Ethereum whales dive in as ETH tests critical level – What’s next?

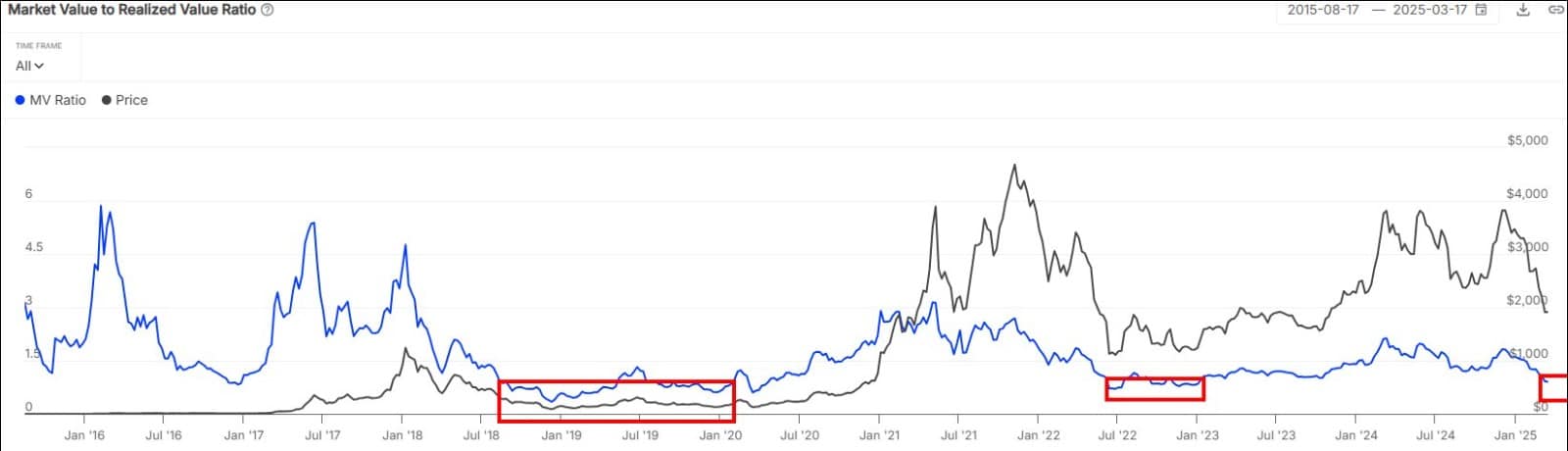

- Ethereum’s MVRV ratio signifies an undervalued market.

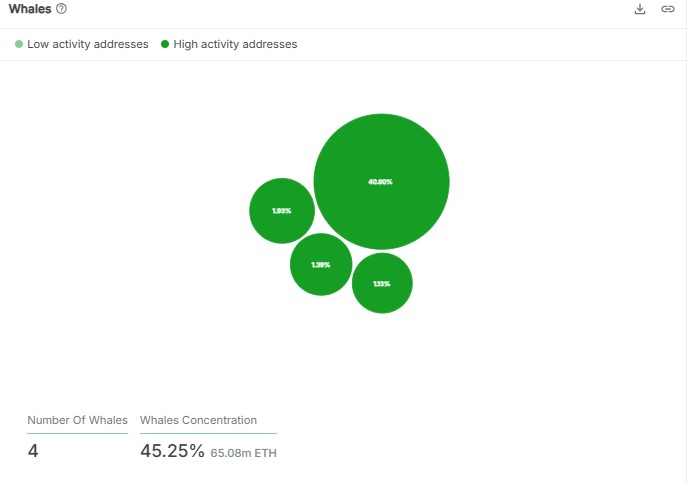

- Whale exercise is surging, with 44% of addresses driving the market.

Ethereum’s [ETH] Market Worth to Realized Worth (MVRV) ratio was 0.9 at press time. For the uninitiated, the formation of recent highs often precedes such low MVRV ranges.

Traditionally, MVRV ratios beneath 1 have been wonderful entry factors for ETH traders. Now that the ratio is exhibiting undervaluation, all the pieces appears in place for a possible bullish reversal.

