Ethereum whales hold back: What their restraint reveals about ETH

- Ethereum consolidation reveals diminished curiosity from whales because the market struggles with uncertainty.

- Assessing the state of demand as change flows drop to 2024 lows.

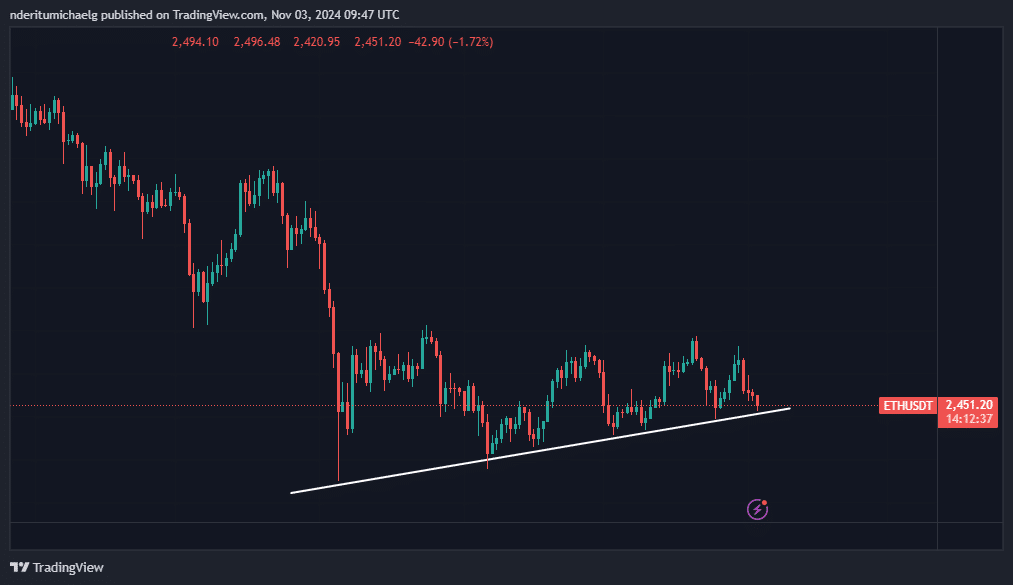

Ethereum [ETH] has been caught in a consolidation section for the final three months. However is there hope for a doable breakout from the consolidation zone in November? Right here’s a take a look at how ETH has been fairing to this point.

Ethereum crushed bullish expectations since August after value failed to realize a considerable restoration, following its crash since Could. Nevertheless, its decrease highs since august means that important accumulation has been happening over the last three months.

Supply: TradingView

Regardless of the upper lows, value has struggled to push above the $2,800 over the last 3 months. This end result was a mirrored image of the present state of demand available in the market, particularly within the whale class.

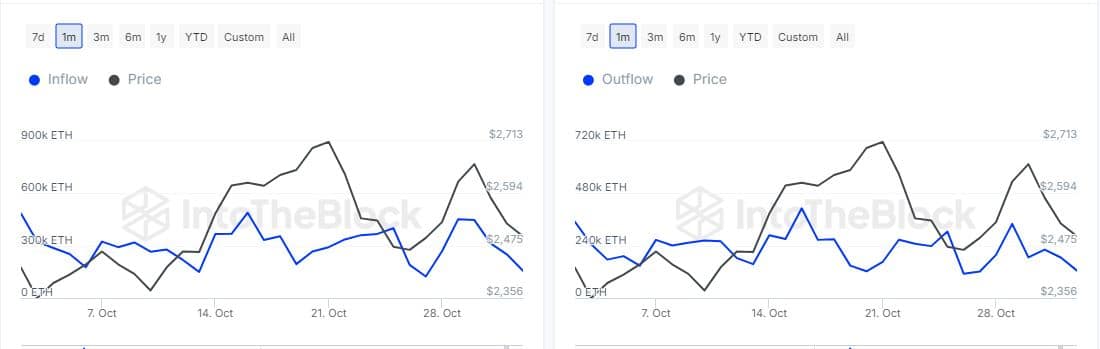

Ethereum massive holder flows have been declining for the reason that finish of October. Nevertheless, outflows have been notably decrease than inflows, which means that demand could also be about to flip promote strain.

A significant cause for this was as a result of the promote strain in the previous few days pushed for a retest of ETH’s ascending help in the previous few days.

Supply: IntoTheBlock

The dip in massive holder outflows means that promote strain from whales has been declining. This might pave the best way for a possible pivot. Nevertheless, the decline in massive holder inflows additionally signifies much less curiosity from whales.

Is Ethereum demand making a comeback?

