Ethereum whale transactions surge: Decoding the spike in large transfers

- Ethereum lately witnessed a surge in massive transactions.

- ETH has fallen beneath its $4,000 milestone however stays shut.

Ethereum [ETH] has witnessed a pointy enhance in massive transactions, with weekly volumes spiking over 300% to $17.15 billion earlier than cooling to $7 billion.

Whale exercise exceeding $100,000 has surged, coinciding with Ethereum’s rally to $4,000.

As trade netflows recommend diminished promoting strain, the market eyes key psychological resistance, with bullish momentum and robust help ranges shaping the outlook.

Analyzing Ethereum’s massive transaction exercise

Ethereum has lately seen a big uptick in massive transactions.

AMBCrypto’s evaluation of the transaction chart on IntoTheBlock confirmed that weekly transaction quantity surged over 300% to hit $17.15 billion on the sixth of December earlier than falling to $7 billion on the time of writing. T

he enhance has sparked curiosity concerning the path and implications of those transactions, particularly as Ethereum’s worth approaches key psychological ranges.

Supply: IntoTheBlock

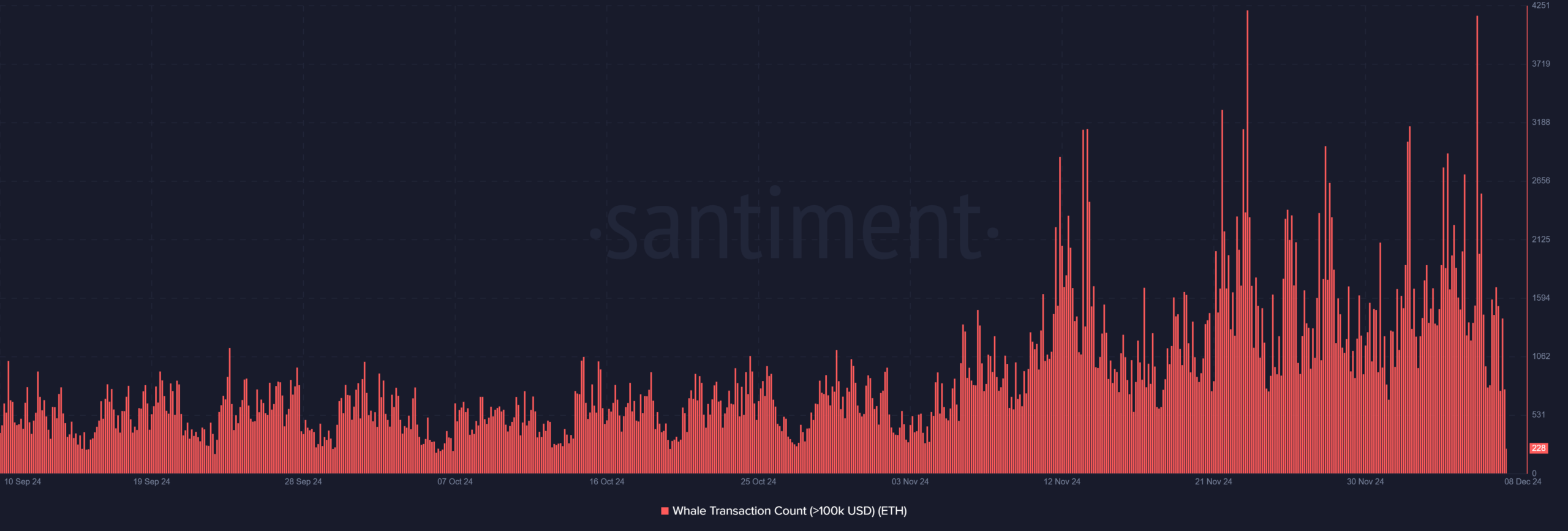

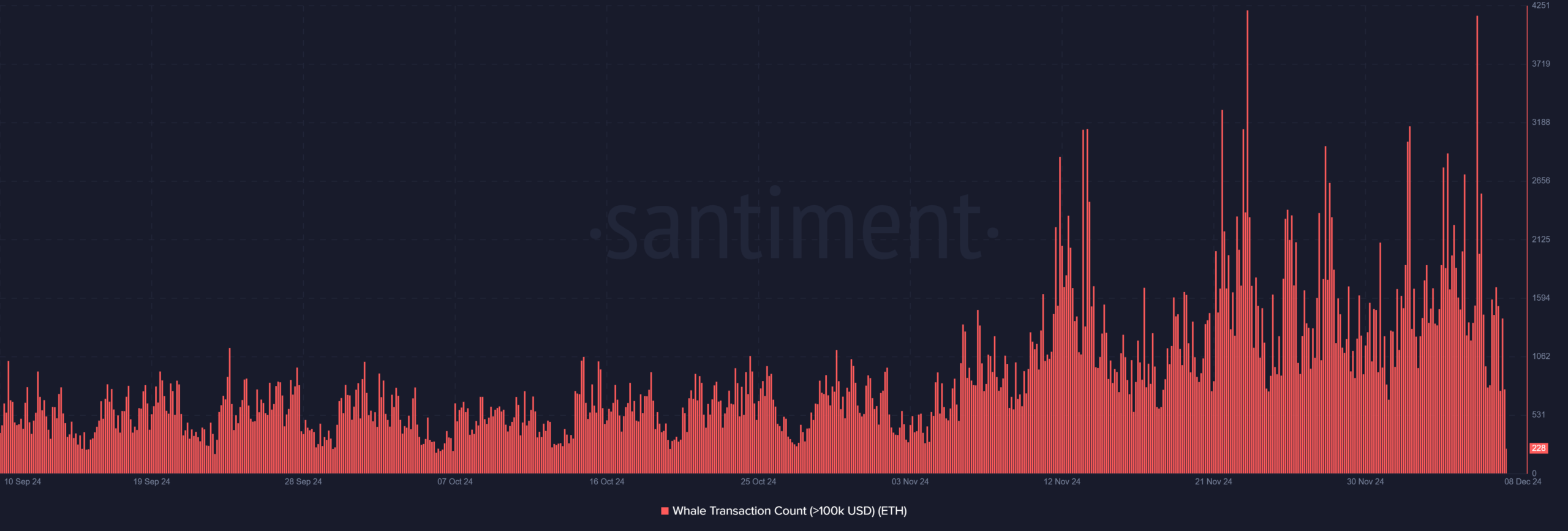

Moreover, the massive transaction chart on Santiment reveals a pointy rise within the variety of whale transactions exceeding $100,000 in worth, suggesting elevated institutional or high-net-worth exercise.

The spike aligns with Ethereum’s current rally to $4,000, indicating that some whales could also be taking income or redistributing holdings.

The whale transaction depend chart demonstrates periodic peaks, underscoring strategic strikes throughout unstable worth phases.

Supply: Santiment

Change netflow and worth correlation

The trade netflow chart exhibits alternating inflows and outflows, with current important outflows suggesting diminished promoting strain. The evaluation of the chart confirmed a unfavorable netflow of over 17,000.

This conduct usually alerts a bullish sentiment as merchants transfer property into chilly storage. Nonetheless, the worth has confronted resistance close to $4,000, which coincides with the psychological barrier and profit-taking exercise.

