Ethereum whales buy ETH worth $440 mln – Preparing for a rally?

- Ethereum whales collected over 126,000 ETH price $440 million in 48 hours.

- Metrics, nevertheless, indicated a possible reversal.

Ethereum [ETH] whales have been on a buying spree during the last 48 hours. These giant holders have purchased up over 126,000 ETH, price about $440 million, per analyst ali_charts.

This has created a big inflow of shopping for stress at a time when the general cryptocurrency market was exhibiting combined alerts.

Trade exercise heats up

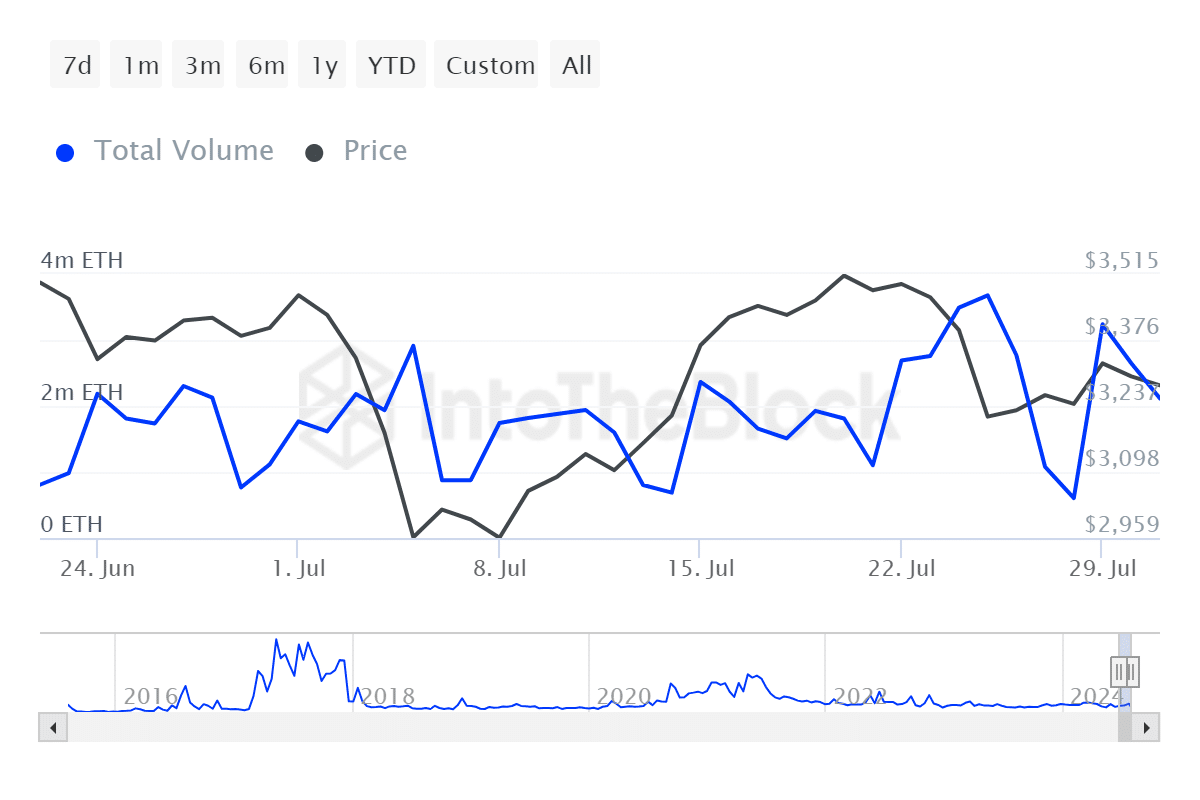

Accompanying whale accumulation, exchanges have recorded a rise in exercise. Main platforms confirmed an increase in ETH buying and selling volumes, in response to IntoTheBlock information.

This uptick in alternate motion usually happens earlier than vital worth actions as merchants set themselves up for potential market shifts.

