Ethereum vs Bitcoin: Which coin should you bet on this week?

- Ethereum witnessed a extra extreme correction final week than Bitcoin.

- Metrics recommended that promoting strain was excessive on BTC and ETH, however ETH had an edge.

Bitcoin [BTC] remained within the limelight over the past week because it approached $70k, however later plummeted close to $66k. Ethereum [ETH] had a harder week because it witnessed a relatively extra correction.

Nonetheless, the most recent replace revealed that traders ought to contemplate accumulating ETH, as its volatility has barely picked up.

Weekly efficiency

CoinmarketCap’s data revealed that after getting rejected from the $70k zone, BTC’s worth dropped. On the time of writing, it was buying and selling at $66,491 with a market capitalization of over $1.31 trillion.

However, ETH witnessed a 3% worth correction final week. At press time, ETH had a worth of $3,325 with a market capitalization of over $399 billion.

As per QCB Broadcast’s insights, BTC’s worth began to say no after the US equities opened. Another excuse was the U.S. authorities’s sell-off of BTC value $2 billion.

The perception additionally talked about that traders would possibly contemplate accumulating Ethereum because it has already gained slight volatility and would possibly witness fluctuations within the coming week.

Ethereum would possibly achieve energy quickly, because the market is perhaps turning into resistant to headline outflow figures because of the rotation from dearer ETHE to the cheaper ETFs.

Ethereum vs Bitcoin

AMBCrypto then deliberate to examine and evaluate these two cryptos, to search out out whether or not Ethereum can outshine BTC this week.

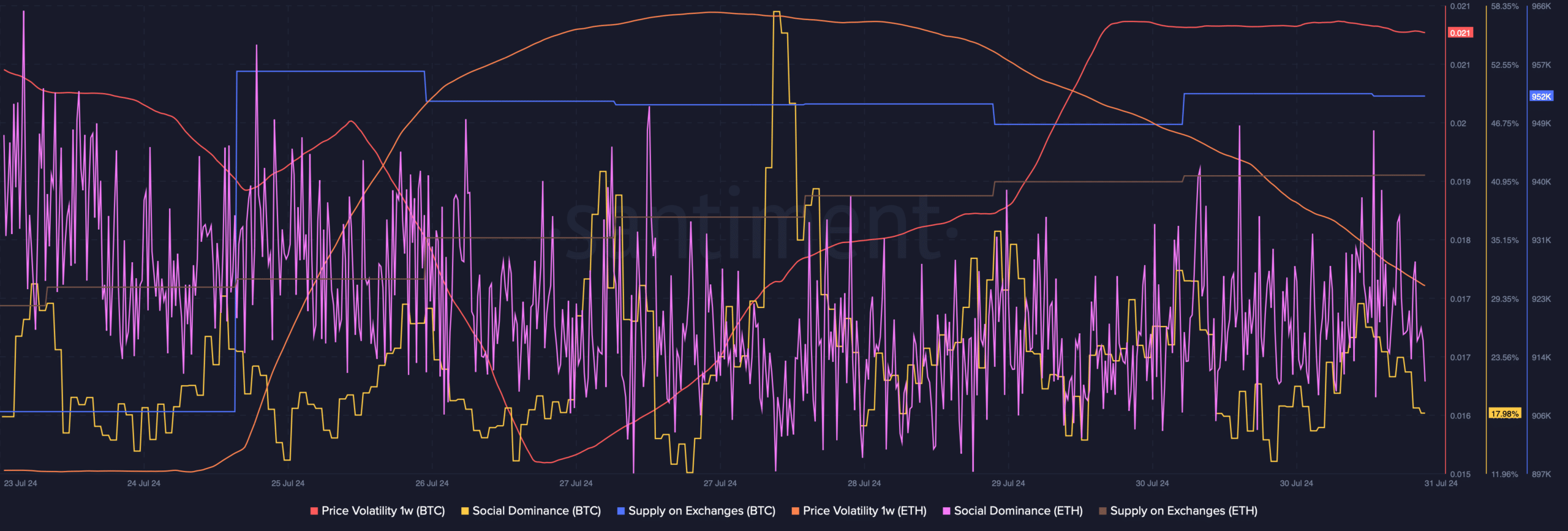

As per our evaluation of Santiment’s knowledge, BTC’s Social Dominance remained comparatively increased than that of ETH. Each cryptos witnessed a rise of their Provide on Exchanges as nicely.

