Ethereum whale activity hits record highs: ETH’s 20% rally explained!

- Ethereum sees a 20% worth enhance pushed by whale accumulation and trade outflows.

- Whale exercise suggests rising bullish sentiment and diminished provide on exchanges.

Ethereum [ETH] has surged by 20% over the previous week, fueled by important outflows from exchanges and rising whale accumulation, reflecting rising confidence within the asset.

Regardless of the bullish momentum, current minor corrections have put ETH at a essential juncture, testing key help and resistance ranges. Because the market waits for readability, these ranges will play a vital function in figuring out the following route for Ethereum’s worth.

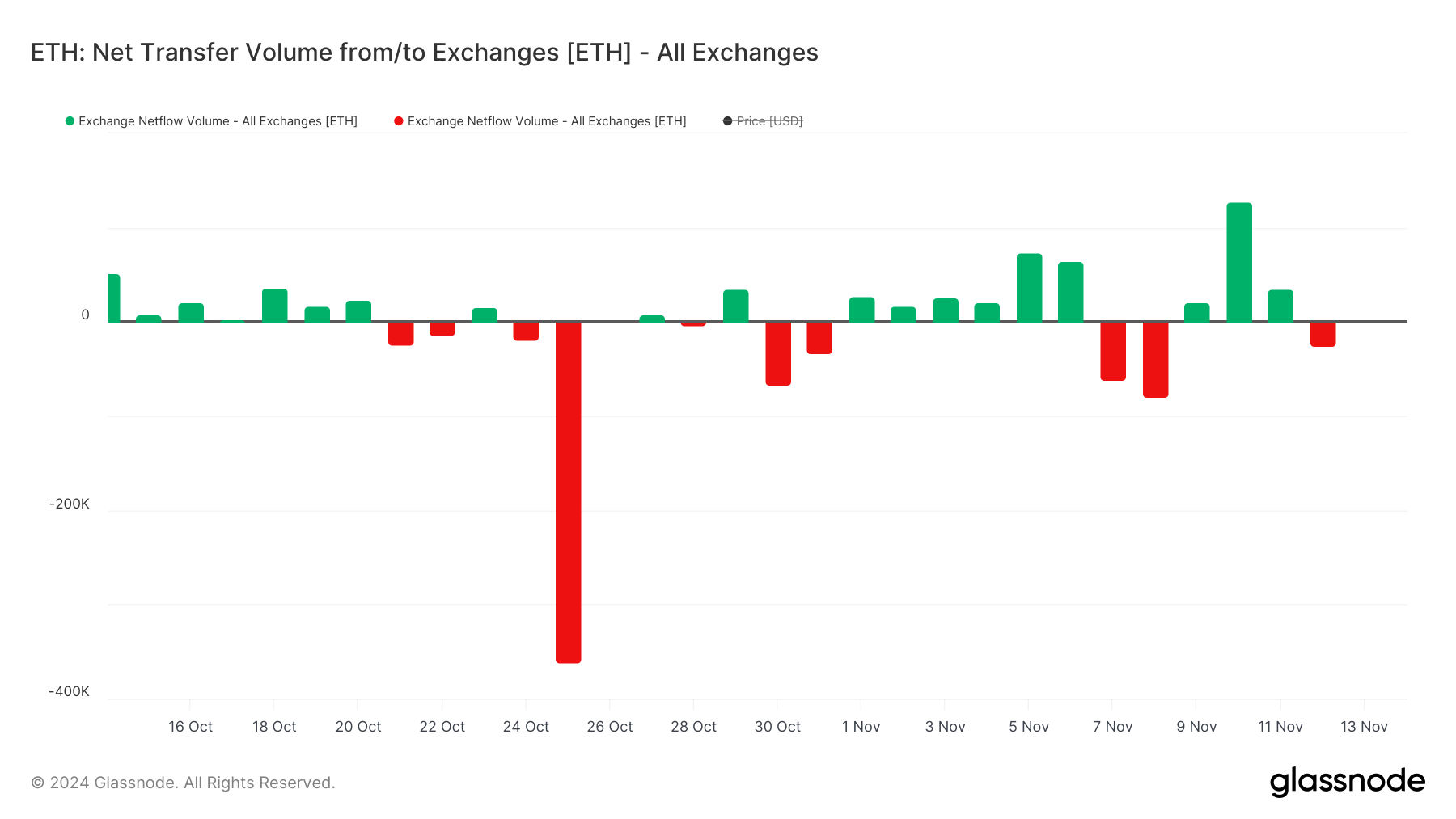

Ethereum trade flows

Ethereum noticed important outflows round twenty sixth October, with large-scale withdrawals from exchanges signaling elevated confidence amongst holders.

