Ethereum whale sale raises concerns: Could ETH drop below $2,600?

- A whale strategically bought 15K ETH into an change, responding to present market dynamics.

- Nonetheless, a reversal might be on the horizon for ETH.

Ethereum [ETH] surged over 14% this previous week, priced at $2,641, with the subsequent goal at $2,769. In the meantime, Bitcoin bulls have been working to take care of a place above $62K.

Sometimes, when BTC faces stress at essential resistance, it will possibly point out growing curiosity in altcoins.

Nonetheless, latest exercise from a “diamond hand” ETH whale, who transferred 15K ETH to a serious change, has sparked concern amongst buyers.

Concern has reached ETH whales

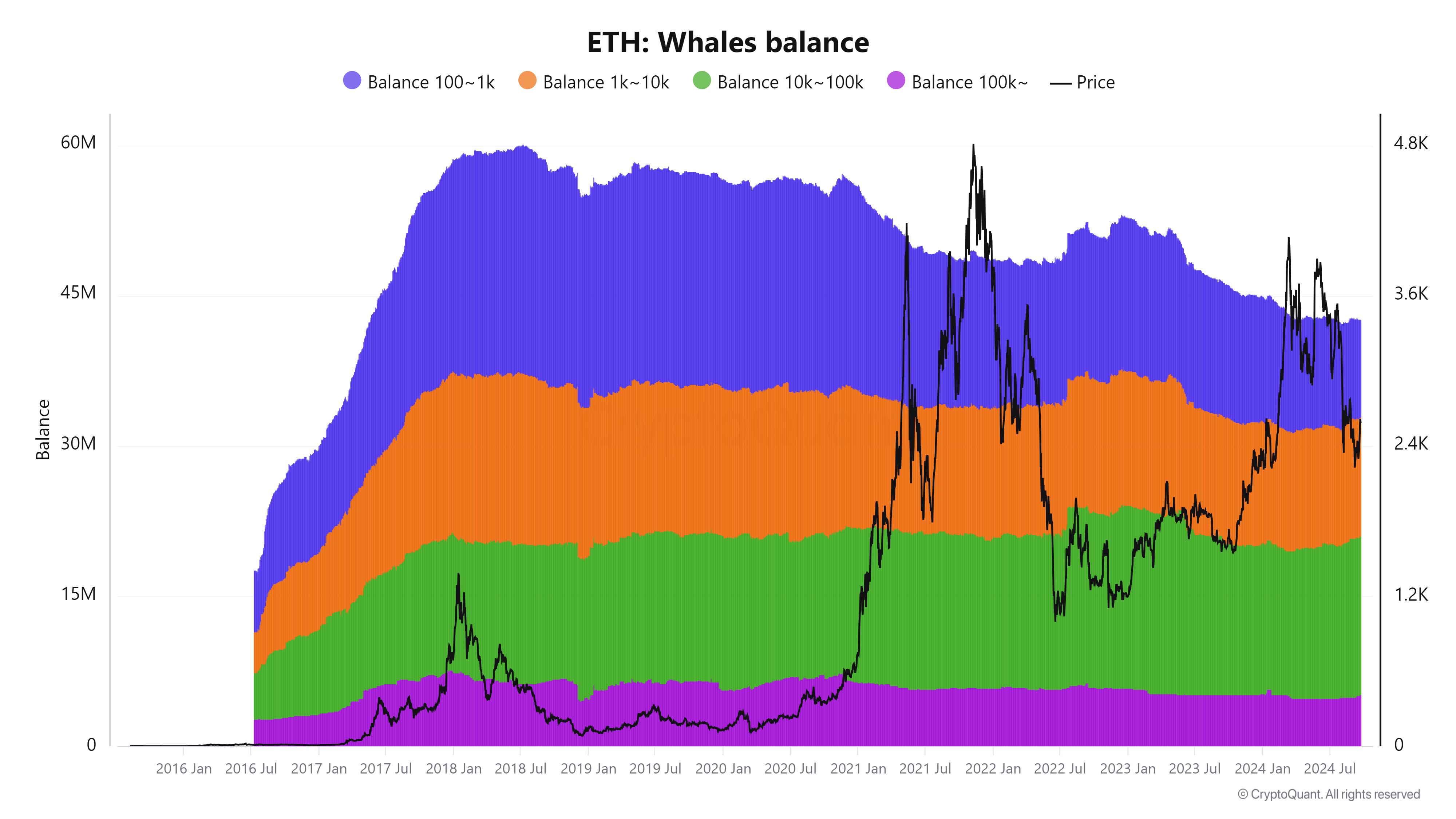

Wanting on the chart under, the whale cohort holding between 100 and 1K ETH has constantly declined since peaking in early 2021, whereas the remaining have proven confidence in future good points.

Supply: CryptoQuant

Nonetheless, a latest X post revealed that an nameless whale bought ETH valued at $38.4 million from their pockets into Kraken.

Curiously, this whale was thought of a “diamond hand” – a time period that describes buyers who HODL their cash for prolonged intervals with out plans to promote.

Understandably, their sell-off might instill worry amongst stakeholders. If this pattern continues, promoting stress on the alt might push it under $2,600.

Sometimes, on this scenario, most buyers try to retreat to breakeven – a method this whale appears to have adopted as effectively.

