Ethereum To Break $2,000? $12M Short Seller Nears Liquidation

The Ethereum worth has adopted Bitcoin’s lead and has seen a ten.3% worth enhance over the previous seven days. Information of BlackRock’s Bitcoin spot ETF submitting with the US Securities and Trade Fee took your entire market without warning and likewise breathed new life into altcoins. For one dealer on the decentralized perpetual change GMX, nevertheless, the information isn’t actually excellent news, however reasonably a nightmare.

Ethereum Brief Vendor Getting Rekt?

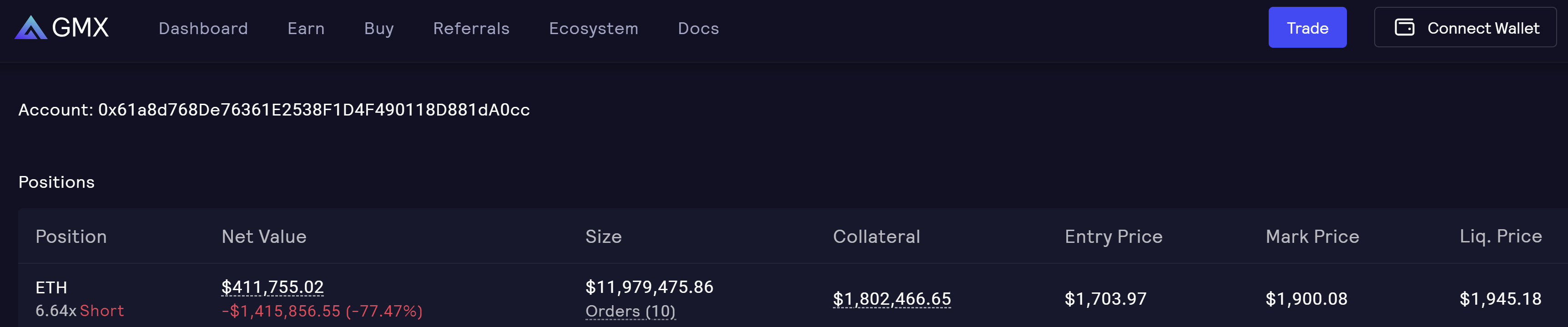

The biggest quick vendor on GMX is utilizing 6.64x leverage to quick Ether (ETH) at an entry worth of $1,703.97. A complete of $1.8 million of collateral is at stake for the nameless dealer. At press time, the place was down 77.4% for a complete of -$1.416 million.

Because it stands, the dealer’s quick place of about $12 million in ETH will probably be liquidated when the Ethereum worth reaches $1,945.18. In accordance with a report from Chinese language journalist Colin Wu, it may very well be the proprietor of rebelvarma.lens.

