Ethereum whale sells 19K ETH : Is a deeper pullback on the way?

- Ethereum whale has instilled worry amongst stakeholders following the discharge of roughly 19K ETH.

- Nevertheless, a deeper pullback should still be on the horizon.

Ethereum [ETH] skilled a serious shock when a distinguished ICO Ethereum whale bought 19,000 tokens – over $47.5 million – inside simply two days, sending ripples by means of the market.

Regardless of beginning October with consecutive crimson candlesticks on the every day chart, which stored ETH from reaching $2.7K, the anticipated downward stress from the whale’s exercise didn’t materialize.

As a substitute, ETH surged roughly 2% from the day gone by, capturing AMBCrypto’s consideration.

Ethereum whale exercise alerts a market prime

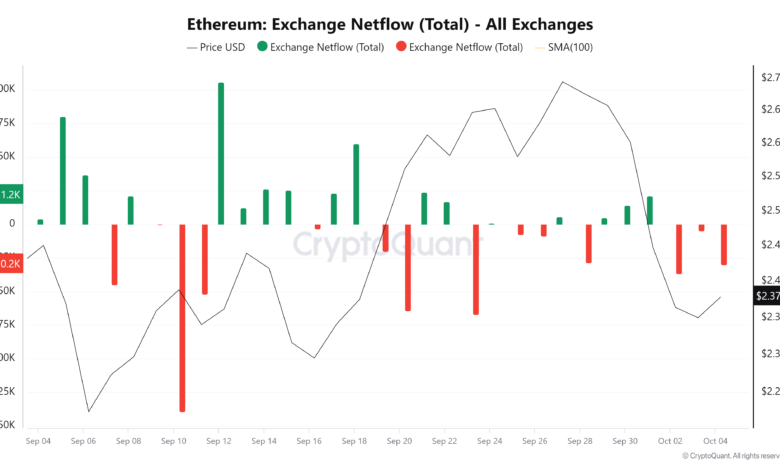

The chart under revealed an intriguing growth. Usually, a big spike in web outflows alerts lively shopping for, indicating merchants’ confidence in a possible worth correction.

Over the previous three days, ETH netflows have stayed unfavorable, hinting at rising optimism.

Supply : CryptoQuant

Nevertheless, this optimism contrasts sharply with the current Ethereum whale exercise, which alerts $2.6K – the value at which the sell-off occurred – as a possible market prime.

If that’s the case, a retracement from $2.37K, ETH’s present worth, again to $2.23K, its earlier rejection stage, would possibly comply with swimsuit.

Moreover, the chart has one other facet. Merchants who bought ETH prior to now three days when it opened at $2.6K, anticipating a bull cycle, now discover themselves in a web loss.

