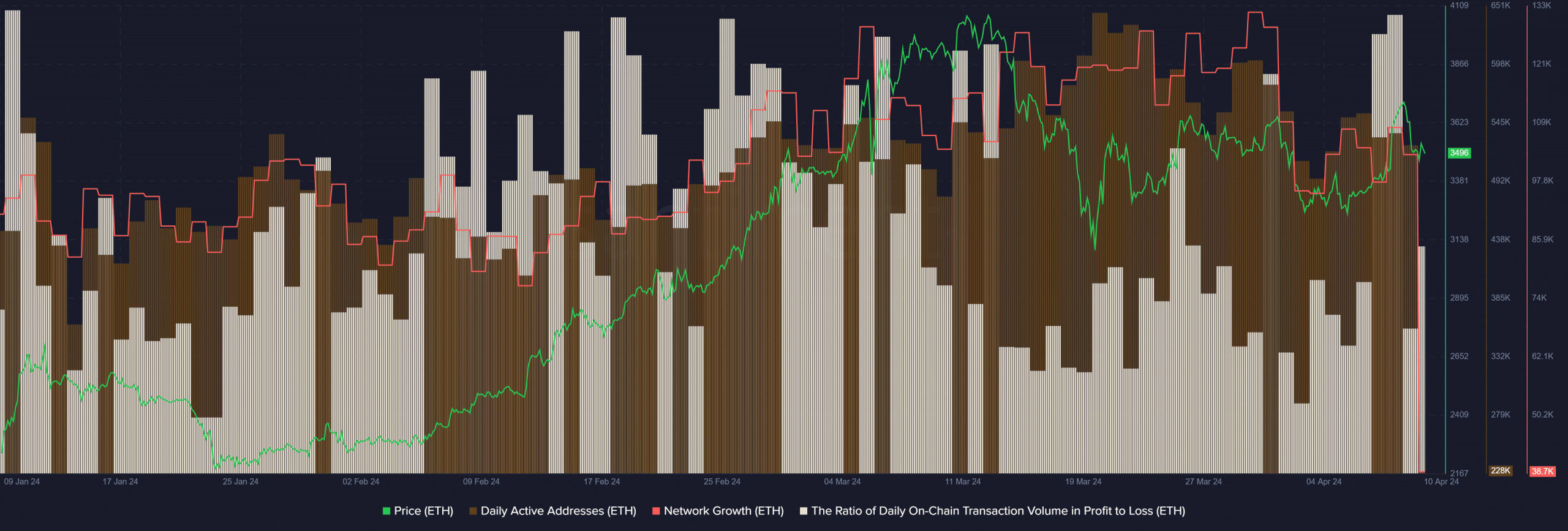

Supply: Coinalyze

When ETH confronted rejection at $3.7k, the Open Curiosity additionally took a flip south. Over the past 36 hours, the OI has fallen from $10.6 billion to $9.72 billion. A drop in costs, alongside the Open Curiosity, appeared to be an indication of bearish sentiment.

Learn Ethereum’s [ETH] Value Prediction 2024-25

The spot CVD additionally started to fall decrease, however it has not retraced all of the beneficial properties it made for the reason that eighth. That being stated, the interval from 26 March to eight April noticed Ethereum’s spot CVD development south. It highlighted that spot market contributors weren’t bullishly satisfied but, however there was an opportunity of a turnaround ought to ETH break previous the $3.7k-mark.