Supply: Glassnode

These outflows have dominated the pattern, particularly over the previous week, aligning with ETH’s worth rally as whales accumulate and cut back provide on exchanges.

Whereas minor inflows across the seventh and tenth of November counsel some profit-taking, the general sentiment stays bullish. Nevertheless, any sustained shift in the direction of inflows may problem ETH’s help ranges, introducing potential volatility.

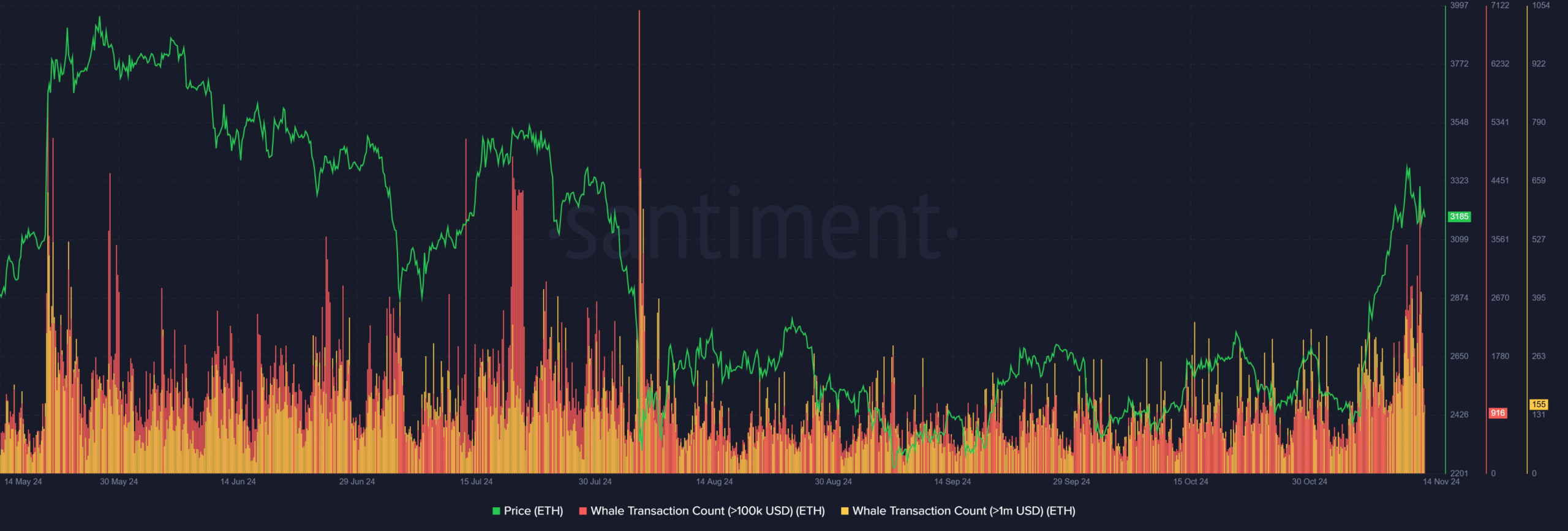

Whale exercise driving ETH’s bullish momentum

Whale transactions surged in late October and early November, correlating with ETH’s 20% worth rally, suggesting that giant holders have been pivotal in pushing costs larger.

Supply: Santiment

Traditionally, spikes in whale exercise usually precede main worth actions, reinforcing the concept that whales are each an indicator and a catalyst for ETH’s worth motion.

Nevertheless, as ETH reaches essential resistance ranges, whale transactions have tapered off, probably signaling profit-taking or warning at elevated costs.

Continued whale engagement will likely be essential in sustaining upward momentum. A sustained decline in whale exercise may point out a possible correction or elevated volatility.

