Ethereum – Up by 3% after 12% drop, what next for ETH’s price?

- Whereas ETH’s value dropped, whales deposited tokens price hundreds of thousands of {dollars}

- Few metrics and indicators recommended that ETH was undervalued

Because the crypto market witnessed a crash final week, the king of altcoins, Ethereum [ETH], additionally fell sufferer to an enormous value correction. Due to the worth decline, many may need misplaced confidence within the token. Nonetheless, the pattern modified over the previous few hours as ETH’s each day chart quickly turned inexperienced.

Ethereum’s excessive volatility

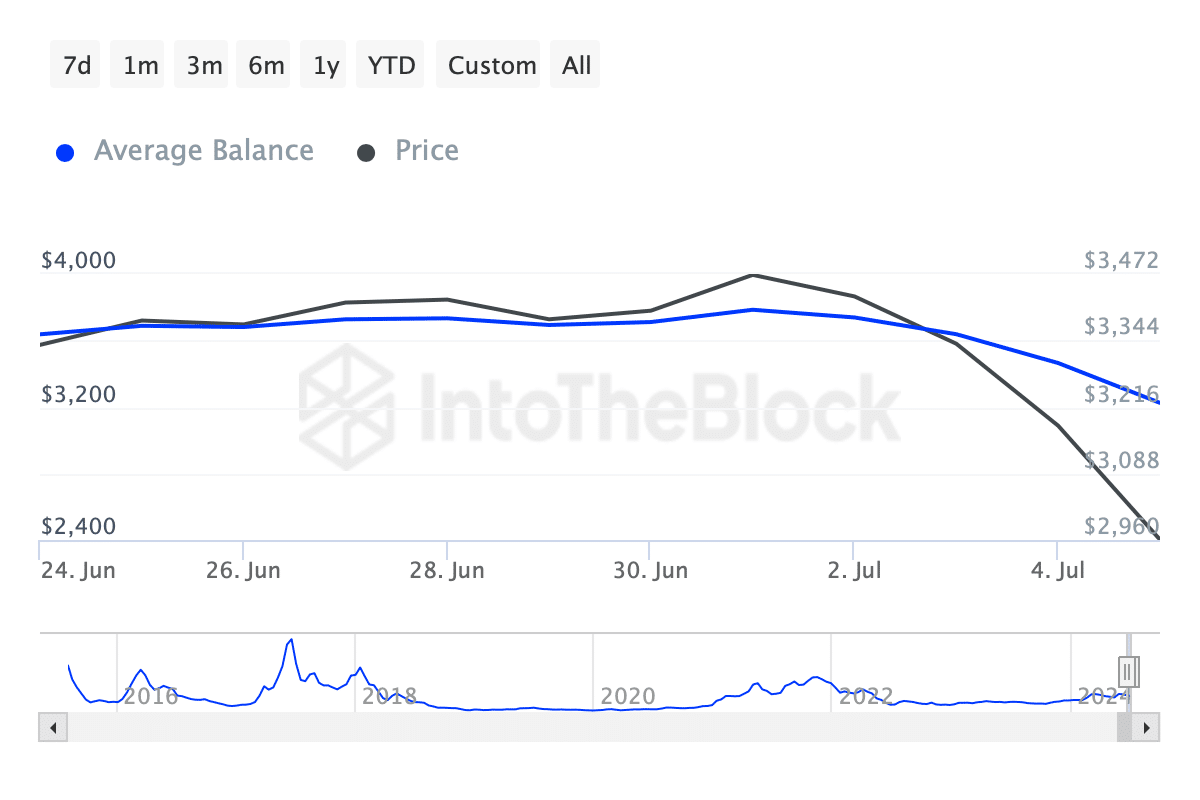

CoinMarketCap’s data revealed that ETH’s value had dropped by greater than 12% in simply seven days. AMBCrypto’s evaluation of IntoTheBlock’s knowledge additionally revealed that ETH’s common steadiness dropped, which may be attributed to the token’s double-digit value decline.

Supply: IntoTheBlock

Within the meantime, Lookonchain posted a tweet sharing an attention-grabbing growth. In keeping with the identical, a number of whales began to promote ETH as its worth fell. To be exact, three Ethereum whales deposited 28,558 ETH, price over $82.2 million, to Binance. Quickly after although, ETH’s value registered a pattern reversal on the charts.

Actually, the altcoin’s value has appreciated by practically 3% within the final 24 hours alone. On the time of writing, ETH was buying and selling at $2,967.81 with a market capitalization of over $356 billion.

