Ethereum tracks 2016 pattern: Will Q4 bring a price decline for ETH?

- Ethereum is repeating 2016 sample.

- Geopolitical tensions impression the broader crypto market.

Ethereum [ETH] continues to current combined indicators because the fourth quarter (This fall) of the yr begins. Traditionally, a bullish shut in September has typically led to optimistic market actions, however Ethereum appears to be following a unique trajectory.

ETH closed inexperienced in September, intently monitoring its 2016 sample, which may point out a possible crimson This fall. If this sample continues, This fall would possibly see a decline, adopted by a restoration within the first quarter (Q1) of 2025.

Ethereum’s value dynamics are intriguing, with its historic efficiency value monitoring to see if it deviates from earlier traits.

Supply: X

Whales taking revenue and unstaking

Ethereum’s present value conduct mirrors its 2016 sample, suggesting a attainable bearish flip in This fall. This expectation is bolstered by massive traders, or “whales,” who’re unstaking their ETH and securing income.

Lately, a whale unstaked 29,480 ETH, transferring it to Coinbase for a revenue exceeding $2 million.

Supply: Onchain Lens

This type of conduct typically indicators that large gamers anticipate a downturn, growing the probability of a crimson This fall for Ethereum. These actions add strain on ETH’s value, with traders watching intently for potential declines.

ETH ETF move and market actions

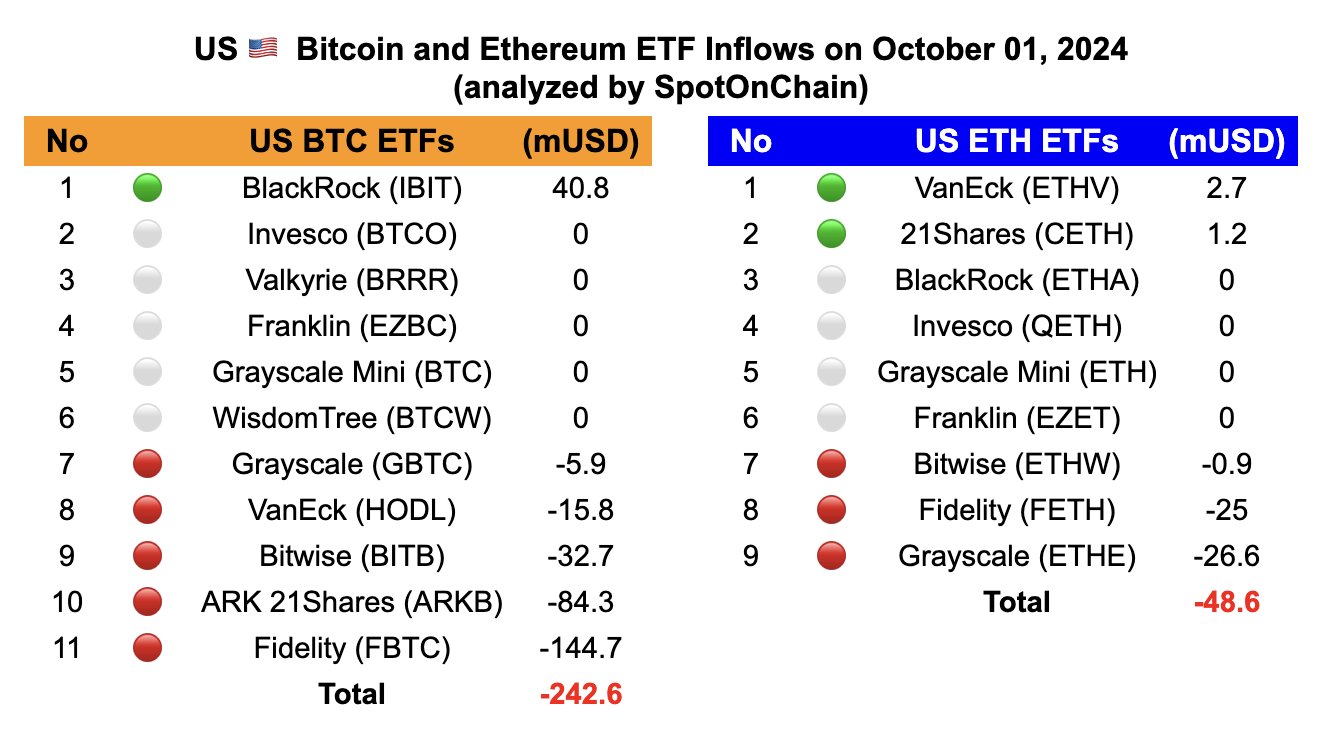

Ethereum has additionally skilled important outflows from its exchange-traded funds (ETFs), additional contributing to a cautious outlook. Since September 3, the market has seen its largest internet outflows for each Bitcoin (BTC) and Ethereum ETFs.

ETH ETFs skilled outflows of $48.6 million, with main gamers like Grayscale and Constancy witnessing massive withdrawals. Though some smaller ETFs noticed inflows, they had been inadequate to offset the broader development.

Supply: SpotOnChain

This implies that institutional traders could also be positioning for a possible decline in Ethereum’s value in This fall, in step with the broader market sentiment.

Geopolitical tensions impacting costs

The continuing battle within the Center East has additionally affected the broader crypto market, together with Ethereum. Each BTC and ETH skilled sharp declines, with ETH dropping beneath $2,500.

Up to now 24 hours alone, 155,000 accounts had been liquidated, amounting to $533 million, of which $451 million got here from lengthy orders.

These liquidations, particularly in ETH, add additional proof to the likelihood that Ethereum could comply with its 2016 sample of a crimson This fall.

Supply: Coinglass

The mix of whale conduct, ETF outflows, and geopolitical tensions means that Ethereum could face challenges in This fall.

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

Whereas ETH’s value has proven power, historic patterns and present market circumstances point out that it would expertise a decline earlier than doubtlessly recovering in early 2025.

Buyers ought to stay cautious and monitor these developments intently, as any deviation from the sample may current each dangers and alternatives for ETH within the months forward.