This recommended that traders had been contemplating promoting BTC and ETH.

Additionally, BTC’s Worth Volatility 1w elevated sharply, whereas ETH’s Worth Volatility dropped. Although this would possibly look unfavourable for Ethereum, the fact is perhaps totally different.

The drop in 1-week worth volatility would possibly point out an finish to the token’s bearish worth motion, in flip hinting at a bullish pattern reversal.

Supply: Santiment

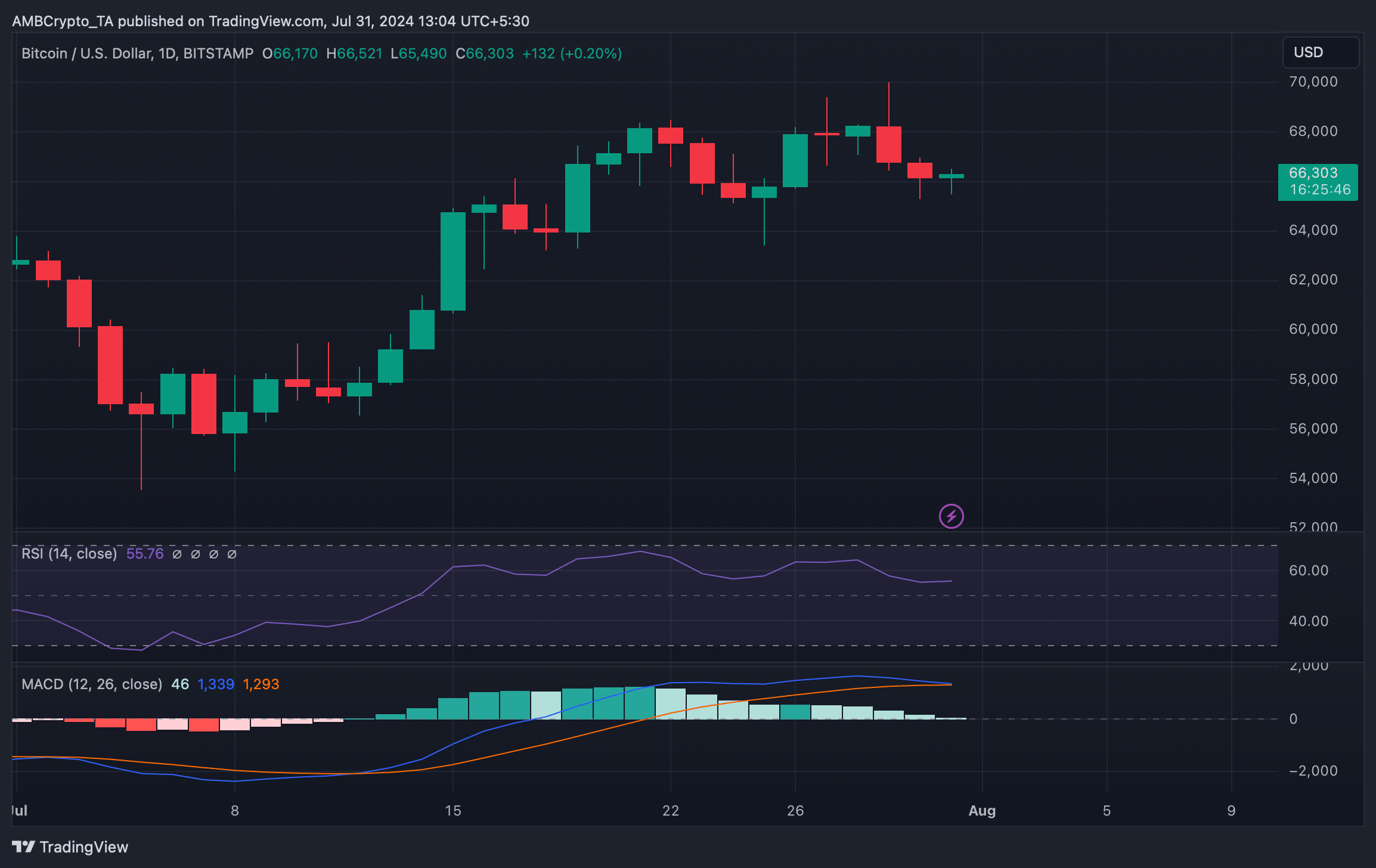

We then checked Bitcoin and Ethereum’s day by day charts to raised perceive which means they had been headed. We discovered that BTC’s MACD displayed a bearish crossover.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

Moreover, its Relative Power Index (RSI) registered a downtick after which moved sideways. These indicators recommended that the probabilities of correction or much less unstable worth motion had been excessive.