Nonetheless, regardless of the rise in value, its buying and selling quantity dropped by double digits. This recommended that ETH won’t maintain its bullish momentum for lengthy.

Will ETH’s bull rally final?

Just like the buying and selling quantity, a couple of different metrics additionally seemed fairly bearish.

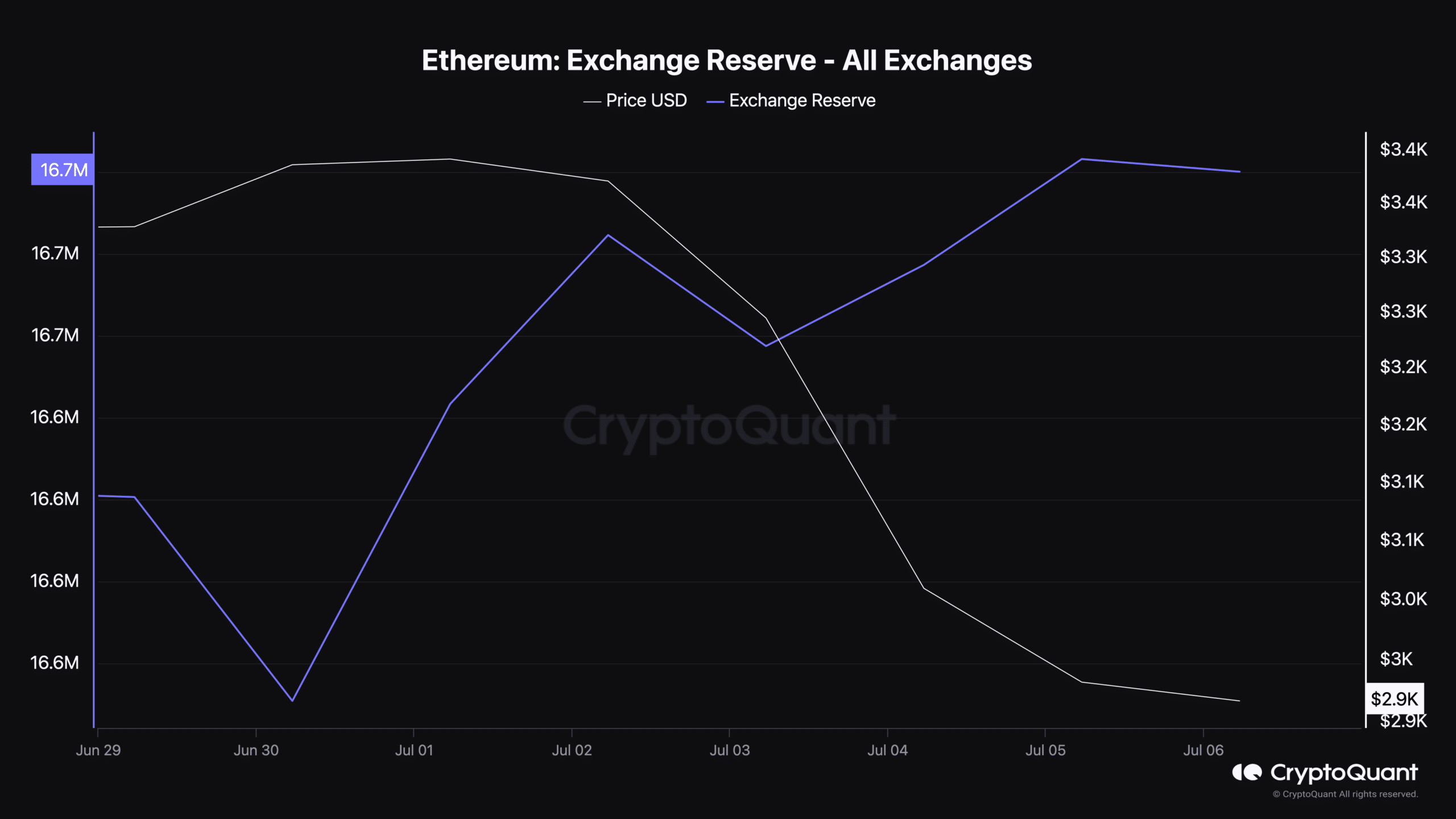

As an example, although ETH recorded a value hike, promoting strain on the token continued to stay excessive. This was evidenced by CryptoQuant’s knowledge, with the identical highlighting an increase in ETH’s alternate reserves. Merely put, a number of traders selected to promote.