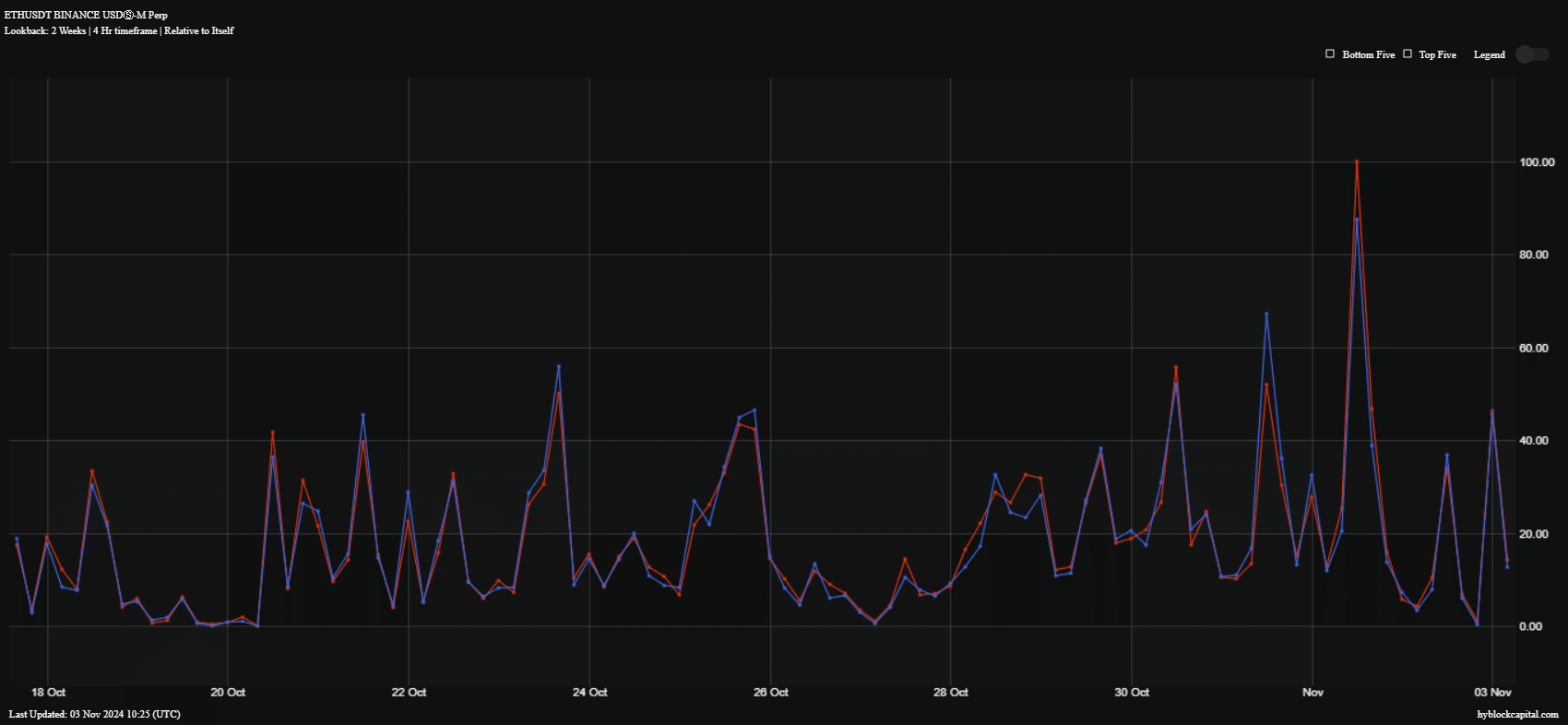

Whereas massive holder flows didn’t essentially point out a resurgence of pleasure, however purchase and promote quantity reveals one thing fascinating. Ethereum purchase and promote quantity registered an enormous spike on 1 November, with purchase quantity dominating.

Supply: HyblockCapital

The spike in purchase volumes could point out the potential for renewed curiosity in ETH this month, though that was but to be seen. A part of the rationale for this commentary might be that traders have been holding again as a result of uncertainty across the election interval.

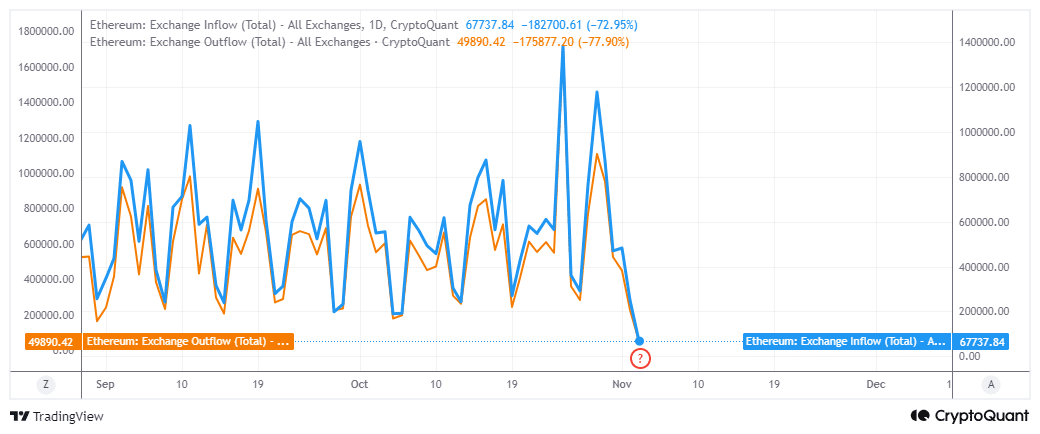

Alternate flows reacted to the present stage of uncertainty by dropping to the bottom ranges seen to this point in 2024.

Supply: CryptoQuant

Alternate inflows have been notably increased than the extent change outflows. The latter amounted to 49,890 ETH whereas the previous had 67,737 ETH within the final 24 hours on the time of writing.

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

Primarily based on all of the above observations, it was clear that Ethereum value motion was a mirrored image of dampened investor sentiment. The consolidation nevertheless, means that we might see renewed curiosity after the U.S elections.

Nevertheless, the elections end result could have a unfavourable or optimistic affect relying on which candidate will win.