Ethereum to ATH in 2024? Why ETH’s surge has excited investors

- Promoting stress on Ethereum was excessive within the final week.

- Market indicators have been bullish on the token.

Ethereum [ETH] lastly gained bullish momentum at press time. If the newest knowledge is to be thought of, then ETH could be on the point of attain new highs by the top of this yr.

Let’s take a more in-depth have a look at what’s occurring.

Ethereum to breakout quickly

AMBCrypto’s have a look at CoinMarketCap’s data revealed that ETH’s value elevated by over 2% within the final seven days. Within the final 24 hours alone, the token’s value surged by greater than 3%.

On the time of writing, ETH was buying and selling at $3,488.88 with a market capitalization of over $419 billion. Because of the latest value enhance, solely 10% of ETH traders have been at a loss, as per IntoTheBlock’s data.

Issues can get even higher for the token as a bullish sample appeared on ETH’s chart. World of Charts, a preferred crypto analyst, lately posted a tweet highlighting a bullish falling wedge sample.

ETH’s value began to consolidate contained in the sample in Could, and at press time, it was on the verge of a breakout.

It was fascinating to notice that ETH obtained rejected from the higher restrict of the sample a number of occasions earlier. Nonetheless, World of Charts talked about that there have been nonetheless probabilities of a breakout.

If that really occurs, then traders would possibly witness the token touching new highs by the top of this yr.

Supply: X

What’s there within the brief time period?

AMBCrypto then deliberate to take a more in-depth have a look at ETH’s metrics to higher perceive what to anticipate within the brief time period. We discovered that promoting stress on the token elevated.

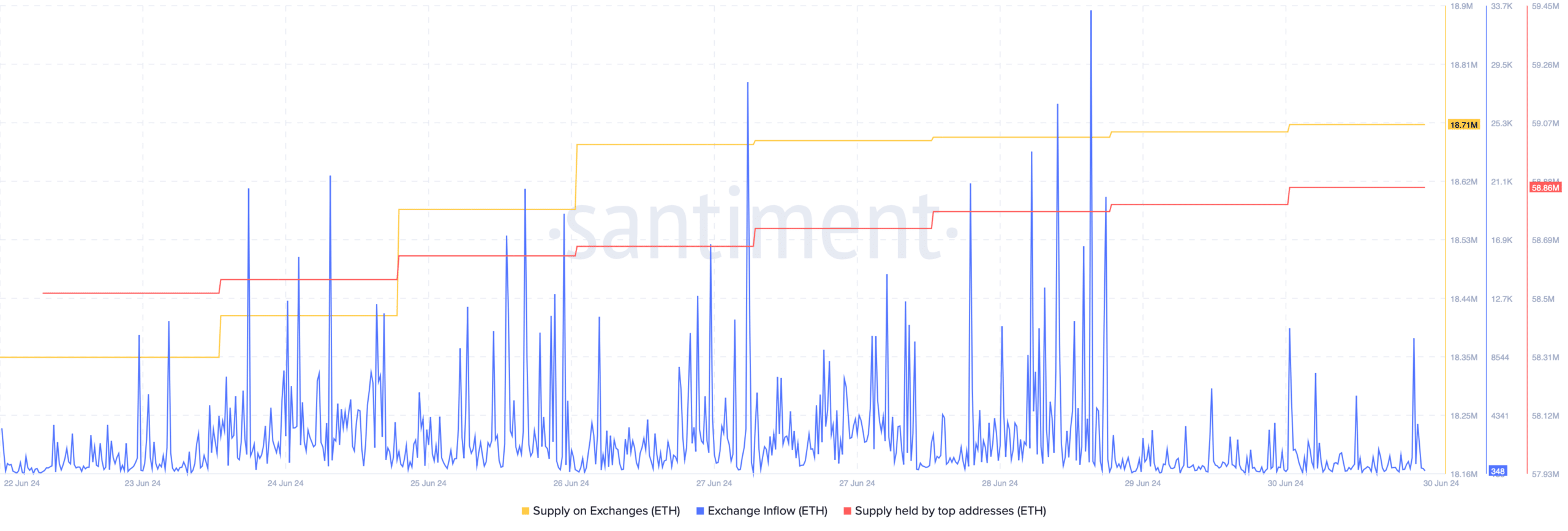

As per our evaluation of Santiment’s knowledge, Ethereum’s Change Influx spiked final week. Its Provide on Exchanges additionally elevated, that means that traders have been promoting the token.

Whales remained assured within the token, as ETH’s provide held by prime addresses elevated.