Supply: CryptoQuant

Nonetheless, different metrics supported the opportunity of a sustained uptrend as properly.

For instance – ETH’s funding fee has been rising, that means that long-position merchants have been dominant and could also be prepared to pay short-position merchants. Its Relative Energy Index (RSI), as per CryptoQuant, was within the oversold zone too. This may assist enhance shopping for strain within the coming days, which could in flip end in a value hike on the charts.

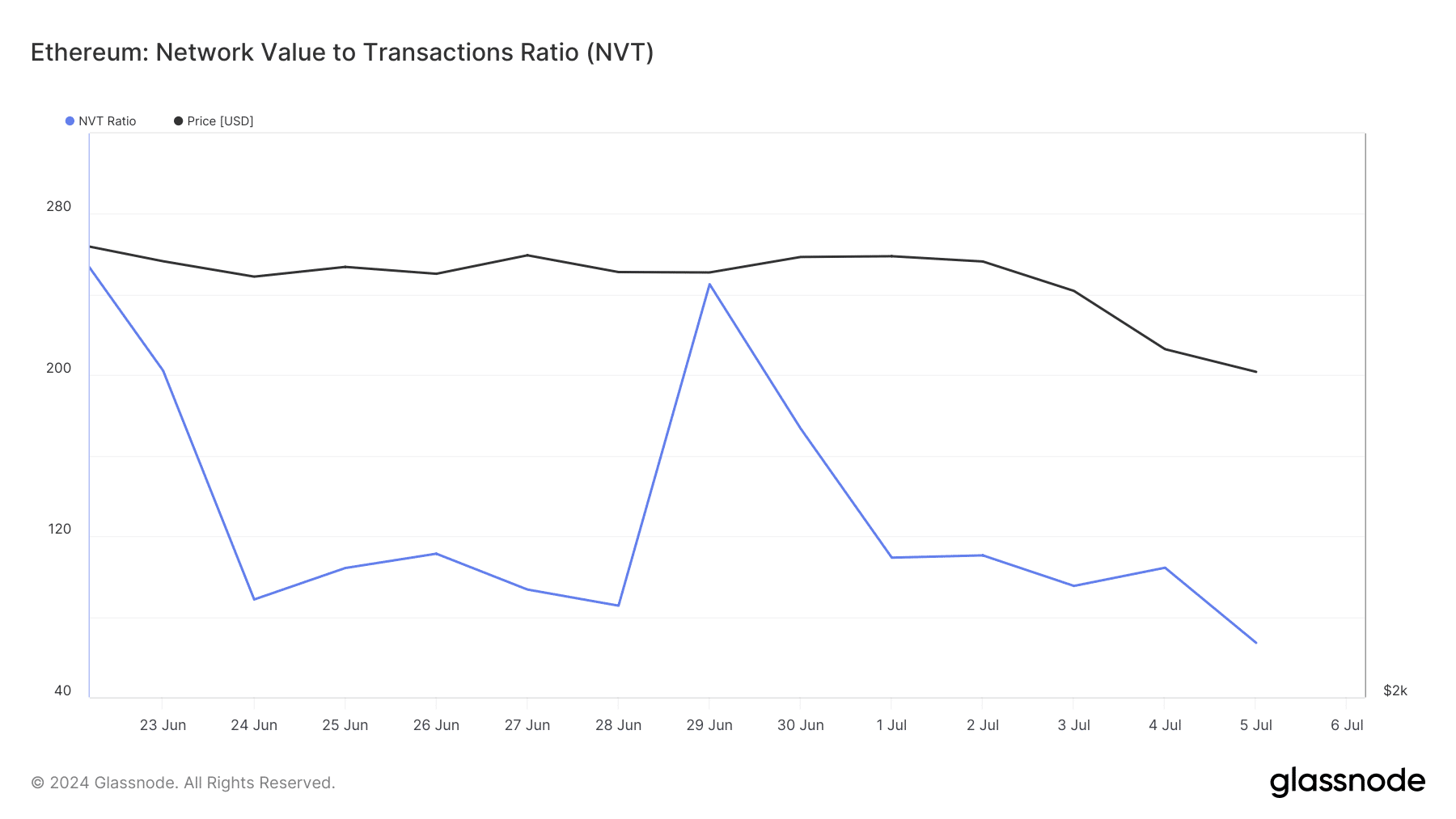

On high of that, AMBCrypto’s evaluation of Glassnode’s knowledge revealed that EThereum’s NVT ratio dropped sharply. A fall on this metric implies that an asset is undervalued, which is mostly adopted by value hikes.