Supply: TradingView

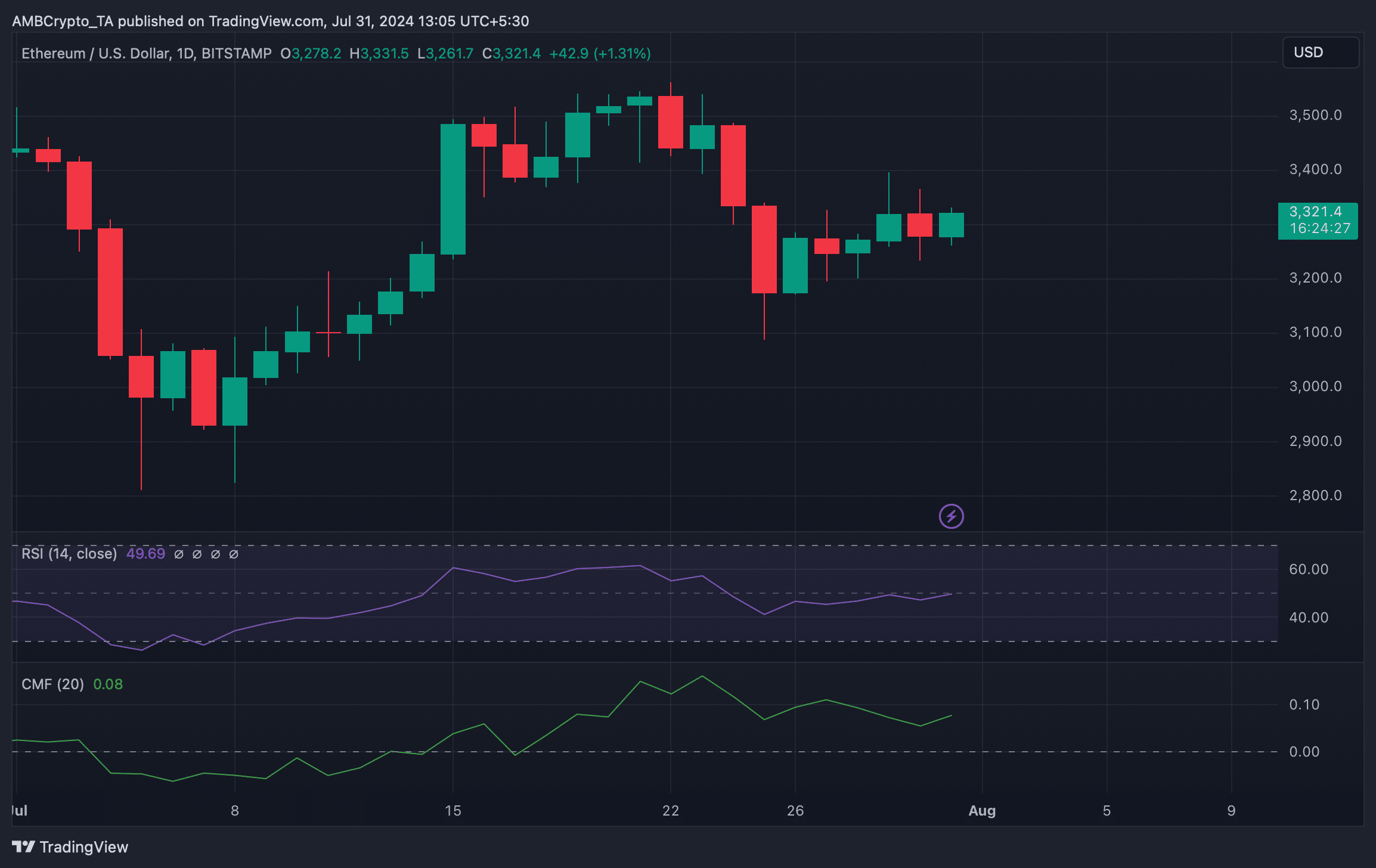

Quite the opposite, Ethereum’s Relative Power Index (RSI) gained bullish momentum. Its Chaikin Cash Movement (CMF) additionally adopted an identical pattern, hinting that ETH would possibly achieve bullish momentum earlier than Bitcoin.

Supply: TradingView