Ethereum whales moves millions to exchanges

- A serious Ethereum whale deposited $154M value of ETH to exchanges, sparking hypothesis of a possible sell-off.

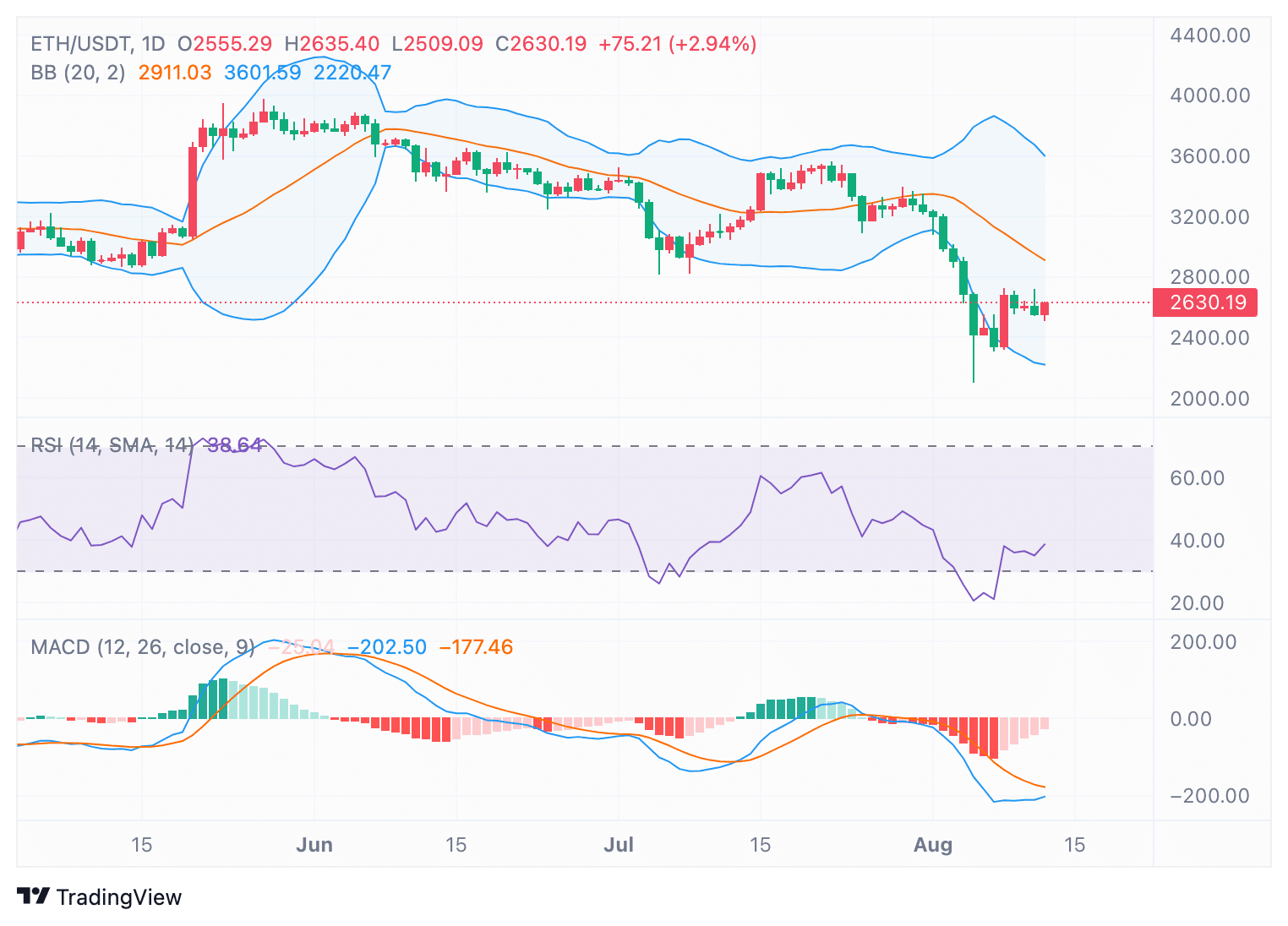

- Ethereum’s RSI hinted at recovering from oversold ranges, whereas the MACD instructed a doable bullish turnaround.

Ethereum [ETH] has lately skilled elevated market exercise, with notable transactions suggesting doable market actions.

Amongst these, a whale, who initially acquired 1 million ETH throughout the Ethereum ICO at a worth of $0.31, has drawn consideration.

In response to Lookonchain, the whale deposited 5,000 ETH, valued at roughly $13.2 million, to the OKX change on the twelfth of August.

This transaction adopted a sequence of enormous deposits over the previous month, totaling 48,500 ETH, value round $154 million, at a mean worth of $3,176.

The whale’s steady switch of enormous quantities of ETH to exchanges has sparked discussions a few potential sell-off.

Traditionally, such actions are intently watched as they might sign a forthcoming shift in market dynamics.

Furthermore, one other whale transaction was reported by Whale Alert, the place 12,682 ETH, equal to roughly $32.3 million, was moved from an unknown pockets to Coinbase.

This motion added to the hypothesis that enormous holders could also be getting ready to dump their property, particularly in a market surroundings that has seen volatility in current days.

Present market circumstances

Ethereum’s worth has been risky, buying and selling at $2,598.65 at press time, reflecting a 3.32% decline within the final 24 hours however an 11.74% improve over the previous week.

