Ethereum: Top reasons why ETH to $5K in 2024 is certain

- ETH would possibly face delicate resistance however a climb to $5,000 seemed nearly sure.

- Rising confidence within the altcoin strengthened the bullish prediction.

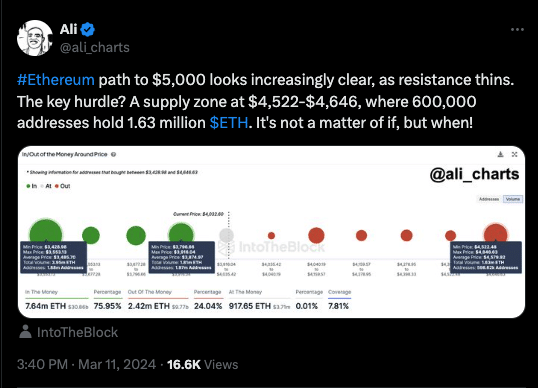

The worth of Ethereum [ETH] would possibly quickly hit $5,000, in keeping with analyst Ali Martinez. However the altcoin has to interrupt via the provision wall between $4,522 and $4,646.

A provide zone is a cumulation of purchase orders. On this occasion, the intention is to create a barrier that stops the worth from taking place. Martinez, who used IntoTheBlock’s information, famous that 600,000 addresses purchased 1.63 million ETH round that area.

Supply: X

The season is already right here

Subsequently, the trail was now a resistance for the cryptocurrency as a number of the consumers would possibly attempt to breakeven. Whereas this would possibly decelerate Ethereum’s bullish strides, the climb to $5,000 seemed nearly sure.

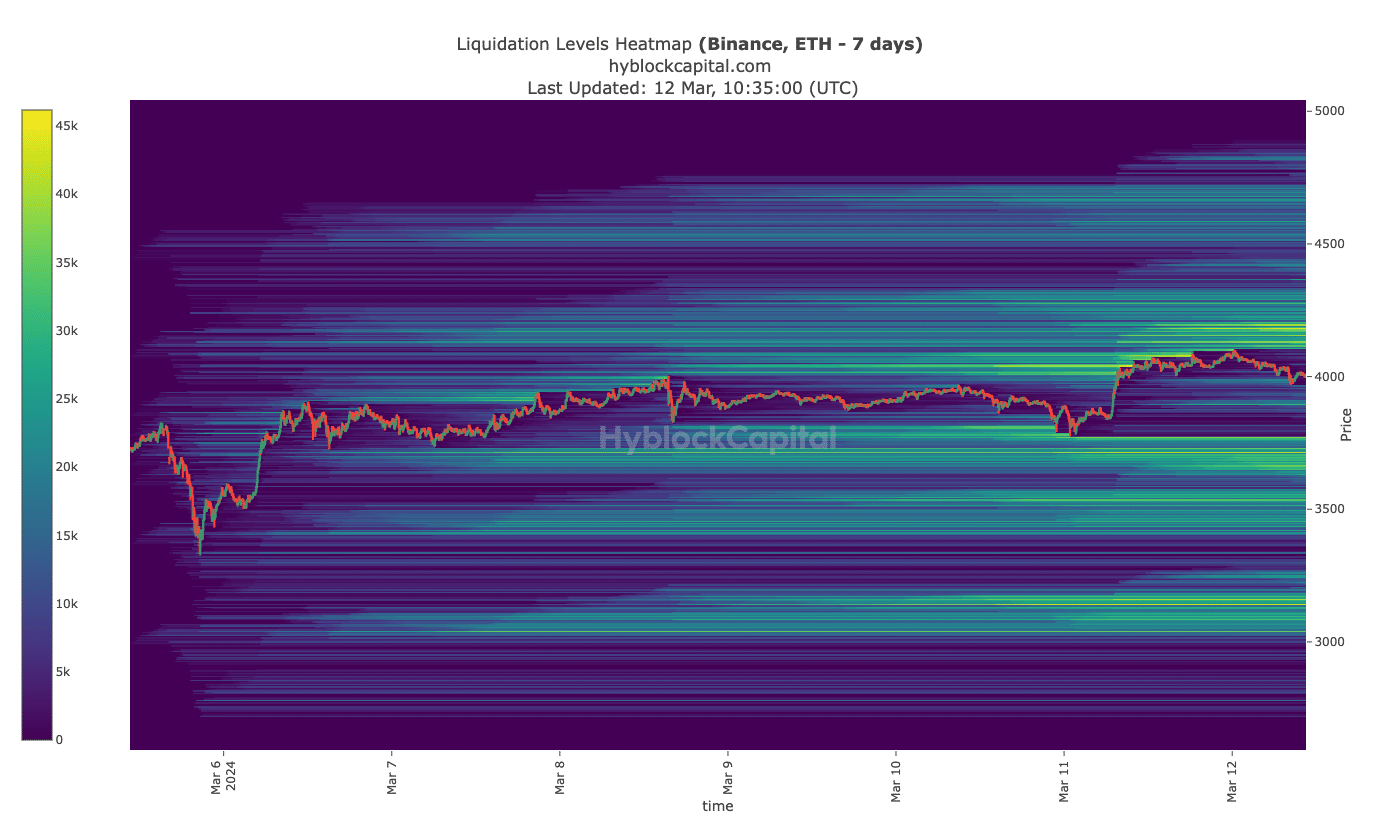

AMBCrypto got here to this conclusion after analyzing the Liquidation Heatmap. In easy phrases, the Liquidation Heatmap predicts value ranges the place large-scale liquidations would possibly happen.

