Ethereum vs. Bitcoin: How a key metric points to ETH as the winner

- Ethereum’s value elevated by practically 3% within the final seven days.

- Promoting stress on ETH continued to stay excessive.

Whereas most cryptos’ costs had been declining, Ethereum [ETH] decoupled from the market because it went the opposite approach. In truth, the king of altcoins was outshining Bitcoin [BTC] on a key entrance, which hinted at a bull rally within the coming days.

Ethereum beats Bitcoin

CoinMarketCap’s data revealed that ETH bulls stepped up their recreation over the past seven days because the token’s value elevated. The token’s day by day chart additionally remained inexperienced because it moved up marginally.

On the time of writing, ETH was buying and selling at $3,575.26 with a market capitalization of over $437 billion.

Whereas that occurred, Ki Younger Ju, a preferred crypto analyst, lately posted a tweet declaring an fascinating improvement.

As per the tweet, ETH’s MVRV ratio was rising, suggesting that ETH’s market was heating up relative to its on-chain fundamentals.

In truth, ETH managed to outperform Bitcoin by way of MVRV ratio progress charge. The tweet additionally talked about that, given the present ETF scenario, this is likely to be an ETH-only season.

It was additionally fascinating to notice that traditionally, when ETH surges, different alts are likely to observe.

Is ETH prepared for a bull rally?

For the reason that aforementioned dataset instructed that the possibilities of ETH showcasing a bullish efficiency had been excessive, AMBCrypto deliberate to verify its on-chain metrics.

As per our evaluation of CryptoQuant’s data, ETH’s internet deposit on exchanges was excessive in comparison with the final seven days’ common, which means that promoting stress was excessive.

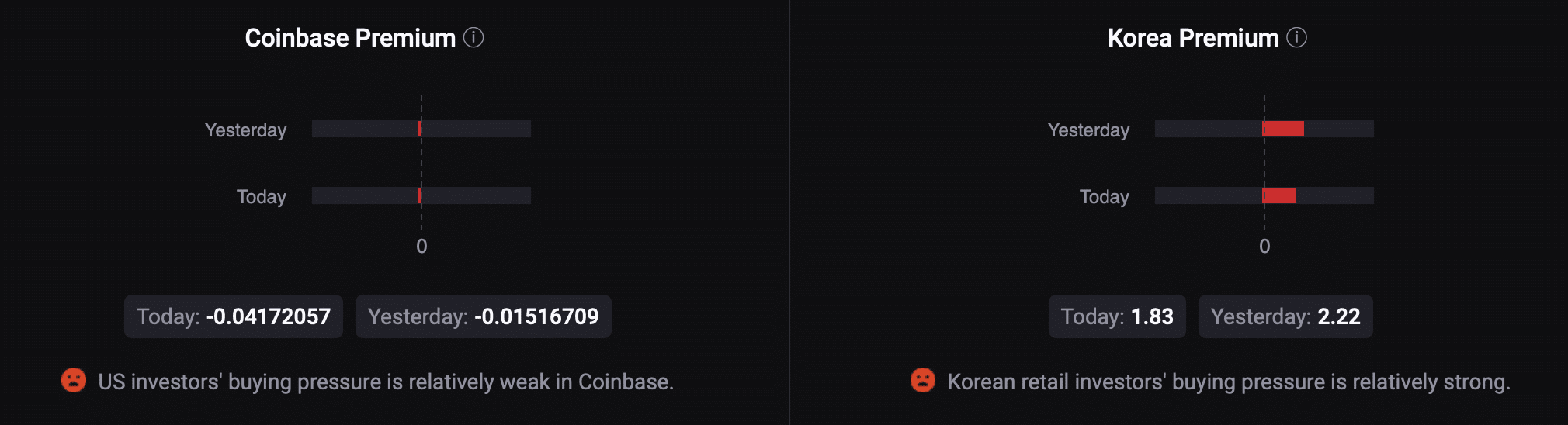

Moreover, its Coinbase premium was crimson, indicating that promoting sentiment was dominant amongst US traders. Nonetheless, the Korea premium appeared optimistic because it indicated that Korean traders had been keen to purchase ETH.