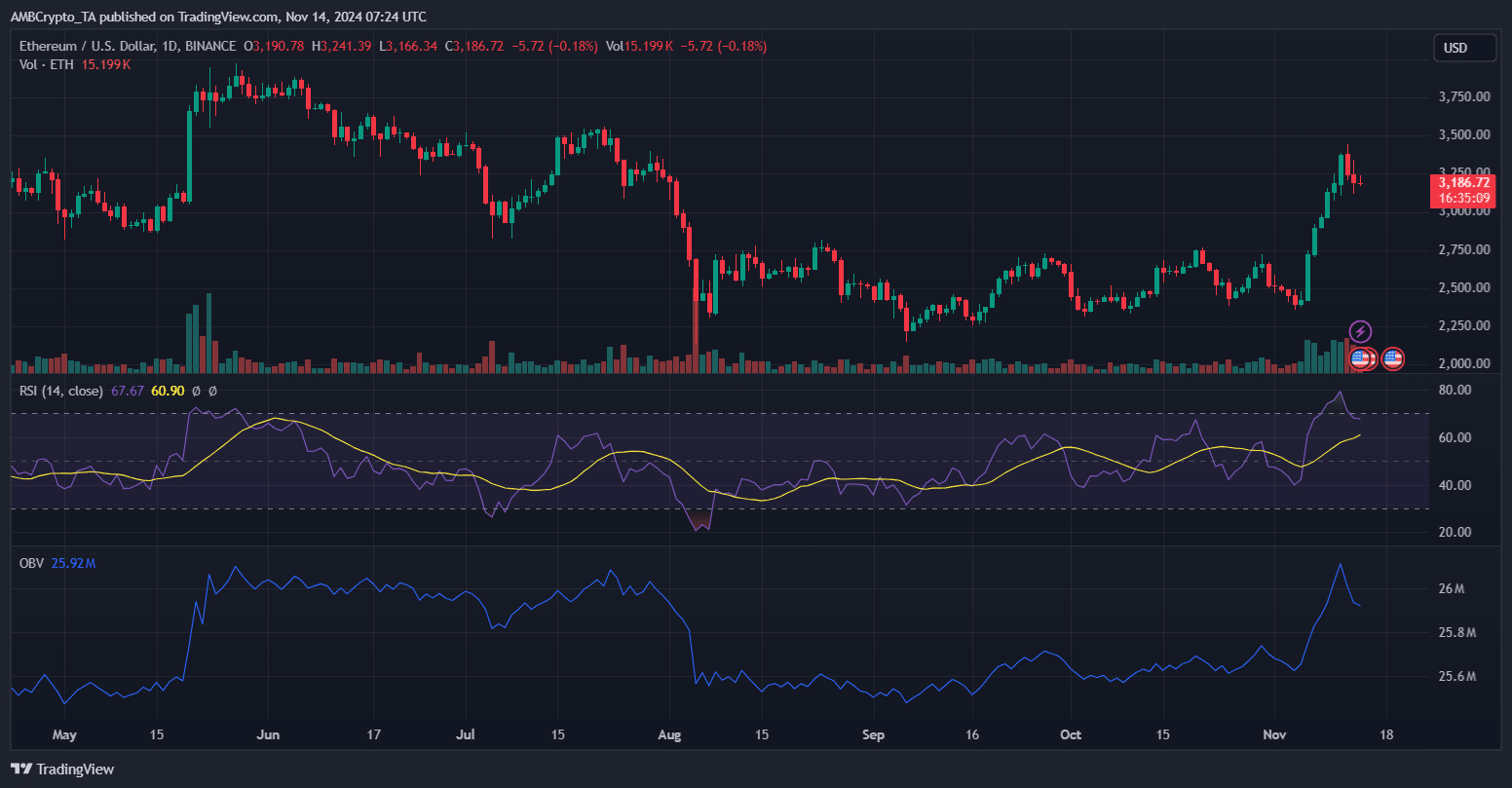

Ethereum’s path to an ATH

Supply: Santiment

Ethereum’s current rally and robust whale accumulation increase the potential of revisiting or surpassing its ATH. The RSI at 67 alerts bullish momentum with out being overbought, suggesting room for additional progress.

In the meantime, the OBV exhibits sturdy shopping for stress, indicating sustained demand.

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

ETH stays above key EMA traces, with $3,500 because the rapid resistance degree – breaking it may result in a transfer towards $3,700, with $4,000 as the following goal.

Minor corrections replicate profit-taking, however ETH’s resilience and whale exercise counsel a possible push for a brand new ATH, supplied help holds above $3,000.