Ethereum whales fuel $188M inflows – Hopes of $4K rise

Ethereum whales netflow indicators a shift in market habits

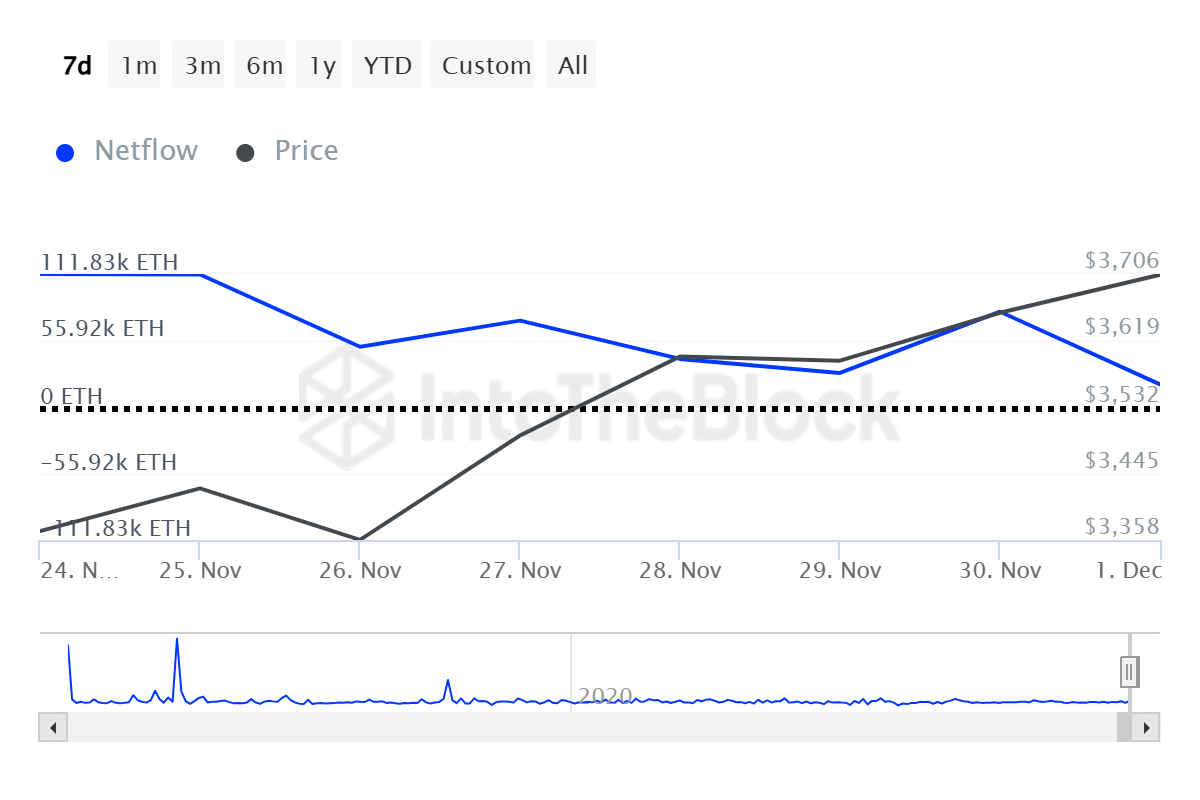

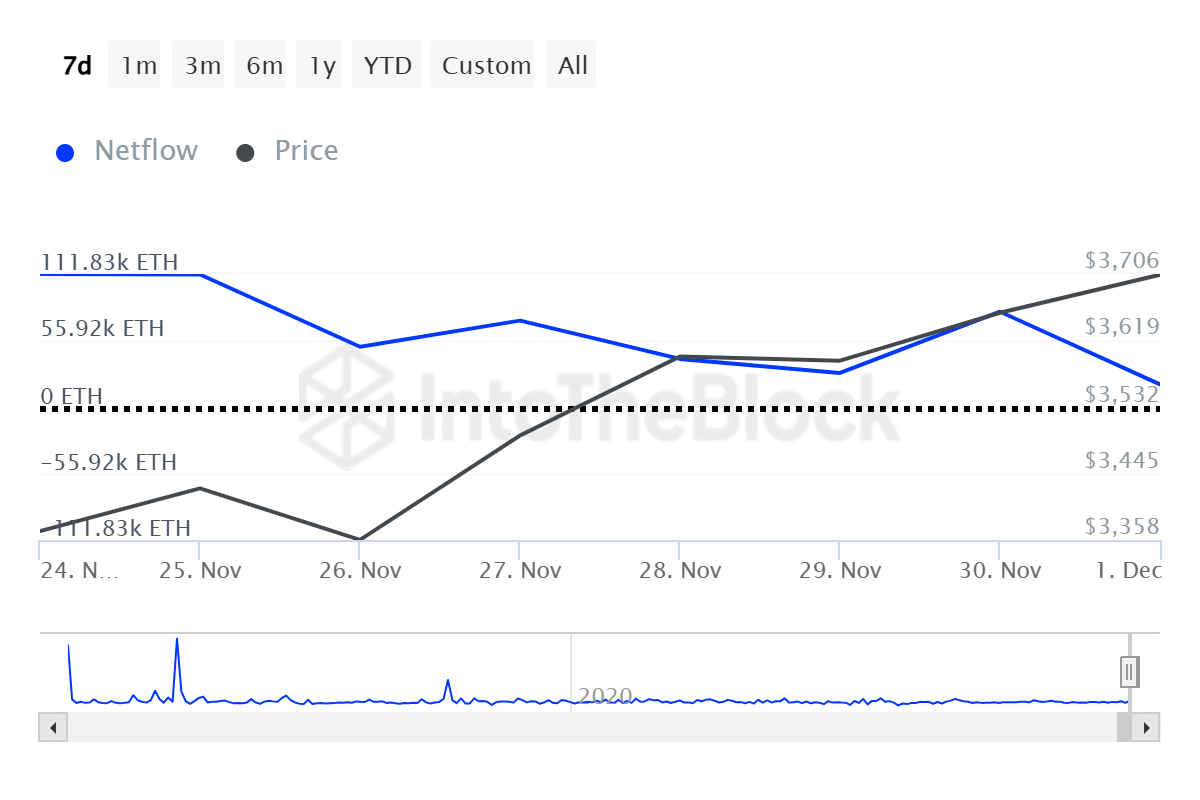

Supply: Into The Block

Latest knowledge revealed a major uptick in Ethereum’s whale netflow, with giant holders accumulating over 111,000 ETH ($188 million) in simply two days.

The netflow chart showcased a pointy inflow on the twenty fourth of November, adopted by a gradual decline, reflecting a strategic accumulation part.

Curiously, this surge coincides with ETH reclaiming the $3,600 stage, suggesting whales are betting on additional upside.

Optimistic netflows usually point out rising confidence amongst institutional and high-net-worth buyers, usually previous bullish worth motion.

Nonetheless, sustained inflows shall be essential to sustaining this momentum, notably as Ethereum approaches the psychologically important $4,000 resistance.

