Ethereum whales buy $19 million of ETH, Bullish signal for ETH?

- Ethereum’s RSI was in oversold territory, signaling a possible bullish reversal.

- CryptoQuant’s Ethereum trade influx was at its lowest level within the final 30 days — a purchase sign.

Ethereum [ETH], the world’s second-biggest cryptocurrency, has seen a big worth decline following the launch of the spot ETH Trade Traded Fund (ETF) in the USA.

Amid these market downturns, on the 2nd of September, two whales discovered the present ETH worth as a chance. They borrowed steady cash from Aave [AAVE] and bought 7,767 ETH value $19.22 million.

Whale exercise alerts purchase the dip sentiment

In a put up on X (previously Twitter), Lookonchain famous that whale pockets “0x761d” had bought 3,588 ETH value $8.8 million, whereas one other handle bought 4,180 ETH value $10.42 million within the final 24 hours.

This vital ETH accumulation through the market downturn alerts potential purchase alternatives.

Ethereum technical evaluation and upcoming ranges

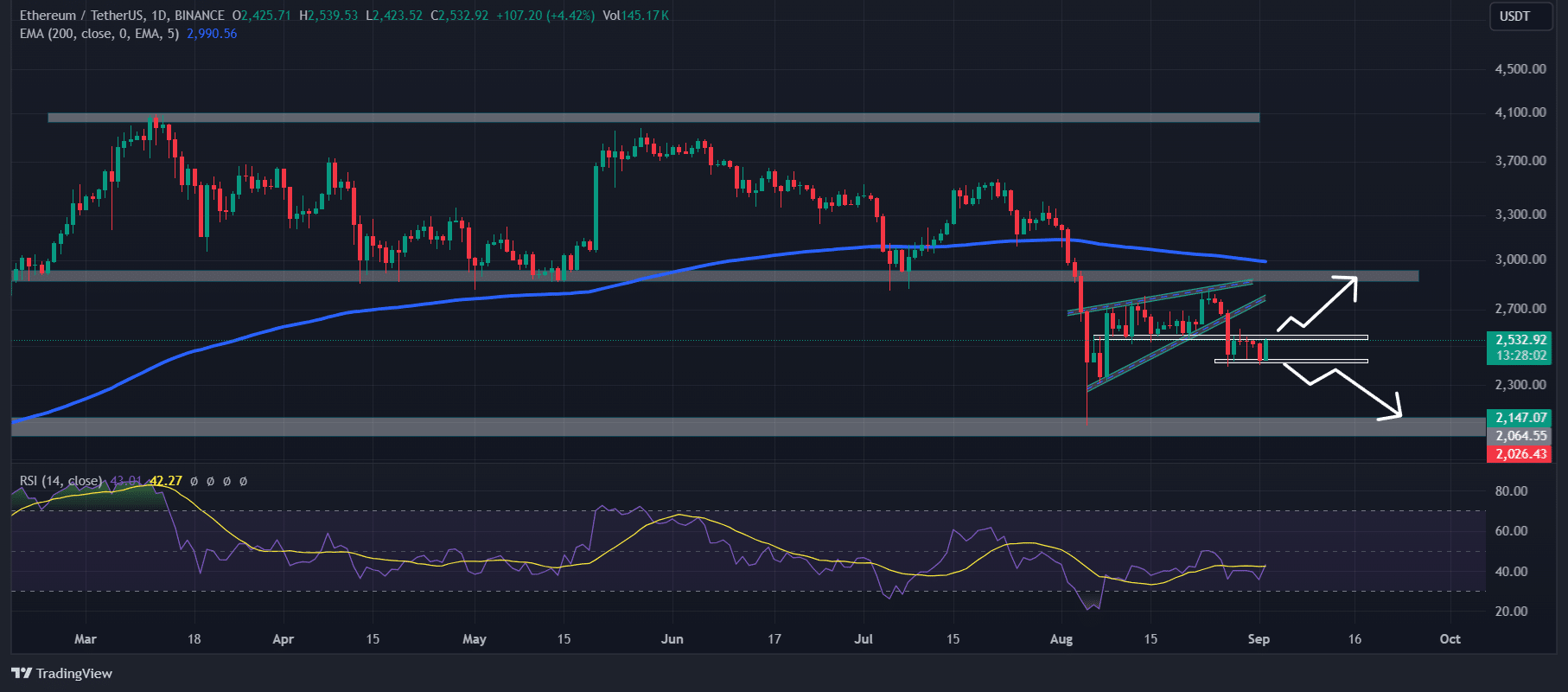

In accordance with the skilled technical evaluation, ETH was in a downtrend as it’s buying and selling under the 200 Exponential Shifting Common (EMA) on a every day time-frame.

