Ethereum Traders Pivot to Extreme Bullish Amid Renewed Whale Demand; Is ETH Price Rebound Next?

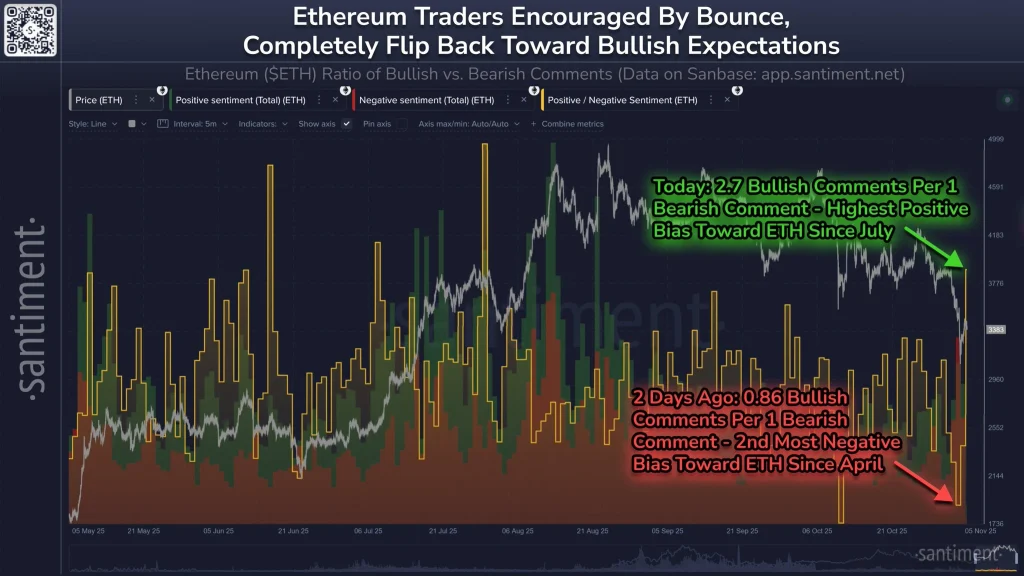

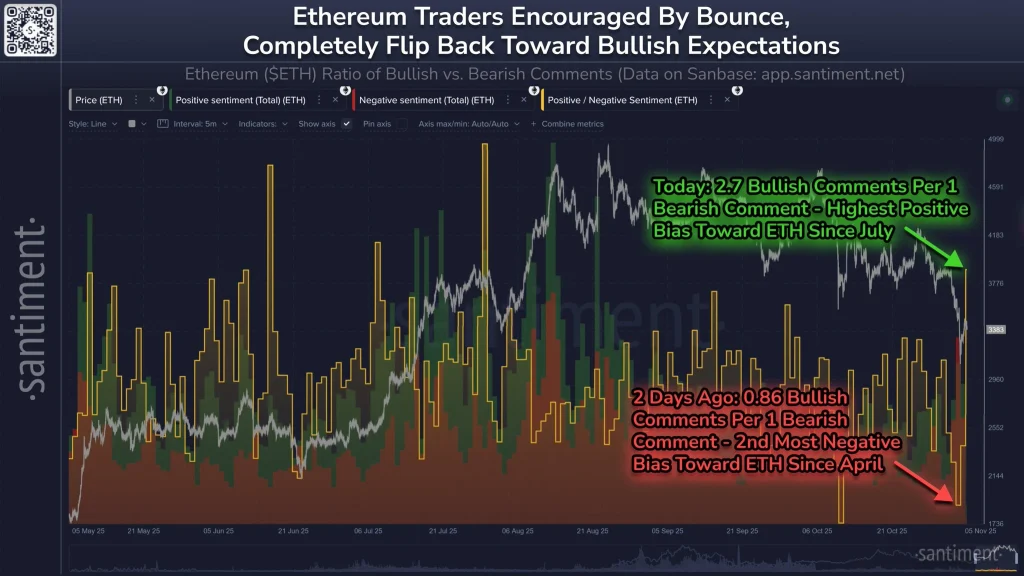

Ethereum (ETH) merchants have shortly pivoted to excessive bullishness after the latest crypto market crash. Based on market information evaluation from Santiment, Ethereum merchants have been anticipating a powerful rebound within the coming days following a sequence of deleveraging.

Supply: Santiment

Nevertheless, Santiment cautioned Ethereum merchants for turning extraordinarily bullish as historical past has confirmed that the market typically strikes in the other way of the group’s expectations.

Why are Ethereum Merchants Getting Extraordinarily Bullish?

Renewed Demand from Whale Traders amid Supportive Macro Backdrop

Ethereum merchants have turned extraordinarily bullish within the latest previous following the notable deleveraging and renewed demand from whale buyers. As an example, on-chain data analysis shows Tom Lee-led BitMine has been shopping for the latest market dip, whereby it withdrew ETH valued at about $70 million on Thursday.

The Ethereum merchants have been anticipating a bullish rebound as Wall Road regularly turns to altcoins. Forward of the anticipated Fed’s Quantitative Easing (QE), institutional buyers have been constructing on Ethereum by way of Digital Property Treasuries (DATs), spot Change-Traded Funds (ETF), and tokenization of real-world belongings (RWA).

Technical Tailwind forward of the anticipated altseason 2025

From a technical evaluation standpoint, ETH worth has been retesting a vital help degree, which beforehand acted as a resistance degree for lengthy.

Supply: X

With the ETH’s day by day Relative Power Index (RSI) hovering round oversold ranges, a possible rebound in direction of a brand new all-time excessive is very probably. Nevertheless, if Ether worth constantly dips under the help degree above $3000, a full-blown bear market will probably be inevitable within the subsequent months.

Belief with CoinPedia:

CoinPedia has been delivering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict Editorial Tips primarily based on E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness). Each article is fact-checked in opposition to respected sources to make sure accuracy, transparency, and reliability. Our evaluate coverage ensures unbiased evaluations when recommending exchanges, platforms, or instruments. We try to supply well timed updates about all the pieces crypto & blockchain, proper from startups to trade majors.

Funding Disclaimer:

All opinions and insights shared characterize the creator’s personal views on present market situations. Please do your personal analysis earlier than making funding choices. Neither the author nor the publication assumes duty in your monetary selections.

Sponsored and Commercials:

Sponsored content material and affiliate hyperlinks could seem on our website. Commercials are marked clearly, and our editorial content material stays fully impartial from our advert companions.