Ethereum whale cashes out 17,000 ETH – Here’s what it means for you

- An Ethereum whale that has been holding ETH for a protracted time frame sells its holdings.

- Value of ETH stays unaffected, nonetheless, exercise on Ethereum’s ecosystem poses considerations.

After seeing a large rally during the last week, the value of Ethereum[ETH] began to get stagnant across the $3500 worth degree. Attributable to this stagnancy, many holders determined to bask in profit-taking.

Whale takes revenue

In line with latest knowledge, an preliminary holder of ETH exchanged 17,770 ETH for 62.24 million DAI at a fee of $3,503 per ETH.

This particular person amassed 14,280 ETH, valued at roughly $2.6 million, at a mean worth of solely round $182, spanning purchases made out of Gemini and Bittrex between March 2017 and April 2021.

With a staggering achieve of 23 occasions their preliminary funding, the revenue quantities to $59 million.

This whale’s sale of 17,770 ETH injects a considerable amount of the foreign money into the market. This could trigger downward stress on the value within the quick time period, particularly if there aren’t sufficient consumers to soak up all of the ETH being bought.

Nonetheless, the general influence is dependent upon market sentiment. If the sale triggers panic promoting, the value may drop additional. However, if the market views it as a wholesome correction or the whale is just taking earnings, the value may stabilize and even rebound as others see a shopping for alternative.

ETH stays resilient

At press time, ETH was buying and selling at $3,571.59, marking a 27% distinction from its all-time excessive. The value of ETH had examined the $3674.23 ranges twice over the previous couple of weeks.

If ETH manages to interrupt previous this degree, it’ll put an finish to the bearish development that was noticed after its worth fell from $4081.55. ETH may additionally presumably head within the path of the $4081.55 resistance but once more.

Nonetheless, the coin’s CMF (Chaikin Cash Stream) declined in the previous couple of days, indicating that the cash circulation for ETH had fallen. This means that the value of ETH may see a interval of sideways or downward motion earlier than it begins to rally.

Supply: Buying and selling View

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

State of the Ethereum community

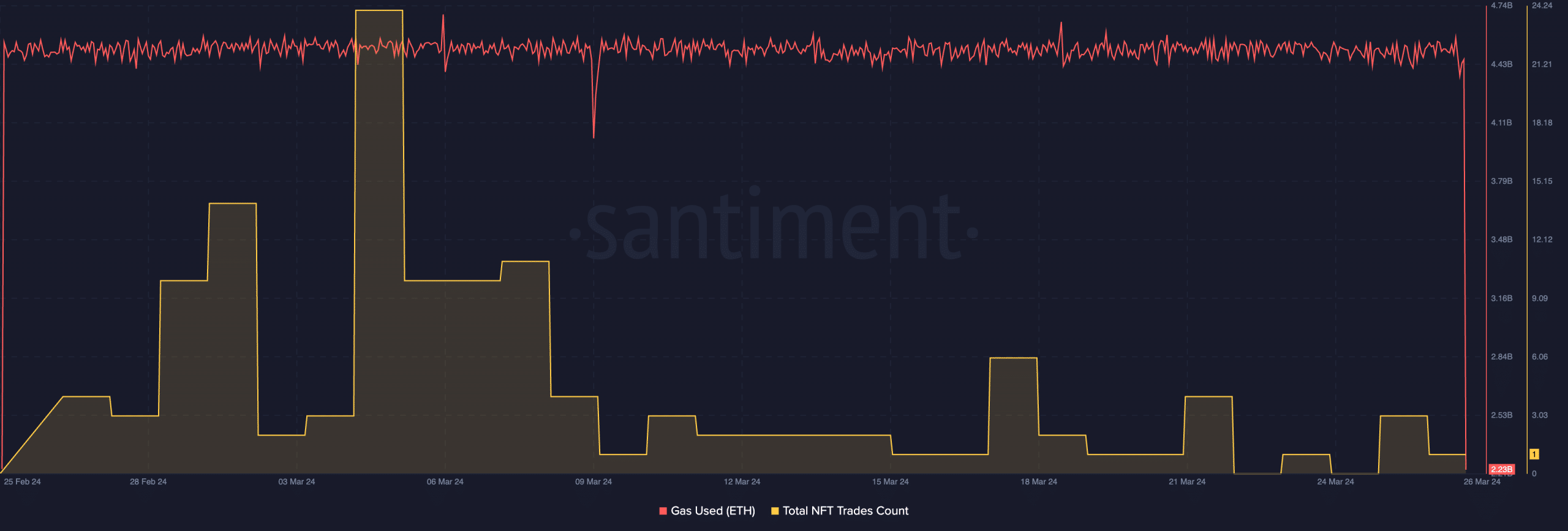

The recognition of the Ethereum ecosystem may even support ETH positively sooner or later. The fuel utilization on the Ethereum community remained constant over the previous month, suggesting a extremely energetic ecosystem.

Nonetheless, the general variety of NFTs being traded on the community fell considerably over the previous couple of days, indicating that the curiosity in NFTs on the Ethereum ecosystem fell. This might harm the exercise on the Ethereum community in the long term.

Supply: Santiment