Value efficiency and technical evaluation

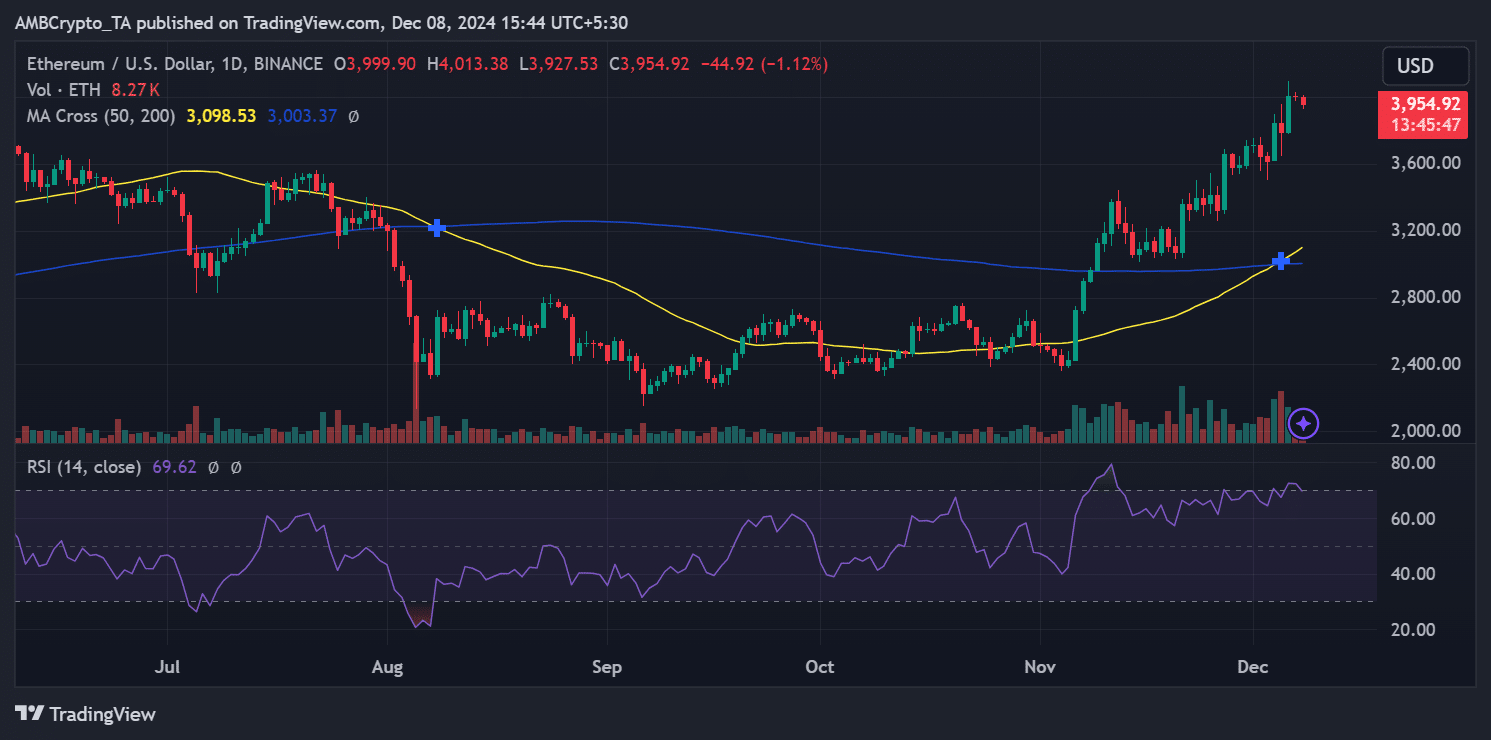

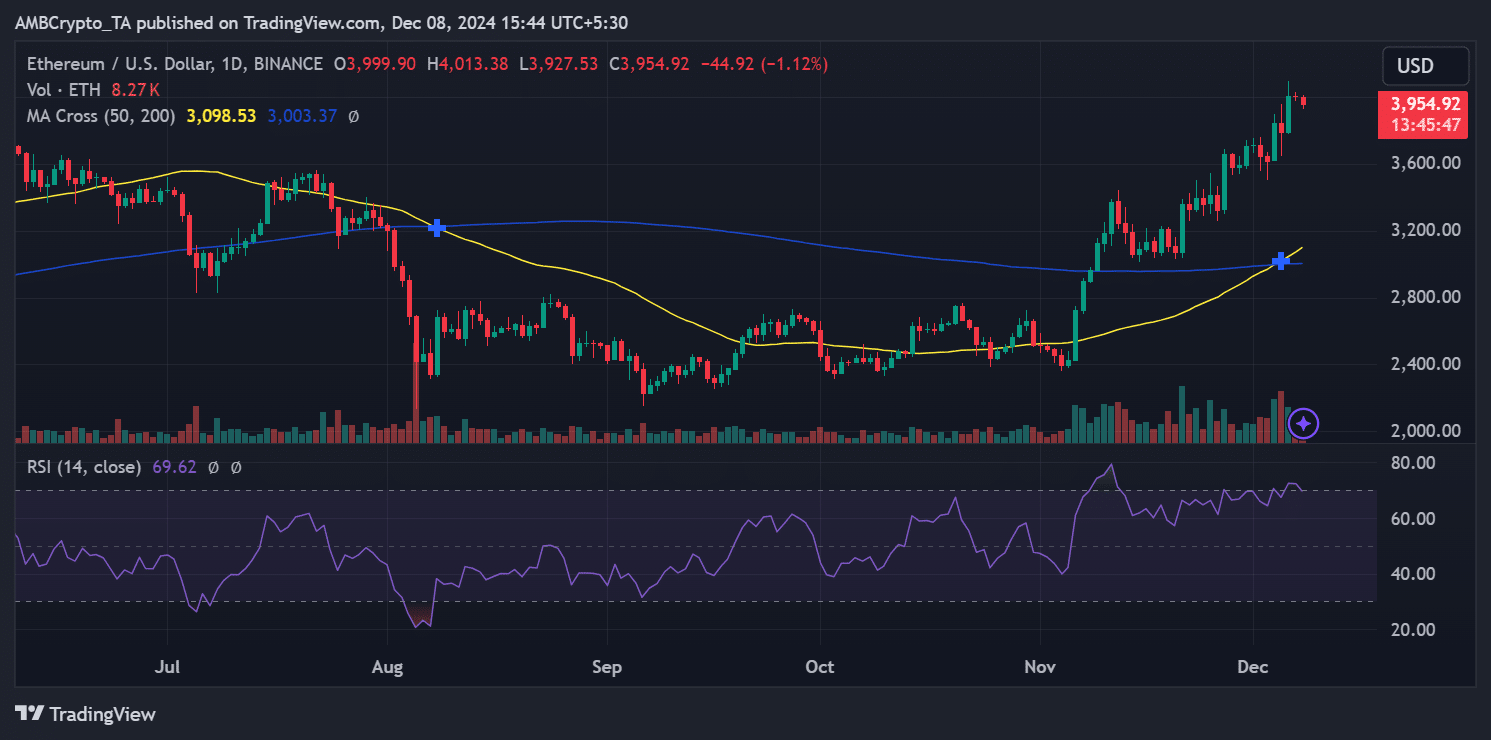

Ethereum’s worth chart displays a constant uptrend since early November, with the 50-day transferring common providing strong help all through.

The current rally to $4,000 was characterised by elevated quantity, as seen on the worth chart, suggesting robust market participation throughout the transfer.

Nonetheless, the RSI studying of 69.62 signifies that Ethereum is approaching overbought territory, usually resulting in short-term worth correction or consolidation.

Supply: TradingView

Apparently, the MACD stays in bullish territory, with its sign line nicely above the zero stage, indicating continued upward momentum.

The histogram exhibits lowering bullish depth, hinting at a doable slowdown, however not essentially a reversal.

Key help ranges lie at $3,800 and $3,500, which align with the 50-day transferring common and former resistance ranges, now was help.

The surge in massive transactions highlights rising curiosity and exercise amongst whales, possible pushed by Ethereum’s enhancing fundamentals and bullish sentiment.

Learn Ethereum’s [ETH] Value Prediction 2024-25

The worth motion suggests Ethereum is in a wholesome uptrend, with key help ranges holding robust and momentum indicators favoring additional upside.

Nonetheless, resistance at $4,000 should be carefully watched, because the market might face a short lived cooling-off interval earlier than making an attempt larger ranges.