Understanding THIS technique would possibly fight stress

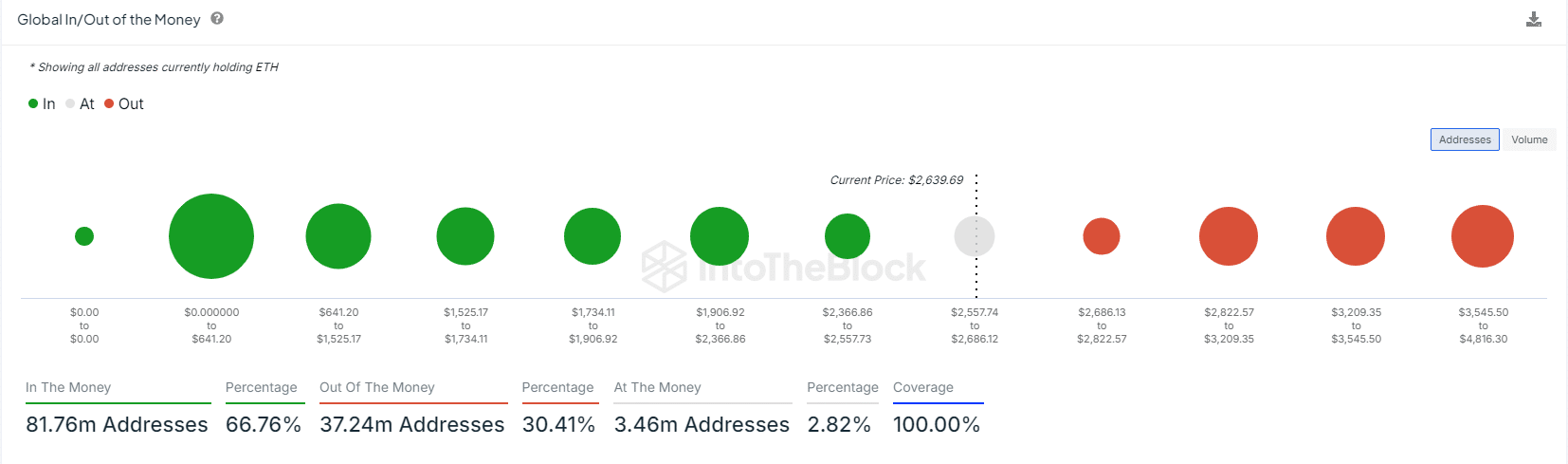

At present, ETH bulls are tasked with defending the $2.6K help towards the promoting stress. As famous earlier, a bearish pullback might ensue if this degree is retested.

In such a situation, roughly 4 million addresses holding $8 million price of ETH would shift right into a loss place.

Supply: IntoTheBlock

On the every day worth chart, the alt final peaked at $2,700 on the twenty third of September. This degree has turn into contentious, having been examined in mid-August earlier than bears pushed ETH under $2.2K.

Earlier than the same pattern might emerge, coinciding with BTC consolidating under $64K, the whale closed its place to breakeven.

If extra whales comply with swimsuit, further stakeholders might slip into loss positions, doubtlessly triggering a bearish cycle that might forestall bulls from surpassing the $2,700 ceiling.

The bulls are regaining management

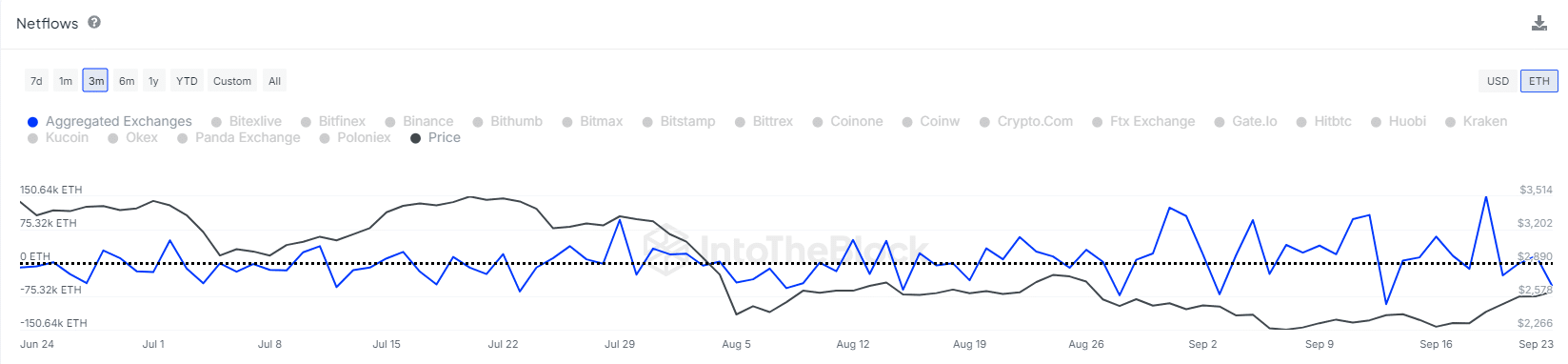

Whereas the whale technique has as soon as once more thwarted a direct breakout alternative, buyers are positioning themselves for a bullish reversal, as illustrated within the chart under.

Supply: IntoTheBlock

Learn Ethereum’s [ETH] Worth Prediction 2024-25

A surge in web outflows factors to a possible correction, indicating that buyers are actively trying to soak up promoting stress by accumulating ETH.

If this pattern holds, a push above $2.7K might be imminent, although vigilance relating to whale exercise stays essential. Conversely, if this uptick proves to be a short lived blip, a retracement to $2.2K might turn into more and more seemingly.