Ethereum Whale buys $132 million of ETH, Eyes on $2,900 level

- Ether might rise to the $2,900 degree if it maintains itself above the $2,570 degree.

- ETH’s Lengthy/Quick Ratio presently stands at 2.023, indicating extraordinarily bullish market sentiment amongst merchants.

Ethereum [ETH], the world’s second-biggest cryptocurrency by market cap, is on the radar of whales, who’re on a shopping for spree probably attributable to its bullish on-chain metrics.

Ethereum whale on a shopping for spree

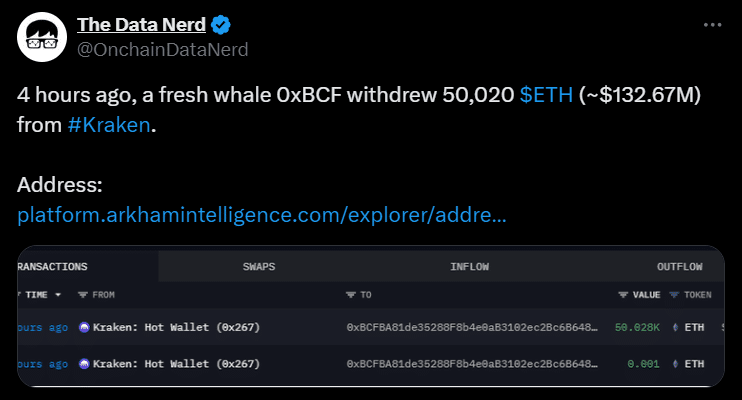

On the twenty fourth of September, on-chain analytic agency TheDataNerd made a submit on X (Beforehand Twitter) that whale pockets handle “0xBCFB” had bought a big 50,020 ETH price $132 million from Kraken.

Supply: X

This large buy occurred as ETH broke its two-day consolidation following the breakout of the $2,570 degree.

Nevertheless, some crypto whales take a look at the present value degree as a possibility and are closely accumulating, whereas some others proceed to dump their holding, believing the value will decline additional within the coming days.