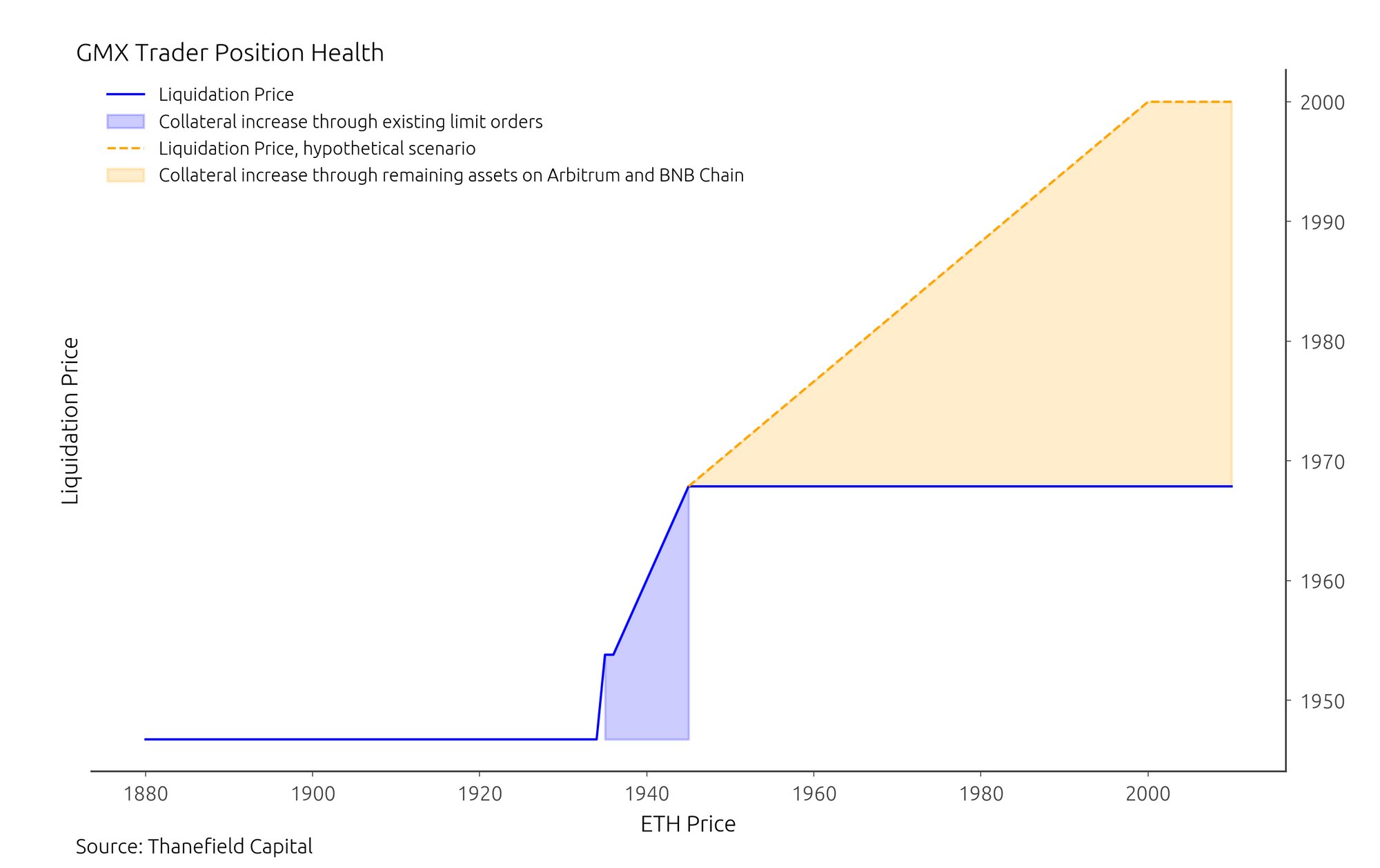

As fashionable analyst An Ape’s Prologue speculates, the ETH quick vendor might even double down on his guess. Because the analyst writes, the consensus assumes that the quick place will probably be liquidated when ETH reaches $1945. Nonetheless, there are restrict orders that might add a complete of $149,000 to the dealer’s collateral inside the $1935 and $1945 worth vary. If triggered, this might enhance the liquidation worth to round $1967.

The analyst’s chart beneath exhibits how his liquidation worth adjustments with ETH worth swings. Till Ethereum reaches $1935, the liquidation worth stays at $1945, however restrict orders are triggered when ETH enters the $1935 and $1945 vary, rising the liquidation worth to $1967.

As well as, the analyst notes that the deal with holds about $224,000 price of different property unfold throughout Arbitrum and the Binance Sensible Chain: $90,000 in USDT, $51,000 in USDC, $64,000 in WBTC and $21,500 in AAVE.

“With a historical past of mitigating liquidation danger by bridging tokens from different chains to Arbitrum for collateral, we’ll most likely see the same technique if ETH costs enhance. The $224k in obtainable property may very well be used to high up collateral on this situation,” the analyst notes.

If the ETH quick vendor makes use of up all of its property and places them up as collateral, the utmost liquidation worth might rise to round $2,000, representing an additional 6.5% worth enhance from the present worth. Therefore, Twitter consumer @apes_prologue concludes:

Whereas his place seems dangerous, the hazard of liquidation isn’t as imminent as popularly believed, as he has mechanisms at his disposal to guard his place. Moreover, it’s also potential he might have hedged his place in different markets that we’re unaware of.

ETH On The Verge Of Breaking Above $2,000?

Rumors are circulating within the crypto neighborhood that the liquidation of the GMX short-seller might set off a breakout of ETH above $2,000. The 1-hour chart of Ether exhibits that the worth is at the moment caught within the worth vary between $1,964 and $1,930 for the second. A breakout to the upside or draw back may very well be decisive for the subsequent transfer.

A take a look at the 1-day chart reveals {that a} breakout above $1,930 doesn’t essentially imply a follow-through to above $2,000. The 78.6% Fibonacci retracement degree is at $1,975, the place main resistance is anticipated. Ethereum bulls can solely goal the psychologically vital $2,000 degree in the event that they get away above this worth degree.

Featured picture from iStock, chart from TradingView.com