Moreover, the latest breakdown of the bearish rising wedge worth motion sample signifies that ETH might fall to the $2,200 degree, within the coming days except it closes a every day candle above the $2,600 degree.

Supply: TradingView

Nevertheless, ETH’s technical indicator Relative Energy Index (RSI) was in oversold territory, signaling a possible worth reversal within the coming days.

On-chain metrics help bullish outlook

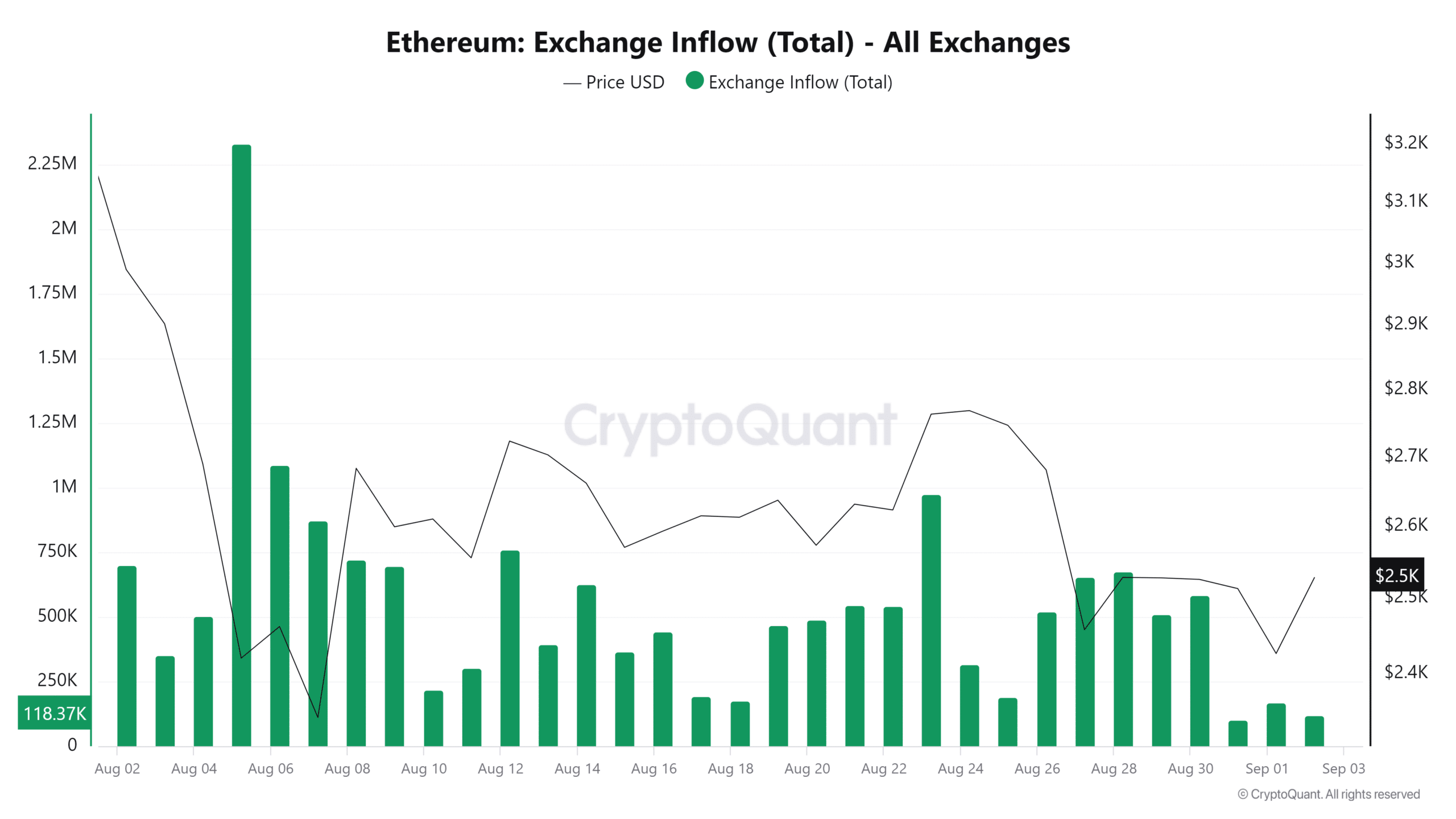

The on-chain metrics additionally supported ETH’s bullish outlook. CryptoQuant’s Ethereum trade influx was at the moment on the lowest level within the final 30 days — a purchase sign.

