Ethereum to recover? Key signals indicate a surge in network activity!

- TVL and stablecoin market cap inflows point out a confidence uptick.

- Ethereum might be on the verge of a DeFi revival after weeks of declining demand.

The Ethereum [ETH] community demonstrated a noteworthy decline in community exercise over the previous few months. An final result that was a mirrored image of the state of DeFi in an atmosphere characterised by weak demand.

Ethereum has traditionally demonstrated sturdy community exercise and engagement in its DeFi ecosystem particularly throughout bullish market circumstances.

The market has up to now achieved a bullish efficiency week, with price reduce bulletins performing because the catalyst. Will this be sufficient to reignite curiosity in Ethereum’s DeFi panorama?

Up to now the Ethereum community has registered some wholesome exercise which will level in direction of restoration. The community’s stablecoin market cap would possibly provide some perspective of the scenario.

Ethereum’s stablecoin market cap (inexperienced) peaked at $82.154 billion in April and has been declining since then. It lately bottomed out at $78.20 billion in the beginning of August. It has since bounced again barely to its $83.84 billion degree on the time of commentary.

Supply: DeFiLlama

The Ethereum TVL (blue) additionally dipped significantly since its $66.91 billion native peak in June, to sub $43 billion lows. Nonetheless, it has since recovered to $47.79 billion. This latest restoration could point out the return of confidence within the Ethereum community.

Is Ethereum out of the woods but?

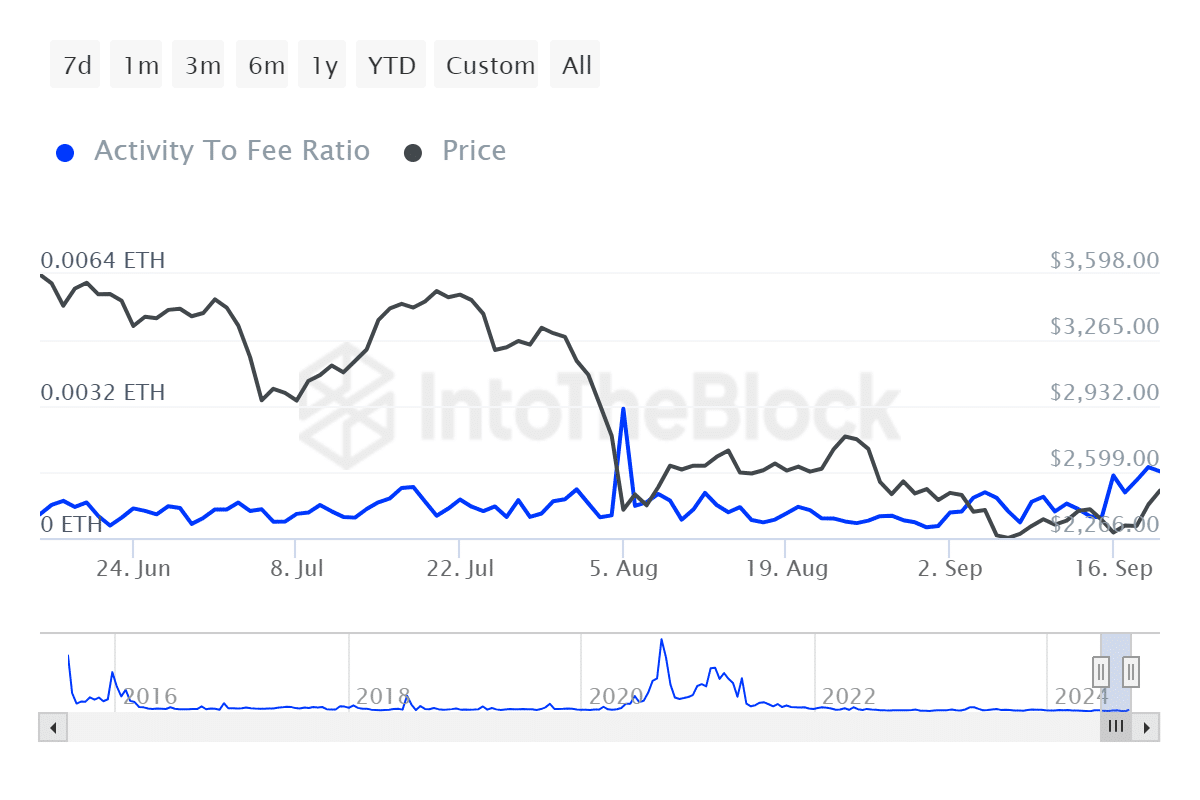

Ethereum registered a notable spike in its community to payment ratio since mid-September. That is the second highest uptick within the metric that we’ve noticed within the final 3 months. It confirms rising charges because of charges generated by extra community exercise.

Supply: IntoTheBlock

This surge demonstrated correlation ETH’s latest bullish value motion and was according to improved sentiment within the crypto market. It might thus not be a really perfect illustration of Ethereum’s DeFi ecosystem’s efficiency.

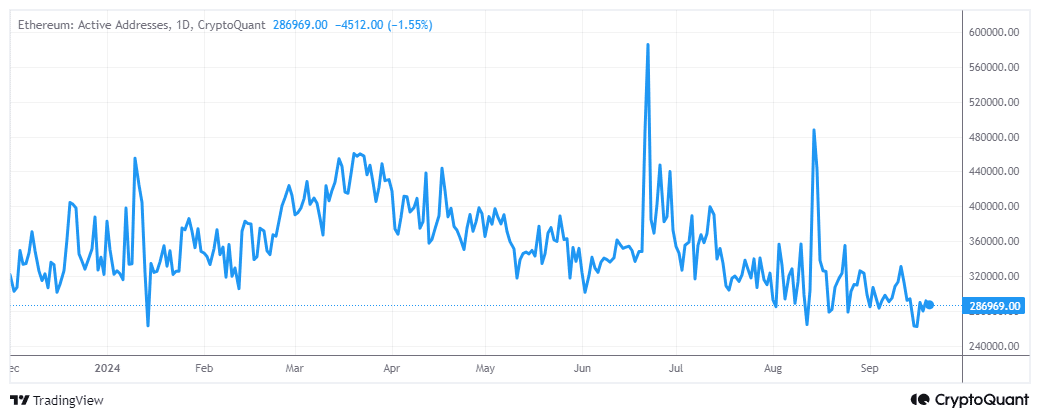

Whereas the above findings underscore some enchancment within the Ethereum ecosystem, there are nonetheless indicators of underperformance. For instance, the variety of lively Ethereum addresses was nonetheless near its YTD lows.

Supply: CryptoQuant

In different phrases, the community hype was nonetheless low regardless of the latest enhance in exercise. This will likely have a adverse affect on ETH value motion. For instance, whale and institutional sentiment was bearish based on latest observations.

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

The evaluation means that the latest ETH uptick was primarily fueled by retail demand. It might additionally point out the likelihood that the latest value uptick is likely to be short-lived particularly if good cash stays bearish for longer.

Additionally, it could take weeks or months for sturdy liquidity to circulate again into the crypto market.