Supply: Glassnode

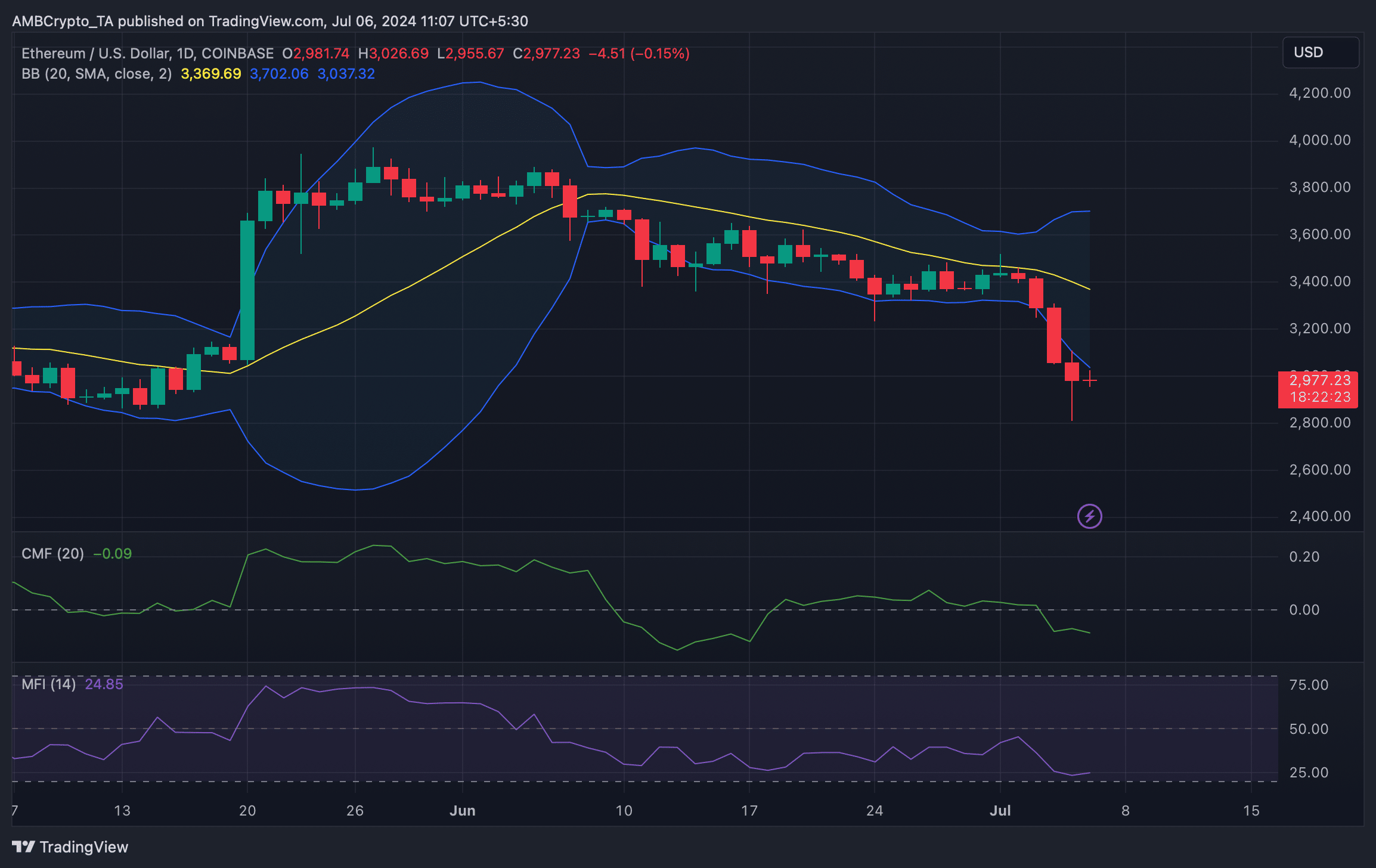

We then deliberate to take a look at ETH’s each day chart to raised perceive what to anticipate. We discovered that ETH’s value touched the decrease restrict of the Bollinger Bands – Underlining the probabilities of a rebound.

Learn Ethereum’s [ETH] Value Prediction 2024-25

Moreover, its Cash Circulate Index (MFI) was additionally about to enter the oversold zone.

Nonetheless, the Chaikin Cash Circulate (CMF) seemed bearish, as at press time it had a worth of -0.09.

Supply: TradingView