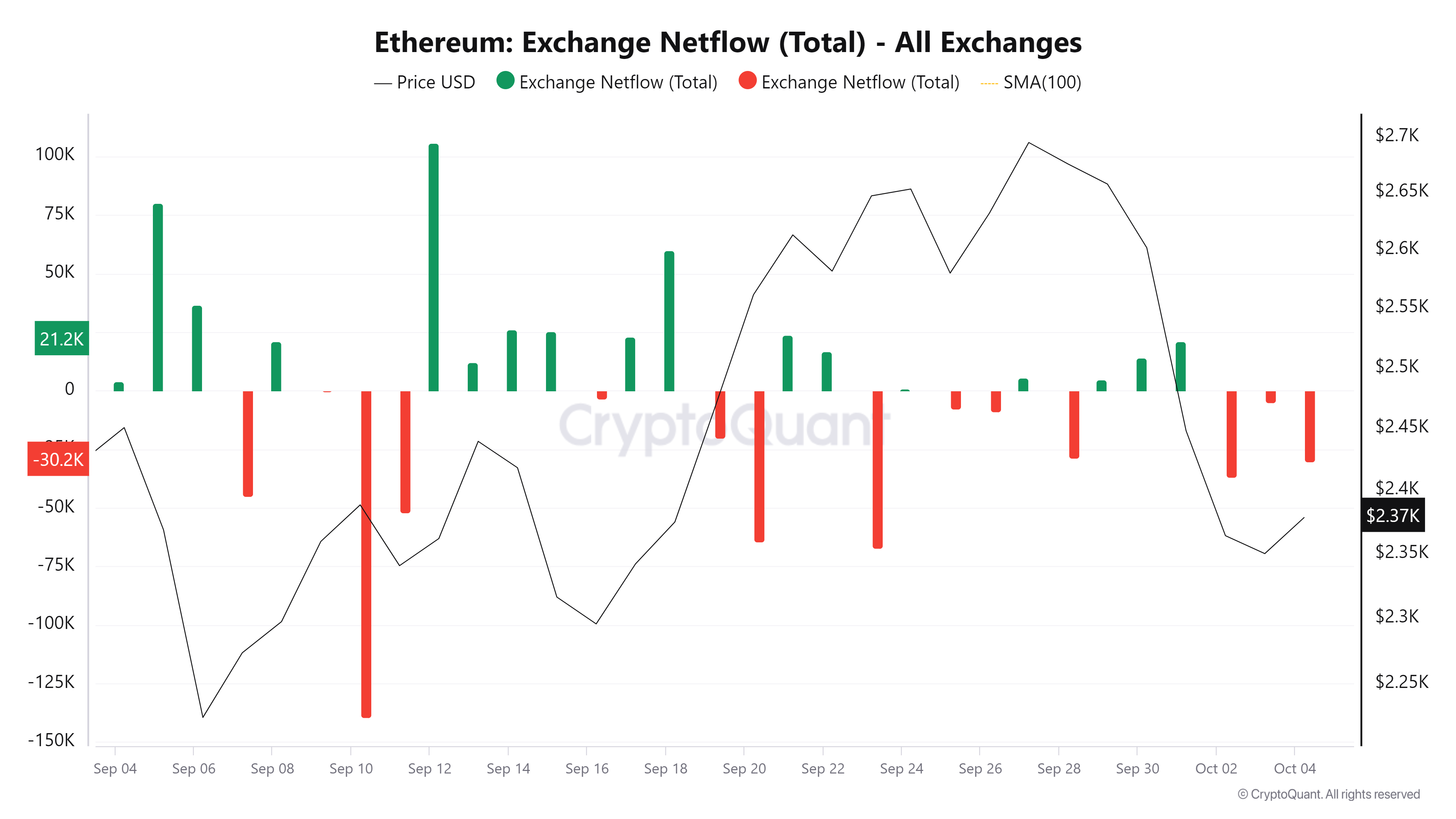

Supply : IntoTheBlock

This case highlights the affect of current Ethereum whale exercise, which has pushed many traders into unfavorable positions.

Consequently, this widespread loss amongst merchants may additional diminish the probability of a market reversal, as confidence wanes within the face of considerable promoting stress.