Supply: X

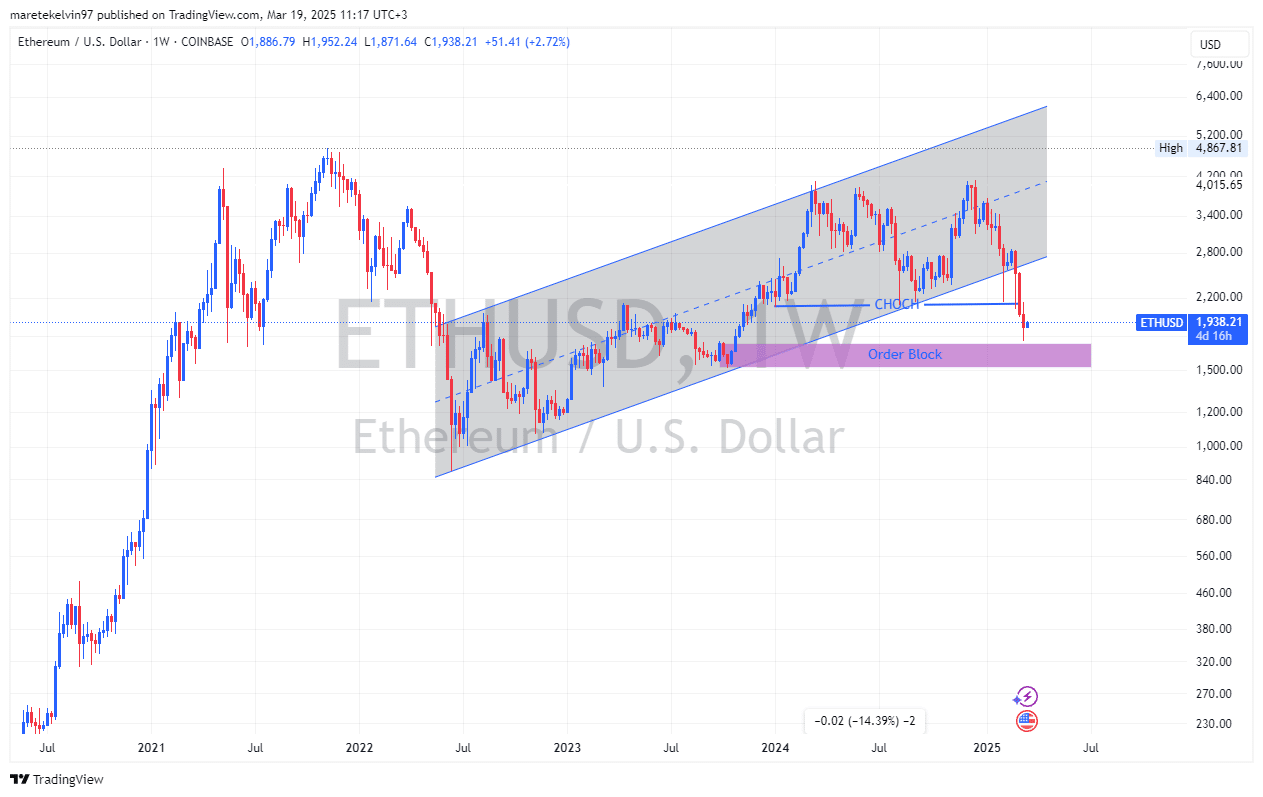

ETH value motion leans bullish

ETH costs are at present testing a key demand zone on the weekly chart at round $1.6K. With the latest change of development to bearish, this value degree may very well be vital in figuring out its subsequent transfer.

On shorter time frames, the king altcoin is exhibiting indicators of a bullish reversal, additional fueling optimism.

In truth, Ethereum has already surged by 2.57% at press time, outperforming many of the prime ten cryptocurrencies. This upward momentum is a robust technical indicator for dip patrons and whales to enter.

Supply: TradingView

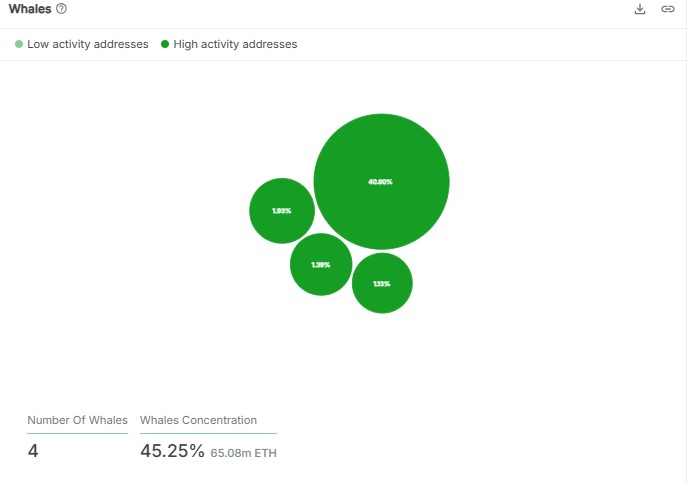

Whale exercise factors to potential rally

Consequently, the exercise focus knowledge from IntoTheBlock indicated that 44% of addresses pushing the market exercise leant on the whales.

With an rising overall whale exercise, ETH value rally to check the flag sample appears inevitable. Whales are sometimes seen as market movers, and their elevated participation suggests confidence in ETH’s short-term potential.

Supply: IntoTheBlock

ETH’s converging low MVRV ratio and bullish whale sentiment presents an intriguing bullish setup for short-term altcoin appreciation.

These confluencing developments are important precedents to main value rallies, thereby making the present setup notably noteworthy among the many market contributors.

With Ethereum testing a big demand zone and whales rising their exercise, it’s all set for an imminent bullish rally.

For traders, this may very well be a golden alternative to benefit from the ETH undervaluation.