Supply: IntoTheBlock

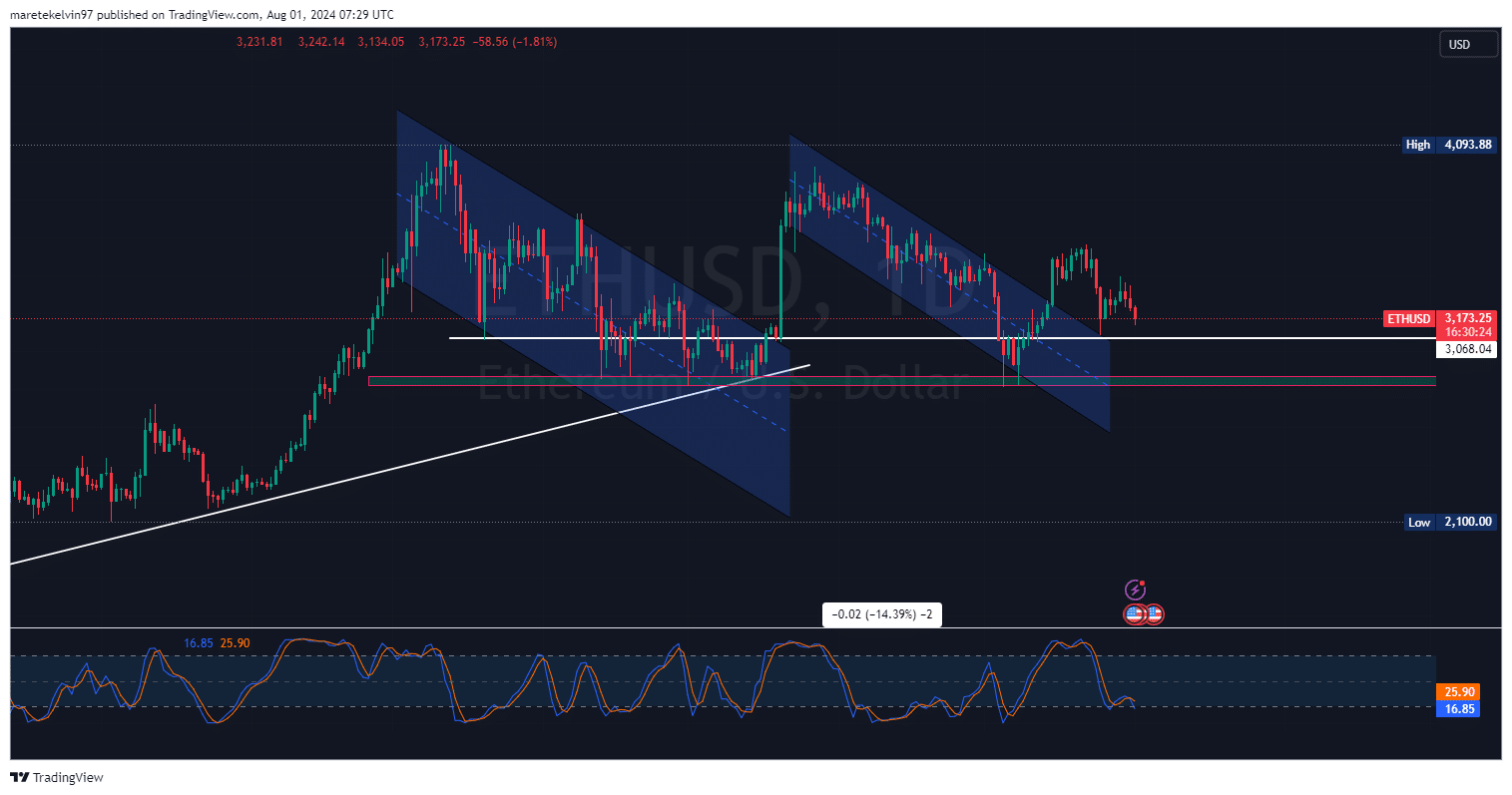

Regardless of Ethereum’s vital whale accumulation, its worth has but to make a considerable surge. For the reason that 10% surge on its ETF approval week, ETH has plummeted by 6.83% to the press time worth of $31.73.

Just lately, ETH was approaching a key help degree of $3068. The bearish stress was easing up because it approached this degree. This indicated a reversal, as large gamers might push the costs up for a bullish rally.

The RSI (Relative Energy Index) indicator was 16.85 at press time, approaching oversold territory. This can be a potential sign for a worth reversal to be bullish.