Worry would possibly set off panic promoting

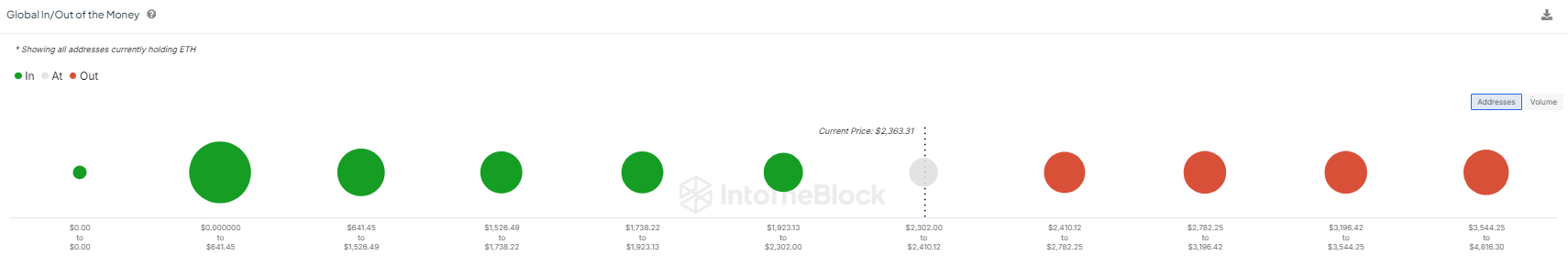

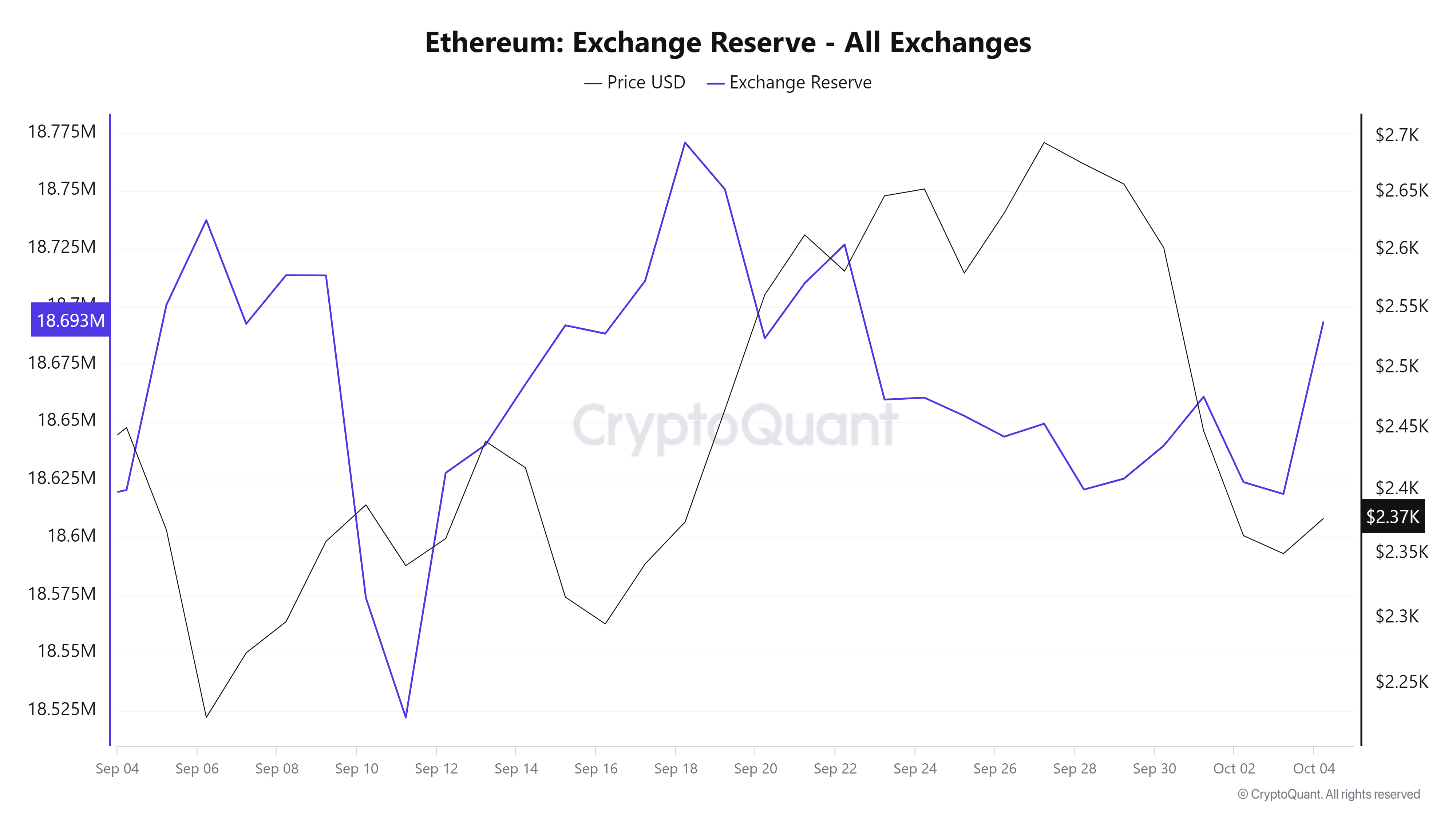

Clearly, the Ethereum whale had a big affect on ETH worth motion. This has additionally affected investor confidence in a future restoration, as evidenced by the chart under.

Ethereum trade reserves have seen a sudden spike, with roughly 18.7 million ETH being deposited into exchanges.

Supply : CryptoQuant

This improve is a direct reflection of the worry gripping stakeholders following the Ethereum whale sell-off of 19,000 ETH.

Typically, excessive worry is critical for an optimum “dip” shopping for alternative. The minor 2% surge talked about earlier, regardless of the numerous sell-off, would possibly point out simply that.

In response to AMBCrypto, a extra aggressive buyout may reverse the present pattern by absorbing the promoting stress brought on by the Ethereum whale. If this occurs, it’d set the stage for a market backside, attracting consumers on the lookout for decrease costs.

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

Nevertheless, for this reversal to work, there must be excessive worry amongst traders. With out that worry, the probabilities of an enduring restoration diminishes.

Due to this fact, along with the Ethereum whale affect, ETH could face a deeper pullback earlier than a big rally happens.