Ethereum: Whale buys 12k ETH- Should you buy the dip now?

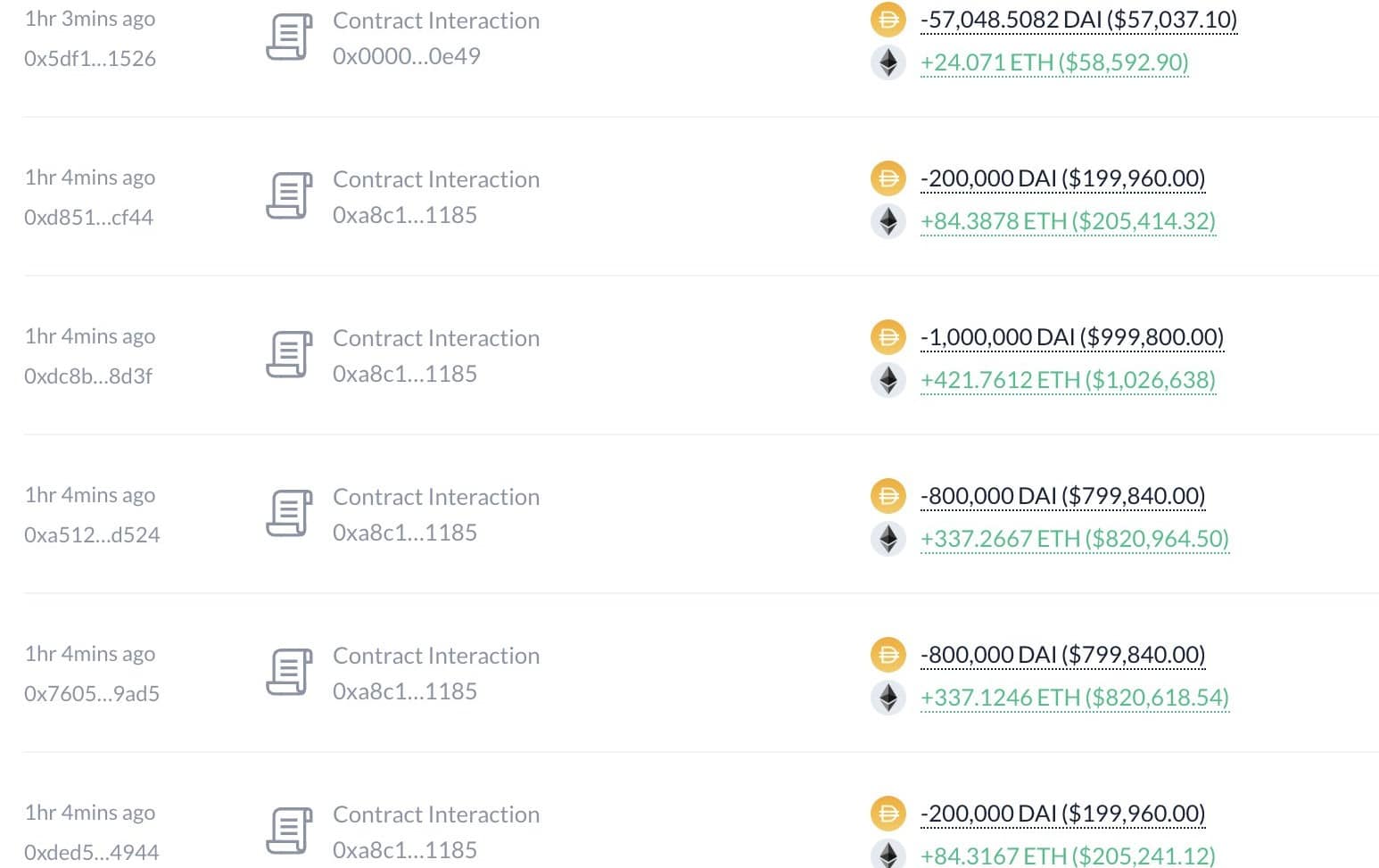

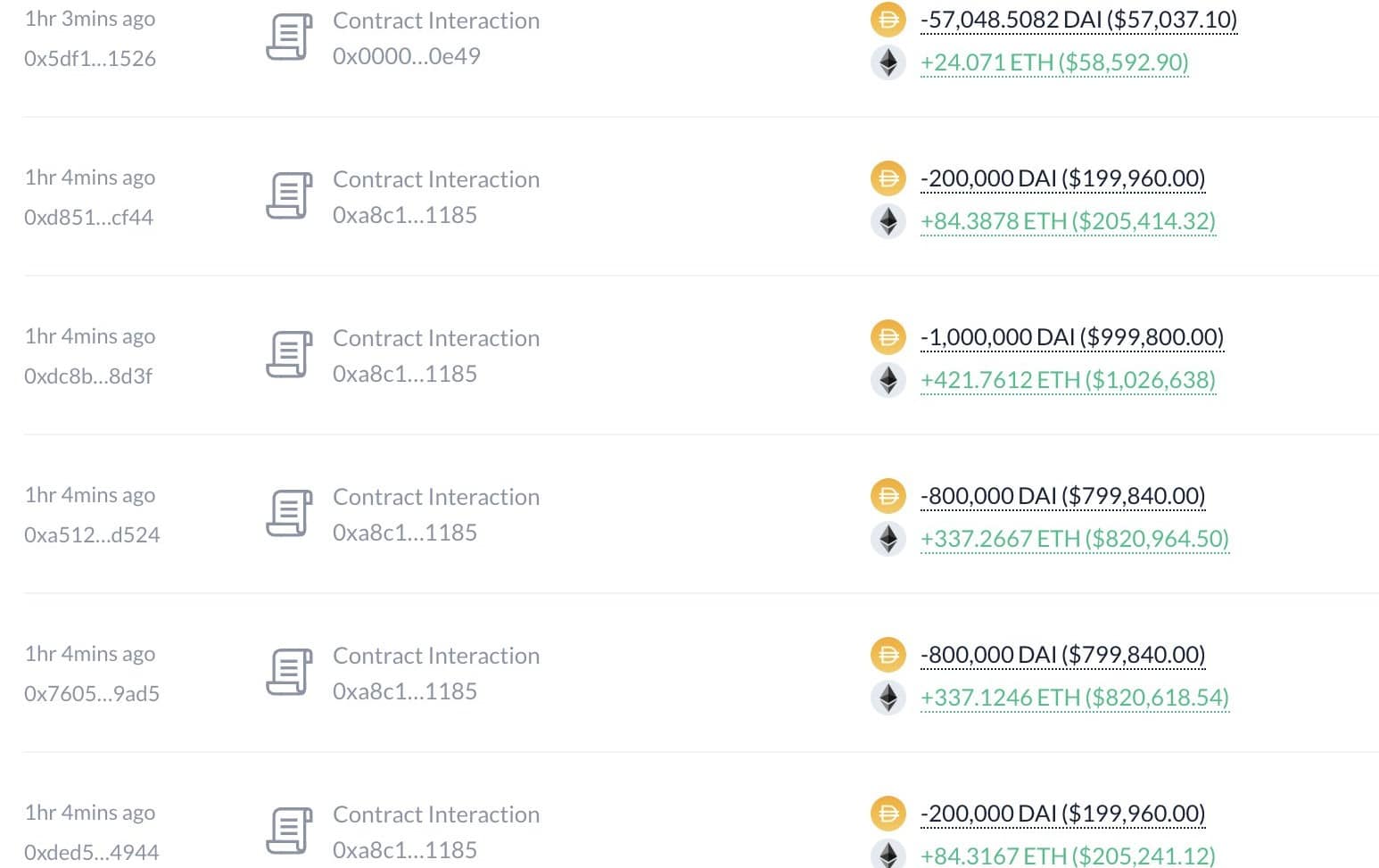

- After the market dropped, 7 Siblings spent 28.75M DAI to purchase 12,070 ETH at $2,382 once more.

- Eric Trump tweeted “Purchase the dips”, does it imply now could be the best time to purchase ETH?

Because the crypto market confronted downturns, the ‘7 Siblings’ pockets continued to strategically make investments closely in Ethereum [ETH] which confirmed their outstanding market optimism.

Current transaction knowledge revealed that inside a quick window, ‘7 Siblings ‘exchanged a staggering 28.75 million DAI to amass 12,070 ETH, pricing every unit at roughly $2,382.

This echoed their final purchase when ETH dipped to comparable ranges.

This buy was a part of a broader technique evident from their holding of 1.15 million ETH, valued round $2.8 billion, throughout simply two wallets.

Observing their sample of funding, it might probably affirm that the ‘7 Siblings’ have been shopping for each important dip on Ethereum.

Supply: Lookonchain

This aggressive acquisition occurred amid wider market unease, suggesting a robust perception in Ethereum’s long-term worth.

Their actions aligned with public sentiments echoed President Donald Trump’s son, Eric Trump, whose current tweet mirrored the timing of seven Siblings’ purchases. Trump wrote on X;

“₿uy the dips!!!”

Such endorsements usually catalyze broader investor curiosity. If the pattern persists and extra giant holders improve their holdings throughout dips, ETH might strengthen its market place.

Conversely, if the broader market fails to stabilize, even hefty buys won’t forestall a possible downturn.

What’s subsequent as ETH worth motion will get in oversold territory?

Ethereum’s worth factors to potential buys because it entered oversold territory, in keeping with its newest RSI studying. This marks a possible turning level for traders. ETH gained greater than 6% up to now 24 hours after the sharp drop, at press time.

The RSI, having dipped beneath 30 not too long ago, started to diverge positively, indicating lessening downward momentum at the same time as costs proceed to say no. This means that whereas sellers have been aggressive, the promoting stress could be exhausting itself.

ETH costs have constantly declined because the begin of the yr however are actually approaching a important assist degree of round $2,480.

If this degree holds, it might sign a reversal level for the market, presenting a shopping for alternative for these watching these technical indicators.

Supply: TradingView

Traditionally, such RSI divergences have usually preceded notable recoveries in Ethereum’s worth.

If sentiment shifts, bolstered by macroeconomic components and enormous holders’ exercise, ETH might retest larger resistance ranges seen in December 2024.

Conversely, if the assist fails underneath continued promoting stress, costs might fall additional, testing decrease thresholds beneath $2,000.

This state of affairs would demand better warning, because it might point out a extra prolonged bearish section earlier than any restoration takes maintain.