For the unfamiliar, liquidation happens when a dealer’s place is forcefully closed on account of value fluctuations. It may additionally occur on account of inadequate margin steadiness to cowl the funding payment.

From our evaluation of HyblockCapital’s information, giant scale liquidations would possibly happen if ETH hit $4,205. Nonetheless, a profitable shut above this value may see the worth climb increased.

Supply: HyblockCapital

As an example, the chart under confirmed that the altcoin won’t face any main resistance under $4,310. Moreover, if ETH rises previous 4,860, the run to $5,000 may turn out to be very straightforward.

Bearish aggression is gas for ETH’s rally

One other metric AMBCrypto assessed to test the probability of a rally was the Funding Charge. The Funding Charge is the distinction between the worth of a perpetual contract and the spot value of a cryptocurrency.

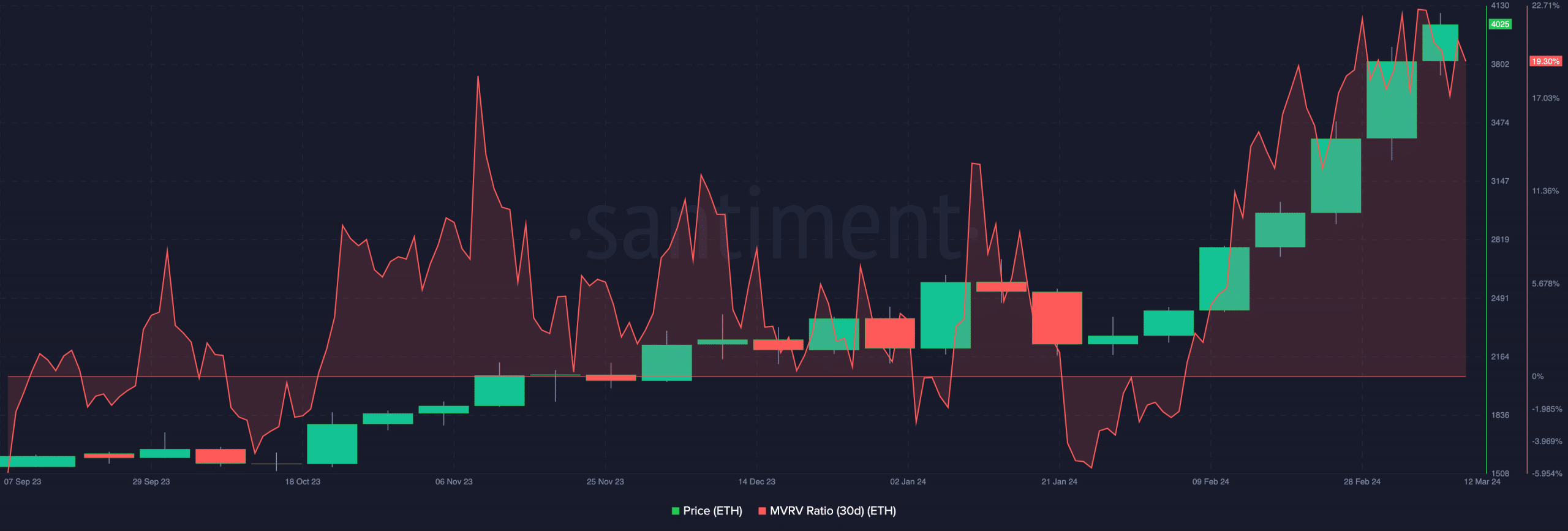

In keeping with Santiment’s information, Ethereum’s aggregated Funding Charge was 0.068%. The optimistic Funding Charge implied that ETH was buying and selling at a premium perp value above the index worth.

The excessive studying of the metric alongside the rising ETH value means that brief are aggressive. Sadly, their aggression shouldn’t be being rewarded. Subsequently, ETH’s value motion is doubtlessly bullish.

Past the happenings within the derivatives market, we additionally checked out the energetic addresses. At press time, the variety of energetic addresses on the Ethereum community was 537,000. This was a big improve from what the quantity was on the tenth of March.

The rise in energetic addresses point out growing interest and confidence in ETH. Whereas it additionally signifies that the community has gotten more healthy, merchants may also view it as bullish sign.

Supply: Santiment

Learn Ethereum’s [ETH] Worth Prediction 2024-2025

In conclusion, a mix of the metric evaluated aligned with a value improve. Nonetheless, ETH would possibly expertise some pullback because it targets a brand new all-time excessive.

However indicators confirmed that potential retracement won’t final lengthy.