Supply: Santiment

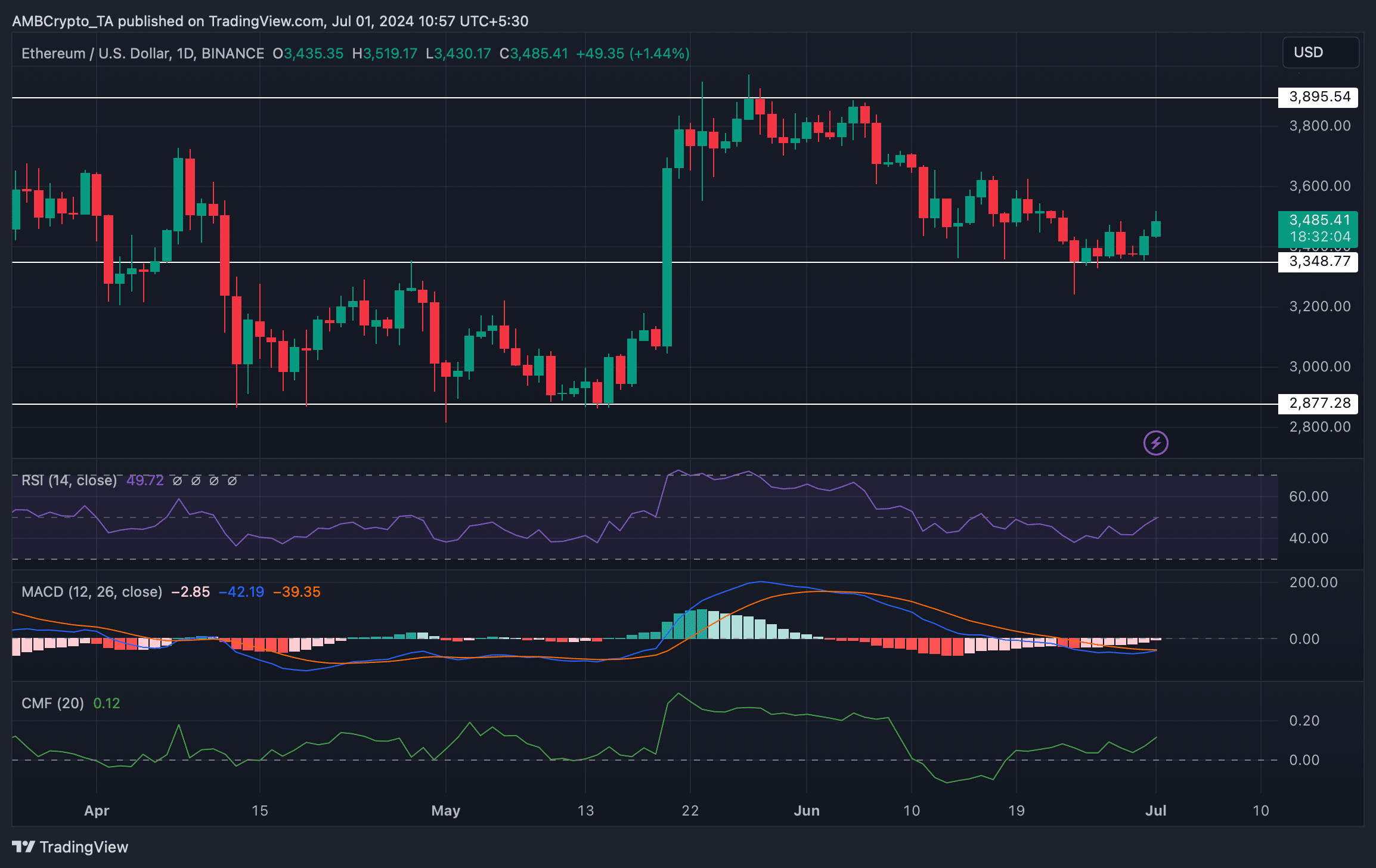

A number of different market indicators additionally regarded optimistic. As an example, the MACD displayed the potential for a bullish crossover.

The Relative Energy Index (RSI) additionally registered an uptick and was headed in direction of the impartial mark at press time.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

Furthermore, the Chaikin Cash Circulation (CMF) adopted an analogous growing pattern, indicating that the probabilities of a value uptick have been excessive.

If that occurs, then traders would possibly witness ETH touching $3,895 within the coming days. But when issues get bearish, then ETH would possibly drop to $2,877.

Supply: TradingView