Ethereum turns deflationary: What it means for ETH prices in 2025

- Ethereum to doubtlessly return to being deflationary subsequent 12 months.

- ETH/BTC has been experiencing some fluctuations.

The availability of Ethereum [ETH] has been rising steadily at round 60K ETH per thirty days for the final six months. Nevertheless, following the latest 50 foundation factors charge minimize, this development has slowed considerably to between 30K and 40K ETH per thirty days.

If this pattern continues, Ethereum’s provide may return to being deflationary by early 2025, earlier than it even reaches its pre-merge ranges. With extra charge cuts anticipated, the inflation charge may lower additional, setting the stage for future worth development.

Ethereum’s provide performs an important position in its market dynamics. Because the charge minimize, ETH’s inflation charge has dropped, which suggests the availability may attain pre-merge ranges in 2025.

Supply: X

This transition to deflation may drive elevated demand for ETH, particularly as financial insurance policies proceed to evolve.

As rates of interest drop, extra customers and traders could flip to Ethereum’s community, boosting general demand and doubtlessly pushing the value greater.

The lowered provide mixed with regular or rising demand may assist a long-term bullish outlook for Ethereum.

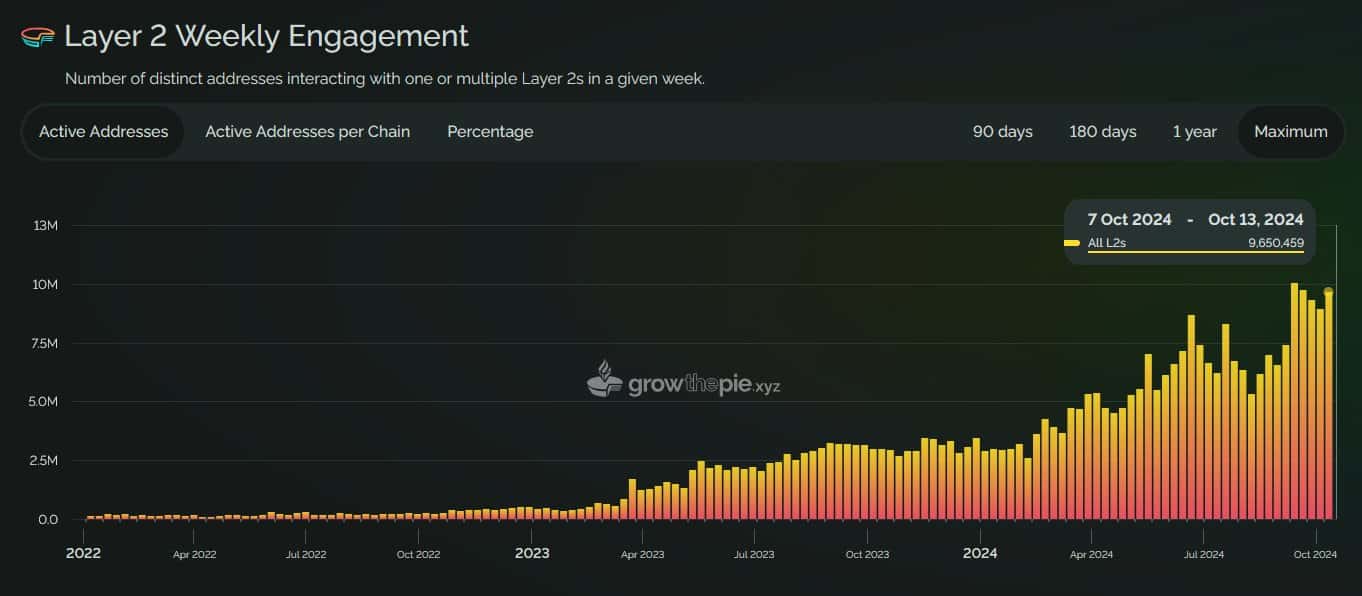

On high of provide adjustments, weekly energetic addresses on Ethereum’s Layer 2 networks are skyrocketing.

At present, these energetic addresses have reached round 9.65 million, with projections suggesting that this quantity may multiply by 10 within the subsequent few years as Web3 adoption grows.

Supply: growthepie.xyz

This surge in exercise on Layer 2 networks displays growing demand for quicker and cheaper transactions on Ethereum, serving to the community scale with out compromising decentralization.

Increased consumer exercise usually correlates with greater transaction charges, additional lowering the general ETH provide via burning mechanisms like EIP-1559.

Influence on ETH worth

The affect of those developments on ETH’s worth is critical. The present lowered inflation charge, mixed with elevated exercise on Layer 2s, strengthens the long-term worth outlook for Ethereum.

If the deflationary pattern continues into 2025, it may result in greater ETH costs, significantly as the availability decreases whereas demand stays excessive.

A run on the vary low into the FVG and presumably demand, for longs. Conversely, a sweep on vary excessive triggers shorts however an in depth above the vary would imply no commerce.

In the meantime, ETH/BTC has been experiencing some fluctuations. Ethereum has lagged behind Bitcoin in latest months, and lots of analysts consider that ETH/BTC may go decrease within the brief time period.

Supply: TradingView

The pair is at the moment buying and selling inside the 0.03-0.04 vary, and a backside could kind at 0.038 and even 0.036. Some even contemplate 0.03 because the worst-case situation, although it’s unlikely to fall that low.

Learn Ethereum [ETH] Worth Prediction 2024-2025

Nonetheless, whereas ETH/BTC could stay weak via the top of 2024, the long-term outlook for ETH/USD is stronger, with 2025 anticipated to deliver a rebound.

Regardless of short-term weak spot within the ETH/BTC pair, ETH’s fundamentals counsel that its worth may rise greater in 2025, making it a stable long-term guess for traders.