Excessive influx signifies greater promoting stress within the spot trade or vice versa.

Supply: CryptoQuant

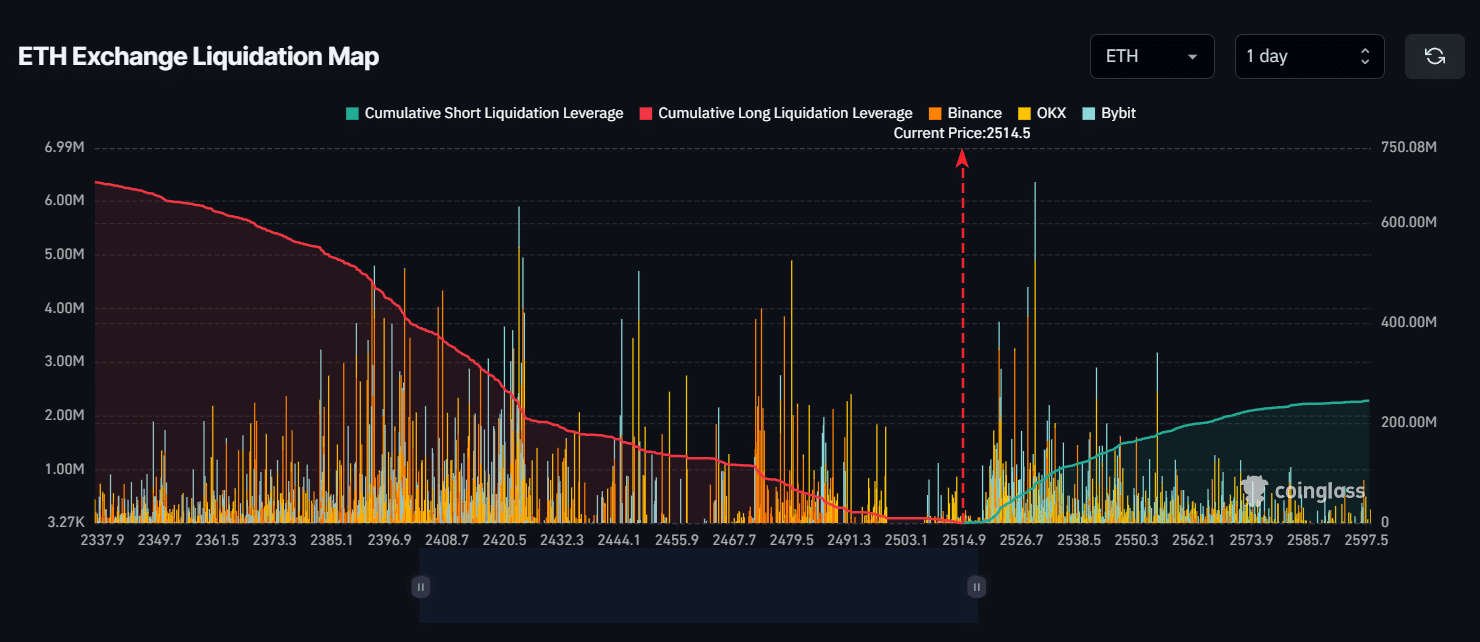

In the meantime, CoinGlass’s ETH trade liquidation map indicated that bulls had been dominating the asset and doubtlessly liquidating quick positions.

The key liquidation ranges had been close to the $2,420 degree on the decrease aspect and $2,530 on the decrease aspect, as merchants are over-leveraged at these ranges.

Supply: CoinGlass

If the sentiment stays bearish and the ETH worth falls to the $2,420 degree, almost $230 million value of lengthy positions can be liquidated.

Conversely, if the sentiment shifts and the worth rises to the $2,430 degree, roughly $70 million value of quick positions can be liquidated.

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

At press time, ETH was buying and selling close to the $2,510 degree, having skilled a worth surge of over 1.3% within the final 24 hours. In the meantime, its Open Curiosity grew, having risen by 1% up to now hour and 1.5% within the final 4 hours.

This rising Open Curiosity alerts rising investor and dealer curiosity amid the latest worth drops.