Supply: TradingView

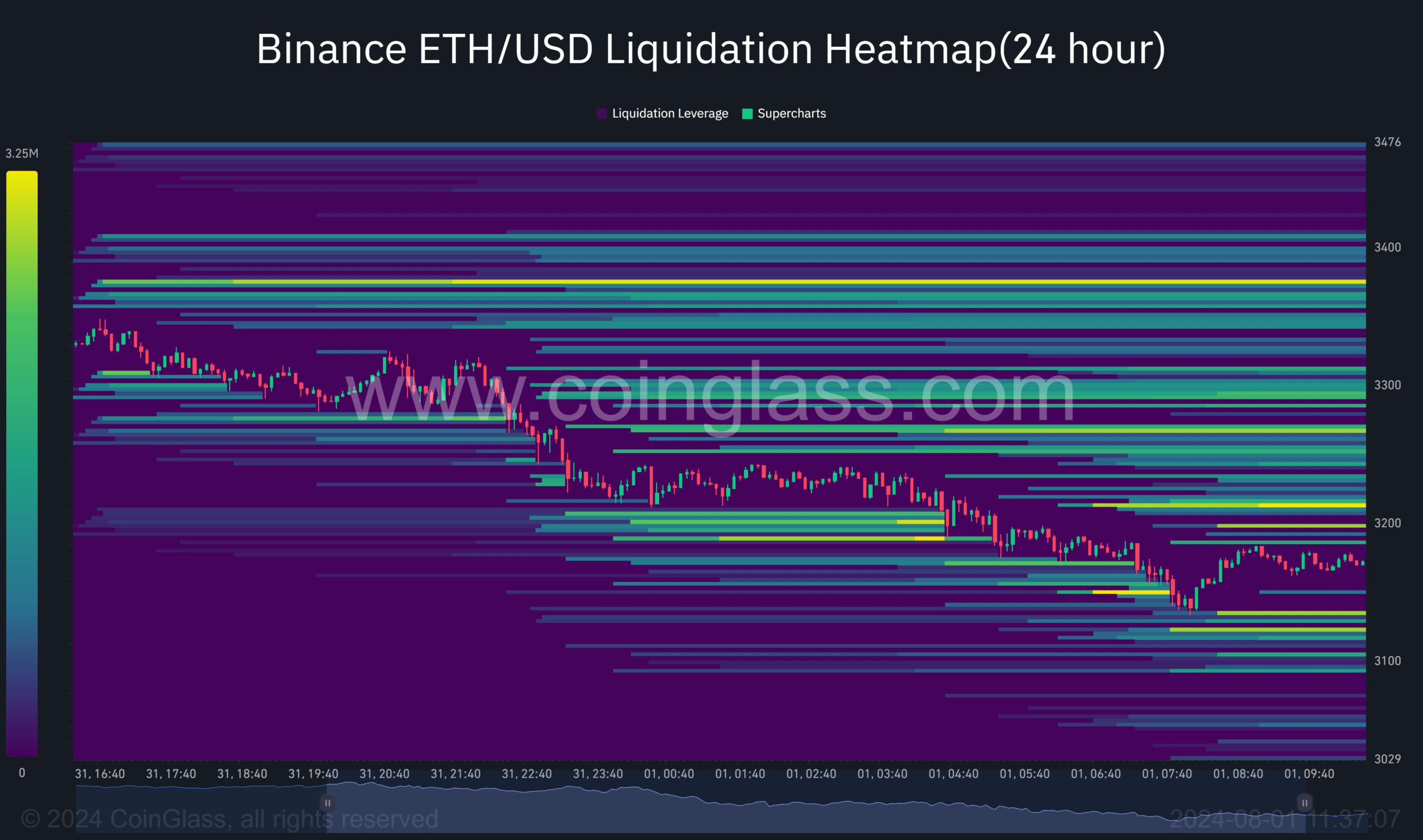

AMBCrypto’s evaluation of the liquidity heatmap information from Coinglass indicated clusters of liquidity swimming pools above and beneath the important thing help degree.

A sudden worth motion in both course may set off a sequence of liquidations, probably fueling worth motion.

Supply: Coinglass

Will whale exercise spark a rally?

From historic information, a major accumulation of whales usually comes earlier than a worth rally. Nevertheless, market dynamics are additionally intricate.

Learn Ethereum’s [ETH] Value Prediction 2024-25

Elevated buying and selling exercise on exchanges would possibly point out that smaller traders are taking income. This will neutralize the bullish stress attributable to whale patrons.

Whereas the substantial shopping for stress from giant holders correlates properly with the worth motion, the market outlook within the coming days might be important in figuring out whether or not the whale exercise will gasoline a bull run.