Retail curiosity in ETH soars

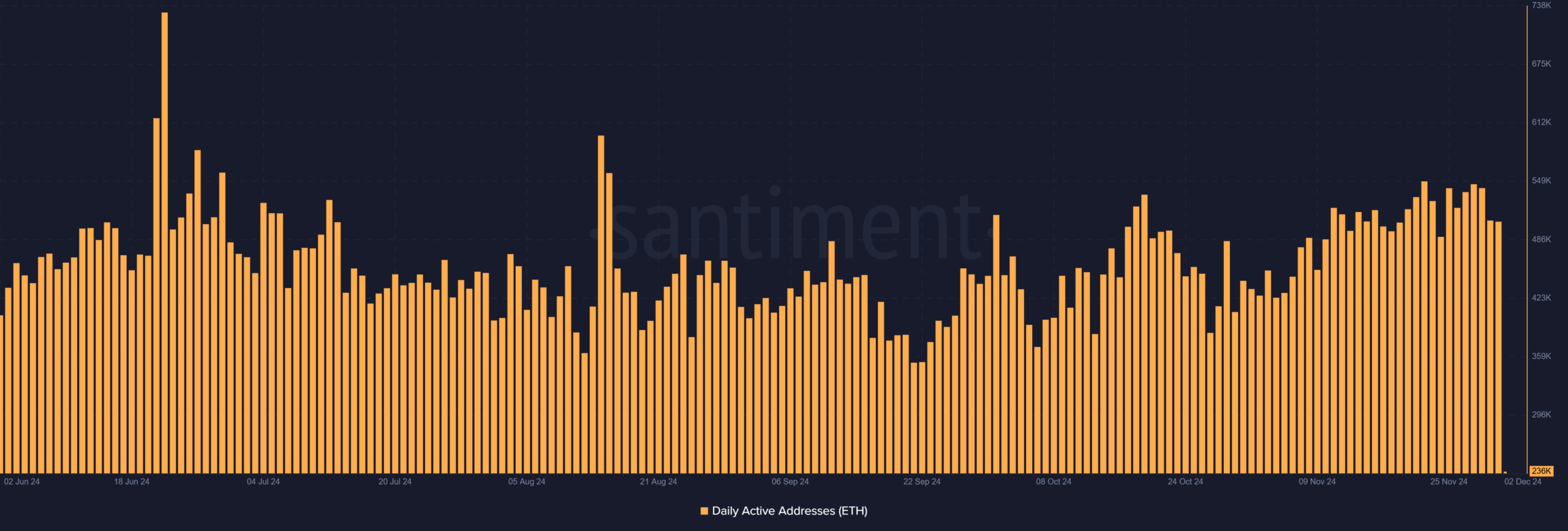

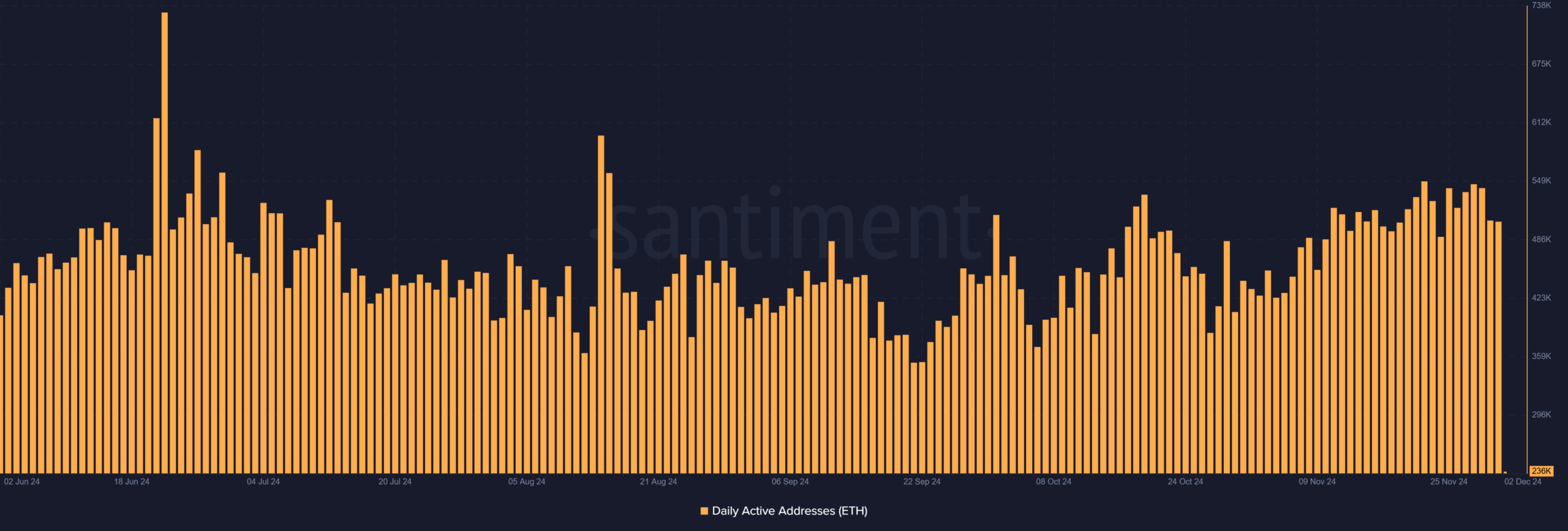

Whereas whale accumulation leads, retail exercise in Ethereum was seeing notable progress.

The every day lively Ethereum addresses confirmed constant engagement, peaking at over 500,000 lively customers in late November 2024, indicating sustained participation from retail merchants.

Supply: Santiment

Moreover, Ethereum’s DeFi ecosystem growth and anticipation surrounding the Shanghai improve are additional fueling optimism.

Nonetheless, whereas retail-driven rallies are likely to generate momentum, in addition they carry the danger of elevated volatility, suggesting warning as ETH eyes the $4,000 mark.

What’s subsequent for Ethereum?

Ethereum’s future trajectory will rely on its skill to interrupt by the essential $4,000 resistance stage. If it manages this, a rally towards $4,500 may very well be within the playing cards, supported by robust whale and retail participation.

Moreover, Ethereum’s rising utility is clear in its increasing DeFi ecosystem and NFT market dominance, the place gross sales on Ethereum-based platforms noticed a major enhance not too long ago, regardless of some market fluctuations.

Nonetheless, dangers stay. A broader crypto market correction, notably if Bitcoin falls under $94,000, may stall ETH’s momentum.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

Additionally, rising gasoline charges may discourage retail adoption, limiting potential worth progress.

For now, Ethereum’s bullish outlook stays intact, however its skill to keep up shopping for strain throughout institutional and retail segments shall be essential for continued success.