The value development aligned with technical indicators, suggesting a blended outlook.

The Relative Power Index (RSI) was 38.64 at press time, indicating that ETH is recovering from an oversold place however remained under the impartial threshold of fifty.

This instructed lingering bearish momentum, though it seems to be weakening.

Supply: TradingView

Moreover, the Shifting Common Convergence Divergence (MACD) remained in adverse territory.

The MACD line was barely under the sign line, with the histogram displaying smaller crimson bars, suggesting a possible bullish crossover.

This might point out the opportunity of additional worth restoration if constructive momentum continues.

Market sentiment and broader implications

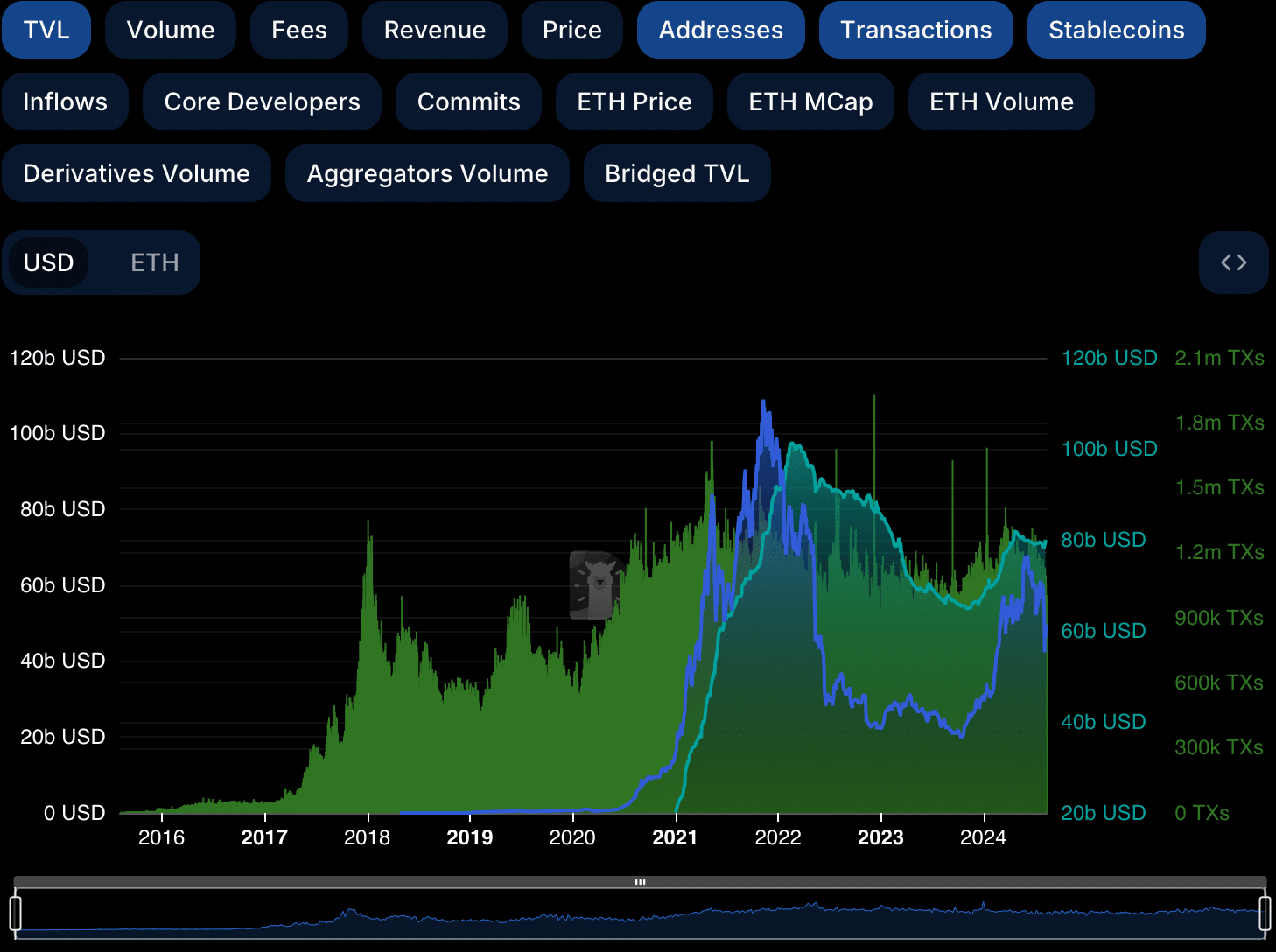

In response to DefiLlama, the Complete Worth Locked (TVL) in Ethereum’s ecosystem was $47.824 billion, with stablecoin market capitalization at $79.913 billion.

Over the previous 24 hours, charges generated amounted to $1.19 million, with $380,540 in income.

Supply: DefiLlama

Lively addresses inside this era reached 299,749, with 64,793 new addresses and 1 million transactions, indicating ongoing strong community exercise.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

The current evaluation by AMBCrypto pointed to a impartial sentiment within the Ethereum market, with the Worry and Greed Index logging a rating of 38, up from excessive worry ranges per week in the past.

This shift in sentiment instructed rising investor confidence, which can assist ETH in testing and probably breaking the $2,800 resistance stage.