Ethereum transactions surge to $60B in a week, highest since July

- Ethereum’s weekly transaction quantity hits $60 billion as exercise surges throughout its community.

- 78% of Ethereum holders stay in revenue amid rising utilization and bullish on-chain indicators.

Ethereum’s [ETH] mainnet noticed a pointy improve in exercise, with almost $60 billion value of ETH settled prior to now week. This marks the best weekly transaction quantity since July, indicating rising demand for the community.

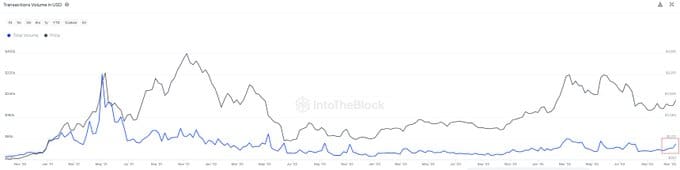

Knowledge from IntoTheBlock shows a gradual restoration in transaction quantity since mid-2022, when market exercise slowed. Regardless of Ethereum’s value being under its all-time highs, the community continues to draw important exercise.

Worth and quantity dynamics

Ethereum’s value and transaction quantity have traditionally moved in tandem. Throughout late 2021 and early 2022, each metrics peaked amid elevated speculative exercise. Nevertheless, each declined in mid-2022 because the market entered a bearish section.

Supply: IntoTheBlock

At press time, Ethereum traded at $3,178.93, with a 24-hour buying and selling quantity of $48.48 billion. Whereas the asset noticed a slight 0.70% decline prior to now 24 hours, it has gained 28.92% over the previous week.

The current surge in transaction quantity indicators rising utilization regardless of value fluctuations.

Key on-chain metrics

DefiLlama knowledge shows Ethereum’s Whole Worth Locked (TVL) at $59.327 billion. Stablecoins on the community have a mixed market cap of $89.517 billion.

Within the final 24 hours, Ethereum processed $2.387 billion in transaction quantity and recorded $72.74 million in inflows.

Energetic addresses prior to now day totaled 391,248, whereas 64,793 new addresses have been created. The community additionally recorded 1.23 million transactions.

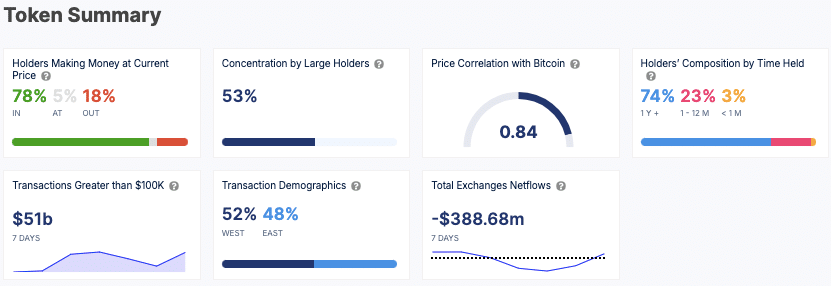

Excessive-value transactions exceeding $100,000 accounted for $51 billion in exercise over the previous week, suggesting sturdy participation from massive traders.

Holder composition and market indicators

Ethereum’s profitability stays sturdy, with 78% of holders presently in revenue. Massive holders management 53% of the token provide, indicating a excessive focus of wealth.

The token additionally has a robust correlation of 0.84 with Bitcoin, exhibiting that its value actions carefully comply with the broader crypto market.

Supply: IntoTheBlock

The vast majority of Ethereum holders are long-term traders, with 74% holding their tokens for over a 12 months. Internet trade flows point out that $388.68 million in ETH was withdrawn from exchanges over the previous week, suggesting lowered promote strain as extra customers transfer property to personal wallets.

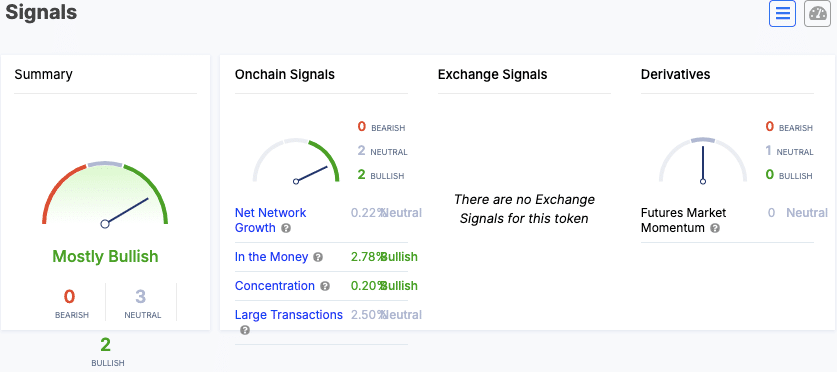

Market indicators are principally bullish, with indicators like “Within the Cash” and “Focus” exhibiting optimistic tendencies.

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

Internet Community Progress and Massive Transactions stay impartial, whereas futures market momentum additionally sits at a impartial degree.

Supply: IntoTheBlock

Ethereum’s rising transaction exercise and favorable on-chain metrics level to an energetic and engaged community.