Key ranges

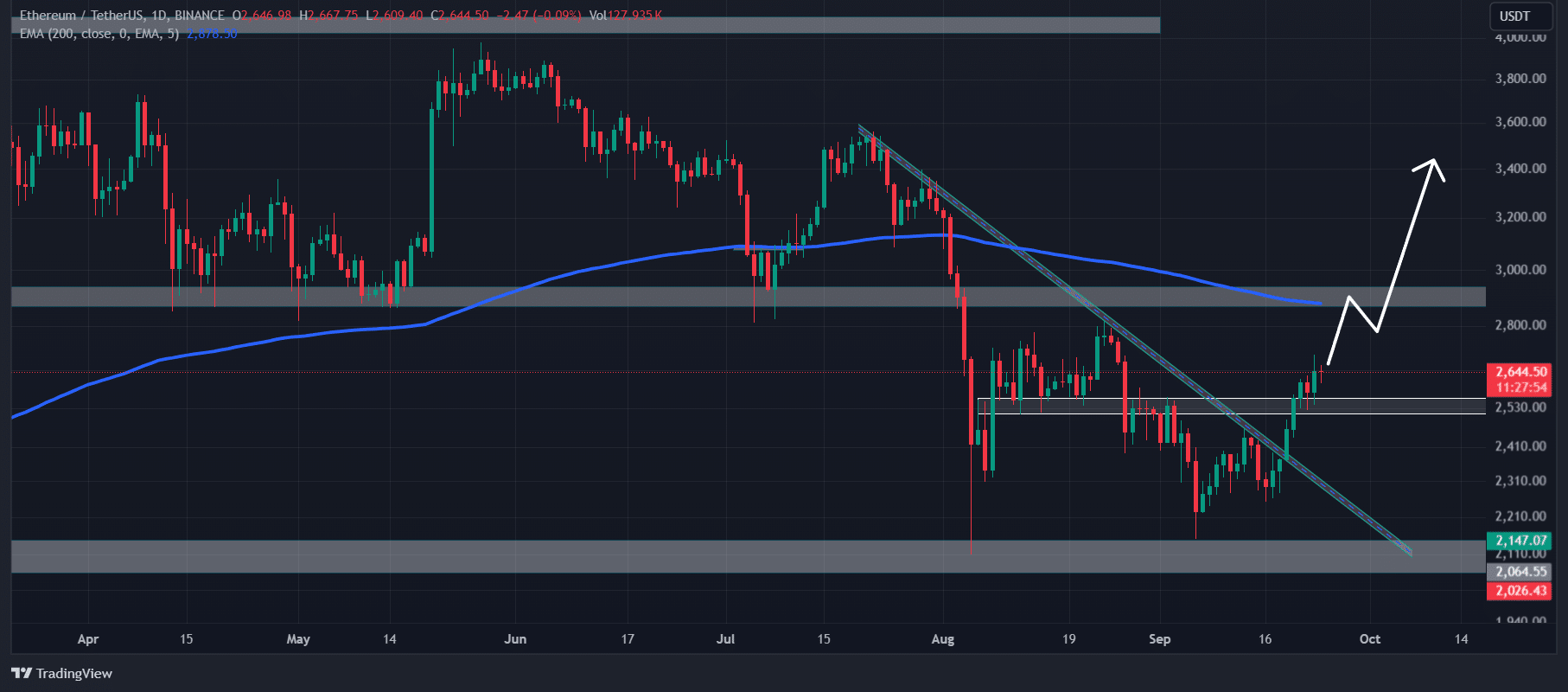

In line with AMBCrypto’s technical evaluation, ETH seems bullish regardless of buying and selling under the 200 Exponential Shifting Common (EMA) on a every day timeframe.

The 200 EMA is a technical indicator used to find out whether or not an asset is in an uptrend or downtrend.

Supply: TradingView

The latest breakout of the essential resistance degree of $2,570 degree and the small consolidation counsel a possible upside rally.

Based mostly on the historic value momentum, if ETH maintains itself above the resistance degree, there’s a robust chance it might rise to the $2,900 degree, and even greater if the market sentiment stays favorable.

ETH’s bullish on-chain metrics

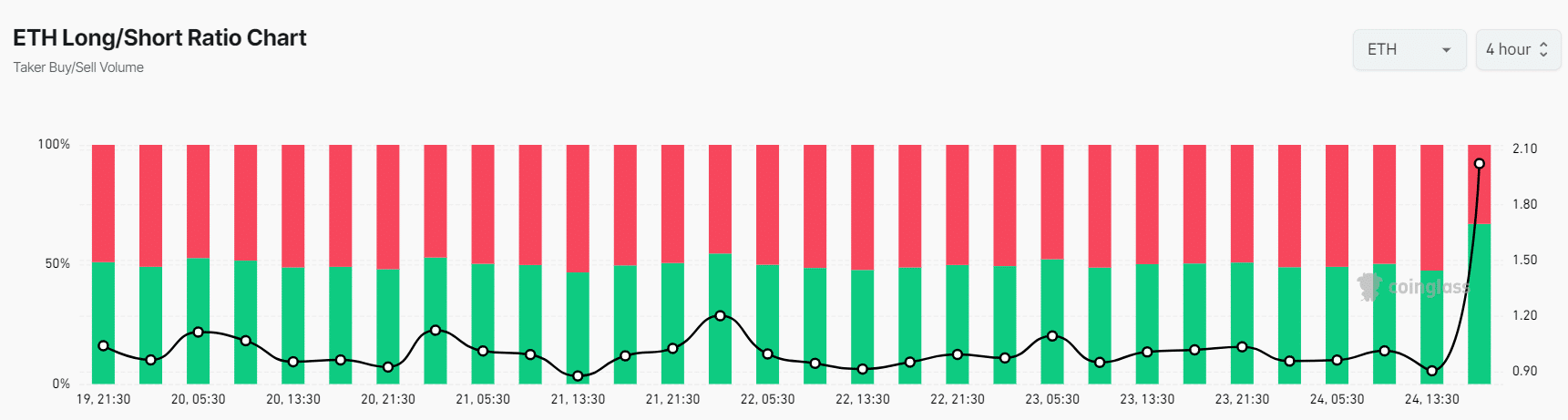

This optimistic outlook is additional supported by on-chain metrics. Coinglass’s ETH Lengthy/Quick Ratio was 2.023 at press time, indicating excessive bullish market sentiment amongst merchants.

Moreover, its Futures Open Curiosity elevated by 3.2% within the final 24 hours.

Supply: Coinglass

Merchants and traders usually use the mix of rising Futures Open Curiosity and a Lengthy/Quick Ratio above 1 when constructing lengthy positions.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

At press time, 66.93% of high merchants held lengthy positions, whereas 33.07% maintain quick positions. This on-chain knowledge means that bulls are presently dominating the asset.

At press time, ETH is buying and selling close to the $2,640 degree, and has remained steady over the previous 24 hours. Throughout the identical interval, its buying and selling quantity dropped by 7%, indicating decrease participation from merchants.