Supply: CryptoQuant

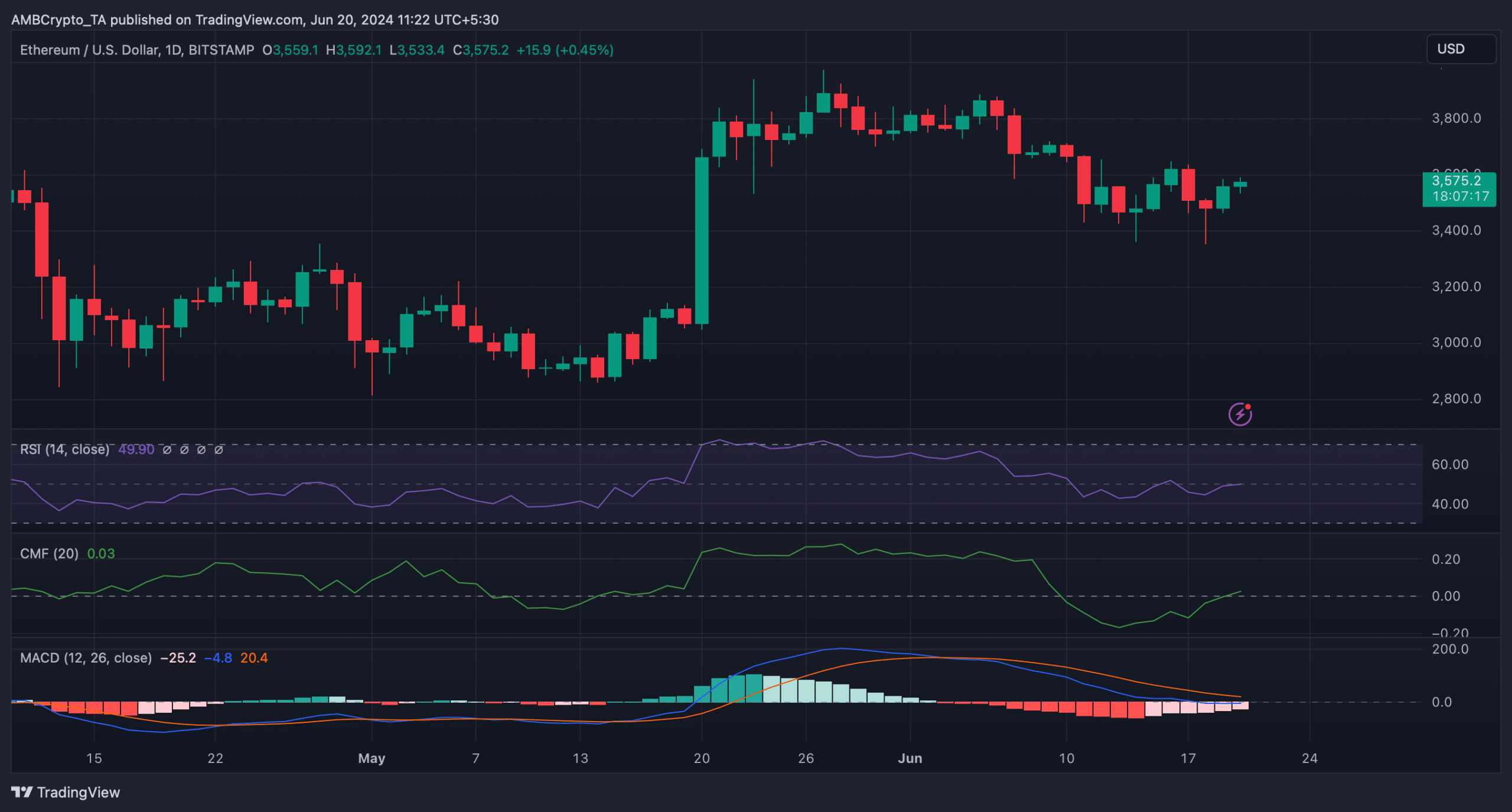

Just a few of the technical indicators additionally appeared bullish on the king of altcoins. As an illustration, the MACD displayed the opportunity of a bullish crossover.

The Relative Energy Index (RSI) registered an uptick and was resting on the impartial mark at press time.

Moreover, the Chaikin Cash Movement (CMF) additionally moved northward, hinting at a value enhance within the coming days.

