Ethereum To Retest Lower Level Before Surging by 47% in Best-Case Scenario, Says Trader – But There’s a Catch

A carefully adopted crypto analyst says that Ethereum (ETH) will dip down to check its decrease boundary earlier than sparking a large rally to the upside.

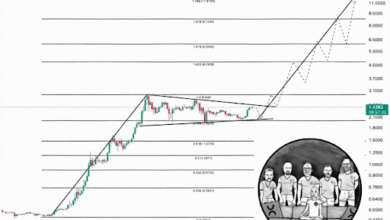

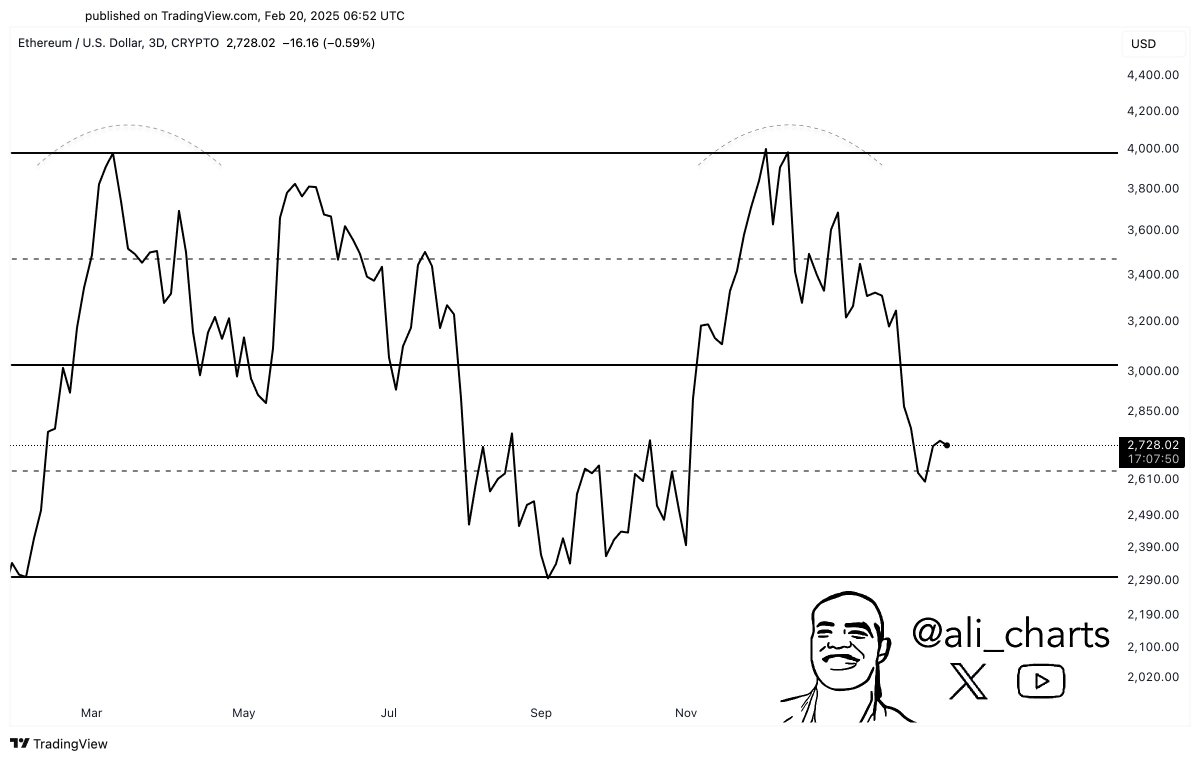

In a brand new technique session, crypto dealer Ali Martinez tells his 127,700 followers on the social media platform X that the second-largest digital asset’s best-case state of affairs has it testing the $2,300 stage as assist earlier than skyrocketing 47% previous $4,000.

Nonetheless, Martinez notes that the main sensible contract platform by quantity’s worst-case state of affairs may have it forming a double-top sample, a bear flag that usually alerts the top of a bull market.

“Within the best-case state of affairs, Ethereum is range-bound, that means it may take a look at $2,300 assist earlier than rebounding towards $4,000. Nonetheless, within the worst-case state of affairs, this could possibly be shaping up as a double-top sample.”

Martinez goes on to warn merchants that altcoin season could possibly be canceled this time round if Ethereum fails to keep up the $2,600 stage. Nonetheless, he notes that whale exercise centered across the high altcoin has risen.

The dealer concludes his evaluation by saying that if Ethereum had been to lose the $2,600 price ticket as assist, it may crash all the way in which again all the way down to someplace between $1,700 and $2,000.

“Ethereum is at present consolidating in a parallel channel… At present, Ethereum is sitting within the decrease assist pattern line, which isn’t good. Primarily, dropping this stage at $2,600 as assist may result in steep correction to $2,000 and even $1,700, which is why nobody is shopping for Ethereum proper now.”

Ethereum is buying and selling for $2,720 at time of writing, a fractional enhance over the past 24 hours.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Worth Motion

Comply with us on X, Facebook and Telegram

Surf The Each day Hodl Combine

Featured Picture: Shutterstock/Katynn/monkographic