Supply: TradingView

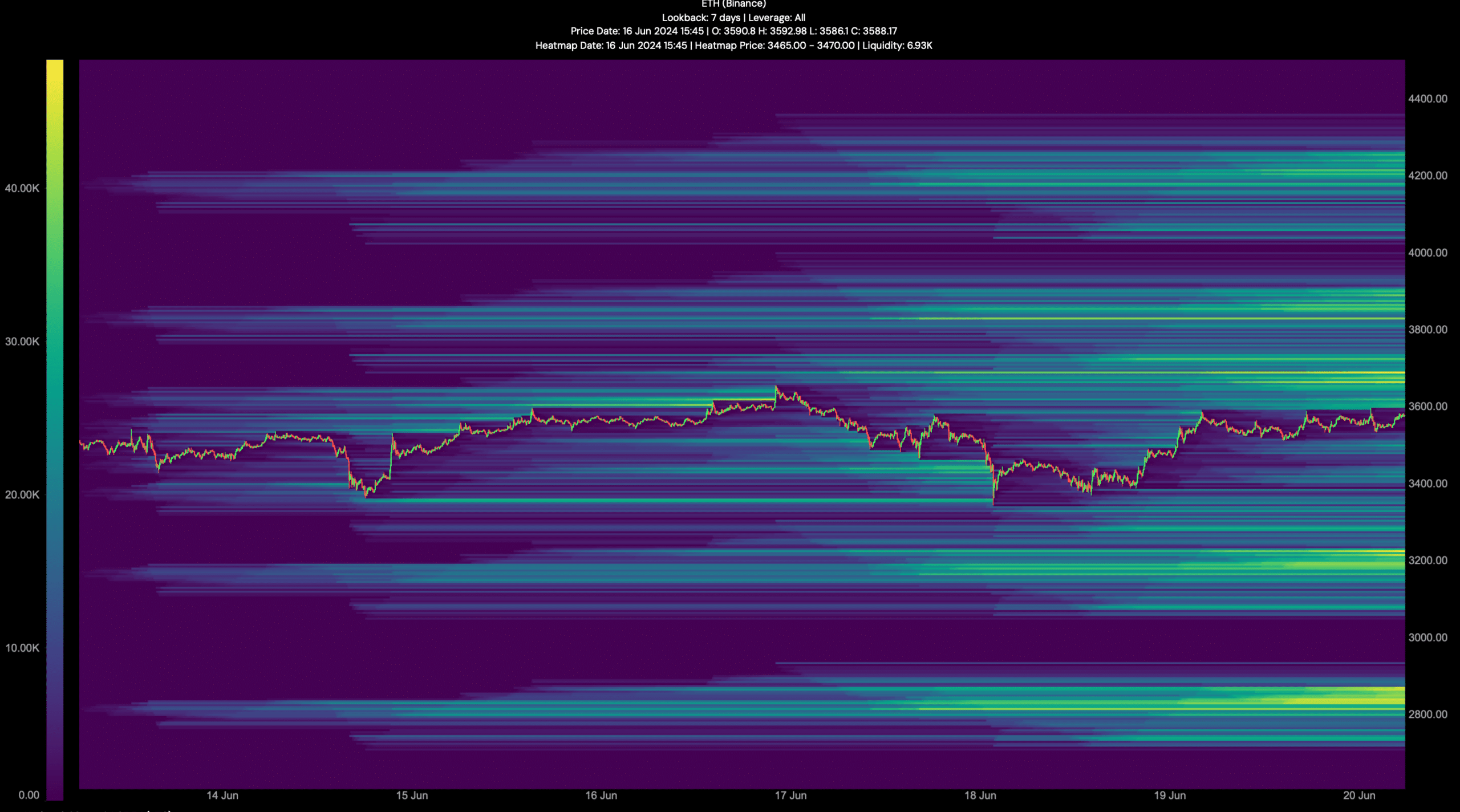

AMBCrypto then checked Hyblock Capital’s knowledge to search for attainable targets for this week if ETH stays bullish.

Learn Ethereum’s [ETH] Worth Prediction 2024-2025

We discovered that ETH would possibly first contact $3,660, as liquidation would rise sharply at that degree. An increase in liquidation usually ends in short-term value corrections.

A profitable breakout above that degree would possibly enable ETH to succeed in $3.8k. Nevertheless, if the bears takeover, then traders would possibly witness ETH drop to $3.28k this week.

Supply: Hyblock Capital